CoinPayments Alternative: 7 Reasons Your Crypto POS Fees Are Too High (And How to Fix Them)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 3 min read

You're getting robbed. Not by hackers. By your payment processor.

Every crypto transaction you process bleeds value. CoinPayments takes 0.5-1%. NOWPayments grabs 0.5%. Add settlement delays, custody fees, and volatility exposure: you're losing serious money.

Time to fix it.

Reason #1: Custodial Models Are Bleeding You Dry

Here's the dirty secret. Traditional crypto payment gateways hold your funds. They custody your crypto. Every second it sits in their wallet, you're exposed to risk.

CoinPayments and NOWPayments both use custodial models. They control your money until settlement. That means intermediary fees. Processing costs. Transfer charges.

The Fix: Self-custody eliminates middlemen. With Larecoin, funds go directly to your wallet. Gas-only transfers. No custody fees. No intermediary costs eating your margins.

Your crypto. Your wallet. Period.

Reason #2: Settlement Times Are Costing You Real Money

NOWPayments settles in 5 minutes. CoinPayments takes minutes to hours. Sounds minor?

Wrong.

Every minute your crypto sits unsettled, you're exposed to market volatility. Prices drop 2% while waiting for settlement? That's a 2% loss on top of processing fees.

The Fix: Instant settlement to self-custody wallets. Larecoin's Web3 infrastructure processes transactions directly to your address. No waiting. No volatility exposure. No additional risk.

Fast settlement = protected profits.

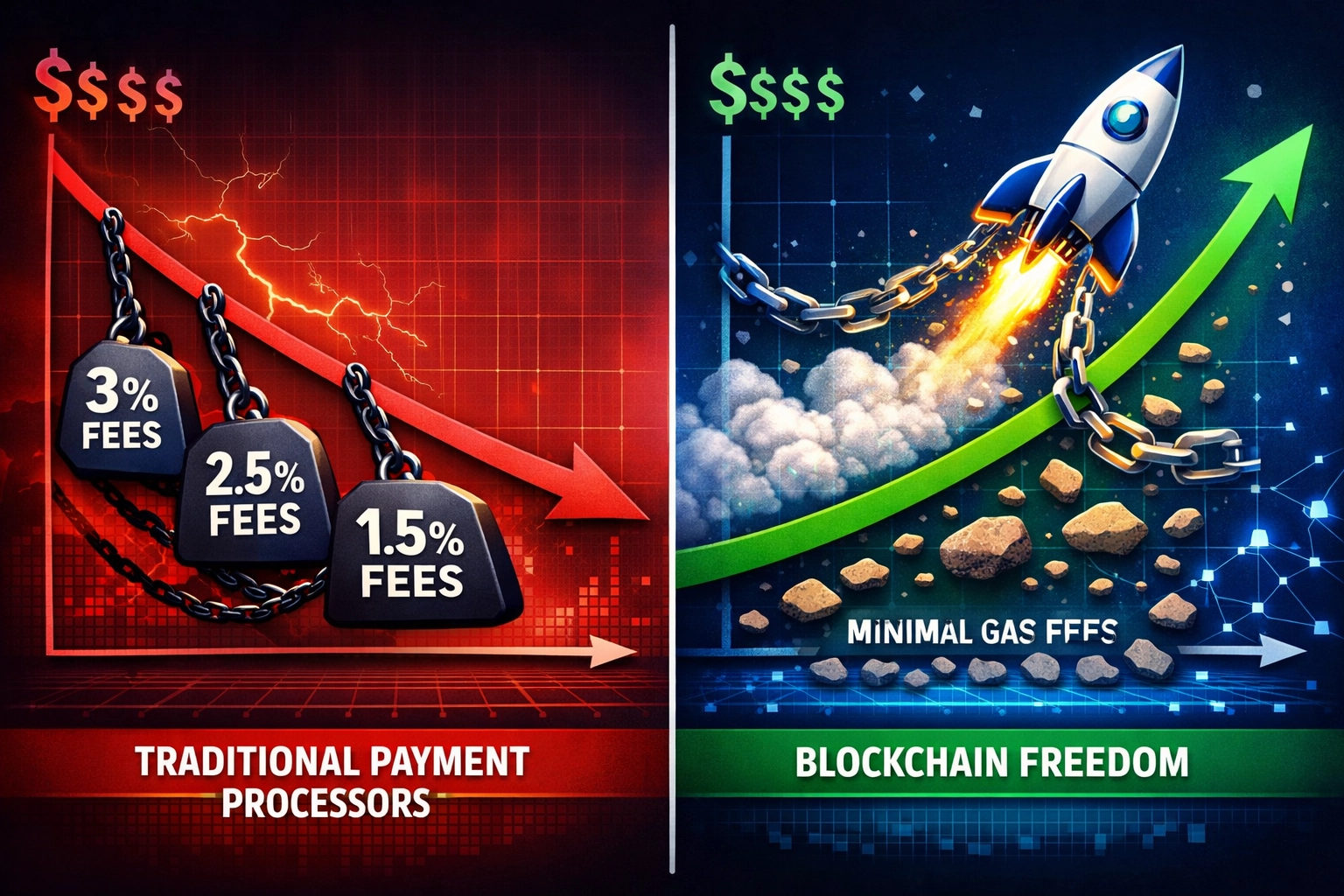

Reason #3: Percentage Fees Scale With Success (Against You)

