Why Web3 Global Payments Will Change the Way You Run Your Small Business in 2026

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 3 hours ago

- 4 min read

Running a small business in 2026 means watching every dollar. Every fee. Every delay.

Traditional payment processors are bleeding you dry. Credit card companies take 2.5% to 3.5% per transaction. Banks hold your money hostage for 3-5 days. International transfers? Forget about it: multiple intermediaries each taking their cut.

Web3 payments flip this entire model on its head.

The Fee Revolution Is Here

Let's talk numbers.

Your business processes $500,000 annually. Traditional processors charge you $13,300 to $22,100 in combined fees, minimums, and compliance costs. That's money vanishing into thin air.

Larecoin cuts this to $2,500-$5,000 annually.

That's $10,800 to $17,100 back in your pocket. Every single year.

Scale to $2 million in revenue? You're saving $43,000 to $68,000 annually. That's a full-time employee. New equipment. Marketing budget. Growth capital.

The math isn't subtle. It's transformative.

Settlement Speed That Actually Matters

Correspondent banking is a dinosaur. Your payment bounces through 3-5 intermediary banks. Each one adds delays. Each one charges fees.

Web3 platforms settle 80% of payments instantly. 88% within 24 hours.

Blockchain-based cross-border payments hit $4.4 trillion in 2024. That's 11% of total B2B cross-border volume. This isn't experimental tech: it's production-scale infrastructure.

60% of cross-border payment volume now moves through routes where blockchain settlement cuts costs by half and settles in minutes instead of days.

Your cash flow just became predictable.

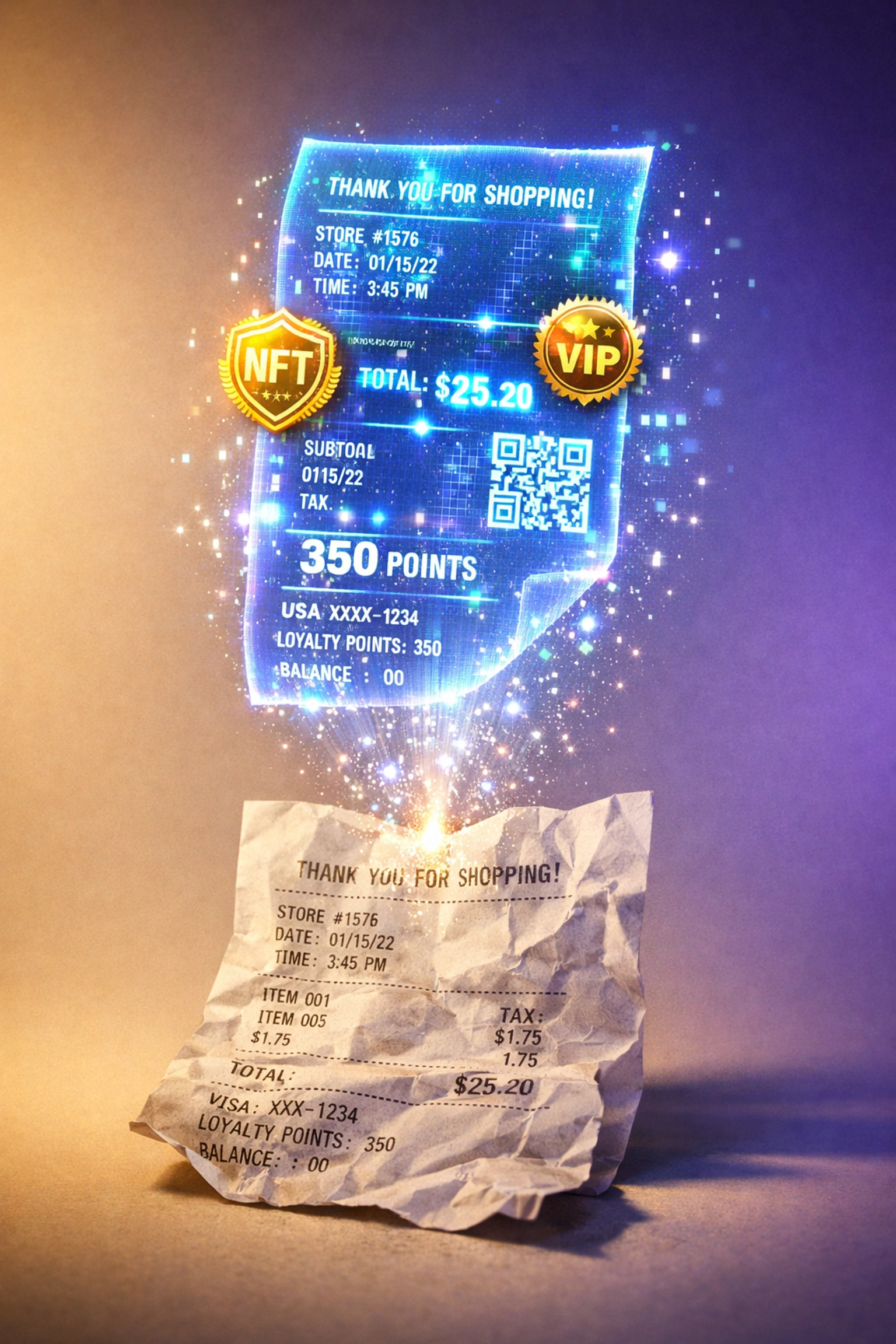

NFT Receipts Aren't Gimmicks: They're Business Tools

Traditional receipts are paper trash or email clutter.

