How to Reduce Merchant Interchange Fees by 50%+ with Web3 Global Payments (2026 Playbook)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 23 minutes ago

- 4 min read

Traditional payment processors are bleeding your business dry.

Interchange fees eat 2.5-3.5% of every transaction. Processing markups add another 0.5%. Gateway fees cost $10-30 monthly. Chargebacks drain 0.5-1% annually.

For a $500K revenue business, that's $15,000-$18,000 gone. Annual.

A $2 million business? $60,000 vanishes just to move money.

Web3 global payments slash these fees to near-zero. Blockchain settlement costs $0.01-$0.30 per transaction. That's a 99.9% reduction compared to card networks.

Here's your 2026 playbook to cut merchant interchange fees by 50%+ using Larecoin and Web3 infrastructure.

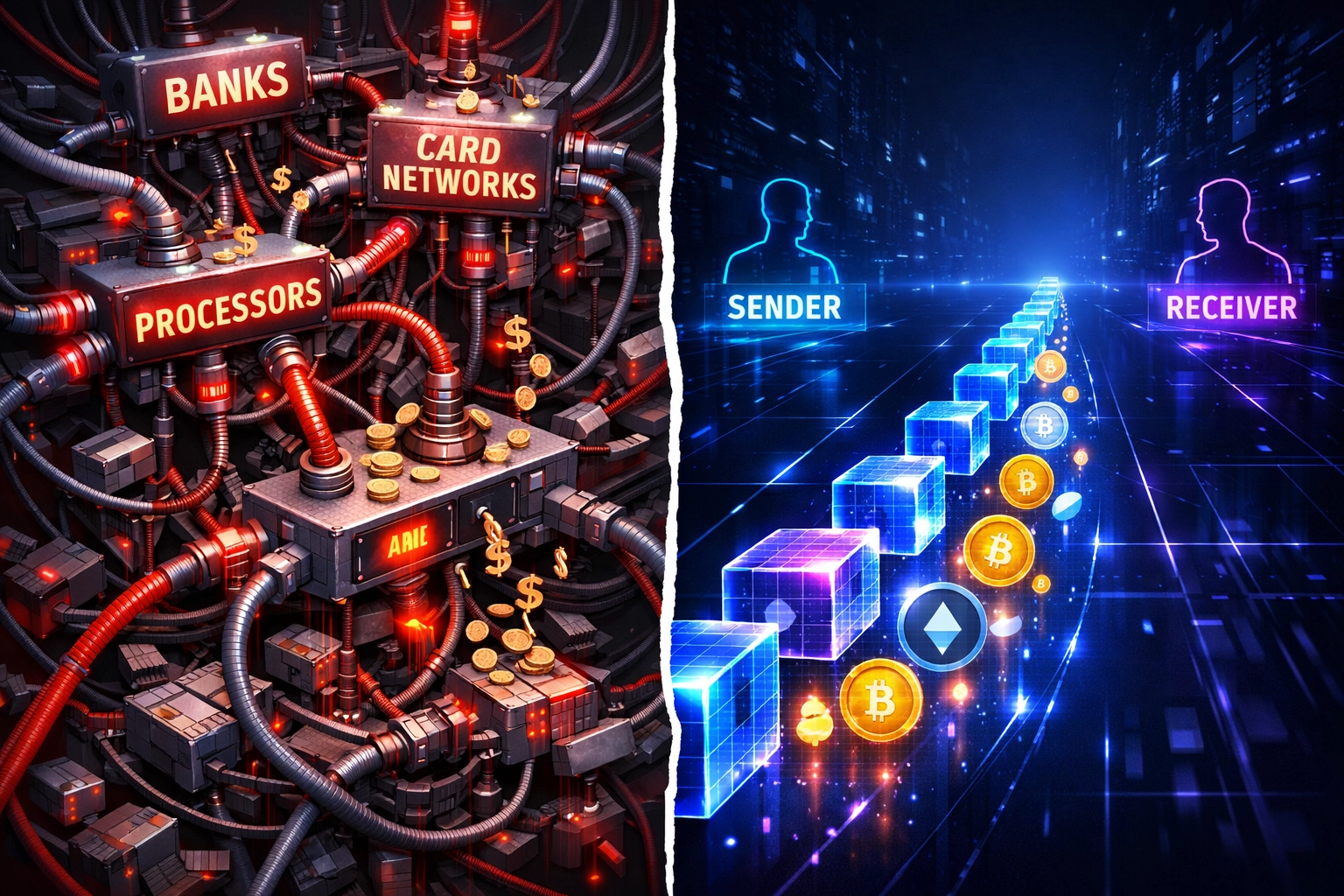

The Traditional Payment Stack is Broken

Four layers of fees stack up on every transaction:

Interchange fees: 2.5-3.5% to card-issuing banks Processor markup: 0.2-0.5% to payment processors Gateway fees: $10-30 monthly minimums Chargeback losses: 0.5-1% annual revenue

Cross-border transactions? Add wire fees ($50), correspondent bank fees ($30-80), and FX markups (2-3%). Total cost climbs to 3-5% per international payment.

Settlement takes 3-5 days. Chargebacks stay active for 120+ days. Your cash flow sits locked in limbo.

How Web3 Eliminates Interchange Fees

Blockchain-based B2B cross-border payments exceeded $4.4 trillion in 2024. That's 11% of total B2B cross-border volume.

Direct peer-to-peer settlement removes middlemen entirely.

80% of Web3 payments settle instantly. 88% deliver within 24 hours. Zero correspondent banking hops. Zero intermediary fee stacking.

Traditional route: Customer → Card network → Acquiring bank → Payment processor → Your account Web3 route: Customer → Your self-custody wallet

60% of cross-border payment volume now moves through routes where blockchain settlement cuts costs in half and settles in minutes instead of days.

