Stop Wasting Money on Payment Processing: The Receivables Token Framework That Gives Merchants Total Control

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 4 hours ago

- 4 min read

You're Bleeding Money Every Single Transaction

Every swipe costs you.

2.9% plus $0.30. Times thousands of transactions. Plus chargeback fees. Plus monthly gateway fees. Plus PCI compliance costs. Plus settlement delays.

The math is brutal.

A $100 sale nets you $97 three days later. If you're lucky. If the payment processor doesn't freeze your account first.

Traditional payment rails weren't built for merchants. They were built to extract maximum fees from your revenue stream.

There's a better way.

The Receivables Token Framework Changes Everything

Blockchain-based receivables tokenization eliminates the middleman entirely.

Here's how it works:

Each customer payment mints directly as a programmable NFT into your self-custody wallet. No intermediary. No settlement delay. No permission required.

Your customer pays with their preferred method: credit card, crypto, LUSD stablecoin. The payment tokenizes transparently in the background. Your accounting systems see a standard transaction. You see immediate access to your funds.

The blockchain handles verification. Smart contracts handle settlement. You handle growth.

What You Get

Instant settlement - Funds available immediately, not in 3-5 business days

Self-custody - Your wallet, your keys, your money

Programmable receipts - NFTs with embedded utility and data

Gas-only fees - $0.02-0.10 per transaction on Solana

Zero account freezes - Decentralized infrastructure can't lock you out

The Cost Comparison Will Shock You

Traditional processing on a $100 sale:

Interchange fee: -$2.50

Gateway fee: -$0.30

Compliance tools: -$0.20

You receive: $97.00 (3 days later)

Larecoin receivables token on a $100 sale:

Blockchain gas fee: -$0.05

You receive: $99.95 (immediately)

That's 99%+ cost reduction.

Over a year processing $500K in revenue:

Traditional fees: $15,000+

Larecoin gas fees: $250

You save: $14,750

Scale that to $1M, $5M, $10M in annual revenue. The numbers become impossible to ignore.

Self-Custody Means Total Control

Here's what most merchants don't realize about traditional payment processors:

You don't control your money. They do.

They can freeze your account without warning. Delay settlements arbitrarily. Change fee structures unilaterally. Terminate service based on opaque risk algorithms.

You're building your business on someone else's permission.

Larecoin's receivables token framework flips this completely.

Your payments mint directly to your wallet. No intermediary holds funds "for processing." No single entity controls the blockchain infrastructure. No approval committee decides if you deserve access to your own revenue.

From the moment payment verifies, you have complete custody. Transfer it. Trade it. Settle it. Your choice. Your timeline.

The infrastructure is permissionless by design. It cannot be censored, frozen, or controlled by any centralized authority.

