Reduce Merchant Interchange Fees: The Ultimate Guide to Web3 Global Payments in 2026

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

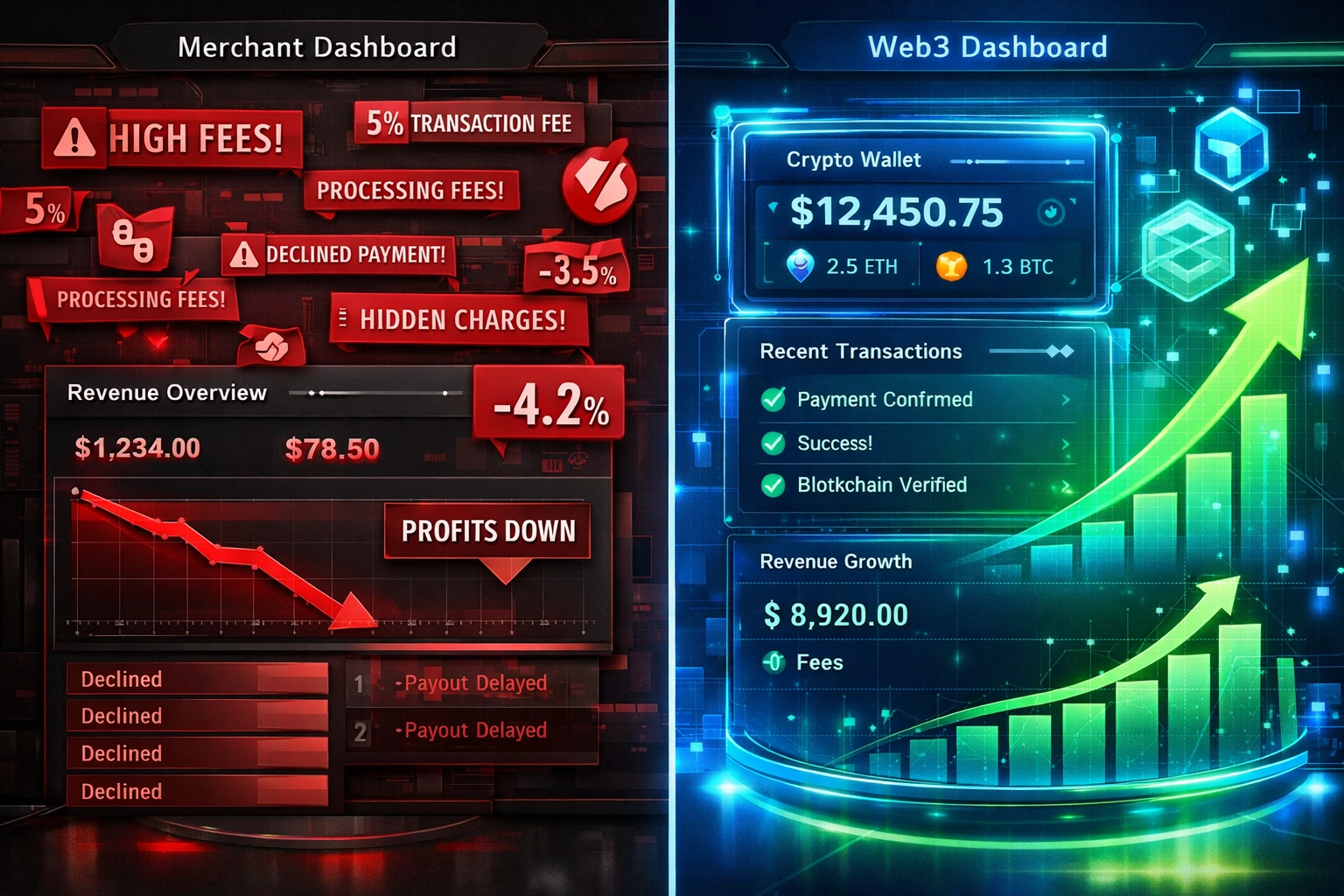

The Fee Problem Is Killing Your Profit Margins

Processing $500,000 monthly? You're paying $14,500 to credit card processors. Every. Single. Month.

