How to Choose the Best Web3 Payment Processor: NOWPayments vs CoinPayments vs Receivables Token Solutions (Compared)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 1 day ago

- 5 min read

Choosing a Web3 payment processor shouldn't be complicated.

But here's the reality: most merchants waste thousands on middleman fees. They hand over custody of their crypto. They wait hours for settlements.

There's a better way.

Let's break down NOWPayments, CoinPayments, and receivables token solutions: no fluff, just facts.

The Fee Reality: What You're Actually Paying

Fees kill profit margins. Period.

NOWPayments: 0.4-1% per transaction plus network fees. On $100,000 monthly volume, that's $400-$1,000 in platform fees alone.

CoinPayments: 0.5% per transaction plus withdrawal fees. Similar economics, slightly tighter range.

Receivables Token Solutions: Gas fees only. Zero percentage cuts. Zero platform fees.

Run the math on high volume. A merchant processing $500,000 monthly pays $2,000-$5,000 to traditional processors. With receivables tokens? Just blockchain gas: typically $50-$200 total.

That's 95%+ fee reduction.

The difference compounds fast. Over a year, that's $24,000-$60,000 staying in your business instead of feeding intermediaries.

Cryptocurrency Support: Breadth vs Flexibility

NOWPayments dominates raw numbers: 300+ cryptocurrencies supported. Every major chain. Most stablecoins. Alt tokens. DeFi tokens.

CoinPayments supports 40+ coins with 21 stablecoins. Narrower but covers the essentials.

Receivables tokens flip the model entirely. No predefined coin lists. If it's built on a supported blockchain layer, you can accept it. Native blockchain operations mean instant compatibility with new tokens.

For niche cryptocurrencies or emerging tokens, NOWPayments wins on coverage. For flexibility and future-proofing, receivables tokens eliminate the "supported coins" limitation entirely.

Custody Models: Who Controls Your Money?

This is where things get serious.

NOWPayments: Optional Custody

Non-custodial by default. Funds settle directly to your wallets. You maintain control.

They offer optional custody if you need it for compliance or simplified operations. Choice matters.

CoinPayments: Custodial Default

Your crypto sits on their platform until withdrawal. They hold the keys. They manage the balances.

Simpler for solo sellers. More centralized risk for serious merchants.

Challenging KYB process. Account freeze potential. Intermediary dependencies.

Receivables Token Solutions: True Self-Custody

Every payment settles to your wallet. Instantly. Permanently.

No intermediary holding period. No withdrawal queue. No platform risk.

You control the private keys. You control the assets. You control your business.

Self-custody eliminates counterparty risk. Your funds can't be frozen by platform policy changes. No terms-of-service surprises.

Settlement Speed: Time Is Money

NOWPayments: 5 minutes average end-to-end. TON blockchain payments clear under 1 minute. Fast and reliable.

CoinPayments: "A few minutes to several hours" depending on blockchain congestion. Variable and unpredictable.

Receivables Tokens: On-chain confirmation timelines. No intermediary delays. Typically faster than traditional processors because there's no middleware layer slowing things down.

Instant settlement means instant cash flow. No waiting for batch processing. No daily settlement windows.

Integration Capabilities: Developer Experience

Both NOWPayments and CoinPayments offer solid integration:

REST APIs with webhook support

Payment creation endpoints

Plugins for major ecommerce platforms

White-label customization

QR code POS systems

Mass payout functionality

Recurring billing support

Receivables tokens add programmable features impossible with traditional processors:

Automatic royalty splits. Revenue shares coded directly into the payment itself.

Multi-signature authorization. Team controls built into the payment layer.

Time-locked releases. Escrow without third parties.

DeFi composability. Idle balances earn yield automatically.

These aren't API features. They're blockchain-native capabilities.

The LUSD Advantage: Stability Without Volatility

Stablecoin settlements solve the crypto volatility problem.

NOWPayments and CoinPayments support major stablecoins (USDT, USDC, DAI). You can accept volatile crypto and receive stable value.

