CoinPayments Alternative? 7 Reasons LarePAY's Master Wallet System Beats Enterprise Competitors

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The Enterprise Custody Problem Nobody Talks About

CoinPayments processes millions in crypto transactions daily.

Triple-A serves 30,000+ merchants globally.

NOWPayments handles 150+ cryptocurrencies.

But they all share the same fatal flaw: custody surrender.

Your funds. Their wallets. Their control.

LarePAY's master wallet system flips this broken model completely.

True self-custody. Unlimited scalability. Zero compromise.

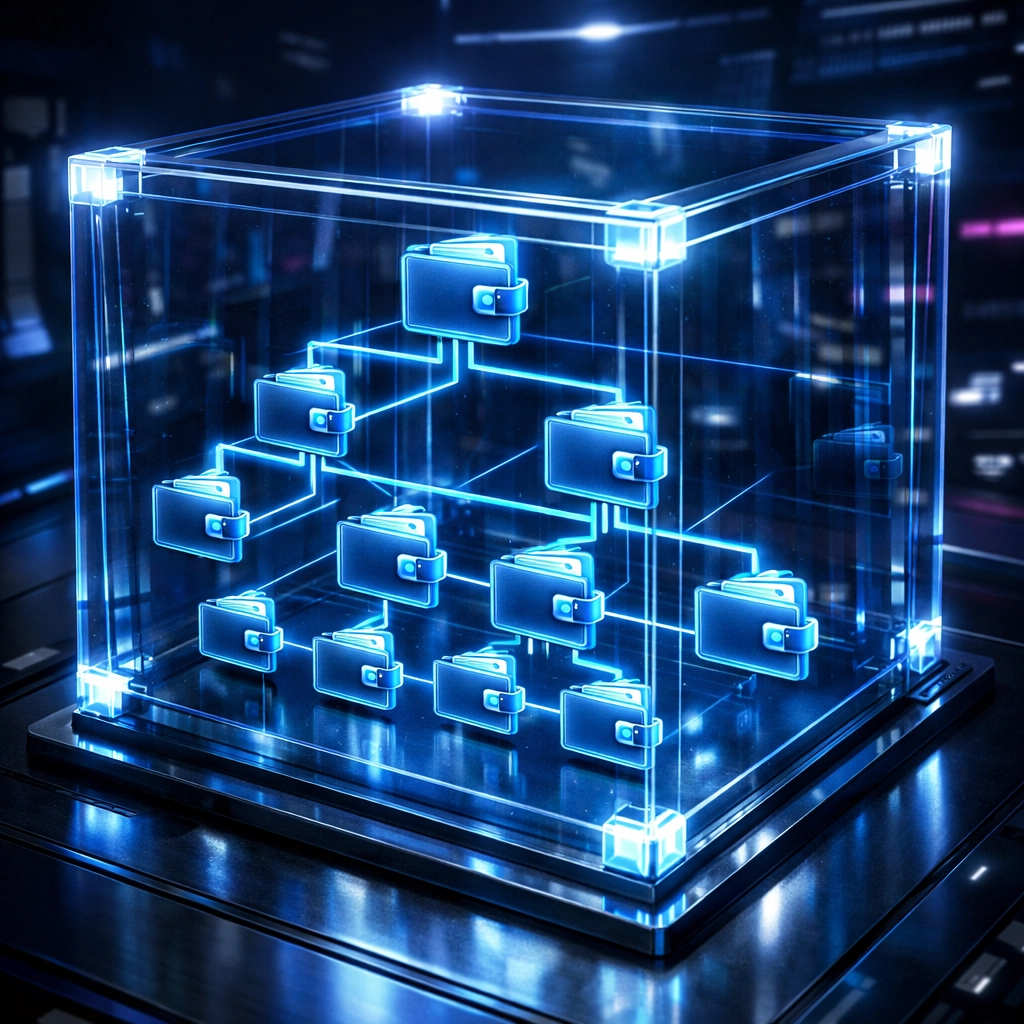

Reason #1: Hierarchical Self-Custody That Actually Works

Traditional processors demand you trust their infrastructure.

LarePAY gives you cryptographic control at every level.

The Master Wallet Architecture:

One master wallet under your exclusive control

Unlimited sub-wallets for locations, departments, revenue streams

Each sub-wallet operates independently

Full cryptographic ownership maintained throughout

CoinPayments requires you to trust their custodial service.

NOWPayments holds your private keys in their systems.

Triple-A controls withdrawal timing and permissions.

LarePAY keeps your keys in your hands. Period.

Create a sub-wallet for your Manhattan flagship store. Another for Chicago. Another for online sales.

Each operates autonomously while you maintain master oversight.

No third-party custody. No delayed settlements. No permission required.

The blockchain doesn't lie about ownership. You either control the keys or you don't.

With LarePAY, you do.

Reason #2: NFT Receipts Replace Outdated Confirmation Emails

Email confirmations from competitors? Editable. Forgeable. Unreliable.

LarePAY generates immutable NFT receipts for every transaction.

What This Means:

Permanent blockchain record for every payment

Instant audit trail generation

Automated accounting compliance

Zero manual record-keeping required

Tax season arrives. Your accountant asks for transaction proof.

CoinPayments users: Download CSV files. Cross-reference emails. Verify timestamps.

LarePAY users: Point to the blockchain. Done.

Every NFT receipt contains transaction hash, timestamp, amount, wallet addresses, and metadata.

