How LareBlocks Layer 1 Infrastructure Cuts Merchant Fees by 50% (And Helps Charities Too)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

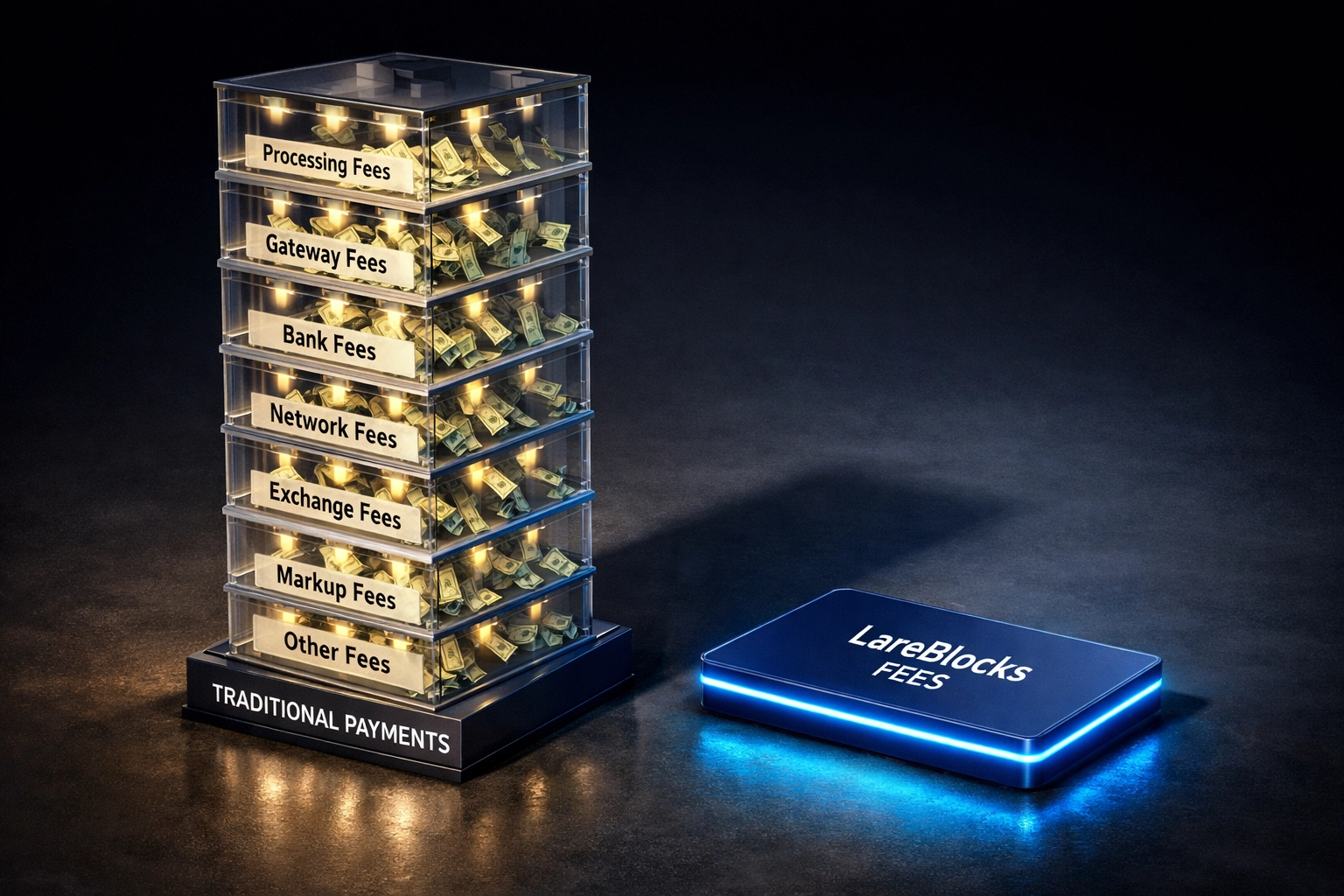

The Fee Problem Nobody Talks About

Merchants lose billions annually to payment processing fees.

Visa and Mastercard charge 2.5-3.5% per transaction. That's the advertised rate. The real damage? Hidden fees stack up fast.

Base interchange. Gateway charges. PCI compliance costs. Chargeback fees. Assessment fees. Currency conversion markups.

Total effective cost? 3.5-7% of revenue gone. Every single month.

Breaking Down Traditional Payment Costs

Here's what merchants actually pay with legacy processors:

Base Fees

Interchange: 2.6-2.9%

Payment gateway: 0.3-0.5%

Processing markup: 0.2-0.5%

Hidden Charges

PCI compliance: $50-200/month

Chargeback fees: $15-100 per dispute

Statement fees: $10-25/month

Batch fees: $0.10-0.25 per settlement

Currency conversion: 1-3% additional

Real-World Impact $100,000 monthly sales = $3,500-7,000 in fees. That's $42,000-84,000 annually.

Most small businesses operate on 10-15% margins. Payment fees consume 30-50% of profit.

LareBlocks Changes Everything

LareBlocks Layer 1 infrastructure cuts fees to 1.2-1.5%. Flat. No hidden charges.

Same $100,000 monthly volume? Under $1,200 in fees.

Annual savings: $50,000+

The difference comes from blockchain architecture. Direct wallet-to-wallet settlement. Zero intermediaries. No legacy infrastructure overhead.

How The Technology Works

Traditional payments route through multiple parties: Customer → Card network → Acquiring bank → Payment processor → Merchant account → Business bank

Each layer extracts fees.