Process $10,000 in crypto payments? Pay $50-100 in fees.

Process $100,000? Pay $500-1,000.

Process $1,000,000? Pay $5,000-10,000.

Percentage-based fees punish growth. The more successful you become, the more they take. It's backwards.

The Fix: Gas-only fee structure. Pay actual network costs. Not inflated percentages. Not arbitrary processing charges. Just real blockchain fees.

Scale without getting penalized.

Reason #4: You Don't Own Your Payment Infrastructure

Custodial platforms control everything. They freeze accounts. Update terms. Change fee structures. Ban cryptocurrencies.

You're renting payment infrastructure. Not owning it.

The Fix: Decentralized payments with self-custody. Larecoin gives you full control. Your private keys. Your wallet. Your payment infrastructure.

Merchant independence isn't optional. It's essential.

Reason #5: No Stablecoin Strategy = Maximum Volatility

Most processors offer basic stablecoin support. USDT. USDC. Maybe DAI.

But they charge the same percentage fees. Converting to stablecoins? Extra fees. Withdrawing to fiat? More fees.

You need a stablecoin-native solution.

The Fix: LUSD integration. Larecoin's ecosystem includes stablecoin versions designed for merchants. Accept crypto. Settle in LUSD. Protect against volatility without percentage-based conversion fees.

Stability without the premium.

Reason #6: You're Paying Fees Without Getting Value

Traditional processors charge fees for basic service. Processing payments. That's it.

No receipts. No loyalty programs. No customer engagement tools. No innovation.

You're paying premium fees for commodity service.

The Fix: NFT receipts transform transactions. Every payment generates a unique, verifiable NFT receipt. Customers collect them. Trade them. Show them off.

Your receipts become marketing. Your transactions become engagement. Your fees deliver value.

That's innovation.

Reason #7: Centralized Platforms = Single Point of Failure

CoinPayments goes down? Your payments stop.

NOWPayments has issues? Your revenue halts.

Platform changes policies? You're stuck.

Centralized infrastructure creates dependency. Dependency creates risk.

The Fix: Decentralized payment protocol. Larecoin operates on blockchain infrastructure. No central servers to crash. No single company to change terms. No platform dependency.

Payment freedom means payment reliability.

The Real Cost of Traditional Crypto POS Systems

Let's do math. Simple math.

Monthly revenue: $50,000 in crypto payments.

CoinPayments fees at 0.75%: $375/month = $4,500/year.

Add custody risks, settlement delays, volatility exposure? Conservatively another $500/year in hidden costs.

Total annual cost: $5,000.

For what? Basic payment processing. No innovation. No value-add. No ownership.

How Larecoin Fixes Everything

Self-custody architecture. Gas-only fees. Instant settlement.

LUSD stablecoin integration. NFT receipt generation. Decentralized infrastructure.

This isn't incremental improvement. It's fundamental redesign.

Traditional processors charge percentages because they can. They custody your funds because it's profitable. They maintain control because it's their business model.

Larecoin flips the model. Merchants own their infrastructure. Control their funds. Pay actual costs.

That's not disruption. That's evolution.

Migration Is Simpler Than You Think

Stop bleeding fees today.

Set up Larecoin merchant wallet

Integrate Web3 payment protocol

Start accepting crypto payments

Keep your money in your wallet

Generate NFT receipts automatically

No complicated onboarding. No lengthy approval processes. No custody handover.

Your business. Your payments. Your control.

The Future Belongs to Independent Merchants

Crypto promised decentralization. Financial freedom. Cutting out middlemen.

Traditional payment processors built new middlemen.

Larecoin delivers the original promise. Decentralized payments. Merchant ownership. Self-custody infrastructure.

Join the merchants who stopped paying unnecessarily high fees. Who took control of their payment infrastructure. Who chose independence over dependency.

Your fees are too high because you're using outdated models. Fix it by switching to self-custody, decentralized, merchant-first infrastructure.

The technology exists. The solution is ready. The only question: how much longer will you overpay?

Stop renting payment infrastructure. Start owning it.

Explore Larecoin's merchant solutions at larecoin.com.

Comments