Receivables token ecosystems like Larecoin integrate LUSD: Liquity's decentralized, algorithmic stablecoin. Zero counterparty risk. No frozen assets. Pure on-chain stability.

Traditional stablecoins require trusting Circle or Tether. LUSD requires trusting math and code. That's the difference between centralized IOU tokens and decentralized stability mechanisms.

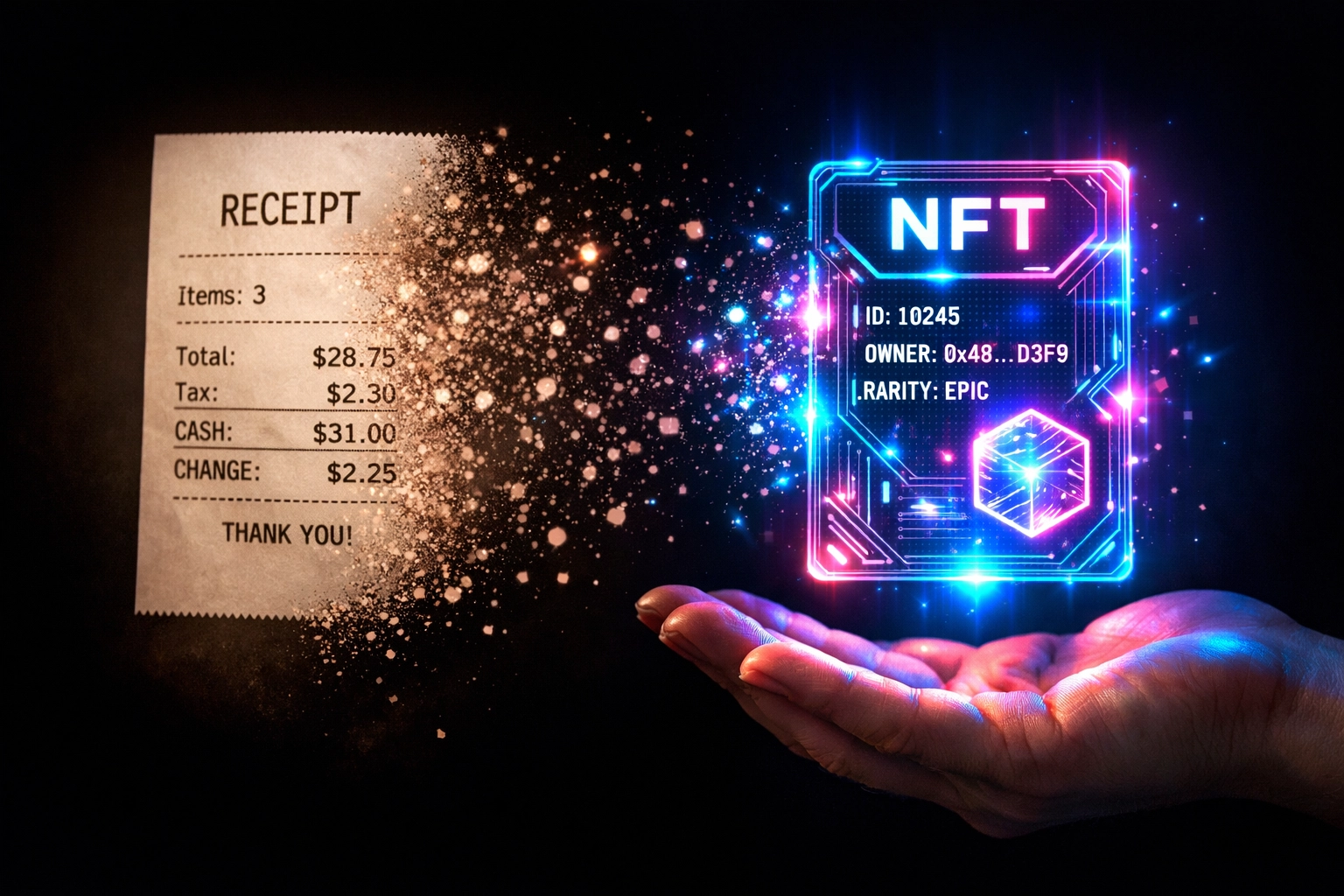

NFT Receipts: Programmable Proof of Payment

Traditional processors give you transaction IDs.

