Larecoin Vs BitPay: Which Crypto Payment Processor Actually Cuts Your Fees?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- Jan 17

- 4 min read

Let's be real.

You didn't jump into crypto payments to watch your margins get eaten alive by processing fees. Yet here we are. Legacy payment processors still charging 2-3% per swipe. Credit card networks taking their cut. And now even some crypto gateways want a piece.

Time to break down the numbers. Larecoin vs BitPay. Head to head. No fluff.

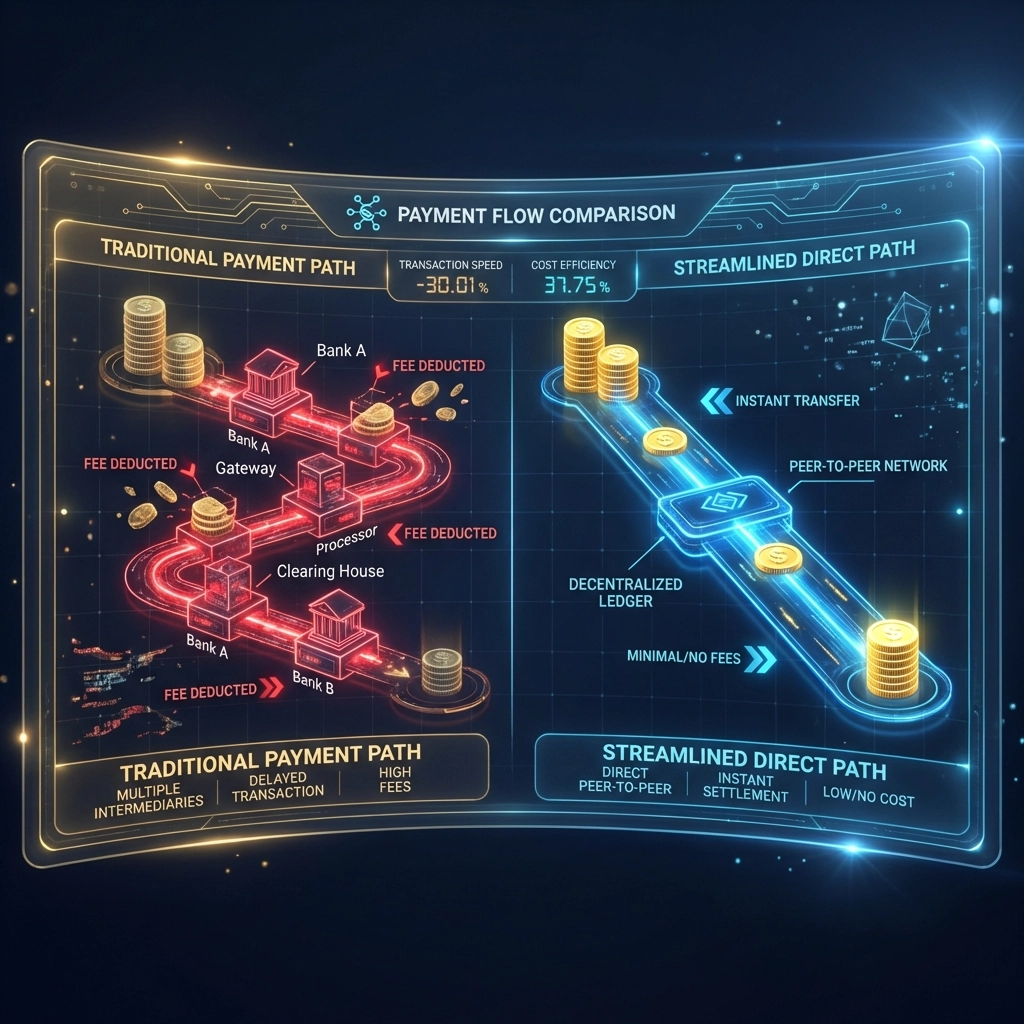

The Fee Problem Nobody Talks About

Every merchant knows the sting. Visa and Mastercard interchange fees hovering around 1.5-3.5%. Then your payment processor stacks their cut on top.

BitPay entered the scene promising a crypto alternative. Their pitch? Accept Bitcoin and other cryptos without the volatility risk.

BitPay's current fee structure:

2% transaction fee

Plus $0.25 per transaction

Settlement fees vary by method

For a $100 transaction, you're looking at $2.25 gone. Scale that to $100,000 in monthly volume? That's $2,250 walking out the door.

Not exactly revolutionary.

Larecoin's Approach: Cut Fees by 50%

Here's where things get interesting.

