7 Reasons Your Crypto POS System Costs Too Much (And How Larecoin Fixes It)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

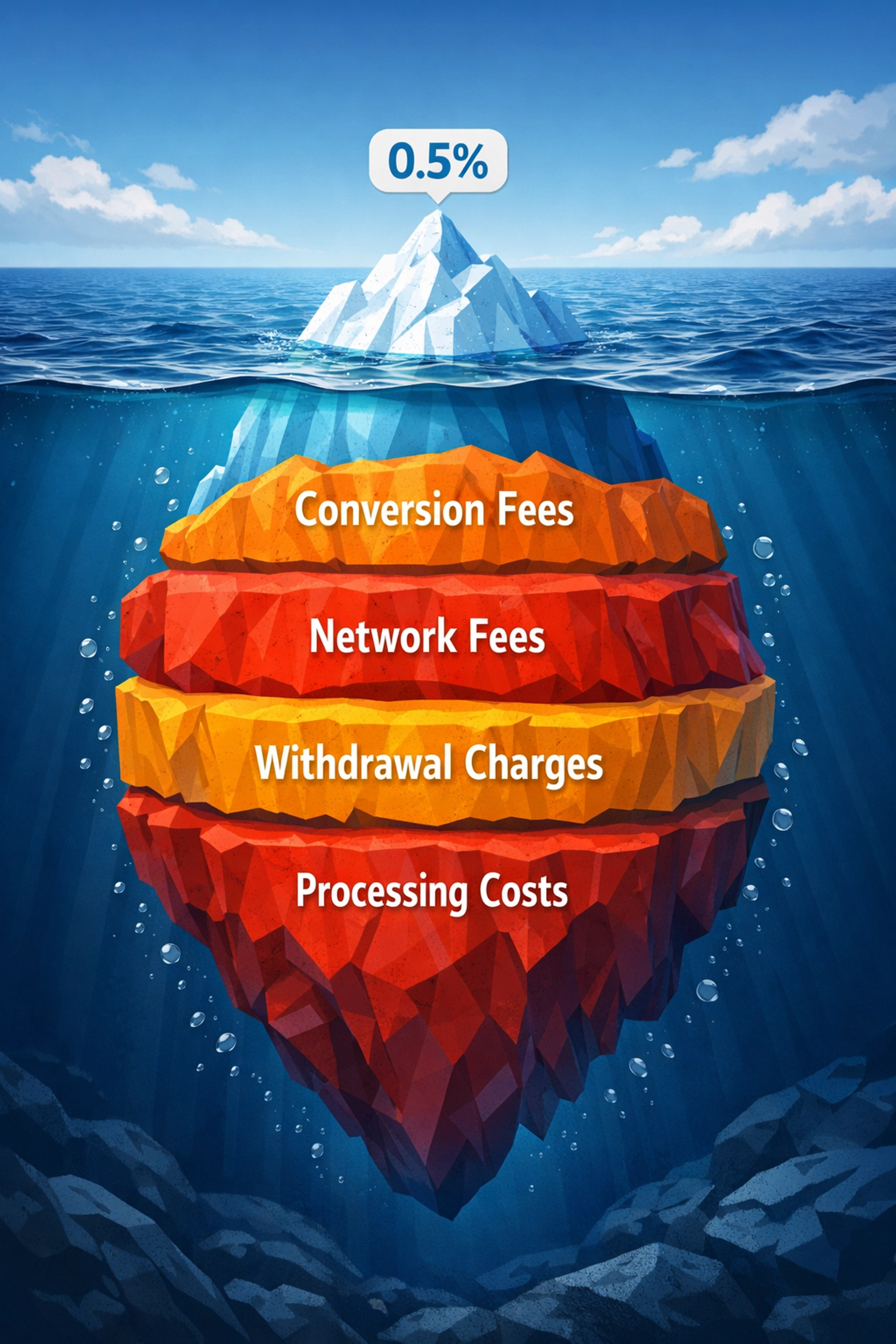

Running a crypto POS system shouldn't cost more than traditional payment processing. Yet most merchants get stuck with hidden fees, conversion charges, and percentage-based models that eat into margins.

Here's the truth: Your crypto payment processor is bleeding you dry.

Let's break down exactly why your costs are too high: and how Larecoin's gas-only model changes everything.

1. Percentage-Based Fees That Scale With Your Success

The Problem:

NOWPayments charges 0.5-1% per transaction. CoinPayments? Same story. Process $500k annually and you're paying $2,500-$5,000 just in transaction fees.

That's insane.

Why should your payment processor profit more when you succeed? Traditional processors charge 2.5-3.5%, but crypto was supposed to be different.

How Larecoin Fixes It:

Gas-only pricing. Period.

You pay network costs: nothing more. No percentage markup. No scaling fees. At $500k annual volume, you're looking at $500-$2,000 in total costs. That's 60% savings compared to other crypto processors.

The more you process, the more you save.

2. Hidden Conversion Fees Destroying Your Margins

The Problem:

Accept multiple cryptocurrencies? NOWPayments slaps an additional 0.5-1% conversion fee on multi-currency transactions.

That "low 0.5% rate" suddenly becomes 1-2% real cost. These hidden charges compound fast. A coffee shop processing $15k monthly loses an extra $75-$150 per month just on conversions.

Over a year? That's $900-$1,800 vanishing into conversion fees you didn't see coming.

How Larecoin Fixes It:

Transparent gas costs. No conversion markups. No surprise charges.

Our LUSD stablecoin version means you can accept payments without volatility concerns: and without hidden conversion fees eating your profits.