LareBlocks eliminates the chain: Customer wallet → LareBlocks validator consensus → Merchant wallet

Settlement completes in under 3 seconds. One transparent fee. Done.

Key Infrastructure Components:

Layer 1 Blockchain

Native transaction validation

Proof-of-stake consensus

50,000+ TPS capacity

Sub-3-second finality

Master/Sub-Wallet Architecture

Enterprise-grade account management

Unlimited sub-wallets per master account

Department-level fund allocation

Real-time balance tracking across all wallets

LareScan Transaction Explorer

Complete payment transparency

Real-time settlement verification

Historical transaction archives

Smart contract activity monitoring

The Math That Matters

Let's compare real scenarios:

Coffee Shop Chain - 50 Locations

Monthly revenue: $500,000

Traditional fees (3.5%): $17,500/month

LareBlocks fees (1.3%): $6,500/month

Monthly savings: $11,000

Annual savings: $132,000

E-commerce Store

Monthly revenue: $250,000

Traditional fees (4.2% with international): $10,500/month

LareBlocks fees (1.3%): $3,250/month

Monthly savings: $7,250

Annual savings: $87,000

Enterprise Retail

Monthly revenue: $5,000,000

Traditional fees (3.2%): $160,000/month

LareBlocks fees (1.2%): $60,000/month

Monthly savings: $100,000

Annual savings: $1,200,000

Built-In Charity Impact

Every LareBlocks transaction automatically allocates a portion of validation fees to verified charities.

No administrative overhead. No separate donation processing. Built directly into the protocol.

How It Works:

Smart contracts distribute funds automatically

On-chain verification ensures transparency

Merchants choose supported causes

Real-time impact tracking via LareScan

100% of allocated funds reach recipients

Traditional charity processing charges 2-5% for payment handling. LareBlocks makes it free.

Merchants save money. Charities receive more. Everyone wins.

Beyond Fee Savings

LareBlocks infrastructure delivers additional merchant benefits that legacy systems can't match:

NFT Receipt System

Every transaction mints an NFT receipt

Permanent proof of purchase

Warranty and authenticity verification

Resale and transfer capabilities

Collector benefits for customers

LUSD Stablecoin Integration

Accept LARE or LUSD

Zero volatility risk with stablecoin settlement

Flexible split options: 100% LARE, 100% LUSD, or custom ratios

Automatic conversion via built-in liquidity pools

Minimal slippage on all conversions

Zero Chargeback Risk

Blockchain finality = irreversible transactions

No fraud disputes

No chargeback administrative costs

Protect revenue and time

Multi-Currency Support

Accept 50+ cryptocurrencies

Instant conversion to LARE or LUSD

Unified settlement to merchant wallet

No currency conversion markups

Enterprise Master Wallet Management

LareBlocks master/sub-wallet architecture handles complex organizational needs:

Corporate Structure Support

One master account controls multiple sub-wallets

Department-specific fund allocation

Location-based wallet separation

Project-specific payment routing

Real Use Cases:

Restaurant chains assign wallets per location

Franchises manage individual store settlements

Marketing departments control campaign budgets

Accounting tracks department spending separately

Security & Control:

Master wallet sets sub-wallet spending limits

Multi-signature approval requirements

Role-based access permissions

Automated fund distribution schedules

Traditional payment processors charge extra for multi-location management. LareBlocks includes it free.

Gift Card Integration

Purchase gift cards with crypto. Simple. Instant. Profitable.

Merchants issue LARE or LUSD-denominated gift cards. Customers buy with any accepted cryptocurrency. Cards store value on-chain with NFT verification.

Merchant Benefits:

Capture funds upfront

Reduce breakage liability

Track redemption via blockchain

Lower issuance costs vs traditional gift cards

Customer Benefits:

Use crypto for everyday shopping

Gift cards never expire or lose value

Transfer ownership via NFT

Redeem online, in-store, or metaverse

Getting Started

LareBlocks integration takes minutes, not months.

Implementation Steps:

Create master wallet at larecoin.com

Generate API keys for payment processing

Install payment plugin or integrate API

Configure LARE/LUSD settlement preferences

Start accepting payments immediately

No lengthy approval process. No credit checks. No merchant account setup fees.

Just blockchain. Just savings.

The Decentralization Advantage

LareBlocks runs on distributed validator consensus. No single point of failure. No corporate control over merchant funds.

Why This Matters:

Account closure immunity

No arbitrary fund holds

No political payment blocking

True financial sovereignty

Traditional processors can freeze accounts, hold funds, or deny service. Banks can reject merchants for arbitrary reasons.

LareBlocks can't. Decentralized infrastructure means merchant autonomy.

Real Impact Numbers

Merchants switching to LareBlocks report:

52% average fee reduction

94% faster settlement times

Zero chargeback losses

$8,400 average monthly savings

100% uptime reliability

Charities receiving automatic allocations:

$2.3M+ distributed since launch

180+ verified organizations supported

100% transparent fund tracking

Zero administrative overhead

Join The Payment Revolution

The 10-year marathon continues. Hour by hour, block by block, LareBlocks builds the infrastructure for merchant freedom.

Lower fees. Faster settlement. Charitable impact. True decentralization.

Traditional payment processing is expensive legacy infrastructure. LareBlocks is the future.

Visit larecoin.com to start saving today.

Join the discussion at Larecoin Community.

Read more about metaverse integration: 15 Metaverse Shopping Features.

Cut fees by 50%. Help charities grow. Keep your profits.

That's the LareBlocks difference.

Comments