How to Reduce Merchant Interchange Fees by 50%+ Using Web3 Global Payments (2026 Guide)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Merchant interchange fees are bleeding your business dry.

Traditional payment processors take 2.5-3.5% of every transaction. Plus monthly minimums. Plus PCI compliance fees. Plus chargeback penalties.

Web3 global payments eliminate this entire stack.

You keep 98-99.5% of every sale. No middlemen. No permission required. Total financial sovereignty.

Here's exactly how to make the switch in 2026.

The Hidden Tax on Every Transaction

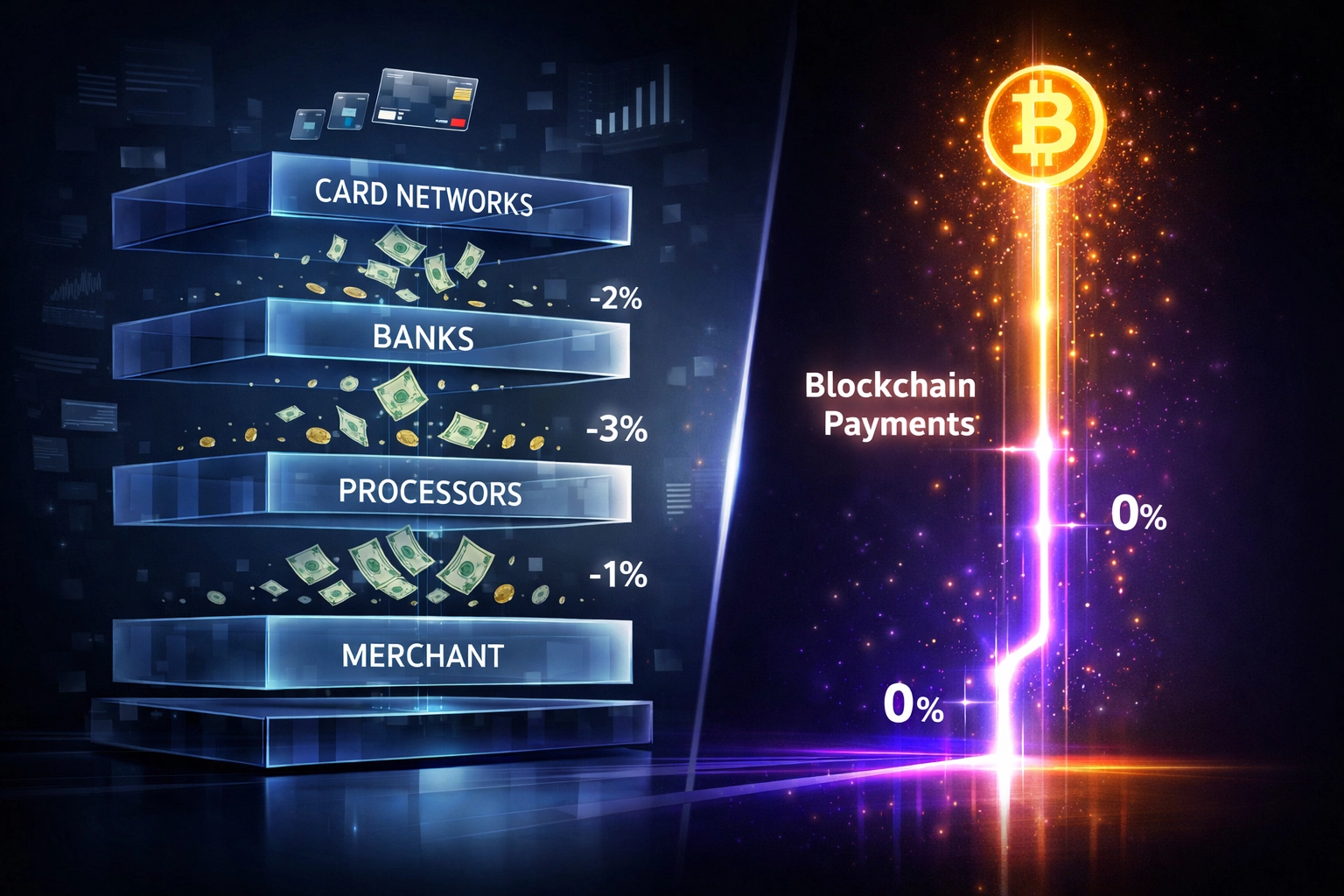

Traditional payment processing chains fees through multiple layers.

Card networks extract their cut. Issuing banks take theirs. Payment processors grab another slice. Every transaction passes through 3-4 intermediaries before funds reach your account.

The math destroys profitability:

$500K annual revenue = $13,300-$22,100 in fees

$50K monthly revenue = $1,400/month lost

$500K monthly revenue = $12,500/month gone

And that's before chargebacks wipe out another 1-2% of revenue.

You're essentially paying a 20-30% tax on profit margins for the privilege of accepting payments.

How Web3 Eliminates the Middleman Stack

Blockchain payments settle directly from customer wallet to merchant wallet.

No card networks. No issuing banks. No payment processors.

Just peer-to-peer transactions on Solana, Ethereum, or other fast chains. Gas fees range from $0.10-$2.00 per transaction. Platform fees hit 0.5-1% maximum.

