How to Reduce Merchant Interchange Fees by 50% with a Receivables Token (Easy Guide for Small Business)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 3 days ago

- 4 min read

Interchange fees are killing your margins.

Every swipe. Every tap. Every online checkout. The card networks take their cut. We're talking 2-3% on every single transaction. For small businesses operating on thin margins? That's brutal.

But here's the thing. There's a better way. A Web3 way.

Enter the receivables token.

What Exactly Are Interchange Fees (And Why They Hurt)

Let's break it down real quick.

Interchange fees are what merchants pay to accept credit and debit cards. Visa, Mastercard, the issuing banks, they all get a piece of your revenue.

The damage:

Average interchange rate: 1.5% to 3.5%

Annual cost for small merchants: $5,000 to $50,000+

Hidden fees stacked on top: gateway fees, PCI compliance, chargebacks

Traditional payment processors love to bury these costs in confusing statements. You're paying. You just don't know how much.

For a coffee shop doing $500K annually? That's potentially $15,000 walking out the door. For a boutique? An e-commerce store? The numbers get ugly fast.

The Receivables Token Solution: How Larecoin Slashes Fees by 50%

Here's where things get interesting.

Larecoin isn't just another crypto payment option. It's a receivables token designed specifically for merchant commerce. The architecture eliminates the middlemen bleeding your revenue dry.

How it works:

Customer pays with Larecoin ecosystem tokens (LARE, LUSD)

Transaction settles directly to your self-custody wallet

No interchange. No processor markup. Just a minimal gas fee.

The result? Up to 50% reduction in payment processing costs.

That's not marketing fluff. That's math. When you remove Visa, Mastercard, and legacy processors from the equation, you keep more of what you earn.

The Larecoin Ecosystem: Your Complete Payment Stack

Let's talk about what makes this work.

LARE Token The native receivables token. Fast transfers. Low fees. Direct settlement.

LUSD Stablecoin Price stability meets crypto efficiency. Customers can pay without worrying about volatility. You receive dollar-pegged value.

LarePAY The merchant payment gateway. Accept crypto at checkout, online, in-store, or in the metaverse.

LareBlocks Transaction verification and settlement layer. Everything recorded. Everything auditable.

This isn't pieced-together infrastructure. It's a purpose-built ecosystem for merchant payments.

Self-Custody: Why Owning Your Money Matters

With traditional processors, your money sits in their accounts. They hold it. They control it. They decide when you get paid.

The Larecoin Smart Wallet changes everything.

Benefits of self-custody:

Funds settle directly to your wallet

No 2-3 day holds on your revenue

No frozen accounts or surprise reserves

Full control over your business treasury

24/7 access to your money

You earned it. You should own it. Period.

The Smart Wallet integrates seamlessly with LarePAY. Accept payment. Receive funds. No gatekeepers.

NFT Receipts: Your New Tax Season Best Friend

Here's where Larecoin gets really clever.

Every transaction generates an NFT receipt. Yes, really.

Why this matters for your business:

Immutable record-keeping: Every sale permanently recorded on-chain

Automatic categorization: Transaction metadata built right in

Tax-ready documentation: Export-friendly for your accountant

Audit-proof history: No lost receipts. No missing paperwork.

Traditional POS systems lose data. Paper receipts fade. Spreadsheets get corrupted.

NFT receipts? Permanent. Verifiable. Searchable.

Come April, your bookkeeper will thank you.

QR-Generated POS: Accept Crypto in 60 Seconds

No expensive terminals. No complicated hardware setup. No monthly rental fees.

Larecoin's QR-generated POS system turns any device into a payment terminal.

Setup process:

Open your merchant portal

Generate transaction QR code

Customer scans and pays

Funds hit your wallet

That's it. Your smartphone becomes a crypto-ready point-of-sale.

Works for:

Pop-up shops and markets

Food trucks

Service businesses

Retail stores

Online checkout

The flexibility is unmatched. Accept payments anywhere. No contracts. No equipment leases.

Larecoin vs. The Competition: Real Talk

Let's compare. Because you've got options, and you should know the differences.