That's $174,000 annually vanishing into interchange fees, gateway charges, and compliance costs.

Web3 changes everything. Same volume. $100 in gas fees. That's a 99.3% cost reduction.

Traditional payment processors are legacy systems built for a centralized world. They weren't designed for global commerce. They were designed to extract maximum fees while giving you minimum control.

Let's fix that.

How Web3 Payments Slash Merchant Fees to Nearly Zero

Web3 global payments operate on blockchain infrastructure. No banks. No payment networks. No intermediaries marking up every transaction.

Direct peer-to-peer settlement. Your customer sends stablecoins. You receive stablecoins. Nobody takes a 3% cut in between.

Here's the math:

Traditional Credit Card Processing:

Base interchange: 2.5-3.5%

Processing markup: 0.3-0.5%

Monthly gateway fees: $25-50

PCI compliance: $100-300 annually

Chargeback fees: $20-100 per dispute

Web3 Blockchain Payments:

Network gas fees: $0.50-$3 per transaction

No monthly fees

No compliance costs

No chargeback mechanisms to abuse

For a $5,000 sale, credit cards charge $125-175. Blockchain charges under $1. Transaction size doesn't matter on-chain.

Stablecoin Settlement: The LUSD Advantage

Stablecoin payment flows exceeded $10 billion monthly in early 2026. Business transactions represent 63% of total volume.

LUSD (Liquity USD) offers something traditional stablecoins don't: true decentralization.

No corporate treasury backing. No blacklist functions. No centralized control.

Just algorithmic stability backed by ETH collateral. Perfect for merchants who want payment freedom without volatility risk.

Why merchants choose LUSD:

Immutable protocol with no admin keys

Over-collateralized with transparent reserves

No depegging risk from corporate decisions

Censorship-resistant settlement

Instant global transfers

Accept LUSD. Convert to local currency later. Or hold it as stable reserves. Your choice. Your custody. Your timeline.

Self-Custody: Take Back Financial Control

Traditional processors control your funds for 3-5 days after settlement. They can freeze accounts. Block transactions. Shut you down without notice.

Self-custody means you control your merchant treasury directly. No permission needed. No arbitrary holds. No waiting for "risk reviews."

Web3 wallets give you:

Instant access to received payments

Multi-signature security for team management

Hardware wallet integration for cold storage

Complete transaction transparency on-chain

Zero monthly account maintenance fees

NOWPayments and CoinPayments still operate custodial models. They hold your crypto. You request withdrawals. They approve or deny.

That's not true Web3. That's centralized crypto with extra steps.

Larecoin ecosystem runs on self-custody architecture. You generate receiving addresses from your own wallet. Customers pay directly to addresses you control. No middleman custody period.

