How to Reduce Merchant Interchange Fees by 50% with a Receivables Token (Yes, Really)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 7 days ago

- 4 min read

Let's cut to the chase.

You're losing 2-4% on every single transaction. Visa, Mastercard, American Express: they all take their cut. And there's nothing you can do about it.

Or is there?

Traditional advice tells you to encourage debit cards. Process more in-person transactions. Negotiate with your processor. Close batches daily. Implement Level 2 and Level 3 data processing.

All decent strategies. But here's the problem: interchange fees are set by card networks and are non-negotiable on a per-transaction basis.

You can optimize around the edges. Shave off a fraction here and there. But the core fee structure? Untouchable.

Unless you bypass it entirely.

The Interchange Fee Problem Nobody Talks About

Here's what your payment processor doesn't want you to know.

Every credit card transaction involves multiple middlemen. The issuing bank. The acquiring bank. The card network. The payment processor. Each one takes a slice.

For a typical $100 transaction, you might pay:

1.5-2.5% interchange fee (goes to the card-issuing bank)

0.13-0.15% assessment fee (goes to Visa/Mastercard)

0.2-0.5% processor markup (goes to your payment processor)

Add it all up? You're looking at 2-4% gone. Forever.

On $500,000 in annual sales, that's $10,000-$20,000 vanishing into the legacy financial system.

Every. Single. Year.

Enter the Receivables Token: A Different Architecture

This is where Larecoin changes the game.

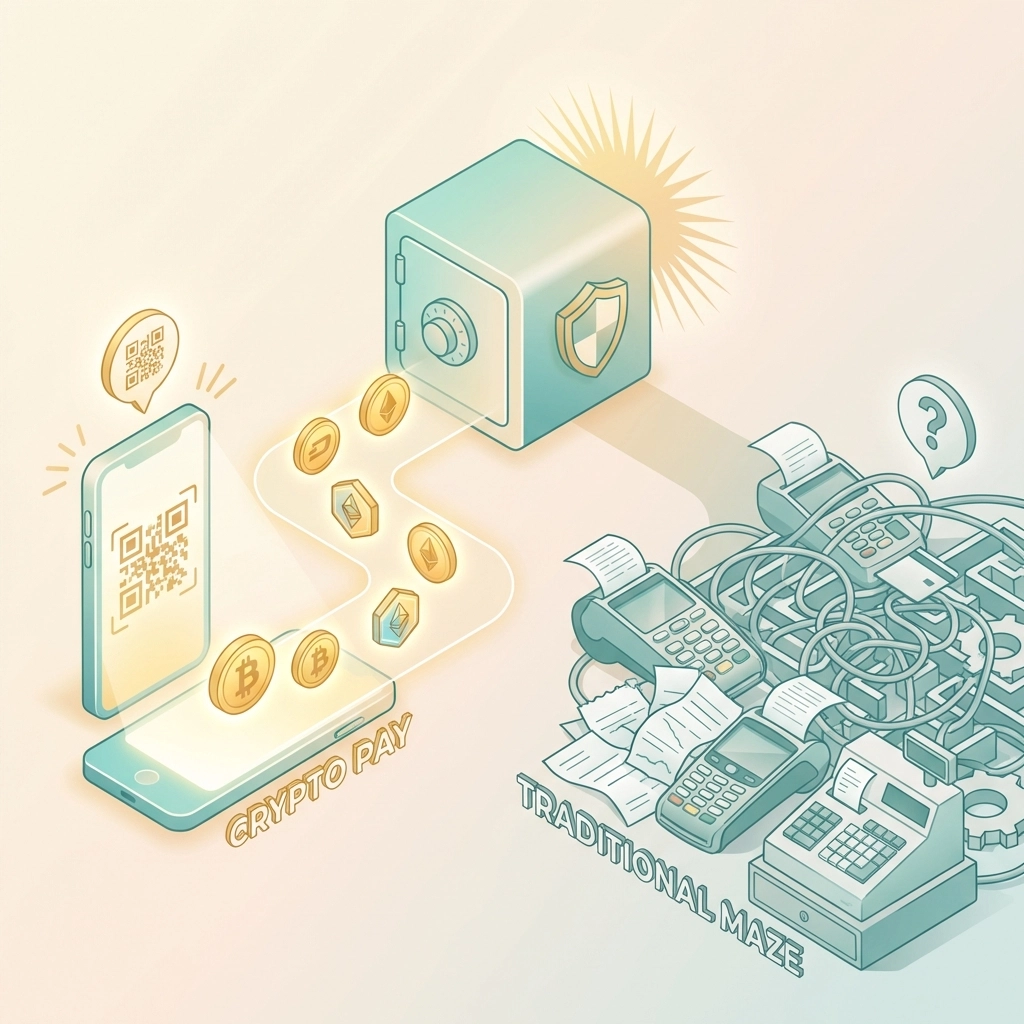

Traditional payment rails were built decades ago. Layer upon layer of intermediaries. Each one extracting value.

