Why the CLARITY Act Will Change the Way Merchants Accept Crypto Payments (H.R. 3633 Explained)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

The Regulatory Fog Is Finally Lifting

For years, merchants who wanted to accept crypto faced a nightmare scenario.

Is this a security? A commodity? Who regulates it?

The SEC and CFTC fought over jurisdiction. Payment processors operated in legal gray zones. Merchants risked compliance violations they didn't even know existed.

H.R. 3633: the CLARITY Act: changes everything.

Passed with bipartisan support, this legislation establishes the first comprehensive framework for digital commodity regulation in the United States.

For merchants accepting crypto payments through platforms like Larecoin, this isn't just regulatory housekeeping.

It's a complete game-changer.

What the CLARITY Act Actually Does

The CLARITY Act creates clear regulatory pathways for three critical components:

Digital Commodity Exchanges

Register with the CFTC, not the SEC

Follow standardized custody requirements

Implement customer fund segregation

Provide transparent disclosure standards

Payment Stablecoins

Supervised by banking regulators

Removed from securities classification

Streamlined compliance for transaction use

Clear operational guidelines for merchants

DeFi Infrastructure

Safe harbors for developers and validators

Reduced liability concerns

Certification process for "mature blockchain systems"

Protection for non-custodial payment protocols

Why This Matters for Merchants Right Now

Before the CLARITY Act, accepting crypto meant operating in uncertainty.

Payment processors couldn't guarantee long-term compliance. Banks hesitated to work with crypto merchants. Integration costs stayed high because legal risks remained undefined.

The CLARITY Act eliminates these barriers.

When Larecoin operates as a digital commodity under CFTC oversight, merchants gain:

Legal certainty for payment acceptance

Banking access without discrimination

Lower insurance costs due to reduced regulatory risk

Simplified tax reporting through standardized frameworks

Protection from arbitrary enforcement actions

Larecoin's classification as a digital commodity means merchants aren't dealing with securities regulations. You're not a broker-dealer. You're just accepting payment.

Like accepting cash. Or credit cards. But with 50% lower fees.

The Larecoin Advantage Under New Rules

Larecoin built its entire infrastructure anticipating this regulatory clarity.

LareBlocks Layer 1 Architecture The CLARITY Act requires custody and segregation standards. Larecoin's Layer 1 blockchain provides transparent, verifiable custody through LareScan explorer. Every transaction is traceable. Every merchant wallet maintains self-custody control.

No intermediary risk. No pooled funds vulnerability.

LUSD Stablecoin Integration The Act specifically streamlines permitted payment stablecoins. Larecoin's LUSD stablecoin operates as a dollar-pegged payment instrument: exactly what the legislation was designed to support.

Merchants can accept LUSD with zero volatility risk. Settlement happens in stable value. Customers pay with crypto flexibility.

CFTC-Ready Compliance Larecoin's merchant dashboard already includes:

Automatic transaction reporting

Built-in AML/KYC workflows

Real-time settlement tracking

Tax documentation generation

Regulatory audit trails

You're CLARITY Act compliant from day one.

The Fee Revolution for Merchants

Traditional payment processing costs merchants 2.9% + $0.30 per transaction on average.

Visa and Mastercard extract billions annually through interchange fees.

Larecoin operates at less than 1% total cost.

Under the CLARITY Act's framework, these savings become sustainable and legally protected. You're not using crypto to dodge regulations: you're using a CFTC-regulated digital commodity with lower infrastructure costs.

The math is simple:

$100,000 monthly revenue through cards = $3,200 in fees

$100,000 monthly revenue through Larecoin = $800 in fees

Annual savings: $28,800

For a mid-sized retailer processing $1M annually? That's $288,000 staying in your business.

NFT Receipts Meet Regulatory Compliance

Here's where Larecoin gets innovative.

Every payment generates an NFT receipt on LareBlocks. This isn't a gimmick: it's a compliance feature that the CLARITY Act's disclosure requirements make even more valuable.

