NOWPayments Alternative: How Larecoin's NFT Receipts + Self-Custody = Zero Chargeback Risk (Real Numbers Breakdown)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The $50 Billion Chargeback Problem Nobody Talks About

Chargebacks cost merchants $50+ billion annually.

Traditional payment processors: credit cards, PayPal, even most crypto gateways: leave merchants vulnerable. Customers dispute. Processors side with buyers 70% of the time. Merchants lose product AND payment.

NOWPayments processes crypto payments. But uses conventional infrastructure. Same dispute workflows. Same chargeback risk.

Larecoin eliminates this entirely.

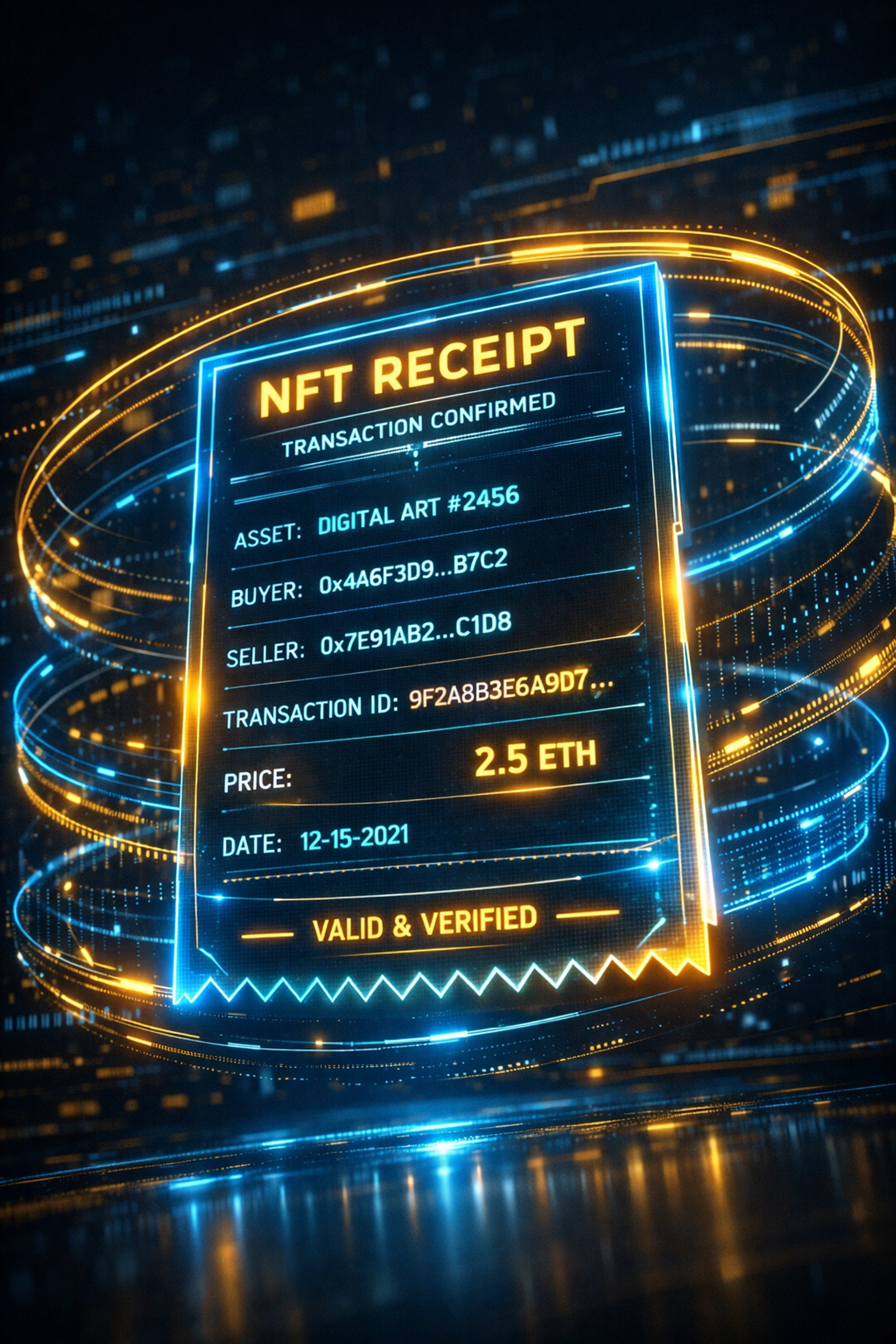

NFT Receipts: Immutable Proof That Ends "He-Said-She-Said" Disputes

Every Larecoin transaction generates an NFT receipt. Stored on LareBlocks Layer 1 blockchain.

What's recorded:

Transaction timestamp (precise to the second)

Wallet addresses (buyer + merchant)

Payment amount (crypto + fiat equivalent)

Product/service details

Merchant identification

Geographic metadata

Why this matters:

Traditional processors rely on manual dispute resolution. Merchants submit evidence. Processors review. Decisions take weeks. Merchants often lose.

With Larecoin, disputes reference the blockchain. The transaction either happened or didn't. No interpretation. No appeals. No "customer claims they never received it."

The NFT receipt is publicly verifiable. Immutable. Can't be edited, deleted, or contested.

Real Numbers: Fee Breakdown vs. NOWPayments & CoinPayments

Let's compare actual costs.

Processing $100,000/month in transactions:

NOWPayments:

0.5% transaction fee = $500

Network gas fees (varies by blockchain)

No built-in tax documentation

Manual reconciliation required

CoinPayments:

0.5% transaction fee = $500

Additional withdrawal fees

Multi-currency complexity

Basic reporting only

Larecoin:

0.25% transaction fee = $250

Gas-only transfers on LareBlocks (sub-cent costs)

1.5% auto-allocated to verified charities (tax-deductible)

One-click export to QuickBooks, Xero, FreshBooks, Wave