Receivables tokens give you NFT receipts.

Every payment generates a unique, tradeable, programmable NFT. That receipt becomes:

Verifiable proof of purchase

Warranty documentation

Membership access credential

Loyalty program entry

Resellable asset

NFT receipts unlock secondary markets for digital goods. They enable automatic warranty tracking. They create loyalty programs without databases.

This isn't a gimmick. It's infrastructure for next-generation commerce.

Merchant Independence: Breaking Free from Platforms

Platform dependency is the hidden cost nobody talks about.

CoinPayments controls your account. They set withdrawal limits. They enforce policy changes. They decide who gets access.

NOWPayments offers more flexibility but still operates as a platform layer between you and your customers.

Receivables tokens eliminate the platform entirely.

You're not a user of a service. You're operating blockchain infrastructure directly. No accounts to freeze. No policies to enforce. No middleman approvals.

True merchant independence means:

No arbitrary account suspensions

No compliance policy surprises

No platform fee increases

No forced migrations

You own the infrastructure. You control the commerce.

When to Choose Each Solution

Choose NOWPayments If:

You need 300+ cryptocurrency support with enterprise features. Fast setup. 24/7 live chat support. Optional custody flexibility. Mass payout automation.

Best for: Growing merchants who want broad crypto acceptance without blockchain expertise.

Choose CoinPayments If:

You're comfortable with custodial solutions. You focus on major cryptocurrencies. You want consolidated platform management.

Best for: Solo sellers and small teams prioritizing simplicity over custody control.

Choose Receivables Token Solutions If:

Fees eat your margins. True self-custody matters. Instant settlement is critical. You want programmable payment automation. You process high volume where percentage fees compound into massive leakage.

Best for: Serious merchants prioritizing independence, fee optimization, and blockchain-native commerce.

The Real Comparison Nobody Discusses

Traditional processors optimize for ease of adoption.

Receivables tokens optimize for merchant economics.

That's the fundamental difference.

NOWPayments and CoinPayments built familiar SaaS platforms with crypto rails bolted on. Easy onboarding. Recognizable UX. Percentage fees forever.

Receivables tokens built blockchain-native financial infrastructure. Steeper learning curve. Superior economics. True ownership.

Which model serves your business better depends on your priorities and technical comfort level.

Making Your Decision

Start with three questions:

1. What's your monthly payment volume?

Higher volume makes percentage fees devastatingly expensive. Calculate annual fee cost at current volume. Compare against gas-only alternatives.

2. How important is custody control?

If "not your keys, not your crypto" resonates, custodial solutions fail the test. Self-custody isn't paranoia: it's financial sovereignty.

3. Do you need programmable features?

Royalty automation, escrow mechanisms, DeFi integration: these capabilities only exist blockchain-native. Traditional processors can't compete here.

The Bottom Line

For most enterprises and marketplaces, NOWPayments wins on flexibility and feature breadth. Broad cryptocurrency support. Enterprise-grade features. Proven infrastructure.

For fee optimization and custody control, receivables token solutions deliver superior economics and technical capabilities. Gas-only fees. True self-custody. Programmable automation.

CoinPayments sits in the middle: custodial simplicity for teams prioritizing convenience over control.

The smartest merchants run hybrid strategies. Traditional processors for mainstream checkout flows. Receivables tokens for high-value transactions and wholesale operations.

No single solution fits every use case. But understanding the tradeoffs: fees vs features, custody vs convenience, platforms vs protocols: lets you optimize for what actually matters to your business.

Choose based on economics, not marketing. Calculate real costs. Measure actual control. Build for merchant independence.

That's how you win in Web3 payments.

Ready to explore receivables token solutions? Check out how Larecoin's ecosystem transforms crypto commerce.

Comments