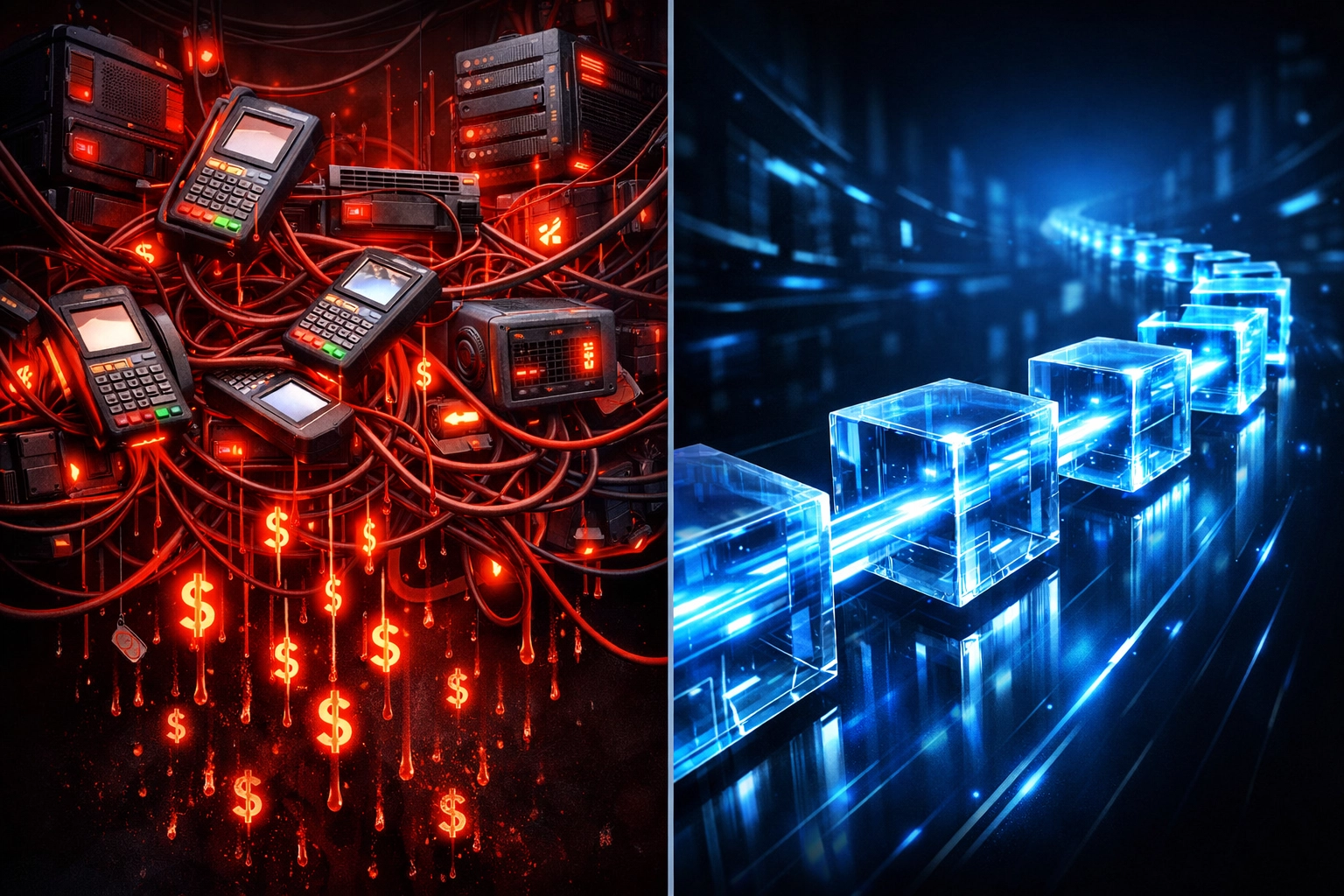

LareBlocks Vs Traditional Payment Rails: How Layer 1 Infrastructure Changes Everything for Merchants

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 6 min read

Payment infrastructure doesn't usually excite anyone.

Until you realize it's quietly eating 3-4% of your revenue.

Traditional payment rails: Visa, Mastercard, Stripe, PayPal: operate on decades-old infrastructure. Middleware stacked on middleware. Banks talking to processors talking to gateways talking to merchants.

Slow. Expensive. Opaque.

LareBlocks flips this entire model. A custom Layer 1 blockchain built specifically for payment processing. Not a plugin. Not middleware. Native infrastructure designed from scratch for commerce.

Let's break down what actually changes for merchants.

The Traditional Payment Rails Tax

Every swipe costs money.

