How to Reduce Merchant Interchange Fees by 50%+ Using Web3 Global Payments (Without Losing Control)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Your payment processor is bleeding you dry.

Every swipe. Every tap. Every online checkout. 2-6% gone. Just like that.

For a business doing $500K annually, that's $15,000-$18,000 evaporating into the traditional payment system's black hole. Hit $2M? You're now paying $60,000 in pure overhead.

The question isn't whether you can afford to switch to Web3 payments. It's whether you can afford not to.

The Real Cost of Traditional Payment Processing

Here's what you're actually paying every time someone buys from you:

Domestic transactions: 2-4% per transaction

Interchange fees: 1.5-2.5%

Network fees (Visa/Mastercard): 0.1-0.3%

Processor markup: 0.2-0.5%

Cross-border transactions: 4-6% per transaction

All the above PLUS

FX conversion fees: 1-3%

Cross-border surcharges: 0.5-1%

That $10,000 international payment? $330 just vanished.

And it gets worse. Add chargebacks (0.5-1% annual loss), payment reversals, and 2-3 day settlement delays that strangle your cash flow.

How Web3 Global Payments Slash Fees to Nearly Zero

Web3 eliminates every middleman.

No banks. No card networks. No processors taking their cut.

Direct peer-to-peer settlement. Customer wallet to your wallet. Done in 3-8 seconds.

Your new fee structure:

Solana transactions: $0.00025 per transaction

Ethereum (Layer 2): $0.10-$2.00

LUSD stablecoin settlement: Zero FX markup

That same $10,000 cross-border transaction? Now costs $66.

80% reduction. Instantly.

Real Merchant Savings With Larecoin

Let's run actual numbers:

Annual Revenue | Traditional Fees | Larecoin Web3 Fees | Annual Savings |

$500K | $15,000 | $2,500 | $12,500 (83% reduction) |

$2M | $60,000 | $10,000 | $50,000 (83% reduction) |

$5M | $150,000 | $15,000 | $135,000 (90% reduction) |

A restaurant doing $100K monthly saves $36,000+ annually. A SaaS business with international customers? Even more.

These aren't projections. This is basic blockchain math.

The Larecoin Advantage: More Than Just Fee Reduction

Larecoin isn't just another crypto payment processor like NOWPayments or CoinPayments. It's a complete Web3 merchant ecosystem.