NFT receipts are programmable proof of purchase stored on-chain. Permanent. Verifiable. Valuable.

Why this matters for your business:

Automatic loyalty rewards embedded in the receipt NFT

Fraud prevention through immutable transaction records

Customer insights through on-chain analytics

Resale tracking for warranty and authenticity verification

Marketing hooks through collectible receipt designs

Your customer buys a product. They get an NFT receipt. That receipt unlocks future discounts, tracks their purchase history, and creates a direct relationship between you and them: no intermediary platform taking 30%.

Larecoin builds NFT receipt functionality natively. No third-party integrations. No additional fees. Just seamless proof-of-purchase that adds value to every transaction.

LUSD Stablecoin: The Smart Treasury Move

Volatility kills adoption. Your customers don't want Bitcoin fluctuating 15% while they're checking out.

Enter LUSD: Larecoin's stablecoin pegged to the US dollar.

LUSD advantages:

Zero volatility risk for everyday transactions

Instant conversion to fiat when you need it

Decentralized backing without central authority risk

Lower conversion fees than traditional fiat rails

Cross-border uniformity without currency exchange spreads

A customer in Tokyo pays in LUSD. A customer in Berlin pays in LUSD. You receive the same value instantly, without currency conversion losses eating 2-4% on every international sale.

Traditional payment processors like NOWPayments force you to accept volatile crypto then charge premium fees to convert. CoinPayments locks you into their ecosystem with limited stablecoin options and clunky UX.

Larecoin prioritizes LUSD natively. Simple. Stable. Smart.

Self-Custody Is Non-Negotiable

Remember when Celsius froze withdrawals? Voyager collapsed? FTX imploded?

Custodial platforms control your money. Until they don't.

Self-custody means you hold the keys. Your business controls its treasury. No third party can freeze your account, delay your withdrawals, or gamble with your deposits.

Larecoin builds for self-custody from day one. Your wallet. Your keys. Your money.

Competitors like NOWPayments and CoinPayments operate as custodians. They hold your funds. They control withdrawal timing. They set the rules.

That's not financial sovereignty. That's just a different bank.

Setup Takes 10 Minutes, Not 10 Weeks

Traditional payment processors demand:

Credit checks

Business documentation

Multi-week approval processes

PCI compliance nightmares

Monthly terminal fees

Expensive hardware

Larecoin setup:

Create a self-custody wallet (5 minutes)

Configure your merchant portal (3 minutes)

Start accepting payments (2 minutes)

Same day. Zero credit checks. No compliance theater. No hardware costs.

You're live before lunch.

Cross-Border Without the Headaches

International payments are broken. SWIFT transfers take 3-5 days and cost $25-$50 per transaction. Currency conversion spreads eat another 2-4%. Intermediary banks take their cuts.

A customer in São Paulo wants to buy from your US-based store. Traditional processors charge them conversion fees, charge you processing fees, and delay settlement for a week.

Larecoin treats borders as irrelevant.

Tokyo, Berlin, São Paulo: same fee structure, same settlement speed, same simplicity. Over 70 countries now have live instant payment schemes integrating with blockchain rails.

Your customer base just went global without the traditional infrastructure nightmare.

Why Larecoin Beats the Competition

NOWPayments offers crypto payments but forces custodial control, limited stablecoin options, and clunky integration. Their fee structure is opaque. Their settlement windows are inconsistent.

CoinPayments provides multi-currency support but locks you into their ecosystem. Limited self-custody options. Poor UX. No native NFT receipt functionality.

Larecoin delivers:

True self-custody by default

Native LUSD stablecoin integration

Built-in NFT receipt functionality

Transparent fee structure (and 50%+ savings)

Instant settlement on 80% of transactions

10-minute setup process

Border-agnostic infrastructure

It's not even close.

The Competitive Advantage Compounds

Your competitor down the street is paying 3% per transaction. Settlement takes 3 days. International customers get frustrated with currency conversion headaches.

You're paying 0.5-1% per transaction. Settlement is instant. International customers get the same frictionless experience as local ones.

Over one year, these differences compound into meaningful competitive advantages:

Better cash flow means faster inventory restocking

Lower fees mean better margins or lower prices

Faster settlement means happier contractors and suppliers

Global accessibility means expanded market reach

Your business becomes more efficient while competitors struggle with outdated rails.

Getting Started Is the Easy Part

The small business landscape is shifting. Blockchain-based payments hit $4.4 trillion in 2024. That's not future speculation: it's current infrastructure.

Businesses adopting Web3 payment rails now capture advantages that compound quarterly. Lower fees improve margins. Faster settlement improves cash flow. Self-custody improves security. NFT receipts improve customer relationships.

Traditional processors offer none of this. They offer the same slow, expensive infrastructure that's existed for decades.

Larecoin offers what's next.

Visit https://larecoin.com and set up your merchant account. Ten minutes. Zero friction. Immediate results.

The payments revolution isn't coming in 2026. It's already here. The only question is whether your business joins it or watches competitors capture the advantage.

Your cash flow will thank you.

Comments