Receivables Token 101: A Beginner's Guide to Mastering Crypto Payments as Real Business Assets

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 4 days ago

- 4 min read

Every payment your business receives is an asset. But traditional payment processors don't treat it that way. They hold your money. They charge fees. They dictate terms.

Receivables tokens change everything.

Welcome to the future of merchant payments: where your crypto transactions become tradeable, verifiable, and entirely yours.

What Exactly Is a Receivables Token?

A receivables token is a digital representation of money your business is owed. Instead of waiting days or weeks for settlement through traditional channels, your payment obligations get converted into blockchain-based tokens.

These tokens represent your legal right to that payment. You can hold them. Trade them. Use them as collateral. The choice is yours.

Think of it like turning your invoices into liquid assets: instantly accessible, fully transparent, and completely under your control.

The Old Way: Why Traditional Processors Fall Short

Let's talk about what's broken.

Platforms like NOWPayments and CoinPayments built their businesses on a simple model: process crypto payments and take a cut. Sounds fine on paper. In practice? Merchants lose money and control at every turn.

The fee problem:

NOWPayments charges 0.5% to 1% per transaction

CoinPayments takes up to 0.5% plus withdrawal fees

Hidden conversion costs eat into your margins

Settlement delays lock up your capital

The custody problem: Most crypto payment processors hold your funds. They're the middleman. Your coins sit in their wallets until they decide to release them.

That's not decentralization. That's traditional banking with extra steps.

The documentation problem: Try reconciling crypto payments at tax time. Good luck. Most processors give you basic transaction logs: nothing that proves ownership, validates the asset, or provides audit-ready documentation.

How Larecoin's Receivables Token System Works

Here's where things get interesting.

When a customer pays you through Larecoin, that payment transforms into something more powerful than a simple transaction record.

Step 1: Payment Initiation Customer sends crypto. Could be Bitcoin, Ethereum, Solana: whatever you accept.

Step 2: Token Generation The payment obligation converts into a digital token on the blockchain. This token represents your verified right to those funds.

Step 3: Smart Contract Execution Automated smart contracts handle distribution, settlement, and compliance. No manual processing. No waiting on intermediaries.

Step 4: NFT Receipt Creation Here's the innovation: every transaction generates an NFT receipt. This isn't just a record: it's proof of ownership, audit documentation, and a tradeable asset all in one.

Self-Custody: Your Keys, Your Crypto

Larecoin operates on a fundamental principle: merchant freedom.

Self-custody means you hold your own private keys. Your funds never sit in someone else's wallet waiting for approval. When a payment clears, it's yours: immediately, completely, irrevocably.

Why this matters for your business:

No withdrawal limits

No account freezes

No third-party access to your funds

No custodial risk

Compare that to NOWPayments, where funds process through their infrastructure before reaching you. Or CoinPayments, where your balance sits in their system until you manually withdraw.

Self-custody isn't a feature. It's a requirement for true financial independence.

LUSD: Stability in a Volatile Market

Crypto volatility scares merchants. Understandably so.

You accept $500 in Bitcoin. By the time you convert it, it's worth $475. Or $525. Either way, budgeting becomes impossible.

LUSD solves this.

Larecoin's stablecoin maintains consistent value while preserving all the benefits of blockchain transactions:

Near-instant settlement

Minimal gas fees

Full transparency

Self-custody compatible

Accept payment in any crypto. Convert to LUSD automatically. Lock in your revenue without touching traditional banking rails.

NFT Receipts: More Than Just Documentation

Traditional receipts prove a transaction happened. NFT receipts prove ownership.

Every payment processed through Larecoin generates a unique non-fungible token containing:

Transaction amount and timestamp

Sender and receiver verification

Smart contract execution details

Immutable blockchain record

For accounting: Your books reconcile automatically with on-chain verification.

For audits: Every receipt is cryptographically proven and tamper-proof.

For disputes: Ownership is mathematically verified, not argued.

