NOWPayments vs CoinPayments vs Larecoin: Which Cuts Merchant Fees the Most in 2026?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Merchant fees destroy profits.

Processing $1 million annually? Traditional crypto payment processors take $5,000-$10,000 straight from your bottom line. Every. Single. Year.

That's money you earned. Money you deserve to keep.

Let's end that.

The Real Cost of Crypto Payment Processing

NOWPayments and CoinPayments both operate on the same outdated model. They charge percentage-based fees. 0.5-1% per transaction. Plus network fees. Plus withdrawal charges. Plus currency conversion costs.

The math gets ugly fast.

Larecoin flipped the script entirely. Zero platform fees. Just Solana gas costs: pennies per transaction.

Direct Fee Comparison: Numbers Don't Lie

Platform | Platform Fee | Custody Model | Hidden Costs |

NOWPayments | 0.5-1% | Custodial (they hold your crypto) | Network fees, withdrawal fees, conversion charges |

CoinPayments | 0.5-1% | Custodial (they control keys) | Blockchain fees, conversion costs, withdrawal penalties |

Larecoin | 0% | Self-custody (you own everything) | Solana gas only |

That custody column matters more than you think. We'll get to that.

What You Actually Pay: Real-World Examples

Let's run the numbers at different scales.

$500K Annual Processing Volume

NOWPayments/CoinPayments: $2,500-$5,000 in fees

Larecoin: Under $2,000 total

Your Savings: 50-60%

$1M Annual Processing Volume

NOWPayments/CoinPayments: $5,000-$10,000 in fees

Larecoin: Under $2,000 total

Your Savings: 67-83%

$5M Annual Processing Volume

NOWPayments/CoinPayments: ~$25,000 in fees

Larecoin: ~$5,000 total

Your Savings: 50-80%

Notice the pattern? The more you process, the more you save. Percentage-based fees scale with your success. Gas-only costs stay relatively flat.

Scale shouldn't punish you.

The Custody Trap Nobody Talks About

Here's what NOWPayments and CoinPayments won't advertise on their homepage.

They hold your funds. They control your private keys. You're trusting a third party with your money.

That's the opposite of crypto's purpose.

Custodial Risks:

Platform security breaches expose your funds

Withdrawal delays when you need liquidity

Account freezes without warning

Regulatory seizures affect your balance

Platform insolvency means your money disappears

Larecoin builds different. Self-custody from transaction one. Your keys. Your crypto. Your control.

Payments land directly in your wallet. No intermediary. No waiting. No trust required.

This is how crypto payments should work.

LUSD: The Stable Coin Advantage

Volatility kills merchant adoption. You can't run a business when your revenue fluctuates 20% daily.

Enter LUSD. Larecoin's stablecoin version.

Accept crypto. Receive stable value. Zero conversion fees.

NOWPayments and CoinPayments charge for stablecoin conversions. Every time. Larecoin includes LUSD in the base ecosystem. No markup. No hidden costs.

Merchants get predictability. Customers get crypto freedom. Everyone wins.