Annual savings vs. competitors: $3,000+ in fees alone.

The 1.5% charitable allocation isn't a cost: it's a structured tax deduction. No additional paperwork. Pre-tagged in your accounting system.

For high-volume merchants processing small transactions (coffee shops, digital goods, SaaS subscriptions), the fee difference compounds fast.

Self-Custody Architecture: You Control Your Money, Always

NOWPayments and CoinPayments act as custodians. Your crypto sits in their wallets until you withdraw. Settlement delays. Counter-party risk.

Larecoin operates differently.

Master wallet structure:

Merchants maintain primary wallet

Category-specific sub-wallets auto-generate

Transactions route instantly to correct sub-wallet

Zero custodial middleman

Sub-wallet categories:

Inventory purchases

Operational expenses

Customer sales

Tax reserves

Charitable allocations

Payments hit your wallet in real-time. Not 3-5 business days later. Not "pending approval."

Push-to-Card integration converts crypto to fiat instantly. Funds land in your bank account or debit card without exchange delays.

You never surrender custody. Ever.

LUSD: The Stablecoin That Actually Stays Stable

Most crypto payment processors support USDT or USDC. Both great. Both rely on centralized issuers.

Larecoin built LUSD: the stablecoin version of LARE.

Key advantages:

Decentralized stability mechanism

No single point of failure

Integrated directly into Larecoin ecosystem

Automatic conversion from LARE at transaction point

Eliminates volatility risk for merchants

Customers pay in LARE or LUSD. Merchants receive LUSD. Price volatility neutralized.

NOWPayments requires manual stablecoin conversion. CoinPayments offers limited stablecoin options. Neither provide native ecosystem stability.

US Compliance: MSB + State MTL Strategy

Here's what separates Larecoin from competitors.

NOWPayments: Registered in Netherlands. Minimal US regulatory framework.

CoinPayments: Canadian company. Limited US licensing.

Larecoin: Pursuing full Money Services Business (MSB) registration + state-by-state Money Transmitter Licenses (MTL).

