Are Traditional Payment Processors Dead? The Web3 Global Payments Revolution Every Merchant Should Know About

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Dead? Not Yet. Dying? Absolutely.

Traditional payment processors aren't collapsing overnight.

But they're bleeding merchants at an accelerating rate.

The reason is simple: Web3 global payments deliver 50-70% cost savings and instant settlements that legacy systems physically cannot match.

Every month you wait costs your business thousands in unnecessary fees.

The Economics Are Brutal

Let's talk numbers.

Traditional credit card processing charges 2.5-3.5% per transaction. Add interchange fees. Add per-item charges. Add monthly minimums.

Web3 payments? Sub-1% costs. Typically around 0.5%.

!

Real World Impact

A business processing $500,000 annually pays:

Traditional fees: $12,500-$17,500

Web3 fees: $2,500-$3,500

That's $10,000-$14,000 going straight to your bottom line instead of Visa and Mastercard.

Multiply that across millions of merchants globally.

The shift isn't coming. It's already here.

Settlement Speed Changes Everything

Traditional cross-border payments take 2-7 days.

Web3 transactions settle in minutes.

No chargebacks. Permanent finality. Funds available immediately.

Companies using blockchain settlement report 40-60% cost reductions compared to correspondent banking systems.

For merchants running tight cash flow operations, this is transformative.

Why wait a week for international payments when you can have funds in 10 minutes?

The Market Is Already Moving

Monthly blockchain payment flows exceeded $10 billion in 2025.

Business transactions represent 63% of total volume.

This isn't speculation. This is legitimate commerce.

!

The blockchain payments market hit $3.2 billion in 2023 and is projected to reach $81.5 billion by 2030.

That's 25x growth in seven years.

The Big Players Are Panicking

Stripe acquired Bridge for $1.1 billion (closed February 2025).

PayPal launched crypto rails.

Visa experiments with stablecoin settlements.

When the legacy giants scramble to integrate Web3 capabilities, you know the writing's on the wall.

Leading AI firms now direct 20% of their payments through stablecoins to capture lower fees and immediate settlement.

They're not doing it for fun. They're doing it because the economics are undeniable.

Traditional Processors Are Adapting (Too Late)

Legacy payment processors face an existential question:

Adapt or die.

The competitive advantage of Web3 payments is too significant to ignore.

Merchants aren't stupid. They can calculate savings.

Why pay 3% when you could pay 0.5%?

!

The financial establishment recognizes adaptation is necessary. But integration takes years. Infrastructure overhauls cost billions.

Meanwhile, native Web3 payment solutions are already live, battle-tested, and scaling rapidly.

Why Web3 Payments Are Winning

1. Self-Custody Merchant Accounts

Your money. Your control. Your keys.

No bank freezes. No account suspensions. No arbitrary holds.

Merchants operating in high-risk industries or emerging markets gain financial sovereignty impossible with traditional processors.

2. Global Reach Without Barriers

Accept payments from 195 countries. No currency conversion fees. No geographic restrictions.

Traditional processors require separate merchant accounts for each region.

Web3 payments are borderless by design.

3. Transparent Fee Structure

Traditional processors hide fees in interchange rates, assessment fees, and monthly minimums.

Web3 payments show exact costs upfront. No hidden charges. No surprise deductions.

4. Programmable Money

Smart contracts enable automated revenue splits, instant contractor payments, and royalty distributions.

Try doing that with ACH transfers or wire payments.

Larecoin: The Web3 Payments Alternative Merchants Choose

Looking for a NOWPayments alternative or CoinPayments alternative?

Larecoin delivers what merchants actually need:

LUSD Stablecoin Integration Price stability without volatility risk. Accept crypto without market exposure.

