Are Traditional POS Systems Dead? Why Small Businesses Are Switching to Web3 Global Payments

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Traditional POS systems aren't dead. But they're bleeding customers fast.

Small businesses are discovering Web3 global payments aren't just cheaper, they're fundamentally different. Lower fees. Instant settlement. No middlemen taking cuts. And the numbers prove it's not a fad.

The Fee Problem Nobody Talks About

Run the math on your current POS system.

Credit card processing charges 2.5-3.5% per transaction. Add monthly terminal fees. PCI compliance costs. Forced hardware upgrades every 24 months.

A business processing $500,000 monthly pays approximately $14,500 in fees. Every month.

Web3 payments operate at sub-1% costs. Often 0.5%. Gas fees for the same transaction volume? Roughly $100.

That's a 50-70% fee reduction hitting your bottom line immediately.

Merchant interchange fees are the silent profit killer. Traditional systems extract value at every step. Web3 infrastructure cuts that extraction to near-zero.

Why Smart Merchants Are Switching Now

Speed kills competition.

Traditional cross-border payments take 2-7 days to settle. Your money sits in limbo. You can't access it. Can't deploy it. Can't grow with it.

Web3 transactions confirm in minutes. Fund access is instant. For businesses working with international suppliers or remote contractors, this operational freedom translates to actual competitive advantage.

No more payment processor gatekeeping.

Traditional systems control your money flow. They can freeze accounts. Reverse transactions. Charge arbitrary fees. You're renting access to your own revenue.

Self-custody merchant accounts flip that model. You control your funds. You set the rules. You decide how and when money moves.

The Technical Edge: NFT Receipts and Smart Accounting

Here's where Web3 payments get interesting.

NFT receipts for accounting aren't a gimmick. They're programmable proof-of-payment stored immutably on-chain. Every transaction generates a unique token containing:

Transaction amount and timestamp

Product/service details

Tax information

Customer wallet address

Merchant verification

Your accounting software pulls directly from blockchain records. No manual entry. No reconciliation errors. No lost receipts.

The receivables token system takes this further. Convert outstanding invoices into tradable tokens. Businesses can sell these tokens at a discount for immediate liquidity instead of waiting 30-90 days for payment.

Traditional POS systems can't do this. They're databases with payment rails. Web3 systems are programmable financial infrastructure.

LUSD: The Stablecoin Advantage

Crypto volatility scares merchants. Fair concern.

LUSD stablecoin benefits solve this. Pegged to USD. Overcollateralized. No central issuer controlling supply.

Accept payment in any crypto. Instantly convert to LUSD. Price stability without volatility exposure. No bank account required.

Compare this to holding fiat in a traditional merchant account. Banks pay 0% interest. They loan your deposits to others. You get nothing.

LUSD in DeFi protocols earns yield. Your working capital actually works for you.

Real-World Implementation: It's Already Happening

Urbanspace Markets in New York ran a pilot. Thousands of non-crypto-native users transacting on-chain through tap-to-pay interfaces. They didn't see blockchain complexity. Just fast, cheap payments.

Monthly payment flows through blockchain systems exceeded $10 billion in 2025. 63% came from business transactions, not retail speculation.

The infrastructure is here. The adoption is accelerating. The question isn't "if" anymore: it's "when."

