Slash Your Merchant Interchange Fees by 50%+: The Self-Custody Advantage That NOWPayments and CoinPayments Can't Match

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Percentage Cuts Are Killing Your Margins

Every transaction costs you money. Not just a little: a lot.

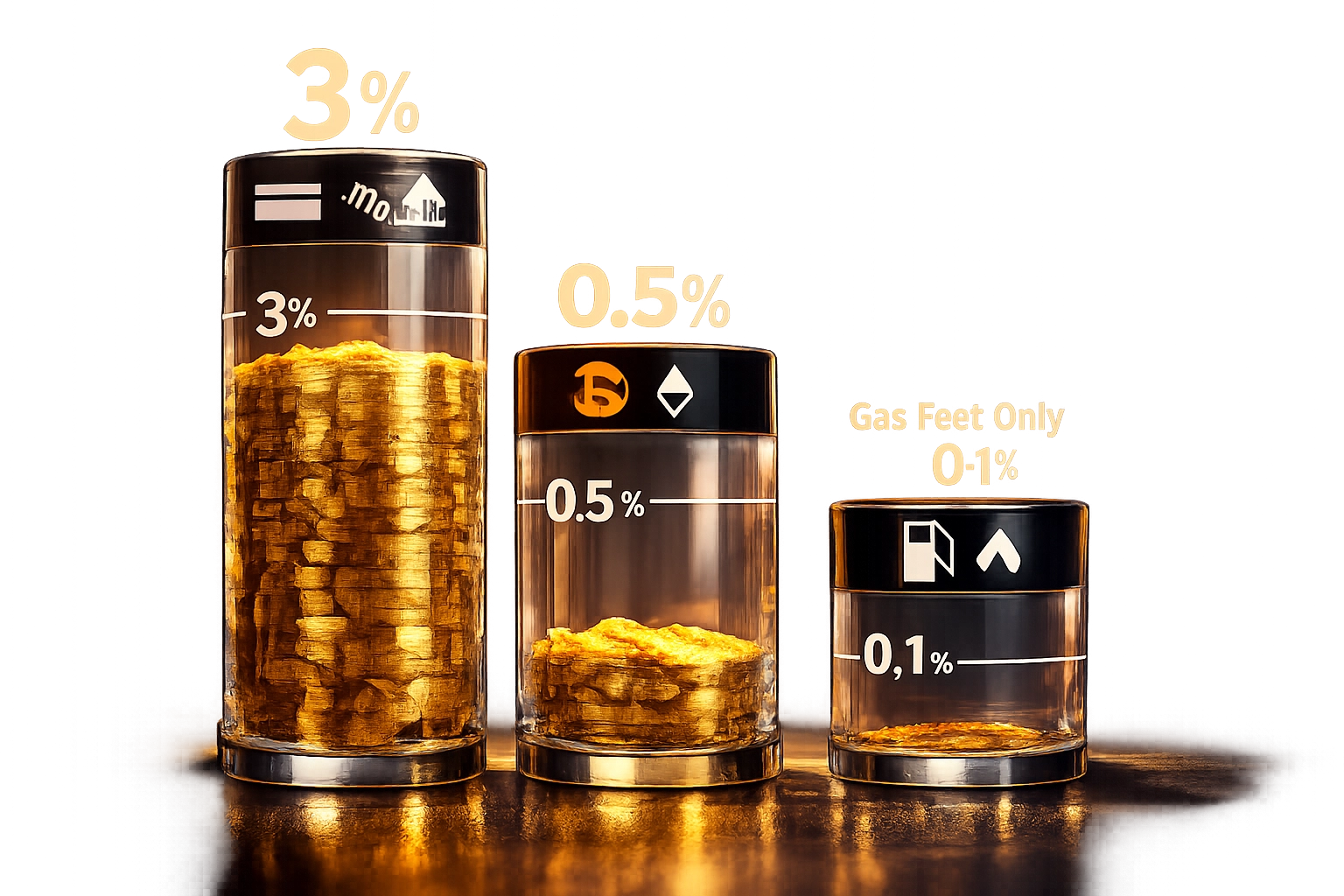

Traditional payment processors charge 2.5-3.5% per transaction. They're eating your revenue alive.

You switched to crypto payments to escape this. Smart move.

But here's the problem: NOWPayments and CoinPayments are still taking their cut.

The Hidden Tax in "Low Fee" Crypto Processors

NOWPayments charges 0.4-0.5% for single-currency payments. Sounds reasonable, right?

Add currency conversion and you're hitting 1% per transaction.

CoinPayments? A flat 0.5% every time.

Let's do the math on $100,000 monthly payment volume:

NOWPayments/CoinPayments: $750/month ($9,000 annually)

Traditional processors: $2,500-$3,500/month

Your actual cost should be: Network gas fees only

That $750 monthly fee? It's pure middleman markup. You're paying for permission to access your own money.

Gas-Only Payments: The Model That Changes Everything

Larecoin operates on a fundamentally different principle.

No percentage cuts. No transaction fees. No revenue sharing.

You pay exactly what the blockchain network charges to validate transactions. Nothing more.

At $100,000 monthly volume, your costs drop to $150-200 monthly. That's $2,000 annually versus $9,000 with competitors.

