Are Receivables Tokens the Future? Why LareBlocks Layer 1 Makes Merchant Payments Faster Than Ethereum in 2026

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Ethereum's Getting Left Behind. Here's Why.

Receivables tokens are exploding.

The RWA market hit $36 billion in 2025. Projected to reach $16-30 trillion by 2030.

And Ethereum? Too slow. Too expensive. Too outdated for merchant payments in 2026.

LareBlocks Layer 1 changes everything.

What Exactly Are Receivables Tokens?

Think of them as digital IOUs on steroids.

Traditional accounts receivable sit in filing cabinets. Or ancient ERP systems. Locked up. Illiquid. Useless.

Receivables tokens convert those future payments into tradable digital assets.

Instant liquidity. Real-time settlement. Transparent ownership.

Merchants get paid today instead of waiting 30-90 days.

Cash flow problems? Gone.

LareBlocks Layer 1: Built Different

Ethereum processes 15-30 transactions per second. Gas fees spike to $50+ during network congestion.

Not exactly merchant-friendly.

LareBlocks Layer 1 handles 10,000+ TPS. Sub-second finality. Gas fees under $0.01.

Purpose-built for commercial payments. Not speculation.

Speed Comparison:

Ethereum: 15-30 TPS, 12-15 second blocks

LareBlocks: 10,000+ TPS, sub-second finality

Settlement time: 99.9% faster than traditional banking

The difference? Architecture.

LareBlocks uses parallel transaction processing. Optimized consensus mechanism. Smart contract efficiency baked in from day one.

Ethereum's trying to retrofit. We built it right the first time.

CLARITY Act: Game-Changer for Larecoin

H.R. 3633 passed. Digital commodities are officially recognized.

Larecoin qualifies. Here's why that matters:

Regulatory Certainty

No SEC security classification headaches

Clear tax treatment

Merchant adoption accelerates

Operational Benefits

Simplified compliance for businesses

Lower legal costs

Cross-state commerce clarity

Competitors like NOWPayments and CoinPayments are scrambling. They support hundreds of tokens. Most lack CLARITY Act protection.

Larecoin's classification as a digital commodity gives merchants legal peace of mind.

50% Fee Savings: The Math That Matters

Legacy payment processors charge 2.9% + $0.30 per transaction.

Larecoin? 1.45% flat. No hidden fees.

Real-World Example:

$100,000 monthly revenue

Visa/Mastercard fees: $2,900 + transaction fees = ~$3,200

Larecoin fees: $1,450

Monthly savings: $1,750

Annual savings: $21,000

NOWPayments charges 0.5% but adds network fees. CoinPayments hits you with 0.5% plus withdrawal fees.

Hidden costs add up fast.

Larecoin's LareBlocks Layer 1 eliminates the middleman. Direct peer-to-peer settlement. Minimal gas fees.

Merchants keep more. Simple.

