Are You Paying Too Much in Interchange Fees? How Larecoin Cuts Merchant Costs by 50%+ (Without Sacrificing Compliance)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 1 hour ago

- 5 min read

The Interchange Fee Problem Nobody Talks About

Every swipe costs you money.

Traditional payment processors take 2.5-3.5% of every transaction. That's before you account for chargeback fees, PCI compliance costs, and fund holding periods that drain your working capital.

Do the math on $100,000 in monthly revenue. You're losing $2,500-$3,500 just to accept payments.

That's not a cost of doing business. That's outdated infrastructure extracting rent.

What Merchants Actually Pay (And Don't Realize)

The interchange fee is just the beginning:

Transaction fees: 2.5-3.5% per swipe

Chargeback fees: $20-100 per dispute (plus lost inventory)

Monthly gateway fees: $25-50

PCI compliance fees: $100-500 annually

Early termination fees: Up to $500

Fund holding: 3-5 day ACH delays locking up capital

Add it up. The real cost approaches 4-5% of gross revenue for most merchants.

How Larecoin Flips the Model

Larecoin operates on a gas-only fee structure.

No percentage cuts. No middleman skimming. No fund holding.

Total cost: 1.5% all-in pricing, primarily blockchain gas fees of $0.02-0.05 per transaction.

That's 50%+ savings compared to legacy processors. Not marketing spin. Mathematical reality.

The model works because Web3 payments eliminate intermediaries. Your customer pays. You receive funds instantly in your wallet. No bank. No processor. No 3-day hold.

Zero counterparty risk. Zero chargeback liability. Zero withdrawal limits.

