How to Reduce Merchant Interchange Fees by 50% with a Receivables Token (Easy Guide)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 15 hours ago

- 4 min read

Interchange fees are eating your profits alive.

Every swipe. Every tap. Every transaction. The card networks take their cut. And you're left wondering where your margins went.

What if you could slash those fees in half? No gimmicks. No complicated setup. Just a smarter payment rail.

Enter the receivables token. Specifically, Larecoin's approach to decentralized merchant payments.

Let's break it down.

What Are Interchange Fees (And Why They Hurt)

Interchange fees are the hidden tax on every card transaction.

When a customer pays with a credit or debit card, a percentage goes to:

The issuing bank

The card network (Visa, Mastercard)

Your payment processor

Average interchange rates in 2026:

Credit cards: 1.5% to 3.5%

Debit cards: 0.5% to 1.5%

Premium/reward cards: Up to 3.5%+

For a merchant doing $500,000 in annual sales, that's $7,500 to $17,500 gone. Every single year.

Small margins. Big problem.

Traditional Methods to Reduce Fees (Limited Results)

The old playbook includes:

Surcharging: Pass fees to customers. Legal in most states. Maximum 4% cap. But customers hate it.

Interchange optimization: Level 2 and Level 3 data submission. Saves 20-30 basis points. Complex implementation.

Negotiate processor markups: Interchange-plus pricing. Transparent. Still expensive.

These methods work. Sort of.

Best case? You save 20-40% on processing costs with Level 2/3 data optimization.

But the underlying rails remain the same. Card networks still control the game.

The Receivables Token Revolution

Here's where crypto payments flip the script.

A receivables token represents the value of a transaction on-chain. Direct. Transparent. No intermediaries skimming percentages.

Larecoin's receivables token system works like this:

Customer pays with crypto (LARE, LUSD, or other supported tokens)

Transaction settles on-chain instantly

Merchant receives funds directly to their self-custody wallet

NFT receipt generated automatically for records

No card network. No issuing bank. No 2-3% disappearing into the void.

Your cost? Gas fees only. We're talking fractions of a cent on efficient networks like Solana.

That's the 50%+ reduction right there.

How Larecoin Stacks Up vs. Competitors

Let's talk alternatives.

NOWPayments offers crypto payment processing. Decent service. But:

0.5% to 1% transaction fees

Custodial by default

Limited merchant control

Conversion fees on top

CoinPayments has been around since 2013. Established. But:

0.5% base fee

Withdrawal fees apply

Custodial wallet structure

You don't truly own your funds

Larecoin's approach:

Gas-only transfers

True self-custody from day one

NFT receipts for every transaction

LUSD stablecoin option for volatility protection

Push-to-card for instant fiat conversion when needed

The difference is philosophical.

Other platforms process your payments for you. Larecoin enables you to process payments yourself.

Merchant freedom. That's the point.

Understanding LUSD: Stability Meets Savings

Crypto volatility scares merchants. Understandable.

That's where LUSD comes in.

LUSD is Larecoin's stablecoin solution. Pegged to the US dollar. Stable value. Crypto efficiency.

Benefits for merchants:

Accept payments without price swing risk

Hold value in stable assets

Convert to fiat or other crypto when ready

Maintain full custody throughout

Your customers pay in crypto. You receive stable value. Fees stay minimal.

Best of both worlds.

NFT Receipts: Beyond Traditional Records

Every Larecoin transaction generates an NFT receipt.

Why does this matter?

Immutable proof: Transaction details permanently recorded on-chain. No disputes. No "lost" records.

Tax simplicity: Exportable records for accounting. Clean audit trail.

Customer transparency: Buyers get verifiable proof of purchase. Reduces chargebacks and fraud claims.

Brand value: Custom NFT receipts become a merchant branding opportunity.

Traditional payment processors give you CSV exports. Maybe.

Larecoin gives you permanent, verifiable, on-chain documentation.