Your NFT receipt contains:

Immutable transaction proof

Timestamp verification

Customer wallet identifier (privacy-preserved)

Product/service metadata

Regulatory compliance markers

When tax season arrives, you have blockchain-verified records that satisfy CFTC reporting standards. No disputes. No chargebacks. No "customer claims they didn't receive the item" nonsense.

The NFT receipt is your legal proof. Forever. On-chain.

How Larecoin Compares to Legacy Crypto Processors

NOWPayments and CoinPayments operate as intermediaries. They hold your funds. They convert crypto. They charge processing fees on top of network fees.

Larecoin operates differently.

You maintain self-custody through your merchant wallet. Customers pay directly to your address. No intermediary holds your funds. LUSD stablecoin payments settle instantly without conversion steps.

Under the CLARITY Act, this matters more than ever.

Intermediaries must register with the CFTC and implement complex custody requirements. Their compliance costs will increase. Those costs pass to merchants.

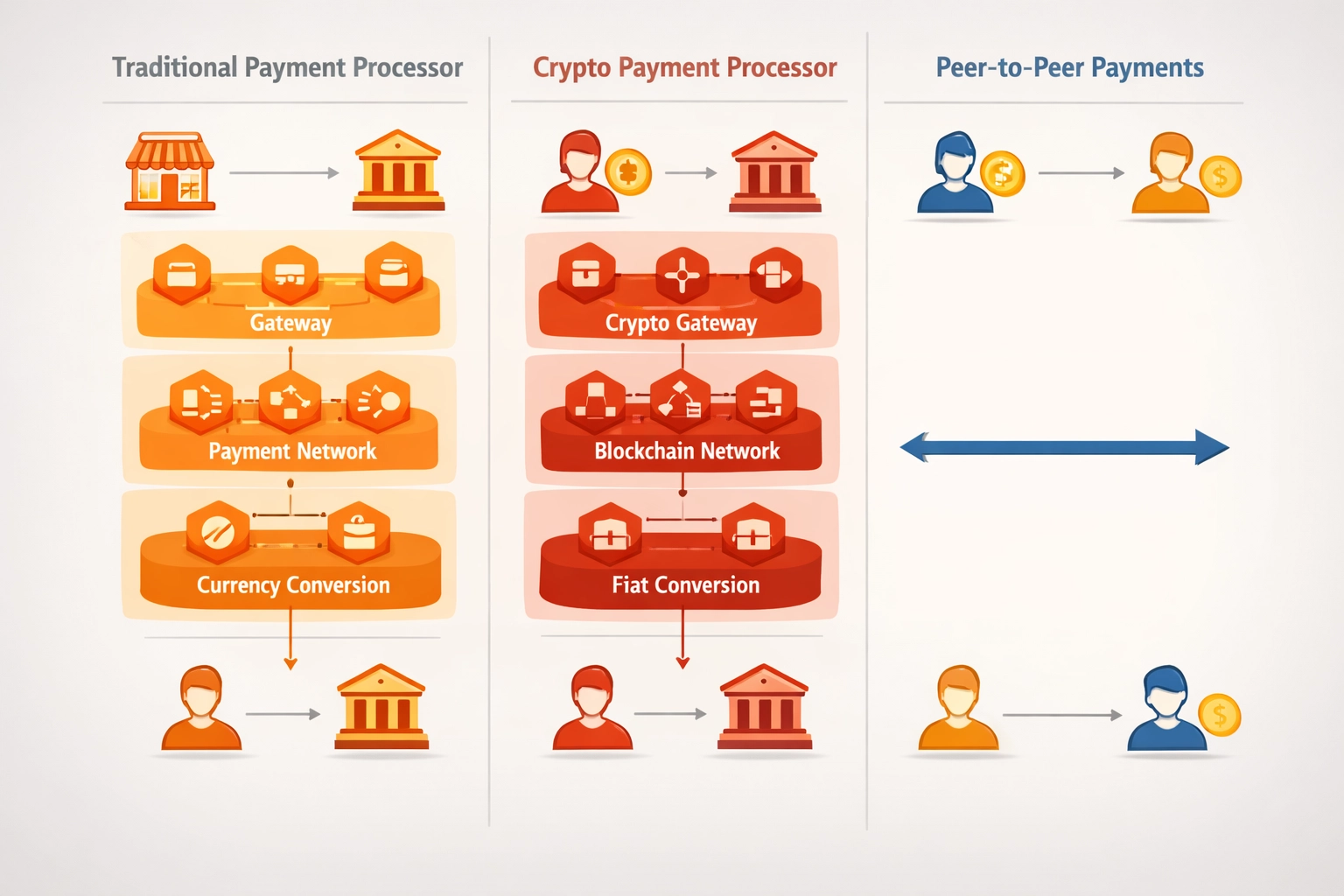

Larecoin's peer-to-peer model eliminates the middleman. You're directly receiving digital commodity payments. Lower fees. Simpler compliance. Full control.

The Mature Blockchain System Certification

The CLARITY Act introduces "mature blockchain system" certification: a framework determining when digital assets transition from investment contracts to commodities.

Larecoin qualifies on every metric:

Decentralized validator network

Functional payment utility beyond speculation

Established developer community

Open-source codebase

Multi-year operational history

Self-sustaining economic model

This certification provides merchants additional legal protection. You're accepting payment in a certified digital commodity, not a speculative token that might get reclassified tomorrow.

Competitors built on centralized infrastructure or newer protocols face years of uncertainty before qualification.

AI-Powered Shopping Meets Regulatory Clarity

Larecoin's AI metaverse shopping integration represents the future of commerce.

Customers browse virtual storefronts. AI assistants help product discovery. Payments execute instantly through LUSD stablecoin.

The CLARITY Act makes this sustainable.