Annual savings: $7,000+

Scale that to $500,000 in annual transactions:

NOWPayments/CoinPayments: $2,500-$5,000

Larecoin: Under $2,000

The difference compounds as you grow. The more successful you become, the more you save.

True Self-Custody: Your Keys, Your Crypto, Your Control

Here's where it gets interesting.

Self-custody isn't just about owning your private keys. It's about complete financial sovereignty.

With Larecoin, payments flow directly to your wallet. No intermediary holds your funds. No custody risk. No waiting for payouts.

You control:

When funds move

Where they go

How they're secured

Who has access

Compare this to custodial models where your crypto sits in someone else's wallet until you request withdrawal.

That's not self-custody. That's just a different bank.

NFT Receipts: More Than Proof of Payment

Every transaction generates an NFT receipt. This isn't a gimmick.

It's programmable proof of purchase with embedded metadata:

Transaction amount

Timestamp

Product details

Warranty information

Loyalty points

Access credentials

Your customers can resell exclusive items with provable authenticity. Secondary market royalties flow back to you automatically.

Lost receipt? Impossible. It's permanently recorded on-chain.

Dispute resolution becomes instant. The NFT receipt contains immutable transaction history.

Traditional e-commerce platforms charge 2-5% for these features separately. You get them built into every payment.

LUSD: The Stability Your Business Actually Needs

Price volatility terrifies merchants. Understandably.

You can't run a business when your revenue fluctuates 10% daily.

LUSD stablecoin solves this without the centralization risks of USDT or USDC.

Decentralized. Overcollateralized. No single point of failure.

Accept payments in LARE tokens or convert instantly to LUSD. Your choice.

Lock in revenue value without trusting a centralized stablecoin issuer.

This is stability with sovereignty.

The Real Cost of "Convenient" Custodial Solutions

Convenience costs more than you think.

When NOWPayments or CoinPayments hold your funds, they're:

Lending your crypto for yield (keeping the profits)

Controlling payout timing

Requiring identity verification

Monitoring transaction patterns

Reporting to authorities

Setting withdrawal limits

You traded one set of intermediaries for another.

The fees you pay aren't just for payment processing. You're paying for the privilege of reduced sovereignty.

Breaking Down the Annual Economics

Let's get specific with real numbers.

Scenario: $250,000 annual payment volume

NOWPayments (0.5% average):

Transaction fees: $1,250

Currency conversion fees: Variable

Custody risk: Unquantified

Total known costs: $1,250+

CoinPayments (0.5%):

Transaction fees: $1,250

No self-custody option

Payout delays

Total known costs: $1,250+

Larecoin (gas-only):

Network fees: ~$500-750

Zero percentage cuts

Immediate self-custody

NFT receipts included

Total costs: $500-750

Savings: $500-1,500 annually

At higher volumes, the gap widens exponentially.

Why Web3 Payments Require True Self-Custody

Web3 isn't just about using crypto for payments.

It's about financial architecture that removes trusted third parties.

Custodial payment processors are Web2 companies wearing Web3 masks.

They're:

Single points of failure

Regulatory capture risks

Counterparty exposure

Privacy vulnerabilities

True Web3 payments mean:

Peer-to-peer transactions

No intermediary control

Cryptographic security

Unstoppable transfers

You can't achieve this without self-custody.

The Merchant Growth Multiplier

Lower fees compound into serious competitive advantages.

That extra $7,000-10,000 annually goes toward:

Better products

Marketing spend

Customer acquisition

Team expansion

Technology upgrades

Your competitors paying percentage-based fees? They're reinvesting 50%+ less into growth.

Over three years, that's $21,000-30,000 in savings.

Over ten years? Six figures.

This isn't just about saving money. It's about accelerating growth while competitors pay middleman taxes.

Getting Started: Simpler Than You Think

Integration takes minutes, not months.

No lengthy approval processes. No compliance documentation. No waiting periods.

Install the Larecoin merchant portal. Generate your payment address. Start accepting payments.

Your customers send crypto directly to your wallet. You receive it instantly.

NFT receipts generate automatically. LUSD conversion happens on-demand.

The technical complexity? We handle it. The cost savings? You keep them.

The Future Is Self-Sovereign

Percentage-based payment processors made sense in Web2.

Credit card networks required massive infrastructure. Someone had to pay for it.

But blockchain infrastructure already exists. It's open. It's permissionless. It's ready.

Paying percentage cuts for accessing public infrastructure makes zero sense.

The early merchants who recognize this will dominate their markets.

While competitors hemorrhage 0.5-1% on every transaction, you're reinvesting those savings into growth.

The math is simple. The advantage is massive. The choice is obvious.

Stop Paying Middleman Taxes

You built your business to serve customers, not payment processors.

Every percentage point you pay is revenue that should be yours.

NOWPayments and CoinPayments can't offer gas-only pricing. Their business model depends on taking a cut.

Larecoin's model is different. We succeed when you succeed. No extraction. No hidden fees. No custody games.

Just direct, peer-to-peer payments at actual network cost.

Your margins deserve better. Your customers deserve better. Your business deserves better.

Ready to slash your merchant fees by 50%+?

Start accepting self-custody payments today at larecoin.com.

Your competition is already paying too much. Don't join them.

Comments