Larecoin Vs NOWPayments Vs CoinPayments: Which Web3 Payment Solution Actually Slashes Your Interchange Fees?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 11 hours ago

- 4 min read

Interchange fees are killing your margins.

Traditional payment processors eat 2.5-3.5% of every transaction. That's $12,500-$15,000 vanishing annually on just $500K in sales. Web3 promises a way out. But not all crypto payment solutions deliver equal savings.

Let's break down the real numbers. Compare the top contenders. And figure out which platform actually puts money back in your pocket.

The Interchange Fee Problem Nobody Talks About

Every card swipe costs you. Visa and Mastercard charge merchants. Banks take their cut. Payment processors add their markup.

Small businesses get hit hardest. Slim margins become slimmer. Growth gets harder.

Web3 payment solutions emerged to solve this exact problem. Blockchain-based transactions eliminate intermediaries. Fewer middlemen means lower fees.

But here's the catch: most crypto payment platforms still charge percentage-based fees. They've just replaced traditional processors with themselves.

That's where the comparison gets interesting.

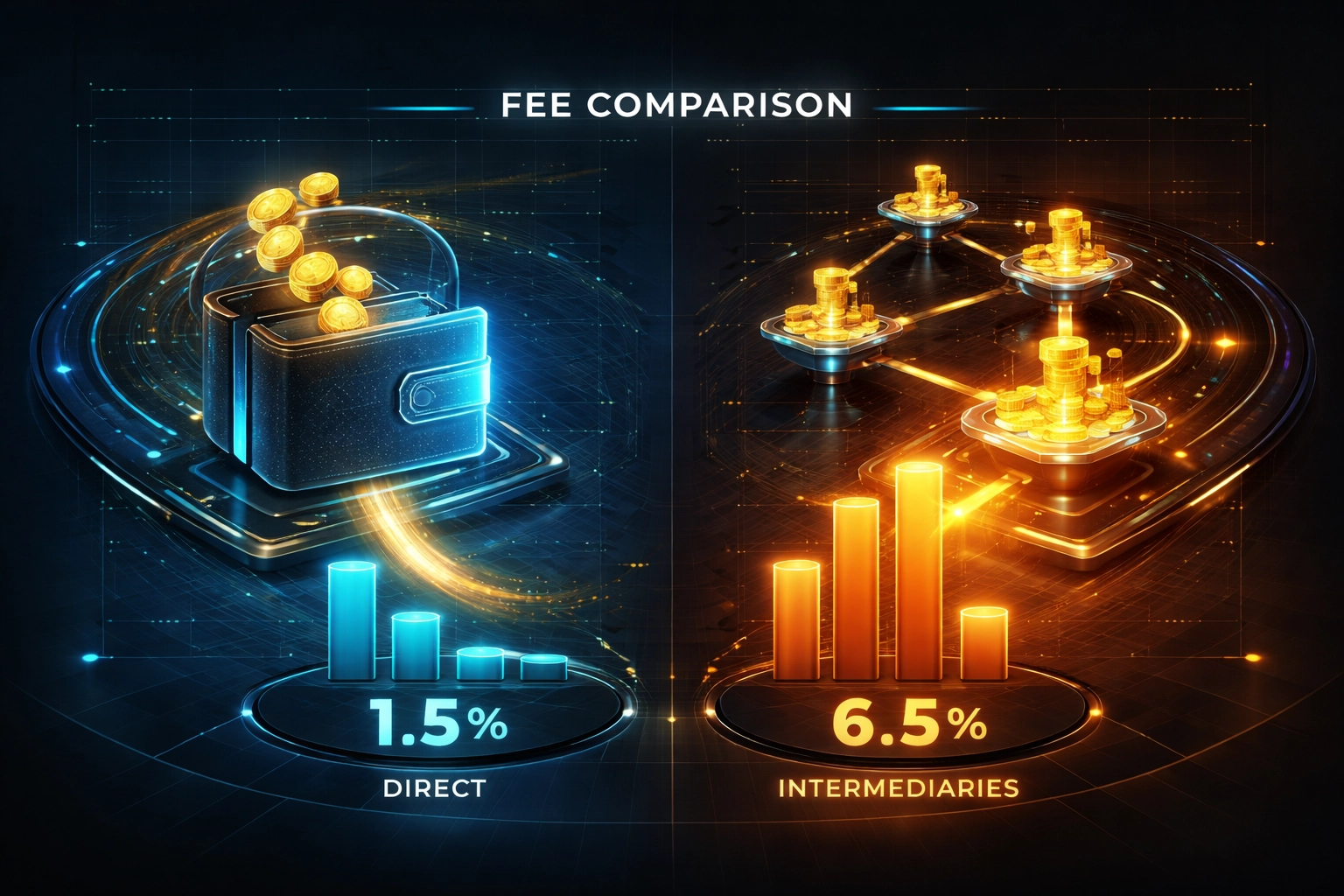

Breaking Down the Numbers: Real Fee Comparisons

Let's look at what a business processing $500,000 annually actually pays across platforms:

Traditional Payment Processors

Fee structure: 2.5-3.5%

Annual cost: $12,500-$15,000

The verdict: Painful. Unsustainable for high-volume businesses.

NOWPayments

Fee structure: 0.5% single-currency, 1% multi-currency

Annual cost: ~$3,750

Withdrawal fees: 0%

Model: Custodial

NOWPayments supports 300+ cryptocurrencies. Processing takes about 5 minutes. They offer customizable network fee options. Merchants can absorb or blend fees for better checkout conversion.

The 75% savings versus traditional processors looks great. But you're still giving up a percentage of every sale.