NOWPayments

Solid crypto payment processor. Wide coin support. But here's the catch: they're still a middleman. Your funds flow through their system. Their custody. Their timeline.

Processing fees: 0.5-1% Custody: Third-party Settlement speed: Varies

CoinPayments

Been around since 2013. Supports hundreds of coins. Established reputation.

Downsides? Complex fee structure. Legacy architecture. Not built for the modern merchant experience.

Processing fees: 0.5% + network fees Custody: Third-party (optional self-custody) Settlement speed: Network-dependent

Triple-A

Focuses on enterprise clients. Good for big businesses with dedicated integration teams.

For small businesses? Overkill. Overcomplicated. Overpriced.

Processing fees: Custom/negotiated Custody: Third-party Settlement speed: Variable

Larecoin

Purpose-built receivables token ecosystem.

Processing fees: Minimal gas only Custody: Full self-custody via Smart Wallet Settlement speed: Near-instant Bonus features: NFT receipts, QR POS, LUSD stablecoin

The architecture difference matters. Larecoin removes friction, not adds it.

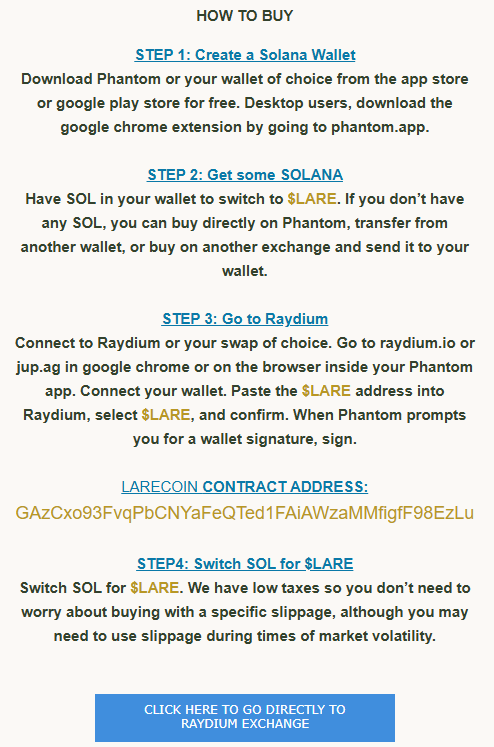

Step-by-Step: Getting Started with Larecoin Payments

Ready to cut those interchange fees in half? Here's your roadmap.

Step 1: Set Up Your Smart Wallet

Download the Larecoin Smart Wallet. Create your self-custody wallet. Secure your recovery phrase.

Step 2: Register as a Merchant

Access the merchant portal and complete business verification. Fast process. No lengthy underwriting.

Step 3: Configure LarePAY

Connect your wallet to LarePAY. Set up your payment preferences. Choose which tokens you'll accept (LARE, LUSD, or both).

Step 4: Generate Your QR POS

Create your first payment QR code. Test a small transaction. Verify funds hit your wallet.

Step 5: Start Accepting Payments

You're live. Every transaction saves you money versus traditional card processing.

The Math That Matters

Let's run the numbers.

Scenario: $30,000/month in card sales

Traditional processing (2.5% average):

Monthly fees: $750

Annual fees: $9,000

Larecoin processing (gas fees only):

Monthly fees: ~$150-200

Annual fees: ~$1,800-2,400

Annual savings: $6,600-7,200

That's real money. Money you can reinvest in inventory, marketing, or your team.

Scale it up. $100K monthly volume? You're looking at $20,000+ in annual savings.

Why Small Businesses Are Making the Switch

The early adopters get it.

Lower fees mean better margins

Faster settlement means better cash flow

Self-custody means real ownership

NFT receipts mean simpler accounting

QR POS means zero hardware costs

The legacy payment system was designed to extract value from merchants. Every layer takes a cut.

Larecoin was designed to return that value.

Your Next Move

Interchange fees don't have to eat your profits.

The technology exists. The ecosystem is live. The savings are real.

Small businesses running on Larecoin keep more of every dollar earned. It's that simple.

Check out larecoin.com to explore the ecosystem. Join the community forums for updates and support.

Your margins will thank you.

Comments