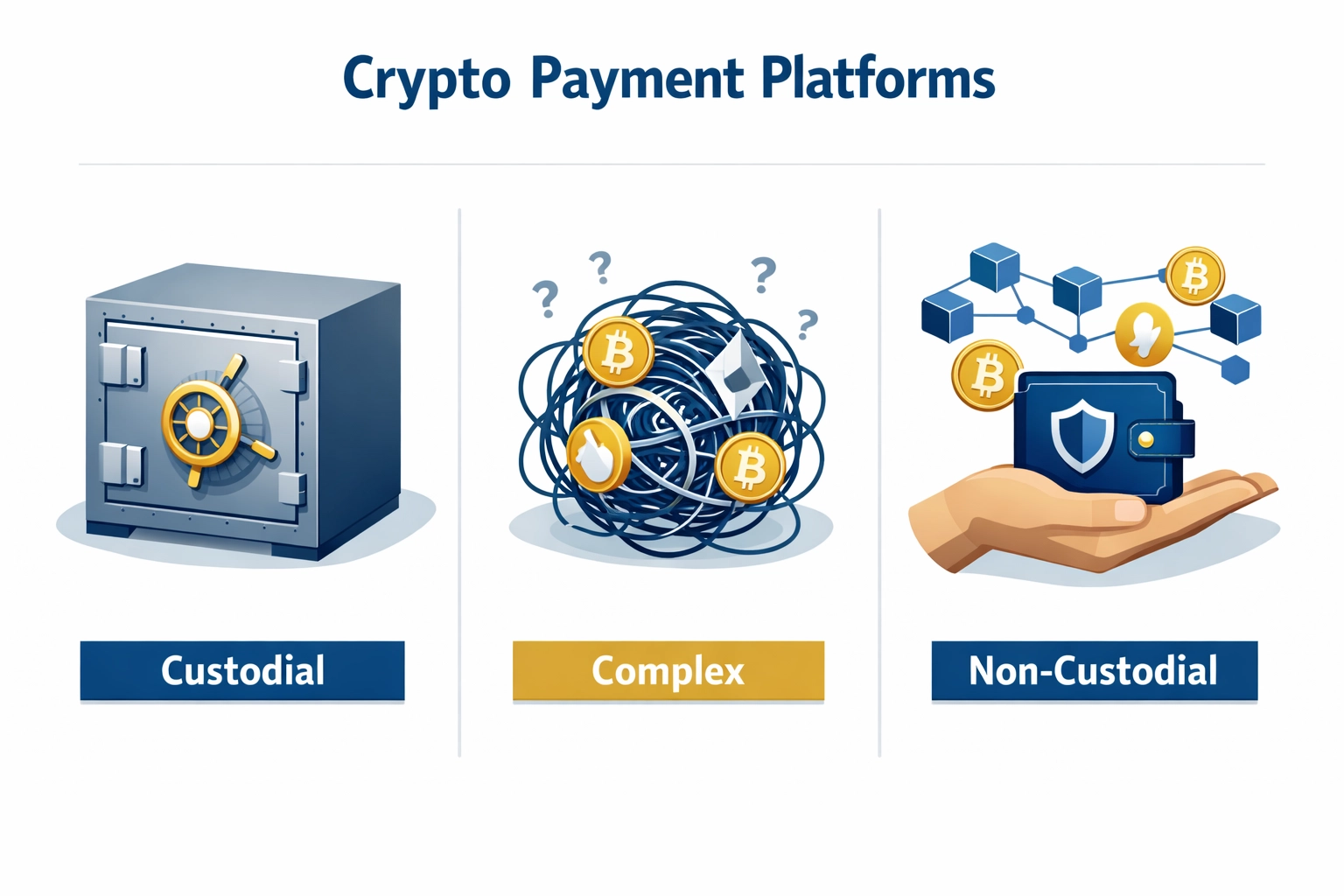

NOWPayments vs CoinPayments vs Larecoin: The Real Comparison

Let's get specific.

NOWPayments:

0.5% transaction fee (sounds great)

But: Custodial model, they hold your funds

Plus: 3-5 day verification before activation

Plus: Limited self-custody options

Plus: No proprietary stablecoin for volatility protection

CoinPayments:

0.5% transaction fee

But: Multi-crypto complexity creates tax nightmares

Plus: No built-in NFT receipt system for compliance

Plus: Relies on third-party stablecoins with fragmented regulatory frameworks

Plus: No direct merchant MSB/MTL compliance strategy

Larecoin:

1.5% all-in pricing (includes gas)

Self-custody from day one, your keys, your crypto

Under-30-minute setup (no verification bottlenecks)

LUSD stablecoin eliminates volatility

NFT receipts provide permanent transaction records

Direct US compliance path through MSB registration and state MTL strategy

The difference? NOWPayments and CoinPayments are payment gateways. Larecoin is a complete Web3 payments ecosystem built for regulatory clarity.

LUSD: The Stablecoin Built for Merchants

Volatility kills crypto adoption for merchants.

Accept Bitcoin at $65K. Customer completes purchase. Bitcoin drops to $60K before you convert. You just ate a 7.7% loss on that transaction.

LUSD solves this.

Pegged 1:1 to USD. Zero volatility risk. Every transaction settles at the exact dollar amount agreed upon.

But here's what makes LUSD different from USDT or USDC:

Single regulatory profile. Built specifically for the post-CLARITY Act environment. No fragmented compliance across multiple issuers or jurisdictions.

Tax advantages. Larecoin receivables are tax-free until you convert to fiat. Hold LUSD in your wallet, pay taxes only when you off-ramp. This creates genuine accounting flexibility.

Native to LareBlocks. Gas fees of $0.02-0.05 per transaction stay consistent because LUSD operates on Larecoin's Layer-1 infrastructure, not congested networks like Ethereum.

For merchants, this means predictable costs, regulatory clarity, and financial control.

NFT Receipts: Compliance Without Complexity

Audits require proof. Chargebacks demand records. Tax authorities want documentation.

Traditional processors provide PDF statements. Larecoin mints NFT receipts on LareBlocks.

Every transaction generates a permanent, immutable on-chain record containing:

Transaction amount

Timestamp

Merchant wallet address

Customer wallet address

LUSD conversion rate (if applicable)

These aren't collectibles. They're legally valid transaction records that satisfy IRS reporting requirements, state sales tax audits, and proof-of-purchase disputes.