Stripe charges 2.9% + $0.30 per transaction. PayPal? Similar rates. Add in chargeback fees, fraud protection costs, monthly service fees, and PCI compliance expenses.

Total damage: 3.5-4% of gross revenue.

For a business doing $2 million annually, that's $70,000-$80,000 walking out the door. Not to employees. Not to inventory. Not to growth.

To payment processors.

And settlement? 2-5 business days minimum. Your money sits in limbo while processors earn interest. Meanwhile, you're covering payroll and rent with credit lines.

Traditional rails weren't built for digital commerce. They were retrofitted for it. The cost structure reflects that legacy burden.

LareBlocks: Purpose-Built Layer 1 Architecture

LareBlocks operates fundamentally differently.

It's a custom Layer 1 blockchain engineered exclusively for payments. Not Ethereum with high gas fees. Not Bitcoin with slow block times. Not a Layer 2 solution relying on external networks.

A dedicated blockchain with consensus mechanisms optimized for transaction speed and cost efficiency.

Block times measured in seconds. No competing with DeFi traders for block space. No network congestion from NFT minting spikes. No unpredictable gas fees.

The entire architecture exists to process payments. Fast. Cheap. Reliably.

Transaction fees on LareBlocks: under 1.5% total cost. Often closer to 0.5-1% depending on volume.

Settlement time: under 30 seconds.

Let's do the math on that $2 million annual business.

Traditional rails: $70,000-$80,000 in fees

LareBlocks: $10,000-$30,000 in fees

Annual savings: $40,000-$70,000. That's hiring a full-time employee. That's a marketing budget. That's actual growth capital.

Real-World Cost Comparison

Numbers get abstract. Let's get specific.

$1,000 transaction:

Traditional processor: $29-$35 in fees

LareBlocks: Under $15 in fees

$100 transaction:

Traditional processor: $3.20 in fees

LareBlocks: $1 or less in fees

8,000 monthly transactions averaging $250:

Traditional rails: $5,720 monthly fees ($68,640 annually)

LareBlocks: $2,000-$3,000 monthly fees ($24,000-$36,000 annually)

Net savings: $32,000-$44,000 per year.

For comparison, crypto payment processors like NOWPayments charge 0.5% for non-custodial transactions. CoinPayments starts at 0.5% but adds network fees. Both still rely on external blockchains with variable costs and slower settlements during network congestion.

LareBlocks controls the entire stack. No external dependencies. No surprise fees.

The Settlement Speed Revolution

Cash flow kills more businesses than bad products.

Traditional payment rails trap your funds for days. T+2 or T+5 settlement cycles. Batch processing from the mainframe era.

You make a sale Monday morning. You see the money Wednesday afternoon. If you're lucky.

LareBlocks settles in under 30 seconds.

Sale happens. Funds arrive. Instantly available for payroll, inventory restocking, or marketing campaigns.

This isn't a minor convenience. It's fundamentally different economics.

Small businesses operate on tight margins and tighter cash flow. Instant settlement means no more waiting for payment processor payouts to cover expenses. No more expensive bridge financing to cover the gap.

The velocity of money increases. Your capital works harder.

Enterprise Infrastructure: Master/Sub-Wallets

Most payment processors treat every transaction the same.

One account. One report. Maybe some basic categorization.

For enterprises with multiple locations, departments, or franchises? Traditional processors require separate bank accounts, complex reconciliation, and manual reporting across siloed systems.

LareBlocks introduces master/sub-wallet architecture.

Set up a master wallet for corporate headquarters. Create sub-wallets for each location, department, or franchise. Assign granular permissions. Set spending limits. Define approval workflows.

Every wallet operates independently but rolls up to consolidated reporting in LareScan: the blockchain explorer built specifically for LareBlocks.

Real-time visibility across the entire organization. No manual reconciliation. No waiting for end-of-month statements.

Franchise owners get autonomy. Corporate maintains oversight. Finance teams get clean data.

This infrastructure simply doesn't exist in traditional payment rails. It requires blockchain-native architecture.

Transparency Through LareScan

Traditional payment processors operate black boxes.

Fees appear on statements with vague descriptions. Interchange rates change without notice. Hidden charges accumulate.

Dispute resolution? Submit a ticket and wait days for a response from a support team reading from scripts.

LareBlocks operates with complete on-chain transparency.

Every transaction recorded on the blockchain. Every fee publicly verifiable. Every settlement traceable.

LareScan provides real-time explorer access. Search any transaction by wallet address, transaction ID, or timestamp. View complete transaction history. Verify fees immediately.

No hidden charges. No surprise rate changes. No opaque fee structures.