A receivables token operates differently.

No card networks. No interchange fees. No acquiring banks taking their cut.

Just peer-to-peer value transfer on blockchain rails.

The Larecoin ecosystem includes:

LARE – The receivables token itself

LUSD – Stablecoin version for price stability

LarePAY – Payment processing infrastructure

LareBlocks – The underlying technology layer

When a customer pays with Larecoin, the transaction moves directly from their wallet to yours. The only cost? Minimal gas fees on Solana: we're talking fractions of a cent.

Compare that to 2-4% on legacy rails.

The math isn't complicated.

How 50% Fee Reduction Actually Works

Let's break down real numbers.

Traditional Card Processing:

$100 transaction

3% total fees

You receive: $97

Larecoin Processing:

$100 transaction

~0.5% total fees (including conversion if needed)

You receive: $99.50

That's not marketing fluff. That's basic arithmetic.

For high-volume merchants processing millions annually? The savings compound dramatically.

But here's where it gets interesting.

Self-Custody: Your Money, Your Rules

With legacy processors, your funds sit in their accounts. Settlement takes 2-3 business days. Sometimes longer.

Chargebacks can hit weeks later. Funds held for "risk review." Account frozen pending investigation.

Sound familiar?

The Larecoin Smart Wallet changes everything.

Self-custody means:

Instant settlement (seconds, not days)

No third-party holds on your funds

No surprise account freezes

Complete control over your money

When a customer completes a transaction through LarePAY, the funds hit your wallet immediately. Not your processor's account. Not a holding account. Your wallet.

You can convert to LUSD for stability. Bridge to other chains. Push to card for fiat spending. Your choice.

This is what financial sovereignty looks like for merchants.

NFT Receipts: Tax Season Just Got Easier

Every accountant's nightmare: reconciling thousands of transactions at year-end.

Larecoin solves this with NFT receipts.

Every transaction generates an immutable, on-chain receipt. Timestamped. Verified. Permanent.

Benefits for accounting:

Automatic categorization

Tamper-proof records

Instant audit trails

Simplified tax preparation

No more digging through payment processor dashboards. No more missing receipts. No more "the dog ate my financial records."

Every transaction, preserved on-chain, forever accessible.

Your accountant will thank you.

QR-Generated POS: Deploy in Minutes

Traditional POS systems require hardware. Installation. Training. Ongoing maintenance fees.

LarePAY takes a different approach.

Generate a QR code. Display it. Done.

Customers scan with any compatible wallet. Transaction completes in seconds. You receive notification instantly.

No hardware required. No monthly terminal fees. No merchant account applications.

Perfect for:

Pop-up shops

Farmers markets

Service businesses

Online checkout

In-store retail

Scale from one location to hundreds without additional infrastructure costs.

The future of point-of-sale isn't expensive hardware. It's a QR code and a smartphone.

How Larecoin Stacks Up Against Competitors

Let's talk alternatives.

NOWPayments offers crypto payment processing. Decent option. But they charge 0.5-1% plus conversion fees. Limited self-custody options. Centralized infrastructure.

CoinPayments has been around longer. Supports 100+ cryptocurrencies. But settlement times lag. Fee structures get complicated. No receivables token benefits.

Triple-A focuses on enterprise. High minimum volumes. Complex integration requirements. Not built for the average merchant.

Larecoin offers:

Lower overall fees

True self-custody

Instant settlement

NFT receipt generation

Simple QR-based POS

Full ecosystem integration (LUSD, LarePAY, LareBlocks)

The comparison isn't close.

Getting Started: It's Simpler Than You Think

Ready to cut your payment processing costs in half?

Here's the path forward:

Visit larecoin.com/payments to explore LarePAY

Set up your Larecoin Smart Wallet for self-custody

Generate your first QR code for instant payment acceptance

Start processing transactions at a fraction of legacy costs

No lengthy applications. No merchant account approvals. No waiting weeks for activation.

From signup to accepting payments? Minutes.

The Bottom Line on Interchange Fee Reduction

Traditional payment processors will tell you interchange fees are unavoidable.

They're right: if you stay on traditional rails.

But blockchain-based payments operate on entirely different infrastructure. No card networks means no interchange fees. No acquiring banks means no middleman markup.

Larecoin's receivables token architecture wasn't designed to optimize within the legacy system. It was designed to replace it.

50% fee reduction isn't a gimmick. It's the natural result of eliminating unnecessary intermediaries.

Your competitors are still paying 2-4% on every transaction. While they negotiate marginal rate reductions, you could be operating on fundamentally better infrastructure.

The math is clear. The technology is ready. The only question: how long will you keep paying legacy fees?

Ready to slash your interchange fees? Explore the Larecoin ecosystem at larecoin.com and discover what payments look like when you remove the middlemen.

Comments