Stop Wasting Money on CoinPayments and NOWPayments: 7 Quick Hacks to Reduce Merchant Interchange Fees by 50%+ with Self-Custody

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Let's talk numbers.

CoinPayments charges 0.5% per transaction. NOWPayments hits you with 0.4-0.5%. Sounds reasonable, right?

Wrong.

You're leaving thousands on the table every month. Maybe tens of thousands if you're processing serious volume.

Here's the truth: self-custody crypto payments can slash your merchant fees by 93-97%. Not a typo. Actual merchants are doing this right now.

Traditional processors charge 2.75-3.5% per transaction. Even the "crypto-friendly" options still skim percentages off every sale. Self-custody? You pay flat network gas fees. That's $0.001-$2.00 per transaction regardless of amount.

Do the math on a $5,000 sale. Traditional processing costs you $150. Self-custody? Maybe $1.50 in gas fees.

That's a 99% reduction.

Let's break down exactly how to make this happen.

Hack #1: Replace Percentage Fees with Flat Gas Fees

This is the foundation. The game-changer.

Traditional processors and platforms like CoinPayments operate on percentage models. They scale their take based on your transaction size. The bigger your sale, the more they extract.

Self-custody flips this completely.

Network gas fees are fixed. A $100 payment costs the same to process as a $10,000 payment. You're paying for network bandwidth, not transaction value.

Real example: You process $100,000 monthly. Traditional fees? $3,000-$3,500 per month. Self-custody with LUSD or other stablecoins? $120-$1,200 annually. That's $34,800 versus maybe $1,200.

The savings compound fast.

Hack #2: Deploy LUSD Stablecoin for Zero Volatility Risk

"But crypto prices fluctuate!"

Not with stablecoins.

LUSD maintains dollar parity. Your customers pay in stable value. You receive stable value. No conversion risk. No price anxiety.

This removes the biggest psychological barrier to crypto adoption. Customers get the benefits of decentralized payments without worrying about Bitcoin dropping 10% while their transaction confirms.

LUSD also offers superior decentralization compared to centralized stablecoins. No freeze functions. No blacklists. True financial sovereignty.

For merchants, this means predictable accounting. The $500 payment you receive today is worth $500 tomorrow. Simple.

Hack #3: Build Master/Sub-Wallet Architecture

Organization matters.

Don't dump everything into one wallet address. That's amateur hour.

Set up a master wallet with multiple sub-wallets. One for each location. One for online sales. One for wholesale. Whatever structure matches your business.

This gives you:

Granular tracking by revenue stream

Simplified accounting reconciliation

Better security (compartmentalized risk)

Cleaner audit trails

Think of it like bank accounts, but without the bank. You control everything. No permission needed to create new wallets. No monthly fees per account.

Takes 10 minutes to set up. Saves hours every month in bookkeeping.

Hack #4: Eliminate Chargeback Fees Forever

Chargebacks cost merchants 1-2% of annual revenue. Plus $15-$100 per dispute in processor fees.

Crypto transactions are immutable. Final. Irreversible.

No more fraudulent disputes. No more chargeback fees. No more losing legitimate sales to scammers who know how to game the system.

This single factor can add 1-2% back to your bottom line. For a $1 million business, that's $10,000-$20,000 recovered instantly.

The dispute process disappears. The fees disappear. The headaches disappear.

Hack #5: Get Instant Settlement (Real-Time Cash Flow)

Traditional processors hold your money for 1-3 business days. Sometimes longer if they flag your account for "review."

That's your working capital sitting in their bank account earning them interest.

Crypto payments settle in minutes. The funds hit your wallet immediately. You control them instantly.

This transforms cash flow management. No more waiting periods. No more settlement delays. No more wondering when you'll actually access your own money.

For businesses operating on tight margins, this liquidity improvement alone justifies the switch.

Hack #6: Deploy QR Code POS Systems in Under 2 Minutes

Setting up traditional payment processing takes days. Applications. Underwriting. Equipment leases. Integration headaches.

Self-custody crypto POS? Two minutes.

Generate a QR code linked to your wallet. Display it at checkout. Customers scan and pay. Done.

No gateway required. No processor approval needed. No intermediary taking their cut.

This works for:

Retail locations

Pop-up shops

Service businesses

Event vendors

Online checkouts

The setup simplicity is stunning. You can spin up new payment endpoints faster than you can write an email.

For small businesses and entrepreneurs, this removes massive friction. Start accepting payments immediately. No permission required.