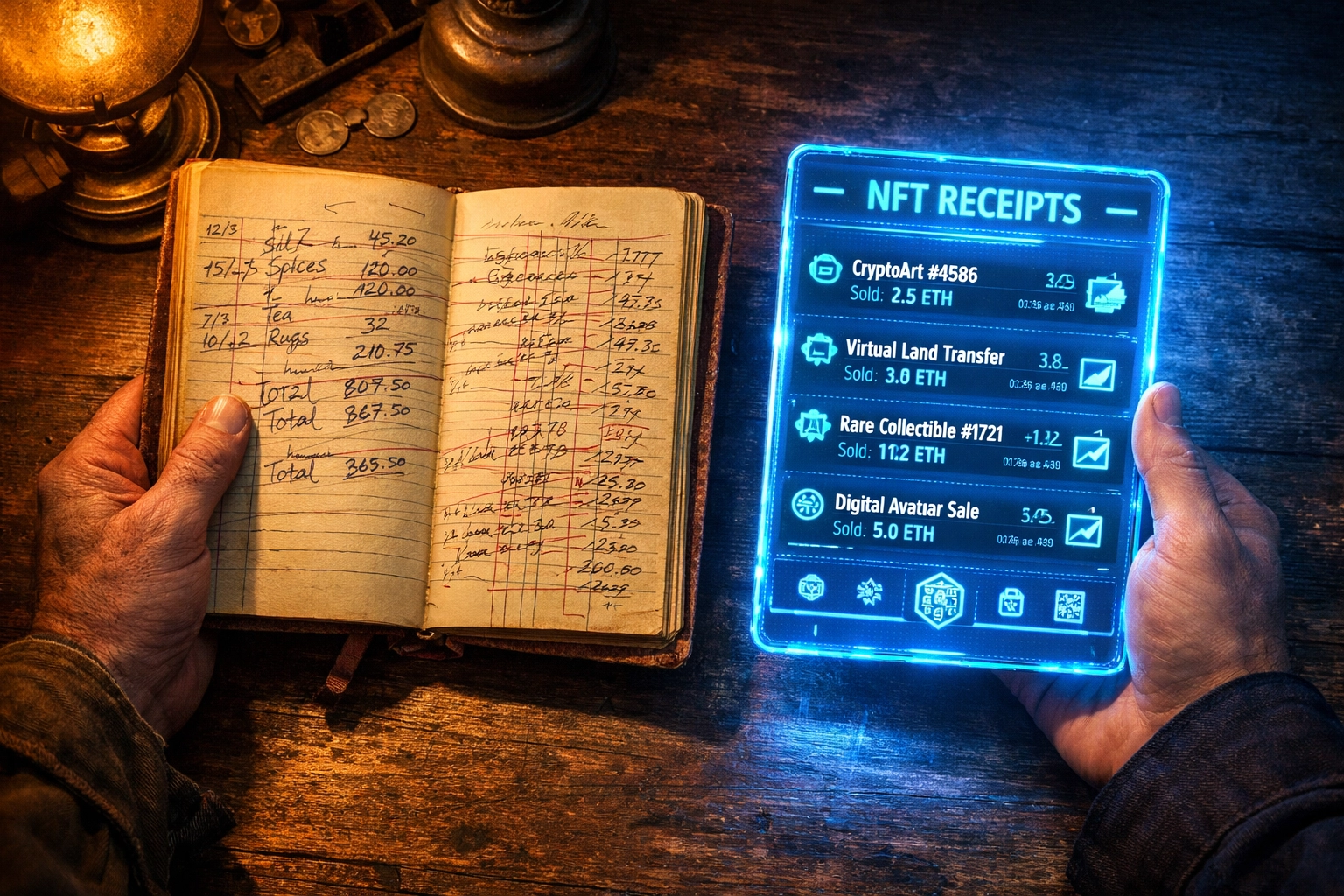

NFT Receipts for Accounting Every transaction generates an immutable, auditable NFT receipt. Accounting teams love it. Tax season becomes manageable.

Crypto POS System for Small Business Seamless point-of-sale integration. Accept crypto in-store, online, or in the metaverse.

Receivables Token Tokenize outstanding invoices. Unlock working capital instantly. No factoring fees.

!

Gas-Only Transfers Eliminate percentage-based fees entirely. Pay only network gas costs for transactions.

Push to Card Convert crypto to fiat instantly and push to debit cards. Bridge digital and traditional finance seamlessly.

The Merchant Reality in 2026

Traditional payment processors aren't dead.

But their dominance is collapsing.

Merchants are calculating savings. Comparing settlement speeds. Evaluating alternatives.

The question isn't whether Web3 will replace legacy systems.

It's how fast merchants will jump ship.

Early adopters gain competitive advantages. Lower costs mean better pricing. Faster settlements mean improved cash flow.

Late adopters pay premium fees while competitors operate leaner.

What This Means for Your Business

Calculate your annual payment processing costs.

Multiply by 0.5%.

That's your Web3 payment cost.

The difference? Pure profit.

!

Merchants processing $1 million annually save $20,000-$30,000 by switching to Web3 payments.

That's hiring another employee. Expanding inventory. Investing in marketing.

Or just keeping more of the money you earned.

The Revolution Is Here

Traditional payment processors built monopolies on inefficiency.

High fees. Slow settlements. Geographic restrictions. Account freezes.

Web3 payments eliminate these friction points.

Lower costs. Instant settlements. Global reach. Self-custody.

The technology exists. The infrastructure is live. The economics are proven.

Merchants who adapt early gain unfair advantages.

Merchants who wait pay the premium.

Take Action Now

Explore Larecoin's Web3 payment solutions at larecoin.com.

Compare your current processing costs against Web3 alternatives.

Calculate your annual savings.

Join the payment revolution or keep funding legacy monopolies.

The choice is yours.

The economics are clear.

Traditional payment processors aren't dead yet.

But they're running out of reasons for merchants to stay.

Comments