How to Reduce Merchant Interchange Fees by 50% Using a Receivables Token (Easy Guide for Small Businesses)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 1 day ago

- 4 min read

Small business owners. You're bleeding money.

Every swipe. Every tap. Every "card inserted successfully."

Interchange fees eat 2-4% of every transaction. That's thousands of dollars annually walking straight out your door. For a business doing $500K in sales? That's $10,000-$20,000 gone.

But here's the thing. There's a smarter way.

Receivables tokens. The Web3 solution that's slashing merchant fees by 50% or more.

Let's break it down.

What Are Interchange Fees (And Why They're Crushing Your Margins)

Traditional payment processing is a middleman circus.

Card networks. Issuing banks. Acquiring banks. Payment processors.

Everyone takes a cut.

The average interchange fee sits between 1.5% and 3.5% per transaction. Add network fees. Add processor markups. Suddenly you're looking at 4%+ disappearing on every sale.

For small businesses operating on tight margins? This is unsustainable.

The legacy payment system wasn't built for you. It was built for the banks.

Time to flip the script.

Enter Receivables Tokens: The 50% Fee Reduction Solution

Receivables tokens change everything.

Here's the simple version:

Instead of routing payments through traditional rails, receivables tokens represent the value of a transaction on the blockchain. Direct. Transparent. No middlemen stacking fees.

How it works:

Customer pays using crypto or stablecoin

Transaction mints a receivables token

Merchant receives funds directly to their wallet

Settlement happens in minutes, not days

The result? Transaction costs drop to gas fees only. We're talking fractions of a penny on efficient chains like Solana.

Compare that to your current processor taking 2.9% + $0.30 per transaction.

The math is simple. The savings are massive.

Why Larecoin's Receivables Token Beats the Competition

Not all crypto payment solutions are created equal.

Platforms like NOWPayments and CoinPayments? They still operate with custodial models. Your funds sit in their wallets. Their keys. Their rules.

Larecoin is different.

Here's what sets us apart:

Feature | Larecoin | NOWPayments | CoinPayments |

Self-custody | ✅ Yes | ❌ No | ❌ No |

Receivables tokens | ✅ Yes | ❌ No | ❌ No |

NFT receipts | ✅ Yes | ❌ No | ❌ No |

Gas-only transfers | ✅ Yes | ❌ No | ❌ No |

LUSD stablecoin | ✅ Yes | ❌ No | ❌ No |

NOWPayments charges 0.5-1% per transaction. CoinPayments takes 0.5%. Sounds low until you realize you're also giving up custody of your funds.

Larecoin? Gas-only fees. Full self-custody. Your keys. Your crypto. Your business.

NFT Receipts: More Than Just Proof of Payment

Every Larecoin transaction generates an NFT receipt.

Not a gimmick. A game-changer.

Here's the utility:

Immutable proof of purchase : No disputes. No chargebacks. Blockchain doesn't lie.

Customer loyalty programs : Track purchases automatically. Reward repeat buyers.

Warranty tracking : NFT receipt = permanent product history.

Tax documentation : Every transaction timestamped and verifiable.

For merchants, NFT receipts eliminate the chargeback nightmare that costs businesses $125 billion annually.

For customers, it's proof they can't lose. Stored forever on-chain.

Traditional receipts fade. Get lost. Get disputed.

NFT receipts are permanent.

LUSD Stablecoin: Volatility Protection Built In

Crypto payments scare some merchants. Volatility risk.

Accept Bitcoin today. It drops 10% tomorrow. You just lost money.

LUSD solves this.

Larecoin's stablecoin version maintains 1:1 USD peg. Accept payment. Know exactly what you're getting.

Benefits for small businesses:

Zero volatility exposure

Instant settlement

Direct fiat off-ramps when needed

Same low gas-only fees

You get the benefits of Web3 payments without the price swings.

Accept crypto confidently. Settle in stability.

Self-Custody: Why It's Non-Negotiable in Web3 Payments

Here's the uncomfortable truth about most crypto payment processors.

They hold your funds.

