The 5-Step Framework to Merchant Freedom: How to Ditch Payment Middlemen and Keep More Profit with Web3

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

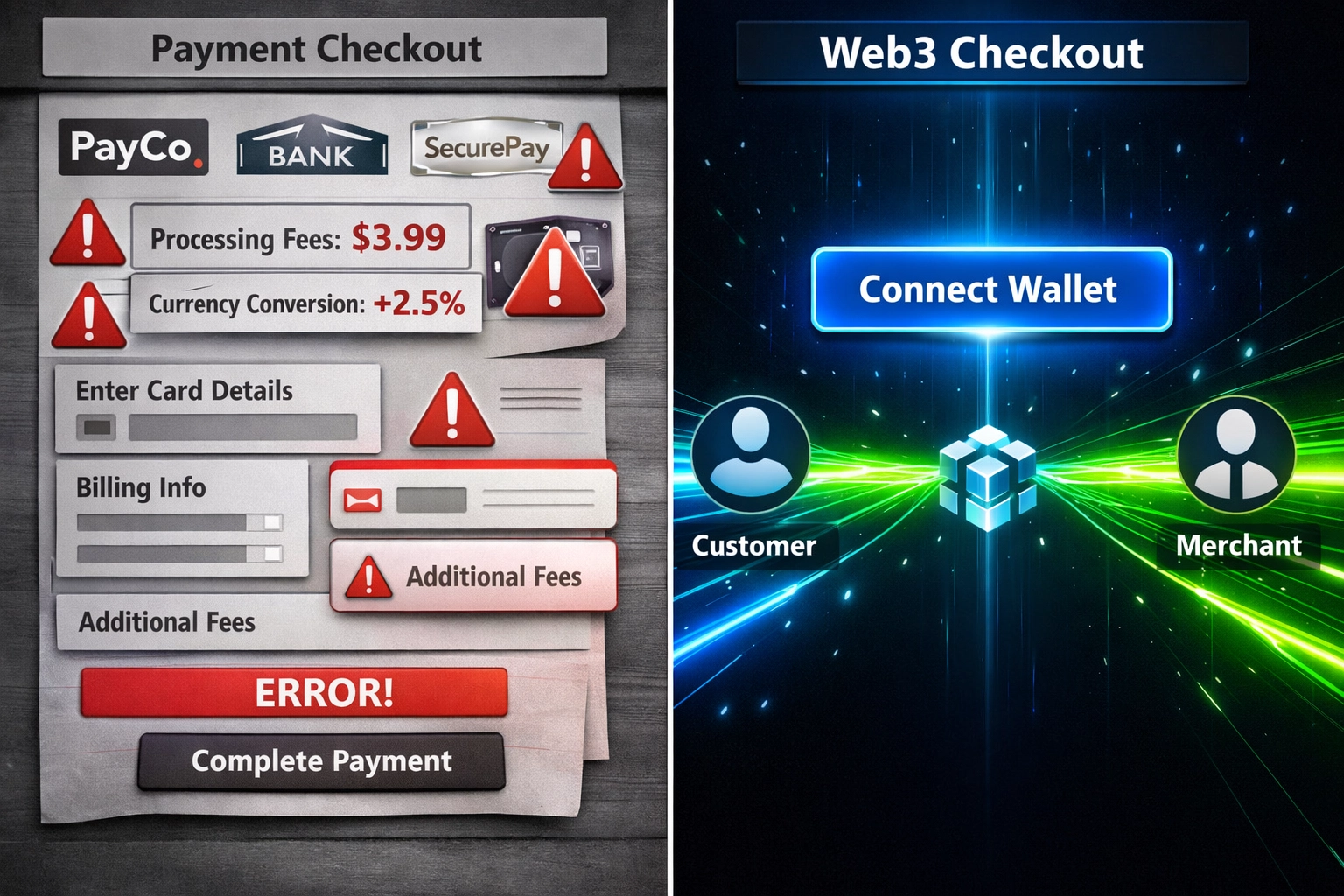

Interchange fees are killing merchant margins.