For compliance teams and financial auditors, this transparency eliminates weeks of reconciliation work. Everything's already documented on-chain with immutable timestamps.

Compare this to NOWPayments or CoinPayments, which still operate semi-custodial systems with internal databases. You're trusting their reporting. With LareBlocks, you verify directly on-chain.

AI-Driven Shopping and Smart Automation

Traditional payment processors move money. That's it.

LareBlocks integrates AI-driven shopping assistants directly into the payment layer.

These assistants understand purchase intent. They compare prices across the entire merchant network. They execute transactions instantly on Layer 1 rails.

Smart contracts enable:

Personalized pricing based on customer history

Automated loyalty rewards distribution

Dynamic inventory management

Programmable payment terms

A customer asks the AI assistant to find the best deal on a specific product. The assistant scans merchant offerings, applies relevant loyalty discounts, and completes the purchase: all within seconds.

Merchants access these capabilities through the same infrastructure handling payments. No separate platforms. No complex integrations.

The AI learns shopping patterns, optimizes product recommendations, and increases conversion rates while reducing customer acquisition costs.

Traditional processors don't touch this functionality. They can't. They're not built on programmable blockchain infrastructure.

NFT Receipts and LUSD Stablecoin Integration

Tax compliance automation matters.

Every transaction on LareBlocks generates an NFT receipt. Immutable proof of purchase stored on-chain. Complete transaction details, timestamps, and merchant information embedded.

Come tax season, businesses have verifiable records instantly available. No digging through email confirmations or lost paper receipts.

Accounting software integrates directly with LareScan. Pull transaction history. Generate reports. File taxes.

Crypto volatility concerns? LareBlocks integrates LUSD stablecoin for volatility protection.

Accept payments in LARE tokens. Automatically convert to LUSD. Maintain stable dollar value without traditional banking infrastructure.

Push-to-Card services let merchants convert crypto payments to fiat instantly, loaded directly to debit cards. Spend like traditional currency. Enjoy crypto's cost savings.

The Social Impact Engine

Here's something traditional payment processors will never offer:

1.5% of every LareBlocks transaction funds the Social Impact Engine.

This tax directly supports global hunger initiatives. Built into the protocol. Automatic. Transparent.

Merchants using LareBlocks don't just save money. They contribute to solving real problems.

Track impact through on-chain reporting. Show customers exactly how their purchases make a difference.

Traditional payment rails extract value. LareBlocks redistributes it.

Gift Card Onboarding: Frictionless Crypto Entry

Getting merchants to adopt crypto payments traditionally requires:

Setting up crypto wallets

Understanding private keys

Learning blockchain basics

Navigating exchange accounts

LareBlocks simplifies entry through Gift Card onboarding.

Purchase gift cards with fiat currency. Receive Larecoin tokens. Start accepting payments immediately.

No crypto exchange accounts needed. No blockchain learning curve. Familiar gift card experience with crypto benefits.

This removes the biggest barrier to merchant adoption: complexity.

Why Layer 1 Architecture Actually Matters

NOWPayments processes payments through multiple blockchains. CoinPayments supports dozens of cryptocurrencies. Both add flexibility.

But both depend on external networks. When Ethereum gas fees spike, costs increase. When Bitcoin network congestion hits, settlements slow.

They're middleware solutions on borrowed infrastructure.

LareBlocks owns the entire stack.

Custom consensus. Optimized block times. Predictable fees. No external dependencies.

This architectural control delivers:

Guaranteed settlement speeds

Fixed cost structures

Enterprise-grade reliability

Unlimited scalability

For merchants, this means no surprises. No network outages affecting your payment processing. No unpredictable cost spikes during high-traffic periods.

You're building on dedicated infrastructure designed specifically for your use case.

The Bottom Line for Merchants

Traditional payment rails cost too much and move too slowly.

Crypto payment processors like NOWPayments and CoinPayments improve costs but still depend on external blockchain networks with variable performance.

LareBlocks delivers:

50-95% lower fees than traditional processors

30-second settlements versus multi-day waits

Enterprise wallet architecture for organizational management

Complete transparency through LareScan

AI-powered shopping and smart automation

Social impact through built-in charitable contributions

NFT receipts for tax compliance

LUSD stablecoin for volatility protection

All running on custom Layer 1 infrastructure built exclusively for payments.

For merchants doing $2 million annually, that's $40,000-$70,000 in annual savings. Instant cash flow. Better customer experiences. Measurable social impact.

Ready to see what your business saves with LareBlocks?

Explore the Larecoin ecosystem and calculate your cost savings compared to legacy payment rails.

The infrastructure exists. The savings are real. The future of merchant payments is already here.

Comments