When you use custodial solutions, you're trusting a third party with your money. Same old banking model. Different technology.

Self-custody means:

Funds go directly to YOUR wallet

No withdrawal limits

No account freezes

No third-party risk

True financial sovereignty

Remember when PayPal froze merchant accounts? When processors held funds for "review"?

Self-custody eliminates that entirely.

With Larecoin, payments settle to your wallet. Period. No intermediary holding your revenue hostage.

This is what financial sovereignty looks like.

Step-by-Step: Setting Up Larecoin for Your Small Business

Ready to slash those interchange fees? Here's your action plan.

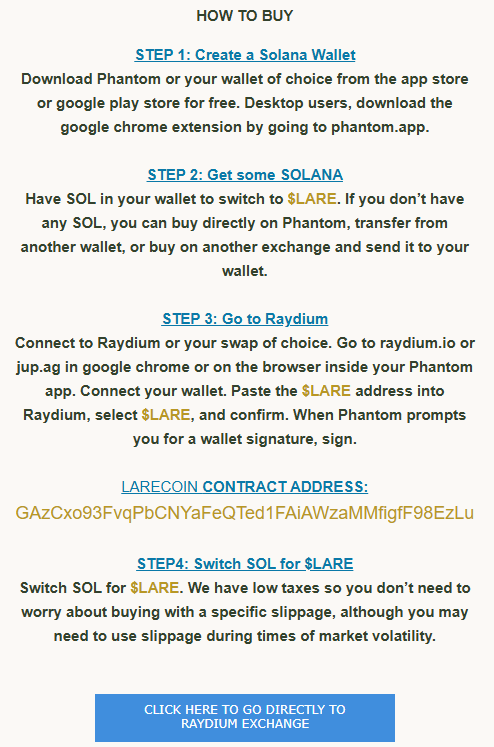

Step 1: Set Up Your Wallet

Download a Solana-compatible wallet. Phantom. Solflare. Your choice.

Write down your seed phrase. Store it safely. This is your key to self-custody.

Step 2: Visit Larecoin

Head to https://larecoin.com and explore the merchant solutions.

Step 3: Integrate Receivables Token Payments

Add Larecoin payment options to your checkout. Online. In-store. Metaverse. All supported.

Step 4: Accept Your First Payment

Customer pays. Receivables token mints. NFT receipt generates. Funds land in your wallet.

Gas fees only. No 2.9% processor cut.

Step 5: Track and Manage

All transactions visible on-chain. Complete transparency. No monthly statements to reconcile.

That's it. Five steps to 50%+ fee reduction.

The Real Numbers: What 50% Fee Reduction Looks Like

Let's run the math for a small business doing $250,000 in annual card sales.

Traditional Processing (2.9% + $0.30 avg):

Interchange fees: ~$7,250

Additional processor fees: ~$1,500

Total annual cost: $8,750+

Larecoin Receivables Tokens:

Gas fees at ~$0.001 per transaction

5,000 transactions annually = $5 in gas

Total annual cost: Under $100

Your savings: $8,650+

That's not 50%. That's 98%+ reduction.

And you're not sacrificing anything. Faster settlement. Better documentation. Full custody of funds.

Why Small Businesses Are Making the Switch Now

The Web3 payments revolution isn't coming. It's here.

Early adopters are already:

Keeping more revenue

Eliminating chargeback fraud

Building customer loyalty through NFT receipts

Operating with true financial independence

Competitors like NOWPayments and CoinPayments were a start. But they didn't go far enough. Still custodial. Still taking cuts.

Larecoin represents the next evolution. Full self-custody. Receivables tokens. NFT receipts. LUSD stability.

This is merchant growth through financial sovereignty.

Take Action Today

Every day you wait is another 2-4% walking out the door.

Interchange fees don't have to be a cost of doing business. Not anymore.

Receivables tokens offer a real alternative. A better alternative.

Visit https://larecoin.com to explore merchant solutions.

Join the community. Ask questions. Get started.

Your margins will thank you.

The future of payments is decentralized. Self-custodied. Fee-efficient.

The future is Larecoin.

Comments