Self-custody ensures you control your assets. No intermediary taking a cut.

3. Withdrawal Fees That Punish You For Accessing Your Money

The Problem:

CoinPayments charges 0.0005-0.001 BTC per withdrawal. Sounds small until you're making regular withdrawals to manage cash flow.

Most crypto POS providers also enforce withdrawal minimums. Your money sits locked until you hit their arbitrary threshold. That's your capital: held hostage.

How Larecoin Fixes It:

Zero withdrawal fees.

Your funds. Your schedule. No minimums. No penalties for accessing what's already yours.

Move money when it makes sense for your business: not when a payment processor allows it.

4. Network Fees Presented As "Variable Costs"

The Problem:

Every crypto processor claims network fees are "outside their control." True: but then they add their own markup on top.

You pay the network fee. Plus their processing fee. Plus conversion fees. Plus withdrawal charges.

Four separate costs when you should only pay one.

How Larecoin Fixes It:

We charge exactly what the network charges. No markup. No "processing fee" addition. No hidden spread.

Pure network costs. That's it.

At scale, this becomes dramatic. A merchant processing $1.2M annually pays $9,000-$12,000 with traditional processors. With Larecoin? Around $2,000.

That's 78-83% savings.

5. Compliance Costs Hidden In "Service Fees"

The Problem:

US compliance isn't cheap. MSB registration, state-by-state MTL licensing, regulatory reporting: it costs millions.

Most crypto payment processors bury these costs in their percentage fees. You subsidize their compliance infrastructure with every transaction.

How Larecoin Fixes It:

We handle the heavy lifting: MSB compliance and strategic state MTL registration.

But we don't pass inflated costs to merchants through percentage fees. Our gas-only model means compliance costs don't scale with your transaction volume.

Process $10k or $10M: compliance infrastructure costs us the same. We don't make you pay more for it.

Regulatory rigor without the price tag.

6. No Value-Added Features Beyond Basic Processing

The Problem:

You pay premium rates for... basic crypto acceptance?

NOWPayments and CoinPayments process transactions. That's it. No loyalty programs. No customer engagement tools. No NFT receipts or innovative features.

You're paying 0.5-2% for commodity services.

How Larecoin Fixes It:

NFT receipts for every transaction. Not a gimmick: a loyalty and engagement tool.

Customers collect branded NFTs. You build a Web3 community. Receipts become collectibles, marketing assets, and proof of purchase rolled into one.

Our ecosystem includes rewards programs, metaverse integration, and social features that turn payments into customer relationships.

Check out our merchants portal to see the full feature set.

7. Lack of True Self-Custody Control

The Problem:

Most crypto POS systems are custody solutions in disguise. They "hold" your crypto. Convert it. Transfer it on their schedule.

You don't really control your funds until they're in your external wallet: minus all those withdrawal fees.

That's not crypto. That's a bank with extra steps.

How Larecoin Fixes It:

True self-custody architecture.

Your keys. Your crypto. Your control. Funds settle to wallets you manage: not intermediary accounts controlled by third parties.

We're building Web3 payments the way they should be: decentralized, transparent, and user-controlled.

Our DAO structure means the community drives development. Not venture capitalists. Not payment processing middlemen.

The Real Cost Comparison

Let's run actual numbers.

Coffee Shop: $15k Monthly Volume ($180k Annual)

Traditional processors (3%): $5,400/year

NOWPayments/CoinPayments (1%): $1,800/year

Larecoin (gas only): ~$500/year

Annual savings vs. other crypto processors: $1,300

Mid-Size Retailer: $500k Annual Volume

Traditional processors (2.5%): $12,500/year

NOWPayments/CoinPayments (0.75%): $3,750/year

Larecoin (gas only): ~$1,500/year

Annual savings vs. other crypto processors: $2,250

Large Merchant: $1.2M Annual Volume

Traditional processors (2.5%): $30,000/year

NOWPayments/CoinPayments (0.6%): $7,200/year

Larecoin (gas only): ~$2,500/year

Annual savings vs. other crypto processors: $4,700

The savings compound as you scale. That's how pricing should work.

Why Gas-Only Pricing Changes Everything

Percentage-based fees made sense in the credit card era. Processing infrastructure scaled with volume. Higher transaction amounts meant more risk, more processing power, more overhead.

Blockchain doesn't work that way.

Network costs are relatively flat. Processing a $10 transaction costs nearly the same as processing $10,000. The only real variable is network congestion: which affects gas fees, not percentage markups.

Larecoin's model reflects actual costs. You pay for network usage. Nothing else.

No artificial scaling. No hidden fees. No penalties for success.

The LUSD Advantage

Our LUSD stablecoin version solves crypto's biggest merchant objection: volatility.

Accept payments in LUSD. Settle in LUSD. Hold in LUSD. No conversion necessary unless you want it.

This eliminates conversion fees entirely for merchants preferring stability. You get crypto payment benefits: speed, low costs, global reach: without price fluctuation concerns.

And because it's built on our ecosystem, you still pay only gas fees.

Ready to Cut Your Payment Processing Costs?

Every percentage point matters. Every hidden fee compounds. Every withdrawal charge adds up.

Larecoin eliminates the nonsense. Gas-only pricing. True self-custody. US-compliant infrastructure. NFT receipts and ecosystem features that actually add value.

Join merchants already saving thousands annually. Explore our crypto payment solutions and see the difference transparent pricing makes.

The Web3 payment revolution isn't coming. It's here. And it costs a fraction of what you're paying now.

Time to stop subsidizing payment processors' profit margins and start keeping your revenue where it belongs( in your business.)

Comments