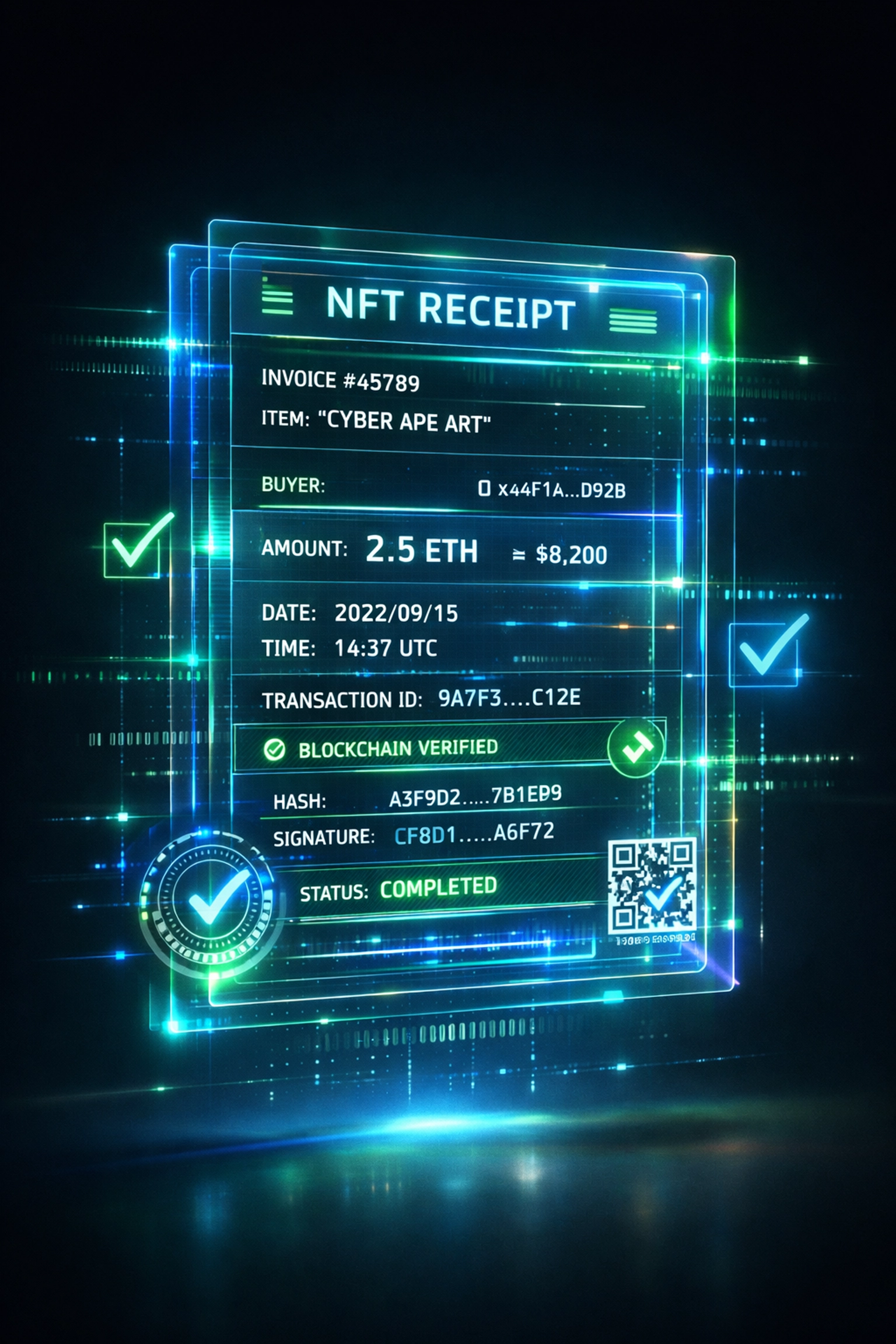

NFT Receipts: Solving the Accounting Nightmare

Every accountant hates reconciling crypto transactions. Blockchain explorers show hashes and addresses. Not invoice numbers and customer names.

NFT receipts change this completely.

Each payment mints an immutable receipt NFT containing:

Transaction hash and timestamp

Invoice number and order details

Customer wallet address

Product SKUs and quantities

Tax calculation breakdown

Refund policy terms

Your accounting software reads NFT metadata. Automatic reconciliation. Zero manual entry. Complete audit trail.

Traditional payment processors charge $50-200 monthly for detailed transaction reporting. NFT receipts cost nothing beyond the minting gas fee.

Plus you get proof-of-payment tokens customers can verify independently. No more "I never received that" disputes when blockchain shows the minted receipt in their wallet.

Direct Comparison: Larecoin vs NOWPayments vs CoinPayments

Let's compare real-world costs for processing $100,000 monthly:

NOWPayments:

0.5% processing fee = $500

Custodial model with withdrawal delays

Limited stablecoin options

No native NFT receipt system

Monthly cost: $500+

CoinPayments:

0.5% processing fee = $500

Additional withdrawal fees (0.5% minimum)

Multi-day settlement periods

Third-party custody risk

Monthly cost: $650+

Larecoin Ecosystem:

Gas fees only = $75-125

Self-custody settlement

LUSD and 50+ token support

Built-in NFT receipt minting

Monthly cost: $100-150

Cost savings scale exponentially at volume. Process $1 million monthly? NOWPayments charges $5,000. CoinPayments charges $6,500. Larecoin costs $500-800 in gas fees.