Virtual commerce platforms now have clear regulatory guidelines. Payment tokens used in metaverse transactions follow commodity rules, not securities regulations.

Your virtual store accepts Larecoin payments with the same legal protection as your physical location.

No regulatory ambiguity. No platform risk. Just commerce in the next frontier.

Implementation Is Stupidly Simple

Merchants worry crypto integration means technical complexity.

Larecoin takes 15 minutes to set up:

Create merchant account at larecoin.com

Generate payment wallet

Install checkout plugin (WordPress, Shopify, WooCommerce supported)

Configure LUSD stablecoin acceptance

Start accepting payments

Your CLARITY Act compliance is automatic. The platform handles regulatory reporting. You focus on selling.

The Competitive Edge You Can't Ignore

Your competitors are still paying 3% to card networks.

You're paying under 1%.

They're dealing with chargebacks and fraud. You have immutable NFT receipts.

They're worried about regulatory changes. You're operating on CFTC-compliant infrastructure.

The CLARITY Act didn't just clarify crypto regulation: it created a competitive advantage for early adopters.

You're either riding this wave or watching from shore.

What Happens Next

The CLARITY Act implementation timeline runs through 2026. CFTC rulemaking is already underway. Banking regulations for payment stablecoins are being finalized.

Larecoin is ready now.

Every feature built anticipating this framework. Every compliance tool designed for CFTC standards. Every merchant joining the platform gets first-mover advantage in the new regulated environment.

Traditional payment processors will adapt slowly. Legacy crypto platforms will struggle with new requirements.

You can start today.

Join the Payment Revolution

Regulatory clarity arrived. Lower fees are real. The technology works.

Set up your Larecoin merchant account. Start accepting LUSD stablecoin payments. Generate NFT receipts for every transaction. Cut your payment processing costs in half.

The CLARITY Act made crypto payments legitimate. Larecoin makes them practical.

Your customers are ready. The regulations are clear. Your competitors are watching.

Are you moving first?

Visit larecoin.com to activate your merchant account. Join the merchants already saving thousands monthly on payment fees.

The future of commerce isn't coming.

It's here.

Comments