Traditional payment processors take 2.5-4% domestically. International? Try 4-7%. That $100 sale just became $93. Or $96. Or whatever the middleman decides to leave you.

Web3 flips this model on its head.

No banks. No payment processors. No middlemen clipping tickets on every transaction.

Just you, your customer, and the blockchain.

Here's exactly how to make it happen.

Step 1: Build Your Self-Custody Payment Infrastructure

First move? Ditch custodial wallets entirely.

You need complete control over your payment infrastructure. Not partial. Complete.

What you'll set up:

Multi-chain non-custodial wallet (MetaMask, Phantom, or equivalent)

Dedicated merchant receiving addresses across Solana, Ethereum, BSC

Hardware wallet backup (Ledger or Trezor) for security layer

Private key management system that only you control

This isn't optional. It's foundational.

NOWPayments and CoinPayments both operate custodial models. They hold your funds. They control access. They can freeze accounts.

Larecoin operates differently. Self-custody from day one. Your keys. Your crypto. Your control.

Setup takes 30 minutes. Not weeks. Not compliance paperwork. Not banking relationships.

Just direct wallet integration with your existing infrastructure.

Step 2: Accept Direct Blockchain Payments

Skip the gateway layer completely.

Traditional crypto payment processors charge 0.5-1% fees. They position it as "low" compared to credit cards. It's not low. It's unnecessary.

Direct blockchain acceptance means:

Web3 wallet connection on your checkout

Unique payment requests generated automatically

Blockchain event listeners confirming transactions

Automatic order fulfillment triggers

Open-source libraries handle the technical complexity. MetaMask SDK. Web3.js. Both free. Both battle-tested.

CoinPayments charges 0.5% per transaction. On a $10,000 monthly volume, that's $50 gone. Every single month. For functionality you can implement yourself.

Larecoin provides the infrastructure without the extraction. You pay network gas fees only. Nothing to middlemen.

The cost difference? 99%+ savings on transaction fees.

Real example: $20 sale through NOWPayments costs $0.10-$0.20 in fees. Direct blockchain routing costs pennies. Literal pennies.

Step 3: Generate NFT Receipts for Every Transaction

Traditional receipts are database entries. Forgettable. Disposable. Zero value after purchase.

NFT receipts are different.

Each completed payment triggers automatic NFT minting that includes:

Full transaction details

Purchase date and time

Item information

Warranty proof

Loyalty token potential

These receipts appear directly in customer wallets. They're transferable. Tradable. Collectible.

Customers actually want them.

Why? Because NFT receipts serve multiple functions traditional receipts can't:

Warranty Verification - Permanent blockchain proof of purchase. No lost paper receipts. No expired email confirmations.

Loyalty Programs - Receipts become loyalty tokens. Accumulate purchases. Unlock rewards. Trade with other customers.

Resale Value - Some receipts from popular brands become collectible. Secondary markets emerge naturally.

Ownership History - Transfer items with verified purchase history attached. Increases resale value.

Larecoin's NFT receipt system operates on Solana. Minting costs under $0.01. Near-instant. Scalable to millions of transactions.

Competitors either don't offer NFT receipts or charge premium fees for the feature.

Step 4: Accept LUSD Stablecoin

Volatility is the biggest merchant objection to crypto payments.

Bitcoin swings 5% daily. Ethereum isn't much better. Merchants need price stability.

LUSD solves this without centralization trade-offs.

Why LUSD specifically:

Decentralized stablecoin protocol

Over-collateralized with ETH

No freezable assets

No centralized control points

1:1 USD peg maintained algorithmically

Compare this to USDT or USDC. Both are centralized. Both can freeze addresses. Both require trust in a corporate entity.

LUSD requires trust in code. Audited smart contracts. Transparent collateral ratios.

Merchant implementation is straightforward:

Accept LUSD at 1:1 ratio with USD pricing

Auto-convert to other stablecoins if needed

Zero price fluctuation anxiety

Customer pays in LUSD. You receive LUSD. Value holds. No volatility drama.

Larecoin's payment infrastructure supports LUSD natively. One-click integration. Automatic conversion options if you prefer different stablecoins.

