Why Larecoin's 1.5% Tax Is Changing How Crypto Companies Give Back (And Slash Fees by 50%+)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Most crypto payment processors talk big about innovation. Then charge you 2.9% plus fees. With zero transparency on where that money goes.

Larecoin flipped the script.

A 1.5% flat transaction tax built directly into the LareBlocks Layer 1 blockchain. Automatic routing to verified global hunger-relief organizations. And merchants save 50%+ on processing fees compared to traditional systems.

No additional work. No hidden charges. Just transparent, automated social impact baked into every transaction.

Here's how it actually works.

The 1.5% Tax Mechanism: Built Into The Protocol

Traditional payment processors layer fees on top of interchange rates. Merchants pay. Customers pay. Nobody knows where the money flows after the transaction clears.

Larecoin's approach? Different beast entirely.

The Social Impact Engine operates at the protocol level. Every transaction processed through Larecoin's payment portal, POS terminal, or merchant integration automatically triggers the 1.5% allocation. Zero manual steps. Zero overhead. Zero guesswork.

How it flows:

Customer pays via Larecoin (LARE token or LUSD stablecoin)

Smart contract automatically allocates 1.5% to Social Impact Engine

Funds distribute to pre-approved hunger-relief partners based on verified need

NFT receipt generates with complete audit trail

Transaction settles on LareBlocks with full transparency

The key difference? The 1.5% doesn't come from merchants. It's protocol-level allocation, meaning customers collectively fund global hunger relief without absorbing additional costs beyond the transaction itself.

Fee Comparison: Real Savings Breakdown

Let's talk numbers.

Traditional processors (Stripe, Square, PayPal):

2.9% + $0.30 per transaction

Additional interchange fees (1.5-3.5%)

Assessment fees

Monthly service charges

Hidden compliance costs

Total effective rate: 3.5-4.5% per transaction

NOWPayments:

0.5-1% processing fee

Network fees (variable, 0.5-2%)

No charitable component

Limited transparency

CoinPayments:

0.5% transaction fee

Additional withdrawal fees (0.5%)

Currency conversion costs

No social impact features

Larecoin:

1.5% flat fee (includes social impact allocation)

Gas costs: $0.10-$0.50 per transaction

LUSD stablecoin option: Gas-only transfers at $0.00025

Full transparency via NFT receipts

Real-world merchant example:

Processing $100,000 monthly:

Traditional processor: $3,500-$4,500 in fees

NOWPayments: $1,500-$3,000 (plus network fees)

CoinPayments: $1,000-$1,500 (plus withdrawal/conversion)

Larecoin: $1,500 flat + minimal gas

Monthly savings: $2,000-$3,000

Annual savings: $24,000-$36,000

Plus? That 1.5% automatically contributes to fighting global hunger. Traditional processors pocket the difference.

Transparency Through LareScan and NFT Receipts

Here's where Larecoin separates from the pack.

Every transaction on LareBlocks generates an NFT receipt. Not a PDF. Not an email confirmation. A blockchain-native, immutable record containing:

Complete transaction details

Timestamp and block confirmation

Social Impact Engine allocation breakdown

Exact routing to hunger-relief partner

Tax-compliant documentation

Why NFT receipts matter:

Traditional processors offer basic transaction logs. Maybe a CSV export if you're lucky. Zero visibility into how they use processing fees. Zero accountability for charitable claims.

Larecoin's NFT receipts provide cryptographic proof of both the transaction and the charitable impact. Scan any transaction through LareScan: Larecoin's custom blockchain explorer: and see exactly where the 1.5% flows.