That's $55,000+ in annual savings compared to crypto-native processors. $200,000+ compared to traditional cards.

Instant Settlement: Stop Waiting for Your Money

Credit card processors take 3-5 days to settle funds. ACH takes longer. International wire transfers take a week.

Blockchain settles in seconds to minutes. Payment confirmed. Funds in your wallet. Done.

This eliminates float costs entirely. You can reinvest revenue immediately. Pay suppliers same-day. Manage cash flow in real-time.

For businesses running on tight margins, settlement speed is profitability. Every day funds sit in processor limbo is money you can't deploy.

Gas Fees: The Only Cost That Matters

Network gas fees are the only unavoidable cost in Web3 payments. Everything else is optional.

Current gas fee ranges (February 2026):

Ethereum L2s (Arbitrum, Optimism): $0.10-0.50

Solana: $0.0001-0.005

Polygon: $0.01-0.10

Base: $0.05-0.30

Even on expensive days, gas stays under $5 per transaction. Compare that to 3% credit card fees on any transaction size.

Smart merchants batch settle to optimize gas costs. Collect payments throughout the day. Consolidate to cold storage once. One gas fee for unlimited daily transactions received.

Merchant Freedom in 2026

Traditional payment processing is permission-based. Processors decide who can accept payments. What products qualify. Which countries are allowed.

Web3 is permissionless. Anyone with a wallet can receive payments. No approval process. No gatekeepers. No arbitrary terms changes.

This matters for:

High-risk merchants blocked by traditional processors

International sellers facing discriminatory restrictions

Small businesses unable to meet minimum processing volumes

Privacy-focused merchants avoiding invasive KYC

Emerging market businesses without banking infrastructure

The blockchain doesn't care about your business model. It processes transactions neutrally. Global access from day one.

The Strategic Shift Happening Now

Major processors see the writing on the wall. Stripe acquired Bridge for $1.1 billion. Visa settled payments with PYUSD across 40+ markets. Mastercard's Multi-Token Network hit $2 billion annualized volume.

They're integrating crypto because the cost advantage is undeniable.

But integration isn't transformation. Stripe can reduce fees from 3% to 1.5%. Native Web3 achieves sub-0.1% costs with complete financial sovereignty.

The blockchain payments market reached $3.2 billion in 2023. Projected to hit $81.5 billion by 2030. That's 25x growth in seven years.

Early adopters capture the advantage. Integrate Web3 payments now while competitors pay legacy fees. Offer customers lower prices. Keep higher margins. Win.

Implementation in Three Steps

Step 1: Set Up Self-Custody Wallet

Generate merchant wallet with hardware backup

Configure multi-signature for team access

Create receiving address rotation system

Step 2: Integrate Payment Infrastructure

Add crypto checkout option to existing flow

Enable LUSD and major stablecoin acceptance

Configure NFT receipt minting

Step 3: Optimize Settlement

Set up automated conversion if needed

Batch transactions to minimize gas costs

Connect accounting software to NFT metadata

Start accepting Web3 payments this week. Implementation takes hours, not months.

The Future Belongs to Decentralized Payments

Credit card networks were revolutionary in 1950. They're obsolete in 2026.

Web3 global payments offer what legacy infrastructure can't: near-zero fees, instant settlement, complete financial control, and permissionless access.

70% cost savings on international transfers. Settlement times from 3-5 days to under 10 minutes. Zero monthly platform fees. Self-custody security.

The question isn't whether to adopt Web3 payments. It's whether you adopt now or watch competitors eat your margin advantage.

Merchants processing volume today are merchants winning tomorrow. Choose your infrastructure accordingly.

Reduce fees. Increase control. Accept the future.

Comments