The advantage? Zero data loss. Zero document corruption. Zero "sorry, we only keep records for 18 months" limitations.

Your entire transaction history exists on-chain forever. Auditors can verify independently. Customers can prove purchase without asking for receipts.

This is compliance built into the protocol: not bolted on afterward.

Self-Custody: Why Control Matters

Custodial processors hold your funds. They can freeze accounts. They can delay withdrawals. They can deactivate merchants without explanation.

You've seen it happen. A merchant flags an automated fraud detection algorithm. Account frozen. Revenue locked. Support ticket response time: 5-7 business days.

Larecoin operates on self-custody principles.

You control the private keys. Funds arrive directly in your wallet. No intermediary can freeze, seize, or delay your revenue.

Setup takes under 30 minutes because there's no verification bottleneck. You're not asking permission to access your own money.

This isn't just philosophical. It's operational resilience.

When payment processors go down (and they do), custodial merchants lose revenue. Self-custody merchants keep processing transactions because the blockchain doesn't have downtime.

US Compliance: MSB and State MTL Strategy

Regulatory uncertainty kills innovation. But ignoring compliance kills businesses.

Larecoin addresses this directly through a dual-layer compliance strategy:

Layer 1: MSB Registration. Money Services Business registration at the federal level through FinCEN. This establishes Larecoin's legitimacy within existing financial regulatory frameworks.

Layer 2: State MTL Licensing. Money Transmitter License applications in key jurisdictions. This creates state-by-state compliance rather than hoping for blanket federal clarity.

Why does this matter for merchants?

Because you're not adopting a technology in regulatory limbo. You're partnering with a platform that's actively building compliance infrastructure before regulators demand it.

This positions Larecoin merchants ahead of enforcement actions, ahead of rushed compliance retrofits, and ahead of competitors scrambling to meet new requirements.

The CLARITY Act passed. Forward-thinking merchants are already preparing. Larecoin's compliance strategy puts you in position to win.

The 50%+ Savings Aren't Hype

Let's run real numbers.

Traditional Processor (Merchant A):

Monthly revenue: $100,000

Transaction fees (3%): -$3,000

Chargeback fees (0.5% avg): -$500

Gateway fees: -$50

PCI compliance: -$40

Total monthly cost: $3,590 (3.59%)

Larecoin (Merchant B):

Monthly revenue: $100,000

Gas fees (1.5%): -$1,500

Chargeback fees: $0 (crypto is final settlement)

Gateway fees: $0 (self-custody)

Compliance fees: $0 (NFT receipts included)

Total monthly cost: $1,500 (1.5%)

Monthly savings: $2,090 Annual savings: $25,080

That's not accounting for faster cash flow from instant settlement vs 3-5 day ACH holds.

Compound that over 10 years. Traditional processors cost Merchant A $358,800. Larecoin costs Merchant B $180,000.

Difference: $178,800 saved.

That's capital you can reinvest in growth, inventory, marketing, or team expansion.

Who This Works For

Larecoin isn't for everyone. Yet.

If you're a mom-and-pop shop processing $5K/month in cash transactions, traditional systems are fine.

But if you fit these profiles, the savings are immediate:

E-commerce merchants processing $50K+ monthly

Digital goods sellers tired of chargeback fraud

Global merchants dealing with cross-border payment friction

High-risk industries facing account closures and rate hikes

Tech-forward businesses seeking competitive advantage

The shift to Web3 payments isn't hypothetical. It's happening now. Early adopters capture the advantage.

Next Steps

Stop paying rent to outdated infrastructure.

Explore Larecoin's ecosystem at larecoin.com.

Read the detailed merchant guide: Reduce Merchant Interchange Fees: The Ultimate Guide.

Compare platforms directly: NOWPayments vs CoinPayments vs Larecoin.

Setup takes 30 minutes. Savings last forever.

Comments