CoinPayments

Fee structure: 0.5% for BTC/ETH, 1% for tokens/stablecoins

Annual cost: ~$3,750

Additional costs: Conversion fees, variable withdrawal fees

Model: Custodial

CoinPayments supports 2,000+ cryptocurrencies. Sounds impressive. But processing speed varies wildly, minutes to hours. That inconsistency creates reliability concerns.

And those extra conversion and withdrawal fees? They add up fast.

Larecoin

Fee structure: Gas-only

Annual cost: Under $2,000

Model: Self-custody

No percentage taken. Just network fees.

That's a 50%+ reduction versus competitors. And 85%+ savings compared to traditional processors.

Why Gas-Only Changes Everything

Here's the fundamental difference nobody explains clearly.

NOWPayments and CoinPayments function as intermediaries. They hold your revenue. Then settle it to you. Every transaction, they take their percentage first.

Larecoin operates differently. Direct merchant-to-customer transactions. No middleman grabbing a slice of each sale.

Your funds transfer immediately to your wallet. No processing delays. No third-party approval requirements. No waiting.

For a business doing $500K annually, that's $1,750+ staying in your pocket versus other crypto options. And over $10,000 saved compared to traditional processors.

Scale that to $1M, $5M, $10M in annual volume. The savings compound dramatically.

Self-Custody: Your Money, Your Control

Custodial solutions introduce risk.

When NOWPayments or CoinPayments hold your funds, you're trusting their security. Their solvency. Their compliance.

Crypto history has painful lessons here. Exchanges collapse. Platforms freeze withdrawals. Regulatory actions lock assets.

Larecoin's self-custody model eliminates this entirely. Funds go directly to your wallet. Immediately. You maintain complete control.

No counterparty risk. No waiting for settlements. No hoping the platform stays operational.

This isn't just about convenience. It's about business continuity and risk management.

LUSD: Zero Volatility, Maximum Utility

Crypto volatility scares merchants. Accept Bitcoin today, it drops 20% tomorrow. That's not a payment: that's a gamble.

Larecoin's native LUSD stablecoin solves this.

Zero volatility. Dollar-pegged stability. All the blockchain benefits without the price swings.

For instant fiat conversion, Larecoin offers push-to-card functionality. Lower gas fees than ETH-based stablecoins. Direct to your debit card.

NOWPayments and CoinPayments? They require external conversion tools. Extra fees. Extra delays. Extra friction.

LUSD keeps transactions clean. Simple. Predictable.

NFT Receipts: The Future of Transaction Records

Traditional receipts disappear. Paper fades. Emails get lost. Disputes become he-said-she-said nightmares.

Larecoin issues NFT-based transaction receipts.

Every transaction. Permanently recorded on-chain. Immutable proof of purchase.

Benefits for merchants:

Dispute resolution becomes instant

Audit trails are automatic

Compliance documentation is built-in

Customer service gets easier

Benefits for customers:

Proof of purchase that can't be lost

Warranty verification simplified

Returns processing streamlined

Digital ownership verified

This isn't a gimmick. It's infrastructure for modern commerce.

US Compliance: Built Right From Day One

Operating in the US means navigating complex regulations. Money Services Business (MSB) registration. State Money Transmitter Licenses (MTL). Know Your Customer (KYC) requirements.

Many crypto payment solutions avoid the US entirely. Too complicated. Too expensive. Too risky.

Larecoin takes the opposite approach.

Rigorous US compliance strategy. MSB registration. State-by-state MTL pursuit. Full regulatory alignment.

Why does this matter for merchants?

Legal protection for your business

Reduced regulatory risk

Bank-friendly compliance posture

Sustainable long-term operations

Working with a non-compliant payment processor puts your business at risk. Larecoin's approach means you're building on solid ground.

Setup Speed: Live in Minutes

Complex integrations kill adoption.

CoinPayments requires technical implementation. API configurations. Testing cycles. Developer resources.

NOWPayments offers faster setup. But still requires integration work for full functionality.

Larecoin? QR-based POS. No hardware required. Minute-level setup time.

Generate your merchant QR code. Start accepting payments. That's it.

No developers needed. No technical expertise required. No weeks of implementation.

For small businesses, this changes everything. Enterprise solutions that require IT departments aren't solutions: they're barriers.

The Transparency Question

Important note: detailed Larecoin comparisons often come from their marketing materials. NOWPayments and CoinPayments data are more independently verified through official pricing pages and third-party comparisons.

Do your own research. Test platforms. Compare actual costs for your specific transaction volumes and types.

But the math is straightforward. Gas-only beats percentage-based fees at every scale.

Making the Switch: What to Consider

Choosing a Web3 payment solution involves several factors:

Volume matters. Higher transaction volumes amplify fee differences. A 0.5% difference on $50K is $250. On $5M, it's $25,000.

Customer base matters. Crypto-native customers expect crypto payment options. Meeting them where they are increases conversion.

Geography matters. US-based businesses need compliant solutions. Larecoin's regulatory approach provides protection.

Control matters. Self-custody versus custodial isn't just preference. It's risk management.

The Bottom Line

NOWPayments and CoinPayments improved on traditional processors. That's undeniable. 75% savings versus Visa and Mastercard fees is significant.

Larecoin takes it further. 85%+ savings. Self-custody. LUSD stability. NFT receipts. US compliance.

For businesses serious about maximizing margins, the choice becomes clear.

Stop giving away percentage points. Keep more of what you earn.

Ready to slash your interchange fees? Explore Larecoin's merchant solutions and see the difference gas-only payments make for your bottom line.

Comments