This matters for:

Tax compliance: Complete audit trail for accounting

Corporate social responsibility: Verifiable impact reporting

Customer trust: Transparent proof of charitable contribution

Regulatory compliance: Immutable transaction records

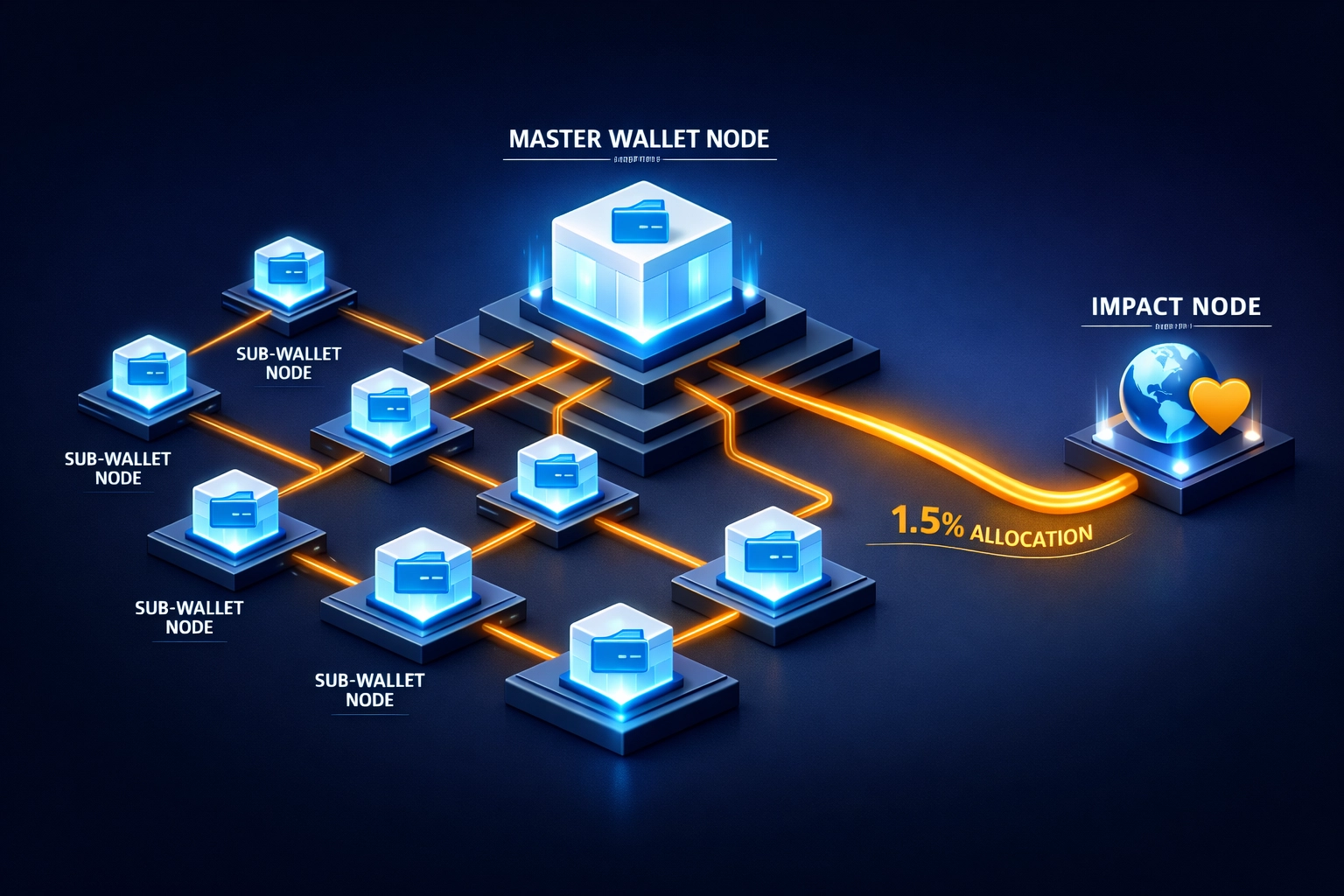

Master/Sub-Wallet Architecture for Enterprise Scale

Enterprise merchants need sophisticated wallet management. Larecoin delivers.

Master/Sub-wallet system:

Single master wallet for treasury management

Unlimited sub-wallets for departments, locations, or projects

Granular permission controls

Automated fund allocation between wallets

Consolidated reporting across all sub-wallets

The 1.5% Social Impact allocation applies across the entire wallet structure. Finance teams get unified reporting. Individual departments maintain operational independence. And the charitable component remains consistent across all transactions.