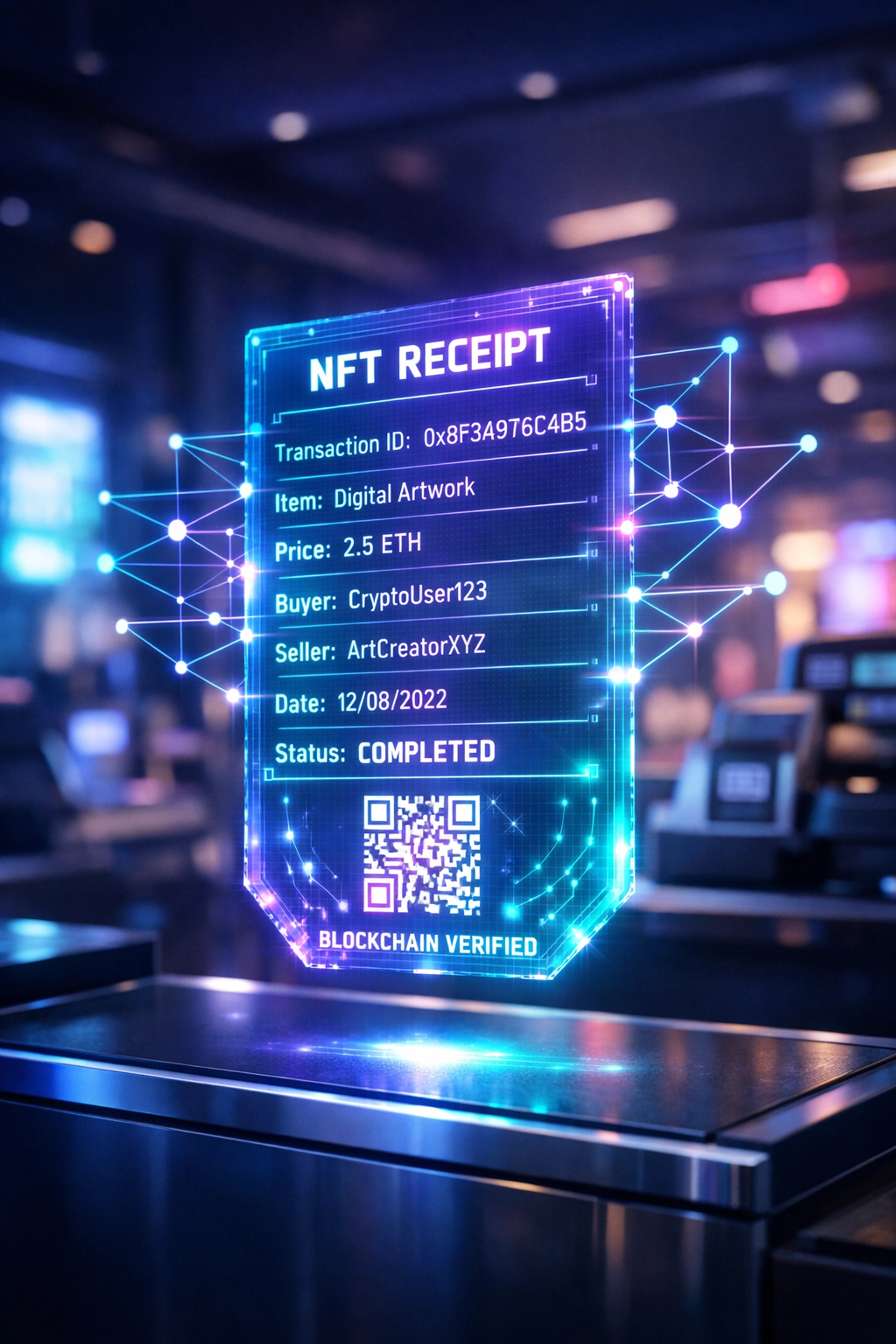

NFT Receipts: More Than a Gimmick

Every Larecoin transaction generates an NFT receipt.

Sounds like a novelty until you consider the implications:

Permanent Records

Immutable proof of purchase

Cannot be lost or altered

On-chain verification forever

Customer Engagement

Collectible transaction history

Loyalty program integration

Exclusive holder benefits

Accounting Simplification

Automatic record-keeping

Easy audit trails

Tax reporting built-in

NOWPayments and CoinPayments give you a database entry. Larecoin gives you a verifiable digital asset.

Merchant Freedom vs Platform Lock-In

Traditional processors want you dependent. Complex integrations. Proprietary systems. Migration nightmares.

Larecoin prioritizes independence.

Open Architecture

Solana-based transparency

No proprietary locks

Easy integration with existing systems

Freedom to switch without penalty

No Artificial Barriers

Withdraw anytime

No minimum holds

No withdrawal limits

No approval processes

True Decentralization

Protocol-level operations

Cannot be arbitrarily shut down

Censorship-resistant by design

Your business, your rules

This matters when platforms change terms. When regulations shift. When you need flexibility fast.

The Solana Speed Factor

Solana processes 65,000+ transactions per second. Transaction finality in 400 milliseconds.

Your customers don't wait. Payments confirm instantly.

NOWPayments and CoinPayments process across multiple chains. Speed varies. Sometimes fast. Sometimes painfully slow.

Larecoin leverages Solana exclusively for payment processing. Consistent speed. Predictable costs. Better customer experience.

Where NOWPayments and CoinPayments Actually Win

Fairness matters. Let's address their advantages:

Multi-Chain Support

NOWPayments and CoinPayments support 100+ cryptocurrencies

Better if you need obscure altcoin acceptance

Wider customer payment options

Established Track Record

Years of operation

Larger merchant base

More integration documentation

Enterprise Features

Advanced reporting tools

Dedicated account managers

Custom solutions for large volumes

If you need maximum coin diversity, they deliver. If you want minimum fees and maximum control, Larecoin delivers.

Choose your priority.

The Math That Matters

At $100,000 monthly processing:

NOWPayments/CoinPayments

Monthly fees: $500-$1,000

Annual fees: $6,000-$12,000

Five-year cost: $30,000-$60,000

Larecoin

Monthly fees: ~$167

Annual fees: ~$2,000

Five-year cost: ~$10,000

That's $20,000-$50,000 in savings over five years. For one merchant. At moderate volume.

Scale that across your entire operation. The numbers get serious fast.

What This Means for Your Business

Lower fees mean better margins. Better margins mean competitive pricing. Competitive pricing means market share growth.

Self-custody means security. Security means customer trust. Trust means repeat business.

Instant settlements mean cash flow. Cash flow means business flexibility. Flexibility means survival when markets shift.

The choice compounds over time.

Making the Switch

Moving from NOWPayments or CoinPayments to Larecoin takes hours, not weeks.

Integration Process:

Connect your Solana wallet

Generate payment addresses

Update checkout flow

Test transactions

Go live

No complex APIs. No middleware nightmares. No developer teams required.

Merchant-friendly by design.

The 2026 Reality

Crypto payments reached mainstream adoption. Merchants who optimized fees early captured market share. Those who stayed with legacy processors leaked profits.

The infrastructure exists now. The choice is yours.

NOWPayments and CoinPayments built businesses on percentage fees. That model worked when crypto payments were niche.

We're past that point.

Larecoin built for the future. Gas-only costs. Self-custody security. NFT innovation. Merchant freedom.

Your Next Move

Calculate your current processing costs. Compare against gas-only pricing. The difference probably shocks you.

Visit Larecoin and explore the ecosystem. Check the whitepaper. Run your numbers.

Then decide if 0.5-1% platform fees still make sense.

Or if pennies per transaction sounds better.

The technology exists. The savings are real. The freedom matters.

Stop paying percentage fees in 2026.

Ready to cut merchant fees? Explore Larecoin's self-custody payment solution and see your actual savings at larecoin.com.

Comments