Why Everyone Is Talking About Web3 Global Payments (And How 1.5% Can Change the World)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 3 hours ago

- 4 min read

The payment processing industry has been bleeding merchants dry for decades.

Every swipe. Every tap. Every transaction.

Traditional processors take 2.5-3.5% off the top. Add gateway fees. Processing markups. PCI compliance costs. Chargeback penalties.

A merchant processing $500,000 monthly loses $174,000 annually to fees alone.

That's not a business model. That's legalized theft.

Web3 global payments flip the script entirely. And Larecoin's 1.5% transaction tax? It's not a fee: it's a global charity fund.

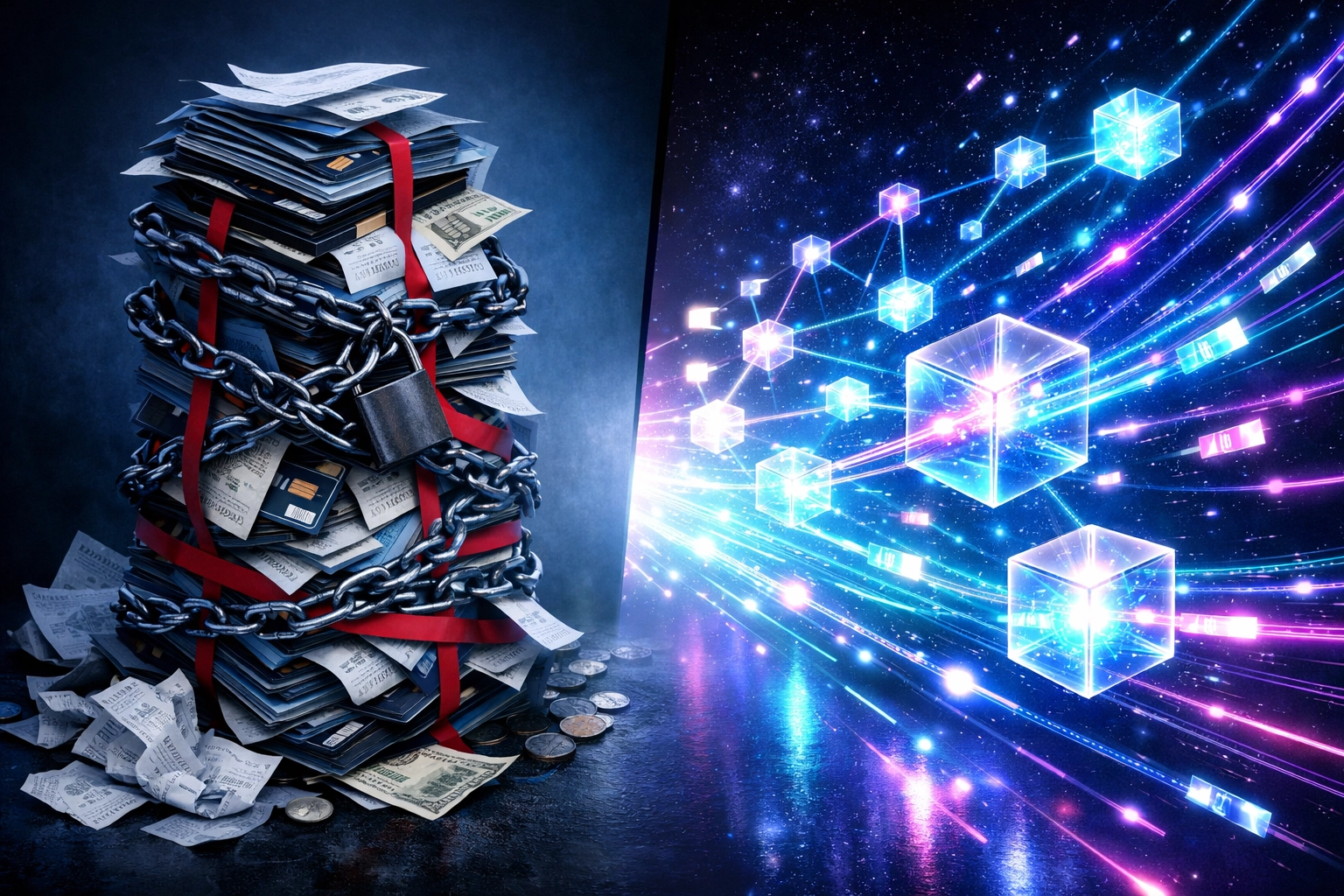

The Traditional Payment Trap

Here's what merchants actually pay:

Base interchange: 2.5-3.5% Processing markup: 0.3-0.5% Monthly gateway fees: $15-30 PCI compliance: $100-500 annually Chargebacks: $15-25 per dispute

Stack it up. Watch your margins evaporate.

The global payment processing market handles $40 trillion annually. Legacy processors extract billions in fees while delivering 3-5 day settlement times and arbitrary account freezes.

Banks profit. Payment networks profit. Merchants lose.

Web3 Payments: The 99.3% Solution

Blockchain-based payments eliminate the middleman entirely.

Transaction cost: $0.50-$3 flat fee. Regardless of transaction size.

That's a 99.3% reduction at scale.

Instant settlement. Not days. Seconds.

24/7 availability. No banking hours. No holidays. No maintenance windows.