This eliminates the "what if crypto crashes during checkout" objection completely.

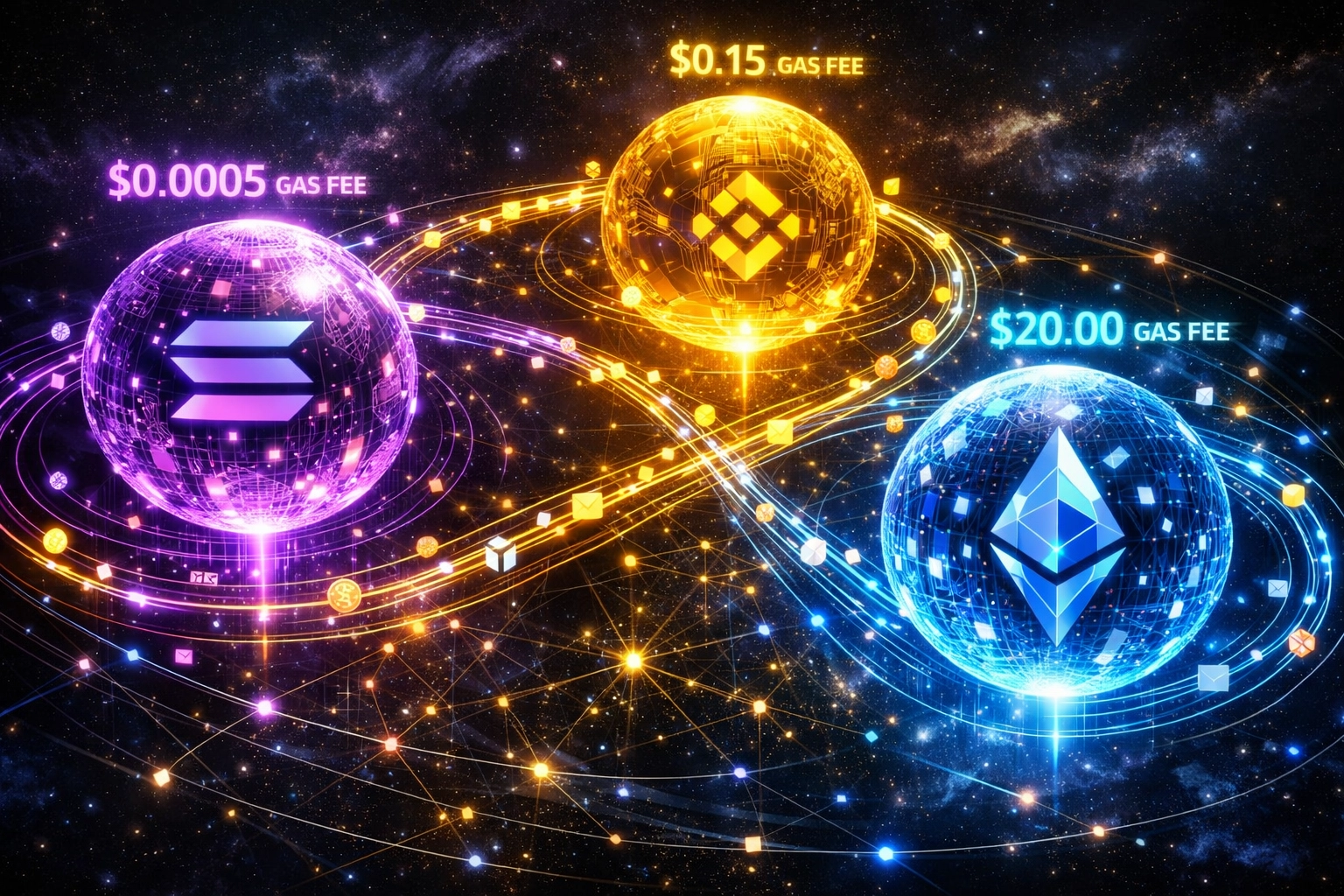

Step 5: Configure Gas-Only Transaction Routing

Different blockchains have different cost structures.

Smart merchants route transactions to the most cost-effective network based on purchase size.

