How to Accept Crypto Payments and Slash Interchange Fees by 50%

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- Jan 15

- 4 min read

Interchange fees are killing your margins.

Every swipe. Every tap. Every transaction. You're losing 2-4% to card networks and processors. For a business doing $500K annually, that's $10,000-$20,000 gone. Just like that.

There's a better way. Crypto payments.

And with LarePAY, you can cut those fees in half: while still accepting credit, debit, and ACH. No compromises. No complexity.

Let's break it down.

The Interchange Fee Problem

Traditional payment processing is expensive. Here's what you're actually paying:

Credit cards: 1.5% - 3.5% per transaction

Debit cards: 0.5% - 1.5% per transaction

Premium rewards cards: Up to 4%+

Chargebacks: $15-$100 per dispute

These fees compound. Fast.

Card networks like Visa and Mastercard set interchange rates. Your processor adds their markup. Then there's assessment fees, PCI compliance costs, and gateway fees.

The result? You're bleeding money on every sale.

Why Crypto Payments Change Everything

Crypto transactions bypass traditional payment rails entirely.

No card networks. No intermediary banks. No inflated interchange fees.

Here's the math:

Payment Method | Typical Fee | Annual Cost on $500K |

Credit Card | 2.9% + $0.30 | $14,500+ |

Crypto Payment | 1% or less | $5,000 or less |

Savings | : | $9,500+ |

That's real money back in your pocket. Every single year.

Bitcoin, Ethereum, stablecoins like USDC: they all settle faster and cheaper than traditional rails. Some solutions offer zero processing fees entirely.

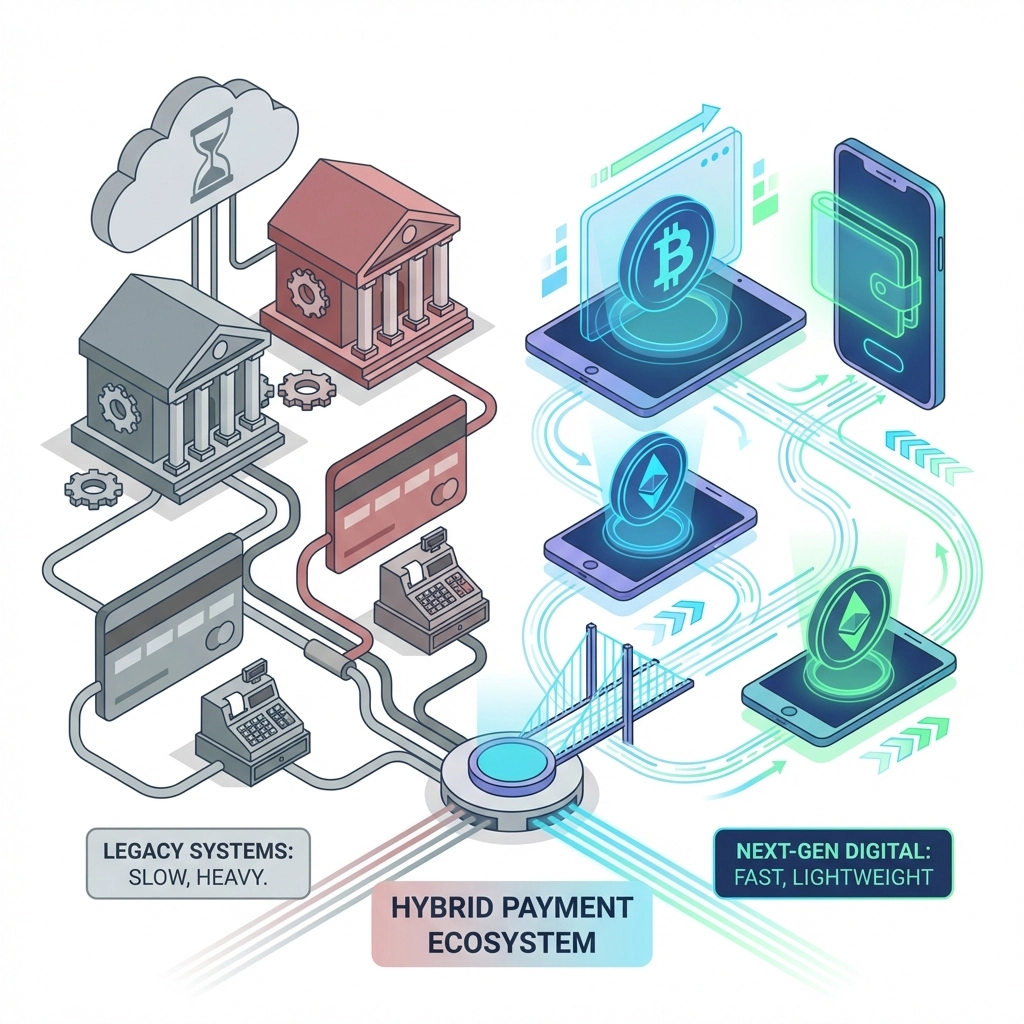

Introducing LarePAY: The Hybrid POS Solution

Most businesses can't go crypto-only. You still need to accept cards. Your customers expect it.