Self-Custody: Your Money, Your Control

Here's the uncomfortable truth about most payment processors:

They hold your money. They control your money. They decide when you access your money.

Common processor issues:

Rolling reserves (they hold 5-10% of your revenue)

Delayed settlements (2-7 business days)

Account freezes (often without warning)

Fund holds during "reviews"

With Larecoin's self-custody model:

Funds go directly to YOUR wallet

Access immediately

No holds

No reserves

No third party between you and your revenue

This is merchant independence. Real financial sovereignty.

Step-by-Step: Setting Up Larecoin Payments

Ready to cut those fees? Here's how:

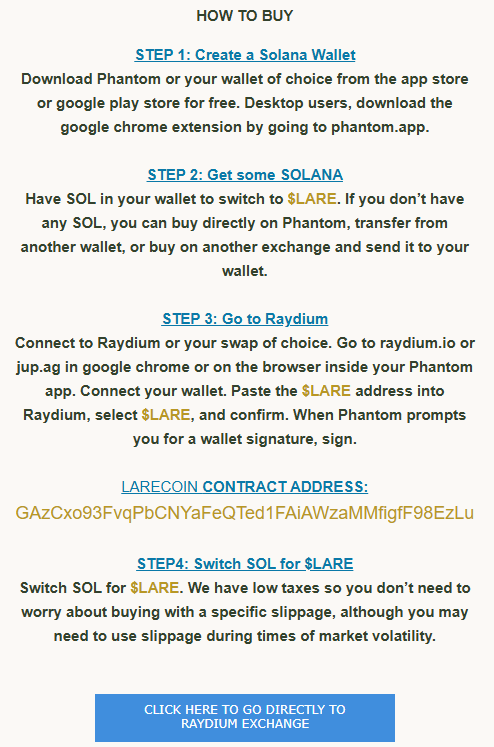

Step 1: Set Up Your Wallet

Get a Solana-compatible wallet. Phantom, Solflare, or any SPL-supporting option works.

Step 2: Acquire $LARE

Head to Raydium. Swap SOL for LARE using the official contract address. Low slippage. Minimal tax.

Step 3: Configure Your Merchant Account

Connect your wallet to the Larecoin merchant dashboard. Set accepted tokens. Configure settlement preferences.

Step 4: Integrate Payment Options

Add Larecoin payment buttons to your checkout. API available for custom integrations. Plugins for major e-commerce platforms.

Step 5: Start Accepting Payments

Customers scan, pay, done. Funds arrive in your wallet instantly.

The Math: Real Savings Breakdown

Let's run the numbers.

Traditional card processing on $100,000 annual revenue:

Average 2.5% interchange: $2,500

Processor markup (~0.5%): $500

Total fees: $3,000

Larecoin processing on $100,000 annual revenue:

Gas fees (estimated): $50-100

No interchange

No processor markup

Total fees: ~$100

Annual savings: $2,900

That's a 96%+ reduction. Not 50%. Way beyond.

Even if you factor in some conversion costs for customers new to crypto, you're still looking at massive savings.

Addressing Common Concerns

"My customers don't use crypto."

More do than you think. Crypto adoption hit mainstream in 2024-2025. Offer it as an option alongside traditional payments. You'll be surprised.

"What about volatility?"

LUSD. Accept stablecoin payments. Problem solved.

"Is it complicated?"

If you can set up a PayPal button, you can set up Larecoin. Seriously.

"What about regulations?"

Larecoin operates within existing crypto payment frameworks. Consult your local regulations. Most jurisdictions are crypto-friendly in 2026.

Join the Decentralized Payment Revolution

The future of merchant payments isn't about negotiating better rates with Visa.

It's about bypassing the entire legacy system.

Receivables tokens. Self-custody. NFT receipts. Gas-only fees.

This is what merchant freedom looks like.

Ready to cut your interchange fees by 50% or more?

Get started at larecoin.com

Have questions? Join the community discussion in our official announcements forum or check out Larecoin updates for the latest features.

Your profits. Your control. Your future.

Let's build it together.

Comments