Immutable. Traceable. Verifiable by anyone, anytime.

Accounting software integrates directly with NFT receipt data.

No more reconciliation headaches. No more disputed charges. No more "the email got lost" excuses.

Reason #3: Hardware-Free POS That Sets Up in Minutes

CoinPayments requires terminal integration. Monthly fees. Maintenance contracts.

LarePAY requires a smartphone.

The QR-generated point of sale eliminates physical hardware entirely.

Setup Process:

Generate location-specific QR code from your sub-wallet

Display QR code at checkout

Customer scans with any smartphone

Payment confirmed on blockchain

No terminals to purchase. No monthly rental fees. No service technician visits.

Physical stores love this. Food trucks love this. Pop-up shops absolutely love this.

One coffee shop in Brooklyn saved $4,200 annually by ditching their terminal rental contracts.

Another merchant set up five locations in three days. No hardware shipping delays. No installation appointments.

Just QR codes and smartphones.

Modern payments shouldn't require 1990s hardware infrastructure.

Reason #4: Gas-Only Fees Destroy Traditional Interchange Rates

CoinPayments charges transaction percentages. Processing fees. Withdrawal fees.

LarePAY charges gas only.

The Math:

Traditional processors: 2-3% per transaction

Credit card interchange: 1.5-3.5% per transaction

LarePAY gas fees: $0.10-$0.50 per transaction (network dependent)

A $100 sale costs you $2-3 with competitors.

The same sale costs you $0.25 in gas with LarePAY.

That's 90%+ fee reduction.

Scale this across thousands of transactions monthly. The savings compound exponentially.

One merchant processing $50,000 monthly saved $14,400 annually by switching to gas-only pricing.

No percentage cuts. No hidden fees. No surprise charges.

Just transparent, predictable, minimal gas costs.

You can verify these fees on-chain yourself. Complete transparency.

Reason #5: LUSD Stablecoin Integration Eliminates Volatility Risk

Accepting Bitcoin or Ethereum carries price risk.

Customer pays $100 in BTC. Market drops 5%. You receive $95 in value.

LarePAY's LUSD integration solves this completely.

Merchants can receive payments in LUSD automatically.

Customer pays in any supported crypto. LarePAY converts to LUSD instantly. You receive stable value.

Zero volatility exposure. Zero market timing stress. Zero conversion hassle.

CoinPayments offers stablecoin support but charges conversion fees.

NOWPayments requires manual conversion settings per transaction.

LarePAY automates the entire process with built-in LUSD rails.

Set your preference once. Receive stable value forever.

Price fluctuations become irrelevant to your revenue projections.

Reason #6: Real-Time Multi-Location Dashboard Without Operational Bloat

Enterprise competitors offer dashboards. But they sacrifice autonomy for visibility.

LarePAY provides both.

The central dashboard shows real-time data across all sub-wallets:

Transaction volumes per location

Revenue breakdowns by department

Individual wallet balances

Historical performance metrics

But here's the difference: Each sub-wallet maintains operational independence.

Your Manhattan store manager controls Manhattan payments. Chicago controls Chicago. Online controls online.

No central bottleneck. No approval delays. No cross-location interference.

CoinPayments requires centralized management for multi-location setups.

Triple-A charges extra for white-label multi-merchant solutions.

LarePAY includes unlimited sub-wallets by default. No tiers. No upgrades. No extra fees.

Scale from one location to one hundred without changing your setup.

Reason #7: Three-Step Onboarding vs. Two-Week Integration Hell

CoinPayments integration: API documentation. Developer resources. Technical support tickets. Testing environments. Production migration.

LarePAY onboarding:

Step 1: Create master wallet (2 minutes)

Step 2: Configure sub-wallets (5 minutes per location)

Step 3: Generate QR codes (instant)

Total time investment: Under 15 minutes for most merchants.

No developers required. No API keys. No webhook configurations.

One bakery in Seattle went live in 11 minutes during their lunch rush.

Another enterprise with 23 locations completed full deployment in one afternoon.

Traditional payment processors require:

Merchant account applications

Credit checks

Bank account verification

Hardware shipping

Installation scheduling

Staff training sessions

LarePAY requires a wallet and five minutes.

The barrier to entry drops to nearly zero.

Why This Matters for Your Bottom Line

Every percentage point in fees matters.

Every hour spent on reconciliation matters.

Every delayed settlement impacts cash flow.

CoinPayments and competitors solve surface-level problems. They accept crypto payments. Great.

LarePAY solves fundamental infrastructure problems. Self-custody. Transparency. Cost efficiency. Scalability.

The difference shows in your financial statements within 30 days.

Lower fees mean higher margins. NFT receipts mean faster accounting. Sub-wallets mean operational flexibility.

One restaurant group calculated $47,000 in annual savings by switching from CoinPayments to LarePAY.

The gas-only fee structure alone justified the migration.

The custody control sealed the decision permanently.

The Enterprise Evolution Starts Here

Traditional payment processors built their models in the custodial finance era.

They adopted crypto but kept the old mindset.

LarePAY started with Web3 principles from day one.

Self-custody isn't a feature. It's the foundation.

Blockchain transparency isn't marketing. It's infrastructure.

Learn more about Web3 global payments and how enterprises are cutting costs while maintaining complete financial control.

The master wallet system isn't experimental. It's operational. It's tested. It's ready.

Your funds. Your wallets. Your control.

Exactly how enterprise payments should work.

Comments