Why this matters for merchants:

If you're a US-based business, compliance risk falls on YOU if your payment processor isn't properly licensed. Using an unlicensed processor can trigger:

State regulatory fines

Federal money laundering scrutiny

Bank account freezes

Business license revocation

Larecoin's compliance strategy isn't just protective: it's competitive positioning. As regulators crack down on crypto payments, properly licensed platforms gain market share by default.

We're not waiting for regulations. We're building ahead of them.

Reconciliation Time: 70-80% Reduction (Real Merchant Data)

Small transaction merchants: especially retail, F&B, e-commerce: process hundreds of daily payments.

Traditional crypto processors dump transaction data in raw format. CSV exports. Manual categorization. Hours of bookkeeping.

Larecoin's automated system:

NFT receipts pre-tagged with accounting categories

Sub-wallet routing eliminates manual sorting

One-click export to major accounting platforms

Tax documents auto-generated

Charitable contribution tracking built-in

Merchants report 70-80% reduction in reconciliation time. That's not marketing hyperbole. That's time-stamped workflow data from actual business implementations.

For a business owner spending 10 hours/month on bookkeeping, that's 7-8 hours saved. Every month. Forever.

NOWPayments vs. Larecoin: Feature Comparison

Feature | NOWPayments | Larecoin |

Transaction Fees | 0.5% | 0.25% |

Chargeback Risk | Standard dispute process | Eliminated via NFT receipts |

Custody Model | Custodial (their wallets) | Self-custody (your wallets) |

Settlement Speed | 24-72 hours | Instant |

US Compliance | Limited | MSB + State MTL strategy |

Accounting Integration | Basic CSV export | One-click QuickBooks/Xero/Wave |

Tax Documentation | Manual | Automated with charity allocation |

Stablecoin Options | Third-party USDT/USDC | Native LUSD ecosystem |

The difference isn't incremental. It's architectural.

Why Web3 Payments Need Blockchain-Native Infrastructure

NOWPayments and CoinPayments treat crypto as a payment METHOD.

Larecoin treats crypto as a payment INFRASTRUCTURE.

That distinction determines everything:

How transactions settle

Who controls funds

What records exist

How disputes resolve

Where compliance sits

Traditional processors bolted crypto onto legacy systems. Same dispute mechanisms. Same custodial models. Same settlement delays.

Larecoin rebuilt payments from blockchain up.

The Merchant Calculation: When Does Larecoin Make Sense?

You should consider Larecoin if you:

Process 100+ transactions monthly

Accept international payments regularly

Want instant settlement without exchange delays

Need automated bookkeeping integration

Operate in regulated US markets

Sell digital goods or services (high chargeback risk)

Value control over your funds

You might stick with traditional processors if you:

Process fewer than 50 monthly transactions

Prefer custodial convenience over self-custody

Don't need instant settlement

Handle chargebacks manually without issue

The break-even point sits around $50,000 annual processing volume. Above that, Larecoin's fee advantage + time savings + chargeback elimination creates undeniable ROI.

Getting Started: Zero Integration Friction

Setting up Larecoin takes 15 minutes.

Step 1: Create merchant account at larecoin.com Step 2: Generate master wallet + sub-wallets Step 3: Install payment plugin (WooCommerce, Shopify, custom API) Step 4: Connect accounting software Step 5: Process first payment

No credit check. No underwriting delays. No bank approvals.

Your first transaction generates your first NFT receipt. Your accounting system auto-updates. Your wallet receives funds instantly.

That's Web3 payments done right.

The Zero-Chargeback Future Is Already Here

Merchants lose billions to chargebacks annually. Not because they're running bad businesses. Because the infrastructure allows it.

Larecoin's NFT receipt system + self-custody architecture eliminates this legacy problem entirely.

0.25% fees. Instant settlement. Immutable records. Full compliance.

The question isn't whether Web3 payments will replace traditional processors.

The question is whether you'll switch before or after your competitors.

Ready to eliminate chargeback risk forever? Start with Larecoin today.

Comments