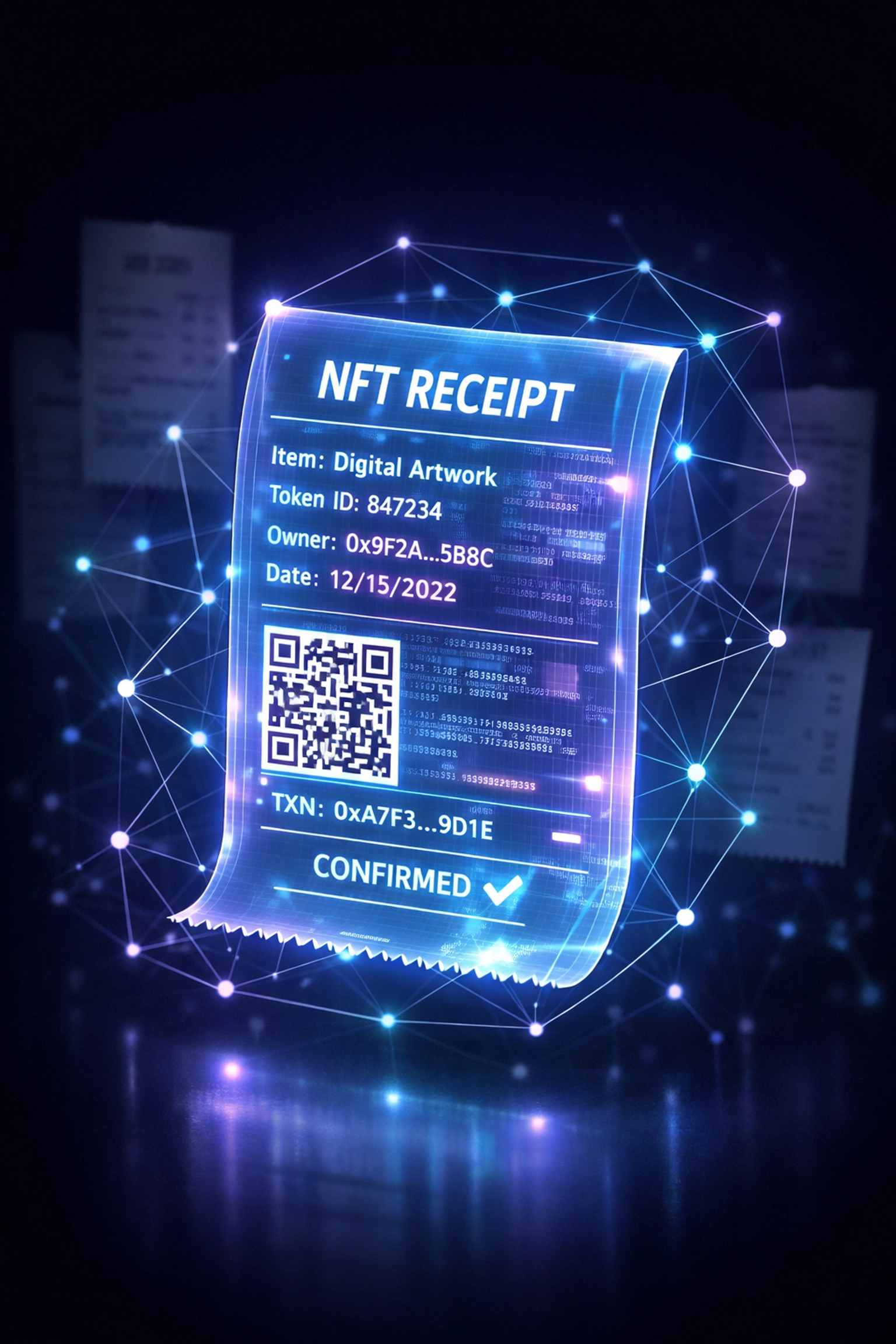

NFT Receipt System

Every transaction generates an immutable NFT receipt. Permanent. Tamper-proof. Blockchain-verified.

Your accountant will love you. Tax audits become trivial. Expense tracking? Automated. Chargebacks? Impossible: transactions are final.

Traditional processors can't offer this. NOWPayments doesn't have it. CoinPayments doesn't either.

LUSD Stablecoin Integration

Crypto volatility freaks you out? Use LUSD.

Dollar-pegged stability. Algorithmic backing. No corporate reserves to implode. Accept crypto, receive stable value, maintain predictable cash flow.

Convert to fiat whenever you want. Or don't. Your choice.

True Self-Custody Merchant Accounts

Your funds. Your wallet. Your control.

Set up master wallets with unlimited sub-wallets for different locations, departments, or revenue streams. Complete visibility. Zero risk of account freezes or processor blacklisting.

Banks can't touch it. Processors can't hold it hostage. Financial sovereignty isn't a buzzword: it's your new operating model.

You Don't Have to Choose: Run Both Systems

"But my customers use credit cards!"

Perfect. Keep accepting them.

Larecoin integrates alongside your existing payment infrastructure. Dual-system approach. Zero disruption.

Implementation options:

Point-of-sale terminals for in-person payments

API integration for e-commerce platforms

Payment links for invoicing

QR codes for mobile checkout

Crypto-native checkout for Web3 customers

Crypto customers get blockchain benefits and lower fees. Traditional customers use cards. You capture both markets while reducing your overall fee burden by 50-70%.

Beyond Fees: The Hidden Benefits Nobody Talks About

Instant settlement: Funds in your wallet in 3-8 seconds. Not 2-3 business days. Your cash flow just got injected with steroids.

Global reach without borders: A customer in Tokyo pays your Texas business in 5 seconds at identical fees. No correspondent banking. No currency restrictions. No geographic limitations.

Zero chargebacks: Blockchain transactions are irreversible. That 0.5-1% annual chargeback loss? Gone. Fraud protection built into the protocol.

Receivables tokenization: Turn future receivables into tradeable assets. Access liquidity without loans. This is next-level treasury management.

How Larecoin Stacks Up Against Competitors

vs. NOWPayments:

NOWPayments: Standard crypto gateway with 0.5% + network fees

Larecoin: Sub-0.5% fees PLUS NFT receipts, self-custody, receivables tokens

vs. CoinPayments:

CoinPayments: 0.5% transaction fee, custodial model

Larecoin: Lower fees, true self-custody, LUSD stability, merchant-first features

vs. Triple-A:

Triple-A: Enterprise focus, complex setup

Larecoin: Small business-friendly, turnkey integration, crypto POS system optimized for merchants

The difference? Larecoin was built for merchants, by people who understand merchant problems.

Not just payment processing. Complete financial infrastructure.

Getting Started: Three Simple Steps

1. Set Up Your Self-Custody Wallet

Five minutes. Create master wallet. Generate sub-wallets if needed. Full control from day one.

2. Choose Your Integration

POS terminal? API connection? Payment links? Pick what fits your business model. Larecoin supports all of them.

3. Start Accepting Web3 Payments

That's it. No lengthy approval process. No underwriting committees. No arbitrary account limits.

Your customers pay. Funds hit your wallet in seconds. NFT receipt generated automatically.

Ready to slash your merchant fees by 50-75%? Visit Larecoin and set up your account today.

The Bottom Line

Traditional payment processors extract 2-6% of every transaction. That's not a service fee: it's a tax on doing business.

Web3 global payments eliminate the middlemen. Direct settlement. Blockchain efficiency. Sub-1% costs.

Larecoin delivers:

50-90% fee reduction

NFT receipt accounting

LUSD stablecoin stability

Self-custody control

Receivables tokenization

Global reach

Instant settlement

Your choice is simple: Keep paying the payment processor tax, or join the Web3 merchant revolution.

The technology exists. The savings are real. The only question is how much longer you'll wait.

Comments