Crypto POS System for Small Business: How Larecoin's Receivables Token Cuts Fees by 50%+ (No Banks Required)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Your Payment Processor Is Eating Your Profits

Small business owners lose 2-3% on every credit card transaction.

That's standard interchange fees.

Add payment processor markups. Gateway fees. Chargeback risks.

Your $100,000 in annual sales just cost you $3,000 in fees alone.

Traditional crypto processors aren't much better. NOWPayments charges 0.5% and makes you wait 24 hours. CoinPayments takes custody of your funds. Triple-A requires KYC verification and withdrawal limits.

There's a better way.

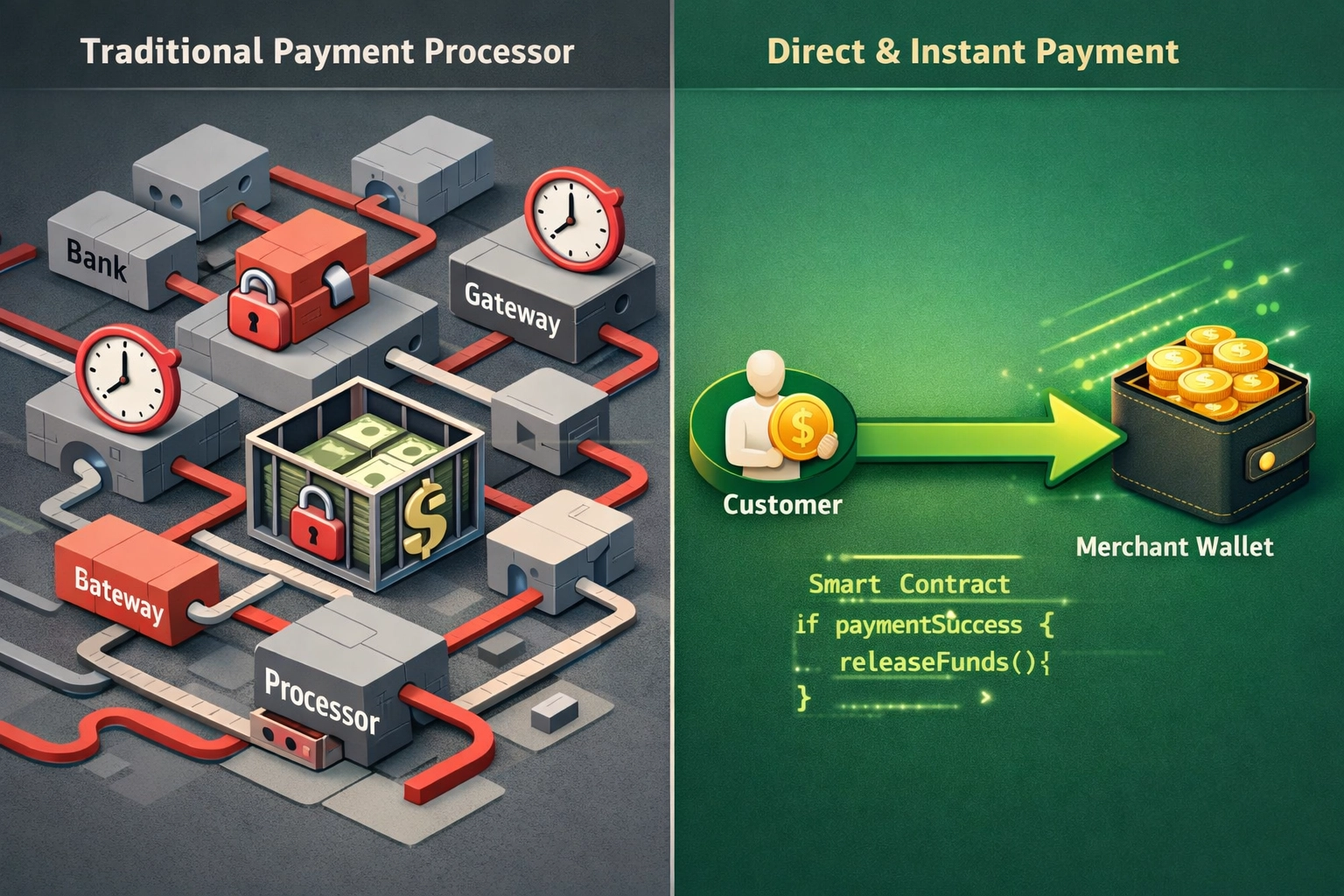

What Is a Receivables Token?

A receivables token is a blockchain-verified proof of payment that mints instantly when a customer pays you.

No middleman. No processor. No custody transfer.

Customer pays → Token mints → Funds hit your wallet.

Three seconds. Done.

The receivables token lives on-chain as permanent proof. It's tradeable, programmable, and auditable.

Think of it as a digital invoice that's also a financial instrument.

How Larecoin Cuts Fees by 50%+

Gas fees only.

That's the entire cost structure.

Standard blockchain transaction costs run 0.1-0.5% depending on network conditions. Compare that to the 2.9% you're paying Stripe or Square.

Real merchants using Larecoin report 60% faster settlement times compared to NOWPayments.

Here's the math on a $50,000 monthly business:

Traditional credit cards: $1,450/month in fees

NOWPayments: $250/month in fees + 24-hour hold

Larecoin: $50-250/month in gas fees + instant settlement

That's $14,400 saved annually. Minimum.

Three Things That Happen Instantly

When a customer pays with Larecoin, the system executes three simultaneous operations:

1. Receivables Token Mints On-Chain

Blockchain verification happens in real-time. The token contains transaction metadata, timestamp, and amount.