Larecoin built its infrastructure from the ground up on Solana. Why does that matter? Transaction costs measured in fractions of a penny. Not percentages.

The Larecoin difference:

Gas-only transfers (we're talking $0.001 or less)

No percentage-based processing fees

Direct merchant settlement

Full custody of your funds

That same $100,000 monthly volume? Your processing costs drop to virtually nothing compared to legacy systems.

We're talking about slashing interchange fees by 50% or more versus traditional card networks. That's not marketing spin. That's math.

Feature Showdown: What Actually Matters

Let's stack the features side by side.

Settlement Speed

BitPay: 1-2 business days for bank settlement. Crypto held in their custody until conversion.

Larecoin: Near-instant settlement. Your crypto hits your Smart Wallet in seconds. Push to card when you need fiat.

Custody & Control

BitPay: Custodial model. They hold your funds until settlement.

Larecoin: Self-custody from the jump. Your keys. Your coins. Your business.

Supported Assets

BitPay: Bitcoin, Ethereum, and a handful of stablecoins.

Larecoin: Full Solana ecosystem support. Native LUSD stablecoin. Cross-chain bridging for broader compatibility.

Accounting Integration

BitPay: Standard transaction records. CSV exports.

Larecoin: NFT receipts. On-chain proof of every transaction. Immutable records for audits.

Crypto Receivables: The New Business Standard

This is where Larecoin pulls ahead of every competitor in the space.

Traditional payment processors treat crypto like a hot potato. Accept it, convert it, dump it into fiat ASAP.

Larecoin flips the script with Crypto Receivables.

Think of it like this: every payment you receive becomes a tokenized asset on your balance sheet. Not just a transaction record. An actual receivable token you can:

Hold for appreciation

Use as collateral

Trade on secondary markets

Settle instantly when needed

For ISOs and enterprises managing high volume? This changes everything. Your accounts receivable becomes liquid. Programmable. Borderless.

BitPay doesn't offer anything close.

NFT Receipts: Accounting That Actually Works

Every Larecoin transaction generates an NFT receipt. Sounds fancy. Here's why it matters.

For your accountant:

Immutable proof of payment

Timestamped on-chain

No disputes about transaction history

Audit-ready documentation

For your business:

Customer loyalty integration potential

Collectible receipt programs

On-chain warranty tracking

Transparent supply chain records

Traditional processors give you a CSV file and wish you luck. Larecoin gives you blockchain-verified proof that lives forever.

Try explaining a chargeback dispute when you've got NFT receipt evidence. Game over.

The Ecosystem Advantage

BitPay is a payment processor. Full stop.

Larecoin is an ecosystem. Here's what that unlocks:

LUSD Stablecoin

Native stablecoin pegged to the dollar. Accept payments in LUSD and skip the volatility concerns entirely. No conversion needed. No waiting for settlement.

Your customers pay in stable value. You receive stable value. Simple.

Smart Wallet

One wallet for everything. Accept crypto payments, manage receivables, swap assets, bridge between chains. All from a single dashboard.

No juggling multiple platforms. No copying addresses between apps.

Gas-Only Transfers

This is the killer feature for high-volume merchants.

Traditional crypto payments mean gas fees on both ends. Sender pays. Receiver pays. Adds up fast.

Larecoin's architecture enables gas-only transfers. Minimal network fees. Maximum value transferred.

Push to Card

Need fiat? Push directly to your debit card. No waiting for bank transfers. No 1-2 business day holds.

Real-time access to your money. The way it should be.

Who Should Actually Switch?

Let's be specific.

High-volume e-commerce merchants: If you're processing $50K+ monthly, the fee savings alone justify the switch. Add in faster settlement and self-custody? No contest.

ISOs looking for competitive edge: Offer your merchants something NOWPayments and CoinPayments can't match. Crypto receivables. NFT receipts. A complete ecosystem.

Enterprises with international operations: Cross-border payments without SWIFT fees. Instant settlement across time zones. Programmable treasury management.

Web3-native businesses: If you're already in the ecosystem, why use a processor built for Web2? Larecoin speaks your language.

The Bottom Line

BitPay had its moment. First mover advantage in crypto payments.

But the game has changed.

Modern merchants need more than a payment gateway. They need infrastructure. Fee reduction. Custody control. Programmable receivables. On-chain accounting.

Larecoin delivers all of it.

The numbers don't lie:

50%+ fee reduction vs legacy systems

Near-instant settlement

Full self-custody

NFT receipt documentation

Native stablecoin integration

Your margins matter. Your cash flow matters. Your sovereignty over your own revenue matters.

Ready to see the difference? Check out Larecoin Payments and run the numbers for your business.

The math speaks for itself.

Comments