Larecoin vs. The Competition

Let's compare real alternatives for merchants looking to reduce interchange fees:

Larecoin

Self-custody merchant accounts (you control funds)

LUSD stablecoin for zero volatility

NFT receipts for automated accounting

Receivable tokens for instant liquidity

Gas-only transfer costs ($0.01-0.30)

Contactless POS for in-store payments

No monthly minimums

NOWPayments

Custodial wallets (they hold your funds)

0.5% fee on crypto transactions

Limited stablecoin options

Basic API integration

No NFT receipt functionality

Standard crypto-to-fiat conversion required

CoinPayments

0.5% processing fee

Custodial model with withdrawal limits

Multi-coin support but no stablecoin focus

No native accounting tools

Traditional KYC/AML friction

Monthly withdrawal fees

Triple-A

1% processing fee

Custodial settlement

Fiat conversion required

No self-custody option

No blockchain-native receipts

Limited global coverage

The winner? Larecoin eliminates custodial risk, slashes fees to network gas costs only, and provides NFT receipts that integrate directly with accounting software.

Implementation: Your 4-Step Playbook

Step 1: Set Up Self-Custody Wallet

Visit Larecoin and create your merchant account.

No lengthy applications. No credit checks. No bank approvals. Setup takes hours, not months.

Your private keys stay with you. Your funds stay in your control. No third-party custody risk.

Step 2: Enable LUSD Stablecoin Payments

Accept LUSD stablecoin to eliminate cryptocurrency volatility.

Customer pays 100 LUSD → You receive $100 stable value. No conversion needed. No FX risk. No volatility exposure.

LUSD maintains a 1:1 peg to USD without centralized control. Backed by over-collateralized ETH. Fully auditable on-chain.

Traditional stablecoins like USDC or USDT require centralized issuers. LUSD is decentralized from the ground up.

Step 3: Add Crypto Checkout to Your Flow

Integrate Larecoin's payment gateway alongside traditional processing.

Keep accepting cards. Add crypto as an option. Let customers choose their payment method.

Your customers in Tokyo, Berlin, and São Paulo pay identical fees with identical settlement speed. Global accessibility requires only an internet connection.

No local bank relationships. No country-specific licensing. No correspondent banking infrastructure.

Accept from 180+ countries instantly.

Step 4: Batch Settlements for Minimal Costs

Instead of transferring funds after every transaction, consolidate throughout the day.

Daily batching reduces gas costs by 80-90%. Your network fees drop from $0.30 per transaction to $0.03 per transaction.

Set automated batch windows: 10am, 2pm, 6pm. Funds move to your business account three times daily instead of 50+ times.

Real Savings: The Numbers

$500,000 Annual Revenue Business:

Category | Traditional | Larecoin Web3 |

Interchange fees | $10,000-$15,000 | $0 |

Processing fees | $2,500-$5,000 | $150-$300 |

Monthly minimums | $300-$600 | $0 |

PCI compliance | $500-$1,500 | $0 |

Annual total | $13,300-$22,100 | $150-$300 |

Annual savings | , | $13,000-$21,800 |

Your first $100K in Web3 transactions saves $2,500-$3,000. Your first $1 million saves $25,000-$30,000.

Scale to $5 million annually? Save $125,000+ per year.

NFT Receipts: Automated Accounting Advantage

Every Larecoin transaction generates an NFT receipt. Immutable. Timestamped. Tamper-proof.

Your accounting software reads blockchain data directly. No manual entry. No reconciliation errors. No lost receipts.

Traditional receipt management costs businesses 120+ hours annually. NFT receipts eliminate this entirely.

Tax season? Export all transactions in seconds. Every payment is cryptographically verified and permanently recorded on-chain.

Competitors like NOWPayments and CoinPayments offer basic transaction logs. Larecoin provides blockchain-native receipts that integrate with QuickBooks, Xero, and enterprise accounting systems.

Eliminating Chargebacks Forever

Traditional processing carries mandatory chargeback risk. Customers reverse transactions for 120+ days.

You lose the original amount. You lose shipped products. You pay $15-$25 chargeback fees per incident.

Blockchain transactions are irreversible. Payment finality in minutes, not months.

This eliminates 0.5-1% annual loss entirely. For a $1 million business, that's $5,000-$10,000 saved per year from chargeback elimination alone.

Self-Custody = Financial Sovereignty

Traditional processors can freeze your account. Hold your funds. Demand additional documentation. Terminate your agreement without warning.

Self-custody merchant accounts mean you control your money. Always accessible. Always liquid. Always yours.

No account freezes. No arbitrary holds. No intermediary deciding if you can access your own revenue.

Larecoin's smart wallet architecture provides institutional-grade security with individual control. Multi-signature options available for team management.

Bank-Free Business Operations

Web3 payments remove banking friction entirely.

No merchant account applications. No underwriting delays. No reserve requirements. No rolling reserves.

High-risk industries welcome. International businesses enabled. No geographic restrictions.

Operate globally from day one without local banking relationships in each market.

Your Next Steps

Start with 10% of transaction volume through Larecoin. Measure savings over 30 days.

Compare your traditional processing fees against Web3 settlement costs. Calculate your annual savings projection.

Scale up as you verify the numbers.

The businesses cutting fees by 50%+ aren't waiting for 2027. They're implementing now.

Traditional payment processors won't lower their fees. Card networks won't eliminate interchange. Banks won't remove correspondent banking hops.

Web3 already removed them.

Your customers are ready. The infrastructure is live. The savings are real.

Explore Larecoin's merchant solutions and calculate your fee reduction today.

The 2026 playbook is simple: Accept crypto. Use LUSD. Enable self-custody. Slash fees.

Everything else is optional.