2. NFT Receipt Generates Automatically

Every payment creates an immutable, tamper-proof NFT receipt. No manual data entry. No CSV exports. No separate accounting software.

Your tax accountant will love you.

3. Funds Hit Your Wallet in Seconds

Zero intermediary processing delays. No "pending" status. No compliance holds.

Self-custody means instant access to your money.

Why Self-Custody Changes Everything

Traditional payment processors control your funds until they decide to release them.

Account frozen? Wait 3-5 business days for support.

Compliance review? Your money's locked until they finish.

Withdrawal limit hit? Too bad.

Larecoin eliminates every permission layer.

You control your private keys from transaction one. No withdrawal limits. No account reviews. No arbitrary freezes.

Your business. Your money. Your rules.

NOWPayments vs Larecoin: The Real Comparison

NOWPayments advertises "low fees" at 0.5%.

Sounds great until you look closer:

24-hour settlement hold

Custodial wallet (they control your keys)

Limited cryptocurrency support

Manual reconciliation for accounting

No programmable payment logic

Larecoin flips every disadvantage:

Instant settlement (seconds, not hours)

Self-custody wallet (you control keys)

Native support for 15+ cryptocurrencies plus LUSD stablecoin

Automatic NFT receipts for accounting

Fully programmable receivables tokens

The 0.5% savings compounds over time. But the real advantage is operational efficiency.

Time is money. Larecoin saves both.

Programmable Financial Logic

This is where receivables tokens become powerful.

Traditional payments are dumb. Money moves from Point A to Point B. End of story.

Receivables tokens execute complex financial operations automatically:

Automated Payment Collection

Set up recurring billing with smart contract conditions. Customer wallet gets charged when contract terms trigger.

No failed payments. No manual invoicing.

Revenue Splits Between Multiple Parties

Restaurant with multiple stakeholders? Program your receivables token to split payments automatically.

60% to owner. 30% to chef. 10% to marketing partner.

Happens instantly. Every transaction.

Collateralized Lending

Use receivables tokens as loan collateral without selling equity. Future revenue becomes immediate liquidity.

Banks won't do this. DeFi protocols will.

Secondary Market Trading

Need cash flow today? Trade invoice portions on decentralized exchanges. Convert future revenue into immediate capital.

No factoring companies. No 15% discount rates.

Infrastructure Requirements (Spoiler: You Already Have It)

Larecoin works on standard smartphones, tablets, and existing POS terminals.

No specialized hardware. No expensive upgrades.

Download the merchant portal. Connect your wallet. Start accepting crypto.

That's it.

Small coffee shop in Brooklyn? Works.

E-commerce store in Singapore? Works.

Freelance designer in Buenos Aires? Works.

Geographic restrictions don't exist in Web3.

Getting Started Takes 10 Minutes

Visit larecoin.com

Set up self-custody wallet

Generate payment QR codes

Accept first crypto payment

Watch receivables token mint automatically

No credit check. No bank account required. No business license verification.

If you can download an app, you can accept payments.

The Bank-Free Business Model

Traditional businesses need banking infrastructure to operate.

Merchant account. Business checking. Payment gateway. Processor relationship.

Larecoin removes every banking touchpoint.

Your wallet is your bank. Your receivables tokens are your invoices. Your NFT receipts are your ledger.

Complete financial sovereignty in a smartphone.

This matters in countries with unstable banking systems. It matters for businesses blacklisted by payment processors. It matters for anyone who values autonomy over permission.

Real-World Use Cases

Food Truck in Austin

Accepts Bitcoin, Ethereum, and LUSD stablecoin. Saves $600/month in credit card fees. Uses receivables tokens for automated supplier payments.

Online Boutique in Tokyo

Processes 200+ transactions daily. NFT receipts eliminate manual bookkeeping. Accountant imports blockchain data directly into tax software.

Consulting Firm in Dubai

International clients pay in crypto. Zero currency conversion fees. Receivables tokens enable instant payment to subcontractors worldwide.

Different industries. Different geographies. Same result:

Lower fees. Faster settlement. Complete control.

What About Volatility?

Use LUSD stablecoin.

Pegged 1:1 to USD. Same instant settlement. Same self-custody benefits. Zero price fluctuation risk.

Accept crypto. Receive stablecoin. Convert to fiat if needed.

Or keep it in crypto and benefit from long-term appreciation.

Your choice. Not your bank's.

The 50%+ Fee Reduction Breakdown

Traditional payment stack costs:

Interchange fee: 1.8-2.9%

Payment processor markup: 0.3-0.5%

Gateway fee: $0.10-0.30 per transaction

Monthly account fee: $10-50

Chargeback fee: $15-25 when it happens

Total: 2.5-3.5% plus fixed costs

Larecoin cost structure:

Gas fees: 0.1-0.5%

Monthly account fee: $0

Chargeback fee: Impossible (blockchain transactions are final)

Total: 0.1-0.5%

That's 50-85% reduction in payment processing costs.

Math doesn't lie.

Join the Web3 Payments Revolution

10,000+ merchants already use Larecoin for daily operations.

They're saving money. Moving faster. Building bank-free businesses.

Your competitors are figuring this out. Don't wait.

Set up takes 10 minutes. First transaction proves the concept.

Start accepting crypto payments today. Cut fees by 50%+ tomorrow.

Visit larecoin.com or explore our merchant tools to get started.

The future of payments is programmable, instant, and autonomous.

Welcome to Web3.

Comments