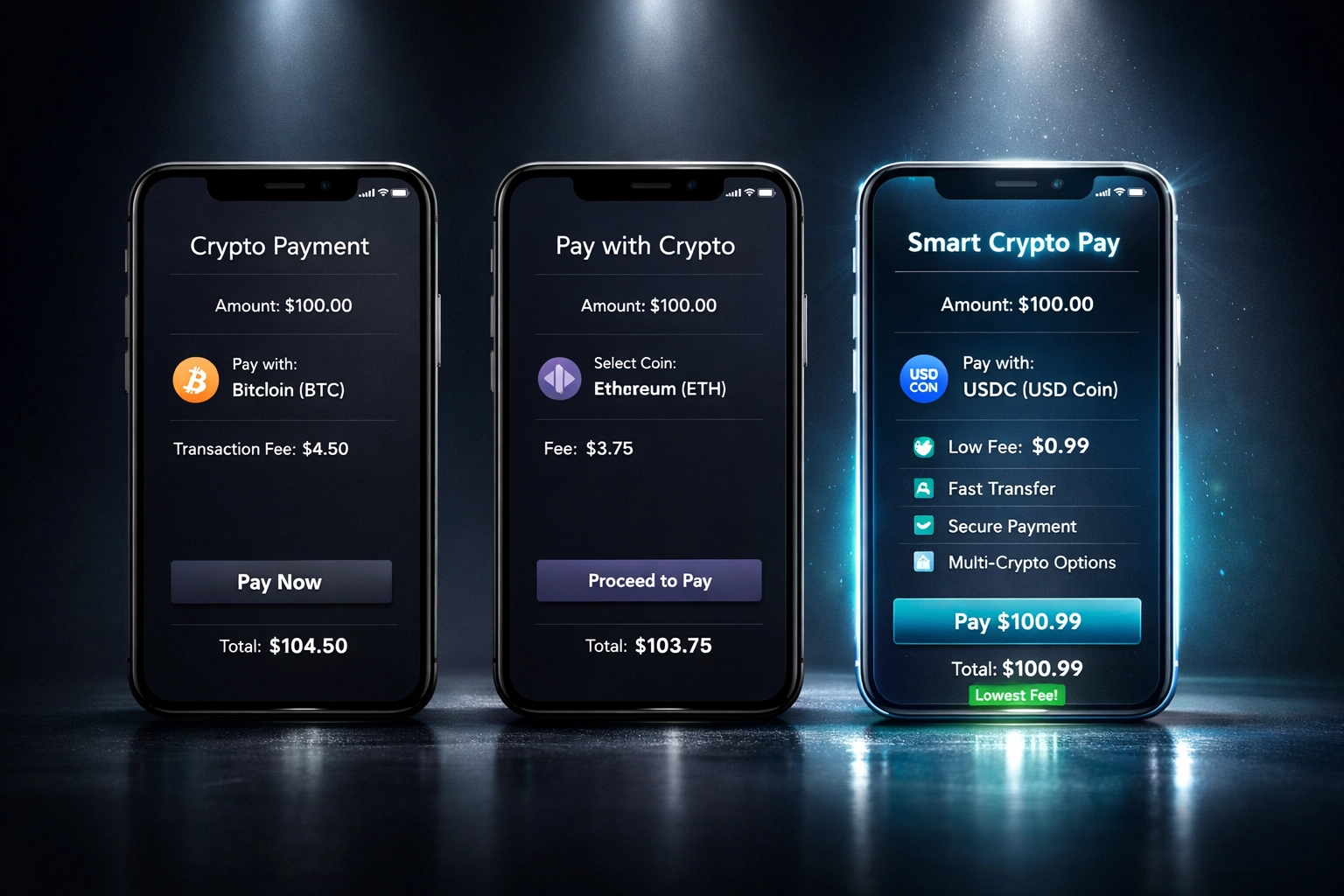

Competitor Comparison: NOWPayments vs CoinPayments vs Larecoin

Let's get specific about alternatives.

NOWPayments offers basic crypto acceptance. But fees remain at 0.5% + blockchain network fees. They custody funds temporarily. Not true self-custody. Limited stablecoin options.

CoinPayments charges 0.5% per transaction with withdrawal fees on top. Account freezes happen. Customer support is notorious. No NFT receipt generation. No receivables tokenization.

Triple-A focuses on enterprise. Pricing isn't transparent. Integration complexity scares small businesses. Overkill for most merchants.

Larecoin approaches this differently.

Gas-only transfer model means you pay network fees only. No percentage cuts. No hidden charges. True self-custody from transaction one.

The crypto POS system for small business includes:

Native NFT receipt generation

LUSD stablecoin integration

Receivables token creation

Multi-chain support

Direct wallet connections

The Self-Custody Revolution

Traditional merchant accounts are loans to your payment processor.

They hold your money. Apply their rules. Charge for the privilege. You're a tenant in your own revenue stream.

Self-custody merchant accounts change everything.

Your private keys. Your funds. Your control. Payment processors become optional services, not mandatory gatekeepers.

For bank-free business operations, this matters deeply. Merchants in underbanked regions. Businesses blacklisted by traditional finance. Anyone tired of arbitrary account freezes.

Web3 global payments don't ask permission. They just work.

What This Means For Your Business

Calculate your current payment processing costs. Include:

Percentage fees per transaction

Monthly terminal rentals

PCI compliance costs

Chargeback fees

Currency conversion fees

International transfer fees

Now reduce that by 50-70%. That's your Web3 advantage.

Add instant settlement. Add NFT accounting automation. Add receivables tokenization. Add self-custody control.

Traditional POS systems can't compete on pure economics. They're legacy infrastructure with legacy costs.

Making The Switch: What You Need

Setup takes minutes, not months.

Create a self-custody wallet

Connect to payment infrastructure

Generate payment QR codes or NFC tags

Start accepting crypto immediately

No merchant application. No credit check. No waiting for approval.

Your customers pay from any wallet. You receive in your preferred stablecoin. NFT receipts generate automatically. Everything records on-chain.

The Hybrid Reality

Traditional systems aren't disappearing tomorrow.

Visa, Mastercard, Stripe, and PayPal are integrating Web3 capabilities. They see the writing on the wall. The defensive measures confirm what merchants already know: cheaper alternatives exist.

The actual market outcome is hybrid. Smart merchants run both systems. Use traditional rails when required. Use Web3 rails when advantageous.

But make no mistake: the price pressure is one-directional. Traditional fees will drop because they have to. Web3 created genuine competition where none existed before.

Bottom Line

Traditional POS systems aren't dead. They're just expensive, slow, and controlled by middlemen.

Web3 global payments offer 50-70% fee reduction, instant settlement, true self-custody, and programmable receipts. Small businesses switching now gain immediate cost advantages and future-proof infrastructure.

The question isn't whether to switch. It's how fast you can implement before your competition does.

Ready to slash your merchant fees and take control of your payment infrastructure? Explore Larecoin's Web3 payment solutions and join the businesses already saving thousands monthly.

The future of payments isn't coming. It's here. And it's significantly cheaper than what you're paying now.

Comments