How to Reduce Merchant Interchange Fees by 50% With a Receivables Token (Easy Guide)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 days ago

- 4 min read

Interchange fees are killing your margins.

Every swipe. Every tap. Every online checkout.

Traditional payment processors take 2-4% off the top. Sometimes more. That's money straight out of your pocket.

But here's the thing. There's a smarter way. A Web3 way.

Receivables tokens are changing the game for merchants. And Larecoin is leading the charge.

Let's break down exactly how you can slash those fees by 50% or more.

What Are Interchange Fees (And Why They're Draining Your Business)

Quick refresher.

Interchange fees are the hidden costs charged every time a customer pays with a card. These fees go to:

Card networks (Visa, Mastercard)

Issuing banks

Payment processors

The average U.S. merchant pays 2.3-3.5% per transaction. For high-risk industries? Even higher.

Do the math:

$100,000 in monthly sales

3% interchange fees

$3,000 gone every month

That's $36,000 per year. Vanished.

Traditional processors like CoinPayments and NOWPayments offer crypto alternatives. But they still charge 0.5-1% plus conversion fees. Plus withdrawal fees. Plus network fees.

It adds up fast.

Enter the Receivables Token: Your Fee-Slashing Weapon

A receivables token is different.

Think of it as a digital representation of the payment you're owed. Built on blockchain. Verified. Transparent. Instant.

Here's why it matters for merchants:

No middlemen. The token moves directly from buyer to seller. No card networks taking their cut.

Gas-only transfers. You pay minimal blockchain fees. Not percentage-based processing fees.

Instant settlement. No waiting 2-5 business days for funds to clear.

Larecoin's receivables token system is built specifically for merchants who want freedom from traditional payment rails.

How Larecoin Cuts Your Fees by 50% (Or More)

Let's get specific.

Traditional interchange: 2.5-3.5%

CoinPayments: 0.5% + network fees + conversion fees

NOWPayments: 0.5-1% + withdrawal fees

Larecoin receivables token: Gas-only transfer

The difference is structural.

With Larecoin, you're not paying a percentage of every sale. You're paying a flat network fee to move the token. On Solana, that's fractions of a penny.

Real example:

$500 sale

Traditional processor: $15-17.50 in fees

Larecoin: $0.01-0.05 in gas

That's not 50% savings. That's 99%+ savings on processing.

Even if you factor in on/off-ramping costs for customers who need fiat conversion, you're still looking at 50-70% reduction in total payment costs.

LUSD: The Stablecoin That Keeps Your Revenue Stable

Volatility is the elephant in the room.

Bitcoin swings. Ethereum swings. Even Solana has its moments.

That's where LUSD comes in.

LUSD is Larecoin's stablecoin. Pegged to the dollar. Built for payments.

When customers pay with LUSD:

You receive dollar-equivalent value

No conversion risk

No waiting for price swings

Instant finality

Compare that to NOWPayments, where you might receive BTC that drops 5% before you can convert it.

LUSD eliminates that headache entirely.

Self-Custody: Your Money, Your Rules

Here's where Larecoin really separates from the pack.

With CoinPayments and NOWPayments, your funds sit in their wallets. Their custody. Their control.

What happens if they:

Freeze your account?

Go offline?

Change their terms of service?

You're at their mercy.

Larecoin is built on self-custody principles.

Your wallet. Your keys. Your funds.

The moment a payment clears, it's in YOUR wallet. Not a third-party account. Not a custodial service.

True merchant freedom.

This isn't just philosophical. It's practical:

No withdrawal delays

No minimum thresholds

No account freezes

No permission needed to access YOUR money

NFT Receipts: Proof That Can't Be Disputed

Chargebacks cost U.S. merchants $125 billion annually.

That's not a typo.

Every chargeback hits you twice, the lost sale AND the chargeback fee. Plus the headache of disputing it.

Larecoin's NFT receipt system changes the equation.

Every transaction generates an NFT receipt:

Immutable proof of purchase

Timestamped on blockchain

Verifiable by anyone

Can't be altered or deleted

When a customer claims they never received something? You have blockchain-verified proof.

When a fraudster tries a friendly fraud attack? The NFT receipt tells the real story.

This isn't available on NOWPayments. Not on CoinPayments. Not on traditional processors.

It's a Larecoin innovation.

How Larecoin Stacks Up Against the Competition

Let's do a direct comparison.

Feature | CoinPayments | NOWPayments | Larecoin |

Processing Fee | 0.5% | 0.5-1% | Gas only |

Withdrawal Fee | Yes | Yes | No |

Self-Custody | No | No | Yes |

NFT Receipts | No | No | Yes |

Stablecoin | Third-party | Third-party | LUSD native |

Settlement Time | Hours-Days | Hours | Instant |

The numbers speak for themselves.

NOWPayments and CoinPayments are fine for basic crypto acceptance. But they're still operating on the old playbook. Percentage fees. Custodial control. Third-party dependencies.

Larecoin is the next evolution.

Getting Started: Your 5-Step Setup Guide

Ready to cut those fees? Here's how to get rolling with Larecoin.

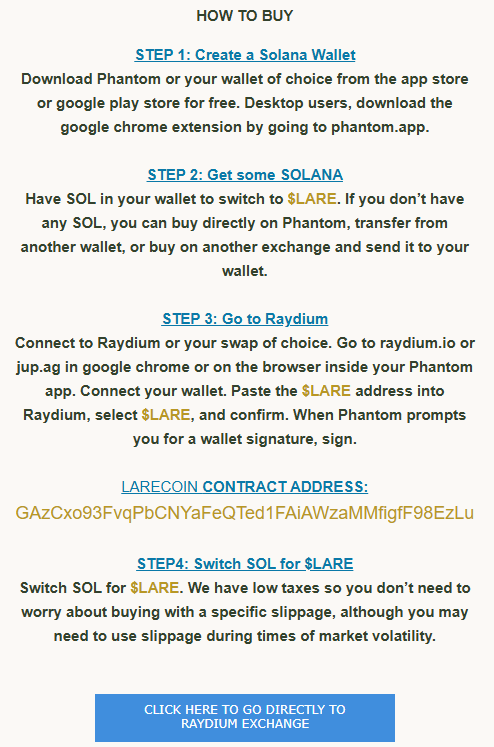

Step 1: Set Up Your Solana Wallet

You need a self-custody wallet. Phantom and Solflare are popular choices. Download. Create. Secure your seed phrase.

Step 2: Get Some SOL

You'll need a small amount of SOL for gas fees. Buy on any major exchange and transfer to your wallet.

Step 3: Connect to Raydium

Head to Raydium to swap SOL for LARE tokens. Use the official Larecoin contract address to ensure you're getting the real thing.

Step 4: Integrate Larecoin Payments

Visit larecoin.com to access merchant integration tools. Set up your payment flow to accept LARE and LUSD.

Step 5: Start Accepting Payments

That's it. You're live. Every payment goes directly to your wallet. Gas-only fees. Full self-custody.

The Bottom Line: Stop Giving Away Your Profits

Every percentage point matters.

Traditional interchange fees are a tax on your business. CoinPayments and NOWPayments are better: but they're still taking a cut.

Larecoin's receivables token model flips the script:

Gas-only transfers

Full self-custody

LUSD stability

NFT receipt protection

50% fee reduction is the conservative estimate. Many merchants see 80-90%+ savings.

The question isn't whether crypto payments make sense for your business.

The question is why you're still paying 3% when you could pay pennies.

Ready to make the switch? Explore the full Larecoin ecosystem at larecoin.com and join the merchant freedom movement.

Your margins will thank you.

Comments