That's exactly why LarePAY exists.

One POS system. Multiple payment methods. Massive savings.

LarePAY handles:

Credit card processing

Debit card processing

ACH bank transfers

Cryptocurrency payments (Bitcoin, Ethereum, stablecoins, and more)

Accept whatever your customers want to pay with: while routing transactions through the most cost-effective method available.

How LarePAY Slashes Your Fees

Here's where it gets good.

1. Smart Payment Routing

LarePAY automatically identifies the lowest-cost payment path. Crypto-paying customers? Processed on-chain with minimal fees. Card customers? Competitive rates without the typical markup stack.

2. Stablecoin Settlement Options

Choose to settle in USD, crypto, or a mix. Stablecoin settlements (USDC, USDT) eliminate volatility concerns while keeping fees rock-bottom.

3. No Hidden Costs

Traditional processors love hiding fees in the fine print. Assessment fees. Batch fees. Statement fees. PCI non-compliance fees.

LarePAY keeps it simple. Transparent pricing. No surprises.

4. Instant Settlement

Why wait 2-3 business days for your money? Crypto settlements can hit your wallet in minutes. Better cash flow. Less waiting.

The Onboarding Process: Easier Than You Think

"But switching payment processors is a nightmare."

Not with LarePAY.

Here's the reality:

Step 1: Sign Up

Create your account at Larecoin. Basic business info. Takes 5 minutes.

Step 2: Connect Your Accounts

Link your existing bank account for fiat settlements. Set up your crypto wallet for digital asset payments. Both options available: choose what works for you.

Step 3: Integrate

In-store: LarePAY POS terminal or tablet app

Online:CoinCheckout integration for e-commerce

Invoicing: Send crypto-enabled invoices directly

Step 4: Start Accepting Payments

That's it. You're live.

Most merchants complete setup in under 24 hours. No lengthy underwriting. No weeks of waiting.

Real Savings Breakdown

Let's get specific.

Scenario: Restaurant doing $50,000/month in sales

Traditional processing costs (2.6% average):

Monthly fees: $1,300

Annual fees: $15,600

With LarePAY (assuming 30% of customers pay crypto):

Crypto transactions (30%): ~$150/month at 1%

Card transactions (70%): ~$910/month at 2.6%

Monthly total: $1,060

Annual total: $12,720

Annual savings: $2,880

Now scale that. If crypto adoption among your customers grows to 50%? You're looking at $5,000+ in annual savings.

And that's conservative.

Who's Already Using Crypto Payments?

This isn't experimental anymore.

Microsoft accepts Bitcoin for Xbox and Windows purchases

AT&T processes crypto for bill payments

Whole Foods accepts Bitcoin via Flexa network

Overstock has accepted crypto since 2014

Major retailers. Tech companies. Service businesses. They've all figured out the cost advantage.

Small and mid-sized businesses are catching on too. Coffee shops. Restaurants. E-commerce stores. Professional service providers.

The early movers are winning on fees while competitors keep paying the interchange tax.

Addressing Common Concerns

"Crypto is too volatile."

Stablecoins solve this. USDC and USDT are pegged 1:1 to the US dollar. No volatility risk. Accept stablecoins, settle in stablecoins or convert instantly to fiat.

"My customers don't use crypto."

You'd be surprised. 40+ million Americans own cryptocurrency. And that number grows every year. Plus, with LarePAY, you're not forcing anyone: you're just adding an option.

"It's too complicated."

Ten years ago? Maybe. Today? Crypto payments are as simple as card payments. LarePAY handles the complexity. You just see the funds hit your account.

"What about taxes and accounting?"

LarePAY provides transaction reports compatible with standard accounting software. Every payment tracked. Every conversion documented. Your accountant will thank you.

Getting Started Today

Ready to stop overpaying on every transaction?

Here's your action plan:

The infrastructure is ready. The technology is proven. The savings are real.

The Bottom Line

Interchange fees are a legacy tax on your business.

Every percentage point matters. Every transaction adds up. And traditional payment processors have zero incentive to lower your costs.

Crypto payments flip the script.

Lower fees. Faster settlement. More payment options for your customers.

LarePAY makes it seamless. Accept crypto alongside cards and ACH. No either/or. No complex integration.

Just smarter payments and bigger margins.

Stop leaving money on the table. Set up LarePAY and start saving today.

Questions about LarePAY or crypto payment integration? Let's chat.

Comments