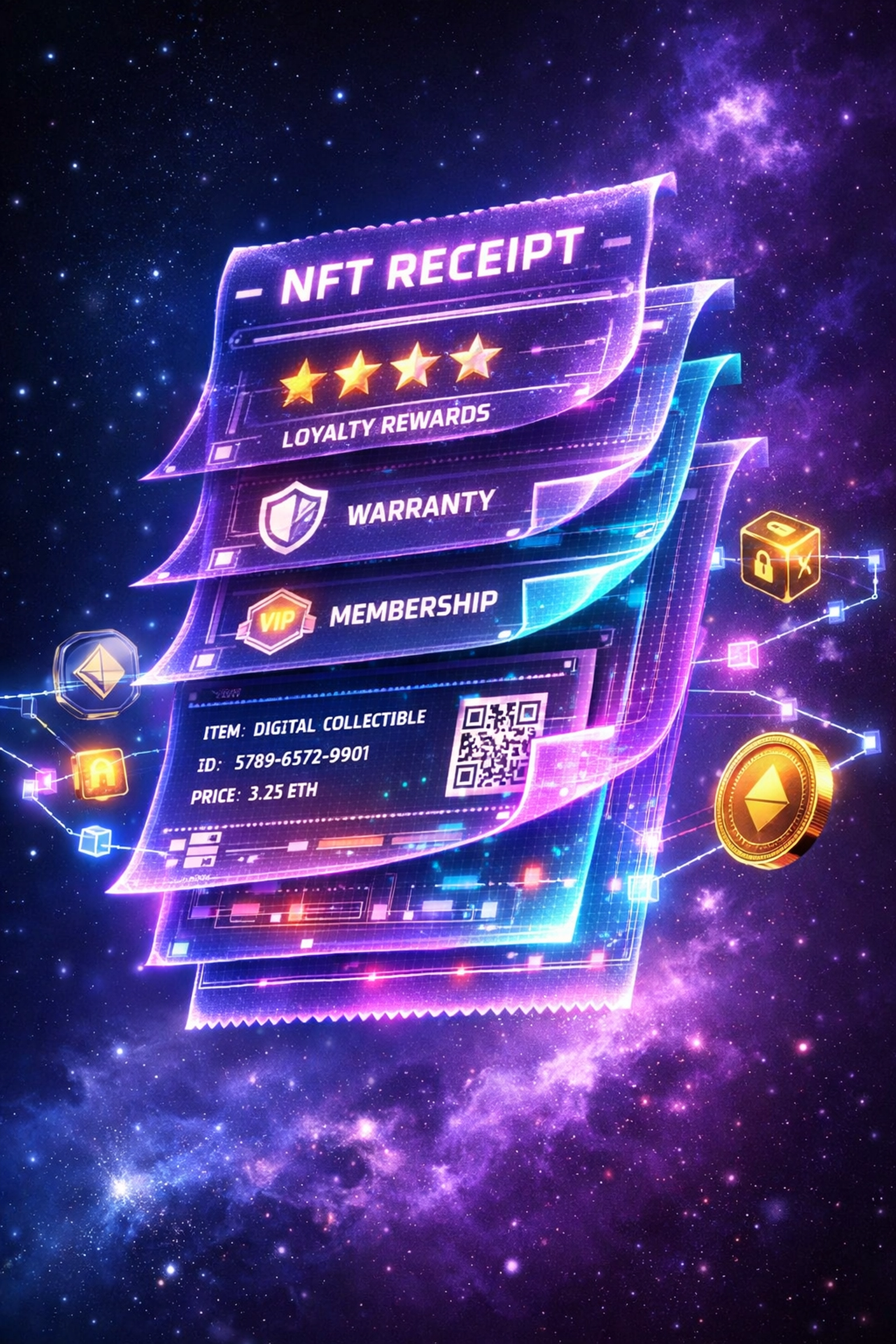

NFT Receipts Unlock Programmable Commerce

Every receivable token is more than just a payment record.

It's a programmable NFT with embedded utility:

Loyalty rewards - Automatically distribute points or tokens with each purchase

Membership verification - Prove purchase history on-chain for VIP access

Resale royalties - Earn commission when customers transfer receipts

Supply chain tracking - Embed product provenance data directly in payment

Warranty management - Receipts double as transferable warranty certificates

Traditional receipts are dead data. NFT receipts are living assets.

Customers can collect them. Trade them. Use them to unlock exclusive experiences. The receipt becomes part of your brand ecosystem.

This isn't theoretical. It's happening now across Web3 commerce platforms.

LUSD Stablecoin Solves Volatility

The crypto payment objection everyone raises: "What about price fluctuations?"

LUSD eliminates volatility entirely.

Larecoin's integrated stablecoin maintains 1:1 peg with USD. Your customers pay in stable value. You receive stable value. Zero conversion risk.

Unlike algorithmic stablecoins that can depeg, LUSD uses decentralized collateralization. It's survived every crypto winter. Battle-tested stability.

Benefits for merchants:

Predictable accounting - Know exactly what you'll receive

No conversion fees - Direct LUSD acceptance

Instant settlements - Stablecoins clear faster than traditional bank transfers

Global compatibility - Accept payments from any country without FX risk

You get crypto-speed payments with fiat-level stability.

Why Larecoin Crushes NOWPayments & CoinPayments

Other crypto payment processors still operate on traditional rails.

NOWPayments:

Charges 0.5%-1% fees (better than Visa, still extractive)

Custodial model - they hold your funds during processing

Manual KYC approval process

Limited stablecoin options

CoinPayments:

0.5% transaction fees

Custodial wallet system

Settlement delays up to 24 hours

No programmable receipt functionality

Larecoin receivables framework:

Gas-only pricing (99% cheaper)

Self-custody from payment verification

Zero approval process - deploy in under an hour

Native NFT receipt functionality

LUSD stablecoin integration

Solana-powered instant finality

The competitors offer "crypto payment processing." We offer tokenized receivables infrastructure.

Completely different paradigm.

Implementation Takes Under An Hour

No merchant approval process. No credit checks. No compliance paperwork beyond basic KYC.

Setup steps:

Create self-custody wallet (5 minutes)

Integrate payment endpoint (30 minutes)

Configure token parameters (10 minutes)

Start accepting payments (immediate)

Compare that to traditional payment processors:

Application review: 3-7 days

Approval process: 1-2 weeks

Integration testing: 2-4 weeks

Go-live: 4-6 weeks minimum

Larecoin gets you processing in 60 minutes.

Your existing checkout flow stays intact. Your accounting systems connect via standard APIs. Your customers see zero difference in payment experience.

The tokenization happens transparently behind the scenes.

The Financial Sovereignty Play

This isn't just about saving on fees.

It's about owning your payment infrastructure.

Traditional processors are gatekeepers. They decide who gets to participate in commerce. They extract rent for that privilege.

Web3 payments eliminate the gatekeeper.

You custody your receivables. You control settlement timing. You program receipt functionality. You build direct relationships with customers through on-chain interactions.

No intermediary can revoke your ability to accept payments. No centralized entity can unilaterally change your costs. No payment network can freeze your revenue stream.

You own the rails.

This is the foundational shift that makes Web3 commerce revolutionary.

Stop Paying The Payment Processing Tax

Every day you process through traditional rails, you lose money.

2.9% per transaction adds up fast. Settlement delays cost you working capital. Account freezes destroy growth momentum.

The receivables token framework fixes all of it.

99% cost reduction through gas-only fees

Instant settlement for improved cash flow

Self-custody for complete control

NFT receipts for programmable commerce

LUSD stability without volatility risk

Deploy Larecoin in under an hour. Start tokenizing receivables immediately. Keep more of what you earn.

The technology exists. The infrastructure is live. The savings are real.

Take control of your payment processing.

Visit Larecoin to start tokenizing receivables today.

Comments