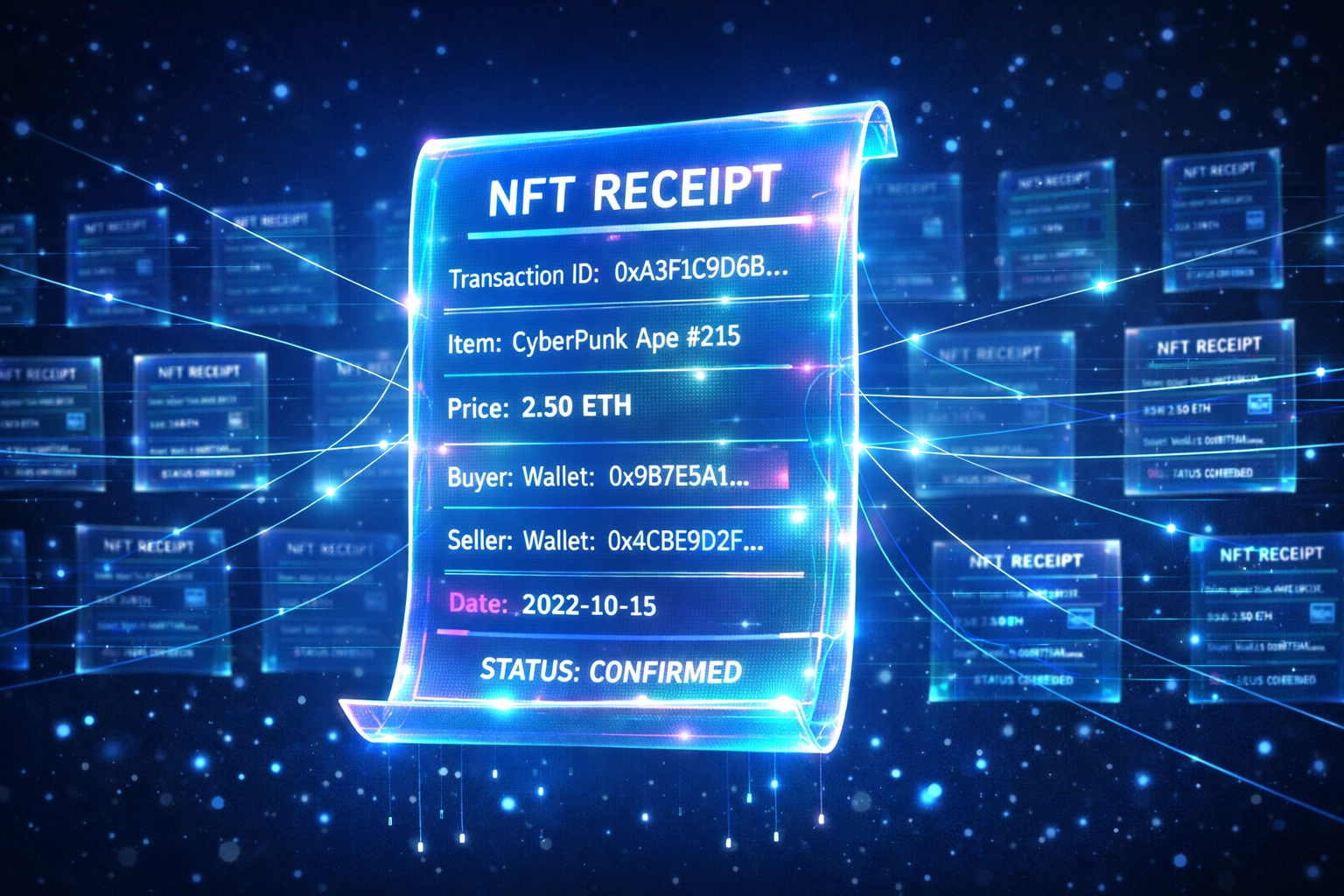

Hack #7: Automate Accounting with NFT Receipts

Here's where Web3 gets really interesting.

NFT receipts aren't just digital art. They're immutable transaction records automatically generated with each payment.

Think of them as blockchain-native invoices that can't be altered, lost, or disputed. Every transaction gets its own NFT receipt containing:

Transaction amount

Date and timestamp

Wallet addresses

Product/service details

Your accounting software can read these directly. No manual entry. No reconciliation errors. No missing receipts at tax time.

This also protects you legally. Someone claims they didn't receive their order? The NFT receipt proves payment and terms. Immutable evidence.

Traditional receipt systems can be manipulated. NFT receipts can't. That's the power of blockchain verification.

Real Numbers: What This Looks Like in Practice

Let's run a realistic scenario.

You're processing $250,000 monthly through NOWPayments at 0.4% fees.

Current costs:

Monthly fees: $1,000

Annual fees: $12,000

Chargeback losses: ~$2,500-$5,000

Settlement delays: Unmeasured opportunity cost

Self-custody with Larecoin:

Monthly gas fees: ~$200

Annual costs: $2,400

Chargeback losses: $0

Settlement: Instant

You save $9,600 annually in direct fees. Add back chargeback recoveries and you're looking at $12,000-$15,000 total savings.

That's a 96-97% fee reduction.

For larger merchants processing $1 million+ monthly, these savings hit six figures annually.

The Limitations (Because Honesty Matters)

Self-custody doesn't work perfectly for everything.

Micro-transactions are problematic. If you're selling $5 coffees, a $1 gas fee makes no sense. That's a 20% transaction cost, worse than traditional processing.

Self-custody works best for:

Transaction values above $50

B2B payments

High-ticket items

Service businesses

International transfers

Many merchants run hybrid models during transition. Traditional processing for small transactions. Self-custody for larger ones.

That's fine. You don't have to go all-in immediately.

Even capturing 30% of your volume in self-custody can slash overall fees by 50%+.

Why Larecoin Makes This Simple

Setting up self-custody sounds technical. It doesn't have to be.

Larecoin provides the full infrastructure:

LUSD stablecoin integration

Automatic NFT receipt generation

Master/sub-wallet architecture

Merchant dashboard with real-time tracking

QR code POS systems

Web3 global payments support

You get the fee savings without the technical complexity. The platform handles blockchain interactions. You focus on your business.

This is the NOWPayments alternative and CoinPayments alternative merchants have been waiting for. All the crypto payment benefits. None of the percentage-based fee extraction.

Take Action Now

Calculate what you're currently paying in merchant fees. Multiply your monthly processing volume by your fee percentage.

That's money leaving your business every month.

Now imagine cutting that by 50%. Or 70%. Or 95%.

Self-custody isn't theoretical. Merchants are implementing this today. The technology works. The savings are real.

Stop feeding percentage-based platforms. Take control of your payment infrastructure.

Check out Larecoin to see how self-custody merchant accounts actually work in practice. The transition is simpler than you think.

Your future self (and your accountant) will thank you.

Comments