Larecoin Vs NOWPayments Vs CoinPayments: Which Crypto POS Actually Cuts Your Fees in Half?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Payment processing fees are bleeding merchants dry.

2.5% here. 3.5% there. It adds up fast.

Crypto POS solutions promise relief. But which one actually delivers? Let's break down the numbers and see who's really cutting your fees in half.

The Fee Problem Nobody Talks About

Traditional payment processors take a massive cut. Credit cards. Debit cards. Every swipe costs you.

On $500,000 in annual sales? You're losing roughly $15,000 to interchange fees alone.

That's not a processing fee. That's a second rent payment.

Crypto payment gateways entered the scene promising better. NOWPayments. CoinPayments. Triple-A. All claiming lower fees.

But here's the thing, lower isn't the same as lowest.

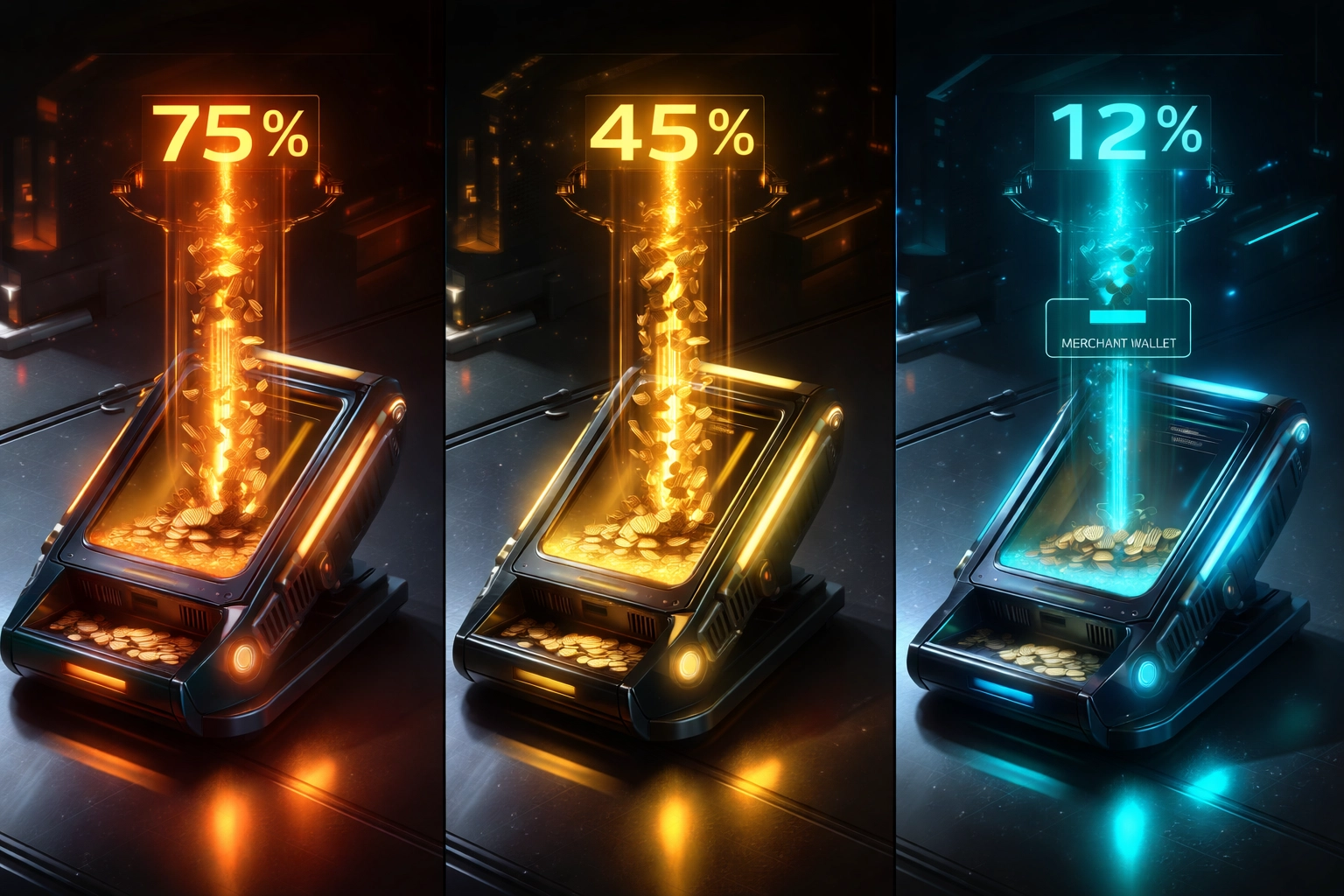

Breaking Down the Real Numbers

Let's get specific. Same $500,000 annual revenue. Different outcomes.

Traditional Processors:

Fee range: 2.5-3.5%

Annual cost: ~$15,000

You eat every basis point

NOWPayments:

Fee range: 0.5-1%

Annual cost: ~$5,000

Network fees extra

CoinPayments:

Fee range: 0.5-1%

Annual cost: ~$5,000

Variable processing times

Larecoin:

Fee structure: Gas-only transfers

Annual cost: Under $2,000

Self-custody model

The math isn't complicated. Larecoin's gas-only approach saves merchants over 50% compared to traditional processors, and significant savings over other crypto gateways too.

NOWPayments: What You Get

NOWPayments runs a solid operation. No argument there.