Permissionless access. No credit checks. No bank account required. No arbitrary rejections.

The blockchain payments market grew from $3.2 billion in 2023 to a projected $81.5 billion by 2030. That's 25x growth in seven years.

Major platforms are moving fast. Coinbase partnered with Shopify for USDC payments. Monthly payment flows now exceed $10 billion on leading processors.

2026 is the inflection point.

The 1.5% That Changes Everything

Larecoin's model is different.

A 1.5% transaction tax funds global charities directly. Every purchase. Every transfer. Every transaction.

Not profit extraction: social impact at scale.

Compare to traditional processors:

Visa/Mastercard: 2.5-3.5% to shareholders

Payment gateways: 0.3-0.5% to corporate profits

Larecoin: 1.5% to verified global charities

Merchants save money. Charities get funded automatically. No additional donation steps. No tax forms. No overhead.

Built into the protocol.

LareBlocks: Infrastructure That Delivers

Larecoin runs on LareBlocks: a custom Layer 1 blockchain designed for merchant operations.

LareScan Explorer Benefits:

Real-time transaction tracking

Complete payment transparency

Automatic reconciliation for accounting

NFT receipt generation for tax advantages

Master and Sub-Wallet Management:

Enterprises get sophisticated wallet architecture. One master wallet. Unlimited sub-wallets. Perfect for:

Multi-location retailers

Franchise operations

Department-level budget tracking

Individual POS terminals

Traditional processors charge extra for multi-location support. LareBlocks includes it by design.

Settlement happens in real-time across all wallets. No batch processing delays. No float games where processors hold your money for days to earn interest.

Global Scale = Global Impact

1.8 billion people worldwide remain unbanked.

Traditional finance excludes them. Web3 includes them.

Any smartphone. Any internet connection. Instant financial access.

Remittances get revolutionized: Workers send money home at near-zero cost. No Western Union taking 7-12% cuts. No multi-day delays while families wait for funds.

Microtransactions become viable: Gaming economies. Creator platforms. API usage. Transactions too small for traditional rails suddenly work economically.

Cross-border commerce explodes: Merchants accept global payments without currency conversion fees or multi-day settlement times.

The 1.5% charity tax scales with transaction volume. As Web3 payments grow, global charitable impact grows proportionally.

$1 million in transactions = $15,000 to charity. $100 million in transactions = $1.5 million to charity. $10 billion in transactions = $150 million to charity.

Built-in. Automatic. Unstoppable.

Merchant Tools That Actually Work

Larecoin's ecosystem includes everything merchants need:

Gift Card Onboarding: Easy customer entry. Buy Larecoin gift cards at retail. Redeem online. No crypto knowledge required.

ACH Integration: Direct bank connections for seamless fiat-to-crypto conversion. Customers pay in dollars. Merchants receive Larecoin.

Push-to-Card Services: Instant withdrawal to debit cards. Merchant wants cash? Done in seconds.

AI-Powered Shopping: Smart product discovery across the B2B2C metaverse. Customers find what they need. Merchants get qualified traffic.

NFT Receipts: Every transaction generates a blockchain-based receipt. Permanent proof of purchase. Tax-deductible donation record. Anti-fraud protection.

Traditional processors offer none of this. You pay more for less functionality.

NOWPayments vs CoinPayments vs Larecoin

The crypto payment space has existing players. Here's how they stack up:

NOWPayments:

0.5% fee + network fees

200+ cryptocurrencies supported

No charitable component

External infrastructure dependency

CoinPayments:

0.5% processing fee

Multi-currency support

Traditional custodial model

No social impact mechanism

Larecoin:

1.5% total (includes charity donation)

Native Layer 1 blockchain (LareBlocks)

Built-in social impact

NFT receipts for tax advantages

Master/sub-wallet enterprise tools

Integrated metaverse commerce

You pay slightly more. You get exponentially more value. And you fund global charities automatically.

That's the difference between a payment processor and a movement.

Why This Conversation Is Exploding Now

February 2026 marks a critical convergence:

Regulatory clarity improved. Digital commodity frameworks like the CLARITY Act (H.R. 3633) provide legal certainty for blockchain payments.

Infrastructure matured. Layer 1 blockchains now handle enterprise-scale transaction volumes with sub-second finality.

Consumer adoption accelerated. Crypto wallet penetration crossed mainstream thresholds. Over 420 million global users.

Enterprise validation arrived. Fortune 500 companies implementing blockchain payment rails. Not pilot programs: production systems.

Cost pressure intensified. Inflation squeezed margins. Merchants actively seeking fee reduction alternatives.

Early adopters capture the advantage. Competitors still paying legacy fees lose ground daily.

The payment revolution isn't coming. It's here.

The Path Forward

Web3 global payments solve real problems:

Merchants save 99.3% on processing costs

Settlement happens instantly instead of days

1.8 billion unbanked people gain financial access

$40 trillion in annual transaction flows get optimized

Global charities receive automatic, transparent funding

Larecoin's 1.5% model proves profit and purpose aren't mutually exclusive.

Traditional processors extract value. Larecoin creates value.

Ready to transform your payment infrastructure?

Explore the Larecoin ecosystem at larecoin.com.

Download the whitepaper. Test the merchant portal. Join the global community building the future of payments.

Or keep paying 3.5% to legacy processors while your competitors move ahead.

The choice has never been clearer.

Comments