5 Steps How to Slash Interchange Fees and Accept Crypto Payments (Easy Guide for Small Businesses)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 6 days ago

- 4 min read

Interchange fees are bleeding small businesses dry.

Every swipe. Every tap. Every transaction. You're losing 1.5% to 3.5% of your hard-earned revenue to card networks and payment processors.

That's thousands of dollars annually. Gone.

But here's the good news. There's a better way. Crypto payments eliminate the middlemen. Keep more money in your pocket. Give you full control over your funds.

This guide breaks down exactly how to slash those fees and start accepting crypto payments, no technical background required.

Let's dive in.

Step 1: Understand What's Actually Eating Your Profits

First things first. Know your enemy.

Interchange fees are the charges card networks (Visa, Mastercard) impose on every credit or debit card transaction. These fees fund rewards programs, fraud protection, and bank profits.

Not yours.

Here's the breakdown of what you're typically paying:

Interchange fee: 1.5% - 2.5% (goes to the card-issuing bank)

Assessment fee: 0.13% - 0.15% (goes to Visa/Mastercard)

Processor markup: 0.2% - 0.5% (goes to your payment processor)

Add it up. That's potentially 3%+ on every transaction.

For a business doing $100,000 in monthly card sales? That's $3,000+ disappearing every single month.

The traditional advice? Switch to interchange-plus pricing. Encourage debit over credit. Set minimum purchase amounts.

Sure, these help. But they're band-aids.

The real solution? Accept crypto payments and bypass the entire legacy system.

Step 2: Ditch Traditional Processors for Crypto Payment Rails

Here's where things get interesting.

Crypto payments operate on decentralized networks. No Visa. No Mastercard. No banks skimming your revenue.

Transaction fees? Often less than 1%. Sometimes just pennies.

The math is simple:

Traditional card processing: 2.5% - 3.5%

Crypto payment processing: 0.5% - 1%

Savings on $100,000 monthly volume: $2,000+ per month.

That's $24,000+ annually back in your pocket.

But not all crypto payment solutions are created equal.

NOWPayments charges around 0.5% per transaction. Decent. But you're still relying on a third-party custodian to hold your funds.

CoinPayments offers similar rates with multi-coin support. But again, custodial. Your funds sit in their wallets until you withdraw.

What happens if they go down? Get hacked? Face regulatory issues?

Your money is at risk.

This is where self-custody changes everything.

Step 3: Set Up Self-Custody Crypto Payments with Larecoin

Self-custody means one thing: you control your funds.

No intermediaries holding your crypto. No waiting for withdrawals. No counterparty risk.

Your wallet. Your keys. Your money.

Larecoin was built with merchant freedom at its core. Here's how to get started:

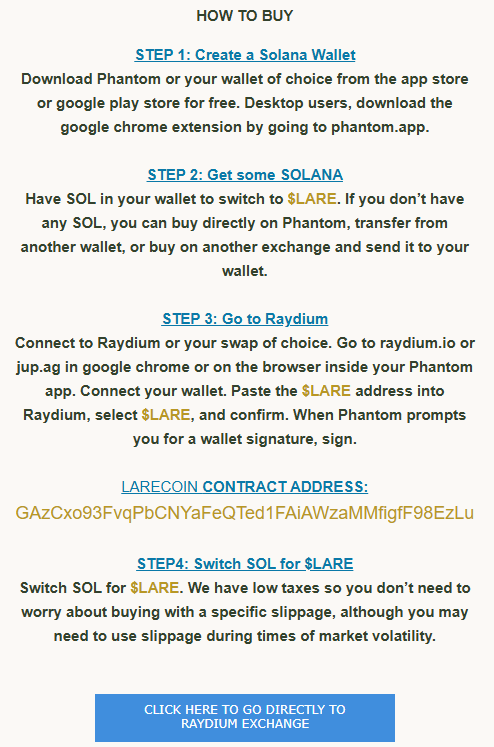

Quick Setup Process:

Create your Solana wallet (Phantom, Solflare, or any compatible wallet)

Connect to the Larecoin ecosystem

Generate your merchant payment address

Display QR codes at checkout or integrate with your e-commerce platform

Receive payments directly to YOUR wallet

No custody. No permission needed. No third-party delays.

Funds hit your wallet the moment the transaction confirms. Usually within seconds on Solana's lightning-fast network.

Compare this to NOWPayments or CoinPayments:

Feature | NOWPayments | CoinPayments | Larecoin |

Self-custody | ❌ | ❌ | ✅ |

Instant settlement | Limited | Limited | ✅ |

Transaction fees | 0.5% | 0.5% | Minimal gas |

Counterparty risk | Yes | Yes | None |

NFT receipts | ❌ | ❌ | ✅ |

The difference is clear. Decentralized. Permissionless. Truly yours.

Step 4: Leverage LUSD Stablecoin to Eliminate Volatility

"But crypto is volatile!"

Heard it a million times. Valid concern.

Nobody wants to accept $100 in Bitcoin and have it worth $85 by end of day.

Enter LUSD, Larecoin's stablecoin solution.

LUSD is pegged to the US dollar. Price stability with all the benefits of crypto payments:

Low fees: Gas-only transfers on Solana

Instant settlement: No 3-day bank holds

Self-custody: Your stablecoins, your wallet

Global accessibility: Accept payments from anywhere

Here's the play for smart merchants:

Accept LUSD directly for predictable value

Offer customers the option to pay in various cryptos

Auto-convert volatile assets to LUSD if desired

Withdraw to fiat whenever you need

You get the fee savings of crypto without the price swings.

Best of both worlds.

Pro tip: Many customers already hold stablecoins. Offering LUSD payments taps into a growing market of crypto-native consumers looking to spend their holdings.

Step 5: Implement NFT Receipts for Transparency and Customer Loyalty

This is where Larecoin truly separates from the competition.

NFT receipts turn every transaction into a verifiable, on-chain record.

Why does this matter?

For You (The Merchant):

Permanent, tamper-proof transaction records

Simplified accounting and auditing

Reduced chargeback disputes (blockchain proof of payment)

Unique customer engagement opportunities

For Your Customers:

Proof of purchase that can't be lost or forged

Collectible receipts (yes, people actually collect these)

Potential loyalty rewards attached to receipt NFTs

Transparent transaction history

Imagine this: A customer buys from you. They receive an NFT receipt. That NFT unlocks 10% off their next purchase. Or grants early access to new products.

Loyalty programs built directly into the payment experience.

NOWPayments doesn't offer this. CoinPayments doesn't either.

This is Web3-native commerce. And it's only possible with Larecoin.

The Bottom Line: Merchant Freedom Starts Now

Let's recap the 5 steps:

Understand interchange fees and how they're draining your profits

Switch to crypto payment rails for 2%+ savings per transaction

Set up self-custody payments with Larecoin: no intermediaries

Use LUSD stablecoin to eliminate volatility concerns

Implement NFT receipts for transparency and customer engagement

The traditional payment system wasn't built for small businesses. It was built to extract value from you.

Crypto payments flip the script.

Lower fees. Instant settlement. Full control. True independence.

The tools exist today. The technology is battle-tested. Millions of transactions processed on Solana every day.

The only question is: Are you ready to stop paying the interchange tax?

Ready to Get Started?

Join the Larecoin Community to connect with other merchants making the switch.

Check out the official announcements for the latest integration tools and merchant resources.

Have questions? The community is active and ready to help.

Your path to fee freedom starts with a single step.

Take it today.

Comments