Optimal routing breakdown:

Solana for micro-transactions (under $50)

Gas fees: $0.0001-$0.01

Settlement time: Under 1 second

Perfect for coffee shops, digital goods, subscriptions

BSC for mid-range purchases ($50-$500)

Gas fees: $0.10-$0.50

Settlement time: 3-5 seconds

Ideal for retail, services, medium-ticket items

Ethereum mainnet for high-value transactions ($500+)

Gas fees: $5-$50

Settlement time: 15-30 seconds

Best for luxury goods, B2B payments, large purchases

This routing happens automatically. Customer connects wallet. System detects transaction size. Routes to optimal chain. Customer pays from their preferred holdings.

Larecoin's multi-chain infrastructure handles this routing natively. No manual configuration. No blockchain expertise required.

Compare this to single-chain processors. NOWPayments supports multiple chains but charges the same percentage fee regardless. You pay 0.5% on a $10 transaction and a $10,000 transaction.

With gas-only routing, your $10 transaction costs $0.01 in fees. Your $10,000 transaction costs $0.50 in fees.

The percentage drops as transaction size increases.

The Financial Impact

Let's run real numbers.

Traditional payment processing:

$100,000 monthly sales volume

3% average payment processing fees

$3,000 monthly cost

$36,000 annual cost

Web3 direct payments with gas-only routing:

$100,000 monthly sales volume

Average $0.25 gas fee per transaction

500 transactions monthly

$125 monthly cost

$1,500 annual cost

Savings: $34,500 annually.

That's 95.8% cost reduction. Not a typo. Not an exaggeration.

And it gets better.

No chargebacks. No payment disputes. No frozen accounts. No deplatforming risk.

Blockchain payments are final. Irreversible. What you receive is what you keep.

Setup time? About 30 minutes total.

Traditional merchant accounts? Weeks of paperwork. Banking relationships. Compliance documentation. Integration headaches.

Merchant Freedom Means Global Reach

Web3 payments unlock every customer in every country.

No geographical restrictions. No currency conversion fees. No international payment processor limitations.

Customer in Japan pays same as customer in Brazil. Same process. Same fees. Same speed.

NOWPayments restricts certain countries. CoinPayments has compliance requirements that vary by region.

Larecoin operates on public blockchains. No geographical restrictions. No arbitrary rules. No selective service.

If you can connect to the internet, you can accept payments.

This is true financial sovereignty.

Why Larecoin Dominates Competitors

NOWPayments charges:

0.5% transaction fees

Custodial wallet requirements

Limited blockchain support

No NFT receipt functionality

Centralized infrastructure

CoinPayments charges:

0.5% transaction fees

KYC requirements for merchants

Withdrawal fees on top of transaction fees

Limited stablecoin options

No automatic gas optimization

Larecoin provides:

Zero transaction fees beyond network gas

Self-custody infrastructure

Multi-chain support (Solana, Ethereum, BSC)

Native NFT receipt generation

LUSD stablecoin integration

Automatic gas-optimized routing

30-minute setup process

No compliance paperwork

The comparison isn't close.

Traditional crypto payment processors operate the same extraction model as credit card companies. Just with slightly lower percentages.

Larecoin operates the Web3 model. Infrastructure without extraction. Technology without middlemen. Payments without permission.

Implementation Reality Check

This framework requires technical comfort. Not expertise. Comfort.

You'll interact with blockchain explorers. Monitor wallet addresses. Configure smart contract interactions.

But you won't write code. You won't become a blockchain developer. You won't need computer science degrees.

Larecoin provides documentation, templates, and support throughout setup.

The 30-minute timeline assumes basic technical literacy. If you can install WordPress plugins, you can implement this framework.

Your Next Move

Merchant freedom starts with a single decision.

Keep feeding intermediaries percentages. Or take control of your payment infrastructure.

The framework is proven. The technology is ready. The savings are real.

Visit Larecoin to access implementation guides, wallet setup tutorials, and merchant success stories.

Your margins are waiting.

Your freedom is available.

The question is whether you'll take it.

Comments