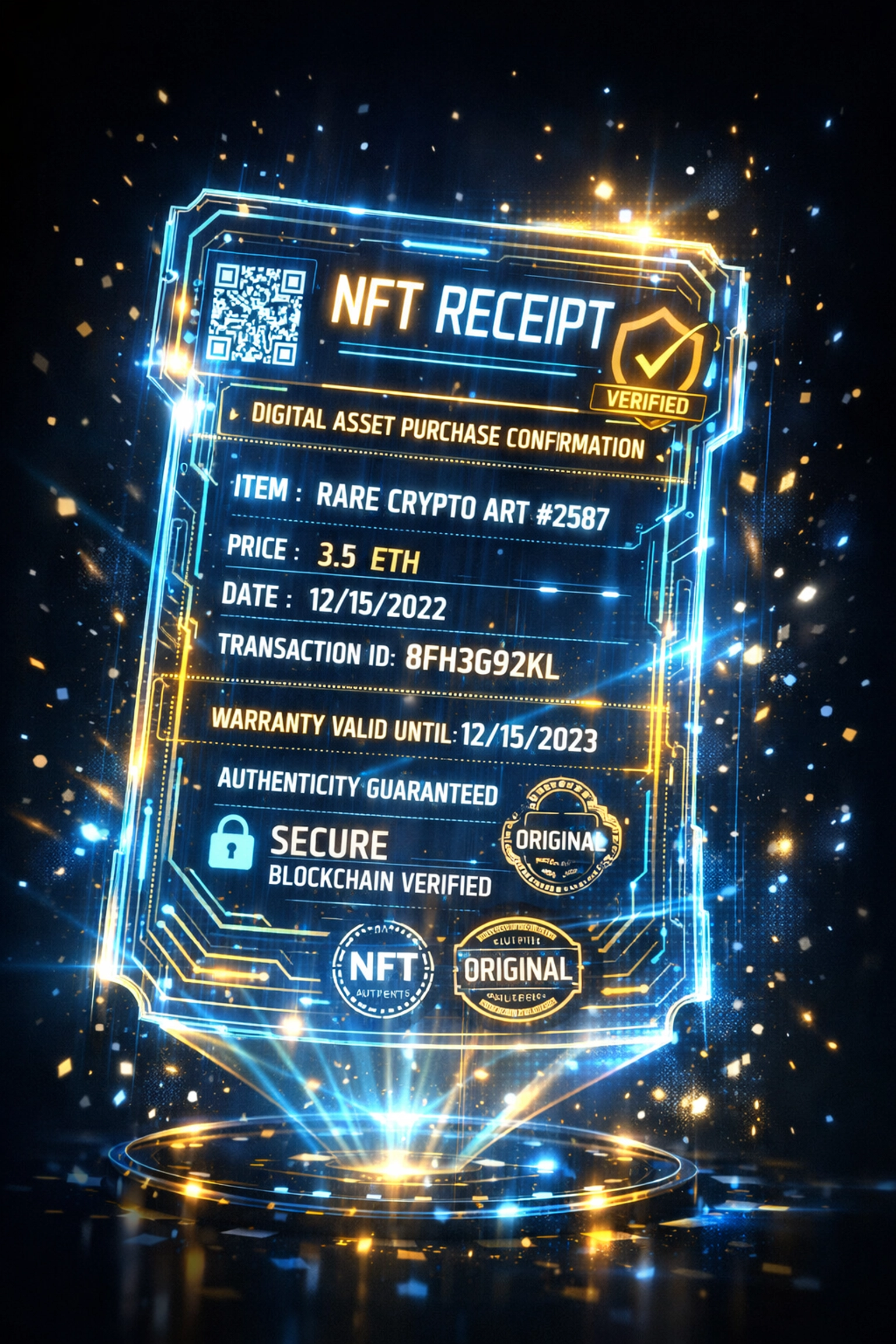

NFT Receipts: Proof That Actually Works

Every Larecoin transaction generates an NFT receipt.

Immutable. Verifiable. Permanent.

Use Cases:

Warranty tracking

Returns processing

Tax documentation

Customer loyalty programs

Fraud prevention

Traditional receipts fade. Get lost. Easy to fake.

NFT receipts live on-chain forever. Searchable. Transferable. Authentic.

Imagine issuing limited-edition collectible receipts for special purchases. Gamified shopping experiences. Loyalty rewards tied to purchase history.

The metaverse integration? Next level.

LUSD Stablecoin: Volatility Eliminated

Merchants hate crypto price swings.

LUSD stablecoin solves this. Pegged 1:1 to USD. Backed by Larecoin reserves.

Merchant Workflow:

Customer pays with LARE

Instant conversion to LUSD

Merchant receives stable value

Optional: Convert to fiat or hold

Zero volatility risk. Full crypto benefits.

CoinPayments offers stablecoin support but charges conversion fees. NOWPayments lacks native stablecoin integration.

LUSD is native to the Larecoin ecosystem. Seamless. Fee-optimized.

Self-Custody: Your Keys, Your Money

NOWPayments holds your funds. CoinPayments controls your wallet.

Not with Larecoin.

LareBlocks Layer 1 supports full self-custody. Non-custodial wallets. Hardware wallet integration.

Security Benefits:

No exchange hacks risk

No third-party freezing

Complete financial sovereignty

Instant withdrawals

Banks can freeze accounts. Payment processors can hold funds. Not with self-custody.

Your business. Your money. Your control.

AI-Powered Metaverse Shopping

LareBlocks doesn't just process payments. It powers experiences.

AI-driven metaverse integration coming Q3 2026:

Features:

Virtual storefronts with AI assistants

Personalized product recommendations

Augmented reality try-before-you-buy

Seamless LARE/LUSD checkout

Traditional payment processors? Stuck in 2D web interfaces.

Larecoin's building the next shopping paradigm.

Imagine customers browsing your virtual store. AI assistant guides them. They select items. Pay with LARE. NFT receipt doubles as loyalty badge.

All on LareBlocks Layer 1. All settlement under 1 second.

The Competitor Breakdown

NOWPayments:

0.5% fee (plus network costs)

Custodial model

150+ cryptocurrencies (compliance nightmare)

Standard invoicing

CoinPayments:

0.5% fee + withdrawal charges

Custodial wallets

100+ cryptocurrencies

Basic POS integration

Larecoin:

1.45% flat fee

Self-custody options

CLARITY Act compliant

NFT receipts standard

Native LUSD stablecoin

Sub-second settlement

AI metaverse ready

The choice is obvious.

Competitors offer quantity. Larecoin delivers quality.

Receivables Tokens: The Endgame

LareBlocks Layer 1 isn't just faster than Ethereum.

It's purpose-built for tokenized commerce.

Receivables tokens represent the future. Instant liquidity. Transparent ownership. Global tradability.

Traditional factoring companies charge 1-5% to buy your receivables. 30-day wait times. Complex paperwork.

Larecoin tokenizes receivables automatically. List them on-chain. Get paid immediately.

The infrastructure exists today. The regulatory framework is set. The technology works.

Join the 100-Post Larecoin Marathon

This is post #[X] in our 100-post marathon. Deep-diving into Web3 payments. Real solutions. Real impact.

Ready to cut your merchant fees by 50%? Future-proof your business with CLARITY Act protection? Join thousands of merchants already using LareBlocks Layer 1.

Questions? Join our Telegram community.

The future of merchant payments is here. Running on LareBlocks. Powered by receivables tokens.

Ethereum can't compete.

Comments