The cost comparison is staggering:

Traditional Processing:

2.5-3.5% transaction fee

$30-50 monthly minimum

$100+ PCI compliance annually

Chargeback fees ($15-25 each)

3-5 day settlement holds

Web3 Payments:

0.5-1% platform fee (or gas-only)

$0 monthly minimum

$0 compliance costs

$0 chargebacks (impossible on-chain)

60-second settlement

Real Merchant Savings Examples

A coffee shop processing $25,000/month saves $9,600 annually switching to Web3 payments.

An e-commerce store doing $100,000/month saves $38,400 annually.

A subscription service with $500,000 monthly revenue saves $120,000 annually.

These aren't theoretical projections. Blockchain-based B2B cross-border payments exceeded $4.4 trillion in 2024. Merchants report 80% of global payments settling instantly.

The infrastructure is production-ready.

Step-by-Step Implementation Guide

Step 1: Set Up Your Self-Custody Wallet

Download Phantom, MetaMask, or similar Web3 wallet. Generate your private keys in under 5 minutes.

This wallet becomes your payment processor. You control it directly. No account approvals. No credit checks. No gatekeepers.

Step 2: Integrate Web3 Payment Gateway

Access Larecoin's merchant tools at larecoin.com. Copy API credentials. Add the payment widget to your checkout page.

Implementation takes 15 minutes for most platforms. No developer required for basic setups.

Step 3: Configure Stablecoin Payments

Enable LUSD (Liquidity USD) as your default payment currency. This eliminates cryptocurrency price volatility completely.

Customer pays $100 in LUSD. You receive $100 in LUSD. No conversion risk. No exchange rate surprises.

Step 4: Activate NFT Receipts

Enable automatic NFT receipt generation for every transaction. Customers get blockchain-verified proof of purchase. You get immutable transaction records.

Tax reporting becomes trivial. Dispute resolution is instant. Customer data lives on-chain, not vulnerable servers.

Step 5: Accept Your First Payment

Customer connects wallet at checkout. Selects payment amount. Confirms transaction.

Funds arrive in your wallet within 60 seconds. No holds. No intermediaries. No permission required.

Larecoin vs NOWPayments vs CoinPayments

Let's compare the leading Web3 payment solutions head-to-head.

NOWPayments:

0.5-1% transaction fee

Custodial wallet structure

Limited stablecoin options

Basic receipt functionality

No NFT integration

CoinPayments:

0.5% transaction fee

Custodial wallet model

Supports 2,000+ cryptocurrencies

Traditional receipt system

No Web3-native features

Larecoin:

Gas-only transfer option (0.1-0.5%)

Self-custody wallet architecture

LUSD stablecoin native integration

Automatic NFT receipts

Web3-native merchant tools

The key difference? NOWPayments and CoinPayments operate as traditional payment processors with crypto features bolted on.

Larecoin operates as a decentralized payment protocol with merchant sovereignty built in.

You maintain custody. You control funds. You own customer relationships.

Advanced Merchant Freedom Features

Gas-Only Transfers

Larecoin's gas-only transfer model eliminates platform fees entirely for direct wallet-to-wallet payments. You pay only network fees ($0.10-$2.00 per transaction).

A merchant processing $1M annually pays $1,000-$5,000 in total fees. Traditional processors would extract $25,000-$35,000.

That's a 75-87% cost reduction.

NFT Receipt Ecosystem

Every transaction generates a blockchain-verified NFT receipt. Customers can resell receipts, trade them, or use them for loyalty programs.

You build direct relationships with customers. No intermediary owns your customer data. No platform can deplatform your business.

LUSD Stablecoin Stability

LUSD (Liquidity USD) maintains 1:1 USD peg through overcollateralization. Unlike algorithmic stablecoins, LUSD is backed by real crypto assets locked in smart contracts.

You avoid volatility. Customers avoid complexity. Accounting stays simple.

Cross-Border Efficiency

Same 60-second settlement globally. No currency conversion fees. No international wire charges. No regional payment processor restrictions.

A customer in Japan pays the same fees as a customer in Brazil. Your business operates truly globally from day one.

The Financial Sovereignty Advantage

Traditional payment processors can freeze accounts without notice. Deny transactions based on subjective risk assessments. Hold funds for weeks during "reviews."

Web3 payments eliminate these control points.

Your wallet. Your keys. Your funds. No third party can block access.

This isn't just about fee savings. It's about merchant independence.

You're not asking permission to run your business. You're operating on open protocols that can't be shut down.

Common Implementation Questions

"What about cryptocurrency volatility?"

Use LUSD stablecoin payments. Problem solved. 1:1 USD peg eliminates price fluctuations.

"How do refunds work?"

Send a reverse transaction from your wallet to customer wallet. Settlement in 60 seconds. No dispute process. No chargeback windows.

"What about regulatory compliance?"

Self-custody wallets don't require KYC for basic operations. Tax reporting uses blockchain transaction records. Consult local regulations for specific requirements.

"Can I convert crypto to fiat?"

Yes. Use decentralized exchanges or centralized onramps like Coinbase. Conversion takes 5-10 minutes. Fees range from 0.5-1%.

Getting Started Today

The Web3 payment infrastructure is live and production-ready.

Thousands of merchants are processing millions in transactions monthly. The technology works. The savings are real. The independence is tangible.

Set up your self-custody wallet. Integrate Larecoin's merchant tools. Start accepting Web3 payments this week.

Your first transaction settles in 60 seconds. Your first monthly savings appears immediately.

Stop paying 20-30% of profits to intermediaries. Keep what you earn.

Visit larecoin.com to access merchant integration tools.

The future of payments is direct, decentralized, and merchant-controlled.

Your business deserves financial sovereignty.

Comments