The Good:

0.5% for single-currency transactions

1% for conversions

300+ supported cryptocurrencies

~5 minute average processing

Customizable network fee options

The Catch:

Still an intermediary model

Platform holds your funds temporarily

Conversion fees stack up fast

Network fees aren't always transparent

For merchants processing moderate volume, NOWPayments works. It's reliable. Established. Gets the job done.

But "gets the job done" isn't innovation.

CoinPayments: The Volume Play

CoinPayments goes wide on crypto support. Really wide.

The Good:

2,000+ cryptocurrencies supported

0.5-1% processing fees

Established since 2013

Multi-coin vault options

The Catch:

Processing times vary wildly (minutes to hours)

No customizable network fee options

Intermediary custody model

Complexity scales with coin variety

If you need to accept obscure altcoins, CoinPayments has you covered. But variety doesn't equal value when fees still stack.

Larecoin: The Architecture Difference

Here's where it gets interesting.

Larecoin doesn't operate like NOWPayments or CoinPayments. Fundamentally different architecture.

Direct Merchant-to-Customer Transactions: No intermediary holding your money. Funds flow directly to your wallet. You maintain custody from second one.

Gas-Only Transfer Model: Forget percentage-based fees. You pay network gas costs. Period. On Solana? Those costs are fractions of a cent.

Self-Custody by Default: Your keys. Your crypto. Your business revenue stays under your control, not sitting in a third-party vault.

This isn't incremental improvement. It's a different model entirely.

Technical Advantages That Actually Matter

Let's talk features that translate to real business value.

NFT Receipts

Every transaction generates a verifiable NFT receipt. Immutable. Timestamped. On-chain forever.

Why it matters:

Automatic audit trail

Dispute resolution simplified

Customer proof of purchase

Zero manual record-keeping

Traditional receipts get lost. Paper fades. Databases corrupt. NFT receipts persist.

LUSD Stablecoin Integration

Volatility kills merchant adoption. Everyone knows this.

Larecoin's native LUSD stablecoin solves the problem directly:

Pegged stability

Instant settlement

No conversion fees within ecosystem

Seamless POS integration

Accept crypto. Hold stable value. Simple.

Master/Sub-Wallet Architecture

Running multiple locations? Franchises? Departments?

Master/sub-wallet structure handles it:

Central oversight

Individual location wallets

Consolidated reporting

Granular permissions

One dashboard. Complete visibility. Every transaction tracked.

QR-Generated POS: Zero Hardware Required

Traditional POS systems cost thousands. Installation fees. Monthly rentals. Hardware maintenance.

Larecoin's QR-generated crypto POS flips that model.

How It Works:

Generate unique QR code

Customer scans with any wallet

Transaction completes on-chain

Funds hit your wallet instantly

No terminal. No hardware investment. No maintenance contracts.

Print a QR code. Accept crypto payments. Done.

For pop-up shops, food trucks, market vendors, this changes everything. Low overhead. Maximum flexibility.

The Metaverse Shopping Future

Here's where Larecoin goes places competitors haven't imagined yet.

Social Shopping in the B2B2C Metaverse:

Imagine your customers browsing virtual storefronts. Trying products in VR. Making purchases without leaving the experience.

Larecoin's building that infrastructure now.

Virtual retail spaces

VR/AR shopping integration

Social commerce features

Seamless payment rails

The future of commerce isn't just online. It's immersive. Spatial. Social.

While NOWPayments and CoinPayments focus on today's checkout pages, Larecoin's positioning for tomorrow's virtual malls.

Compliance: The Trust Foundation

Crypto payments mean nothing without regulatory clarity.

Larecoin's Compliance Stack:

Federal MSB registration

State-level MTL coverage across the U.S.

Ongoing regulatory engagement

Transparent licensing status

MTL compliance isn't optional. It's the difference between a legitimate payment solution and a regulatory time bomb.

Merchants need certainty. Banks need documentation. Auditors need paper trails.

Larecoin delivers on all fronts. Licensed. Registered. Operating within the lines.

The Real Comparison

Let's cut through the noise.

Feature | NOWPayments | CoinPayments | Larecoin |

Fee Structure | 0.5-1% | 0.5-1% | Gas-only |

Self-Custody | No | No | Yes |

NFT Receipts | No | No | Yes |

Native Stablecoin | No | No | LUSD |

QR POS | Limited | Limited | Full |

Metaverse Ready | No | No | Yes |

U.S. MTL Licensed | Varies | Varies | Yes |

Every column tells the same story. Different architecture. Different capabilities. Different future.

Who Should Use What?

Choose NOWPayments if:

You need quick integration

Volume is moderate

Conversion flexibility matters

You're comfortable with intermediary custody

Choose CoinPayments if:

You accept obscure altcoins

Processing time isn't critical

Established reputation matters most

Volume varies significantly

Choose Larecoin if:

Fee savings are priority one

Self-custody is non-negotiable

You want NFT receipt automation

Metaverse commerce interests you

U.S. compliance is essential

The Bottom Line

"Cut your fees in half" gets thrown around a lot.

Larecoin actually delivers it: and then some.

Gas-only transfers. Self-custody. NFT receipts. LUSD stability. QR-generated POS. Metaverse shopping infrastructure. Full MTL compliance.

The question isn't whether crypto POS solutions beat traditional processors. They all do.

The question is which one positions your business for where commerce is heading.

NOWPayments and CoinPayments solve today's problems adequately.

Larecoin solves today's problems while building tomorrow's infrastructure.

That's the difference.

Ready to see what gas-only fee savings look like for your business? Explore the Larecoin ecosystem and run your own numbers.

The math speaks for itself.

Comments