Traditional crypto processors? Most offer single-wallet solutions with minimal enterprise features. Larecoin built wallet architecture specifically for companies processing high volumes across multiple channels.

LUSD Stablecoin: Eliminating Volatility Risk

Merchants love crypto savings. Merchants hate crypto volatility.

LUSD stablecoin solves this tension.

Pegged 1:1 to USD. Gas-only transfer costs ($0.00025 per transaction). Price stability without sacrificing blockchain benefits.

For merchants processing payroll, inventory, or operating expenses, LUSD provides:

Predictable accounting (no exchange rate fluctuations)

Instant settlement (no 2-3 day ACH delays)

Minimal transaction costs (gas fees only)

Full compatibility with Larecoin ecosystem

The Social Impact Engine works identically with LUSD. Same 1.5% allocation. Same transparency. Same savings. But with stablecoin predictability.

Gift Card Onboarding: Crypto Entry Without Complexity

Biggest barrier to crypto adoption? Onboarding friction.

Larecoin's Gift Card system removes it entirely.

Customers purchase Larecoin-loaded gift cards with fiat currency. Use them immediately for purchases. No wallet setup. No private keys. No blockchain knowledge required.

For merchants, this means:

Broader customer base (crypto-curious without crypto wallets)

Reduced cart abandonment (familiar gift card interface)

Instant liquidity (cards redeemable for goods/services)

Same 1.5% social impact allocation

Gift cards bridge traditional commerce and Web3 payments. Customers get crypto benefits without crypto complexity. Merchants expand their addressable market without additional integration work.

Push-to-Card: Instant Fiat Settlement

Some merchants want to hold crypto. Others need immediate fiat liquidity.

Push-to-Card service delivers instant conversion and settlement to traditional debit cards.

Transaction flow:

Customer pays in LARE or LUSD

Merchant chooses automatic Push-to-Card

Funds convert to fiat and settle to linked debit card

Entire process completes in under 60 seconds

This eliminates:

Exchange transfer delays

Multiple conversion steps

Additional withdrawal fees

Liquidity management complexity

The 1.5% Social Impact allocation happens before Push-to-Card conversion. Merchants get immediate fiat access. Hunger-relief organizations still receive their allocation. Everyone wins.

The Competitor Landscape

NOWPayments offers low fees but zero social impact component. Their 0.5-1% fee goes directly to the company. No transparency. No charitable allocation. Pure margin.

CoinPayments provides broader cryptocurrency support but charges withdrawal fees, conversion fees, and offers no built-in giving mechanism. Merchants pay multiple times throughout the settlement process.

Neither competitor provides:

Protocol-level charitable allocation

NFT receipt generation

Blockchain-native transparency via dedicated explorer

Enterprise wallet architecture

Integrated gift card onboarding

Push-to-Card instant settlement

Larecoin isn't just competing on fees. It's redefining what crypto payment infrastructure should deliver.

Real Impact, Real Savings

The math works out simply:

$100,000 monthly processing volume:

Traditional fees: $3,500-$4,500

Larecoin fee: $1,500

Savings: $2,000-$3,000/month

Annual savings: $24,000-$36,000

Hunger relief contribution: $1,500/month ($18,000/year)

Merchants slash processing costs by 50%+. Global hunger-relief organizations receive consistent, transparent funding. Customers support social impact with every purchase.

Zero additional effort. Zero complexity. Just better infrastructure.

Built for February 2026 and Beyond

Traditional payment rails struggle with modern commerce demands. High fees. Slow settlement. Zero transparency. Limited innovation.

Larecoin's LareBlocks Layer 1 infrastructure delivers:

Sub-second transaction finality

$0.10-$0.50 gas costs (LUSD even lower)

Native social impact allocation

Enterprise-grade wallet management

NFT receipt documentation

Fiat on/off ramps via Gift Cards and Push-to-Card

The 1.5% tax isn't a donation request. It's not optional corporate charity. It's protocol-level infrastructure that makes social impact automatic, transparent, and verifiable.

Merchants save money. Customers support global causes. Organizations receive dependable funding.

Ready to slash fees while changing lives?

Explore Larecoin's payment solutions

The 1.5% that changes everything.

Comments