For liquidity: Your receivables become tradeable assets with documented provenance.

This is what turns crypto payments from simple transactions into real business assets.

The Merchant Freedom Advantage

Independence matters. Here's what it looks like in practice.

No permission required: Open an account with NOWPayments? You fill out forms. Wait for approval. Hope they accept your business type. With Larecoin's decentralized approach, you connect your wallet and start accepting payments. That's it.

No geographic restrictions: Traditional processors block certain countries. Limit certain currencies. Impose regional fees. Blockchain doesn't care where you operate. Neither does Larecoin.

No arbitrary limits: Process $100 or $100,000: same system, same fees, same treatment. Your business scales without permission from payment gatekeepers.

No surprise policy changes: Centralized platforms change terms constantly. One day your business is welcome; the next day you're banned. Self-custody on decentralized rails means no one can shut you off.

Fee Comparison: Real Numbers

Let's break down what you're actually paying.

NOWPayments:

0.5% - 1% per transaction

Additional fees for instant settlement

Conversion costs for fiat withdrawals

Monthly minimums on some plans

CoinPayments:

0.5% base transaction fee

Network fees passed to merchants

Withdrawal fees per currency

Integration costs for advanced features

Larecoin:

Gas-only transfers

No percentage-based fees on transactions

Self-custody eliminates withdrawal costs

Smart contracts handle settlement automatically

The math is simple. Lower fees mean higher margins. Higher margins mean sustainable growth.

Getting Started: Your First Receivables Token

Ready to turn your crypto payments into real business assets?

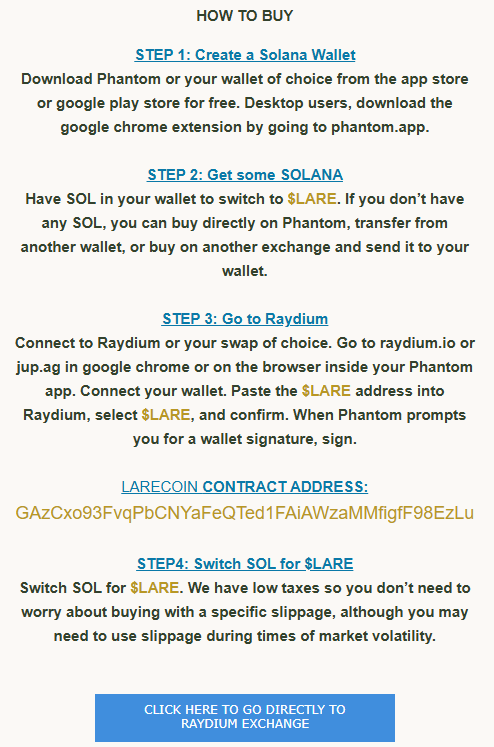

1. Set Up Self-Custody Create a Solana-compatible wallet. Check out our guide for step-by-step instructions.

2. Connect to Larecoin Link your wallet to the Larecoin ecosystem. No approval process. No waiting period.

3. Configure Payment Options Choose which cryptocurrencies you'll accept. Set up automatic LUSD conversion if desired.

4. Start Accepting Payments Generate payment requests. Share wallet addresses. Watch receivables tokens appear in real-time.

5. Manage Your Assets Track NFT receipts. Monitor token holdings. Trade receivables or hold for settlement.

The Bottom Line

Your payments are assets. Treat them that way.

Receivables tokens transform how merchants interact with crypto: from passive payment acceptance to active asset management. You gain liquidity. You gain transparency. You gain independence.

Traditional processors like NOWPayments and CoinPayments serve a purpose. But they operate on old models: custody, fees, intermediation. Larecoin represents what comes next.

Decentralized payments. Self-custody. NFT receipts. Gas-only transfers. Real business assets you actually control.

The technology exists. The infrastructure is live. The only question is whether you're ready to upgrade.

Explore Larecoin and discover what merchant freedom actually looks like.

Comments