How to Reduce Merchant Interchange Fees by 50%+ with Self-Custody Crypto Payments (No Traditional Processors Needed)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Your business is bleeding money every time a customer swipes a card.

Traditional payment processors are taking 2.5-3.5% of every transaction. That's $2,500 to $3,500 monthly on $100K revenue. $34,800 annually.

Self-custody crypto payments cut that to under $1,200 per year. Same revenue. 97% less in fees.

Here's exactly how it works: and why Larecoin is the smartest way to do it in 2026.

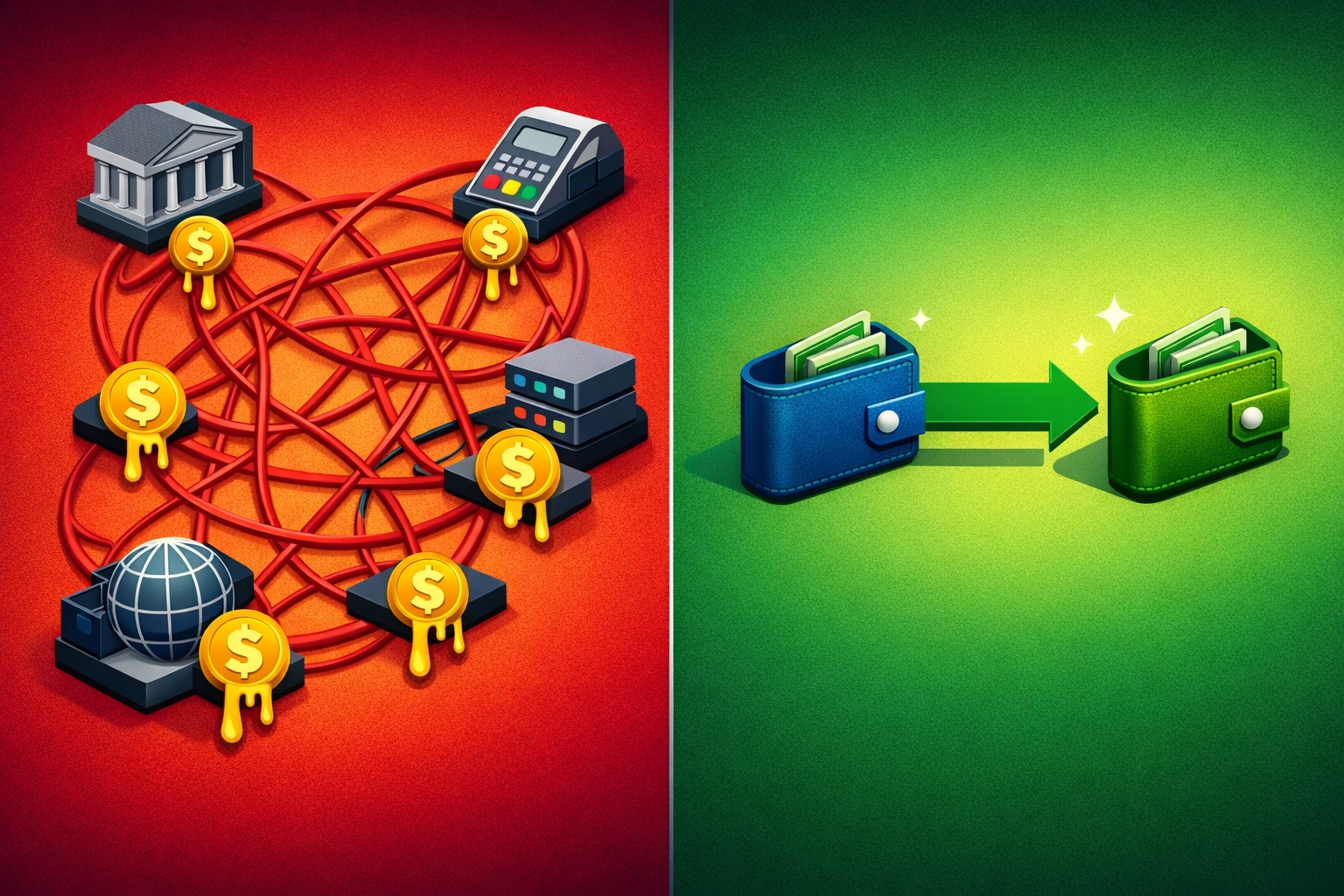

The Traditional Payment Processing Trap

Every credit card transaction passes through multiple intermediaries:

Acquiring bank

Card network (Visa, Mastercard)

Issuing bank

Payment gateway

Payment processor

Each one takes a cut. Each one adds delay. Each one holds power over your funds.

Cross-border? Add another 6-12% in currency conversion and international fees.

Chargebacks? That's $125 billion in annual merchant losses. Plus $15-100 per dispute.

You don't own the rails. You're just renting permission to receive money.

Self-Custody: Direct Wallet-to-Wallet Freedom

Self-custody eliminates every middleman.

Customer scans QR code. Crypto goes from their wallet to yours. Transaction confirms on-chain. Funds arrive instantly.

No intermediaries. No permission. No holds.

Only cost? Blockchain gas fees. Usually $0.001 to $0.10 per transaction: regardless of amount.

$10 payment? $0.05 fee. $10,000 payment? $0.05 fee.

Traditional processor would charge $25 to $350 on that $10K transaction. Self-custody? Five cents.

Real Numbers: Fee Comparison Breakdown

Let's get specific.

Monthly revenue: $100,000

Traditional payment processing:

2.9% average fee rate

$2,900 monthly cost

$34,800 annual cost

Self-custody crypto payments:

$0.05 average gas fee per transaction

1,000 monthly transactions

$50 monthly cost

$600 annual cost

Savings: $34,200 per year. 98.3% reduction.

Scale that to $500K monthly? You're saving $171,000 annually.

International payments? Same gas fee. No currency conversion markup. No international processing fees.

Settlement? Instant. Not 3-5 business days.

Chargebacks? Zero. Blockchain transactions are irreversible once confirmed.

Why Larecoin Beats NOWPayments and CoinPayments

Other crypto payment processors still act like middlemen.

NOWPayments:

0.5-1% transaction fee

Custodial by default

They control your funds

Limited blockchain support

No integrated stablecoin ecosystem

CoinPayments:

0.5% transaction fee

Custodial wallet model

They hold your private keys

Settlement delays for verification

No NFT receipt integration

Larecoin:

Zero transaction fees beyond gas

True self-custody: you control private keys

Multi-chain support (Solana, Binance, Ethereum)

LUSD stablecoin integration for zero volatility

NFT receipts automatically generated

Rigorous US compliance (MSB + state MTL strategy)

You're not replacing Visa with another centralized processor. You're eliminating the entire concept of payment processing.

LUSD: The Stablecoin Advantage

Accepting crypto doesn't mean accepting volatility.

Larecoin's ecosystem includes LUSD: a fully-backed stablecoin pegged 1:1 to USD.

Customers pay in LUSD. You receive LUSD. No price fluctuation between checkout and settlement.

Benefits:

Predictable accounting

No conversion headaches

Same fee savings as crypto

Instant settlement like crypto

Dollar stability like fiat

Accept Bitcoin or Ethereum if customers prefer. Instantly swap to LUSD if you want stability. Everything happens on-chain with transparent, auditable transactions.

Traditional stablecoins like USDC? Still require centralized processors for merchant adoption. LUSD integrates directly into Larecoin's self-custody infrastructure.

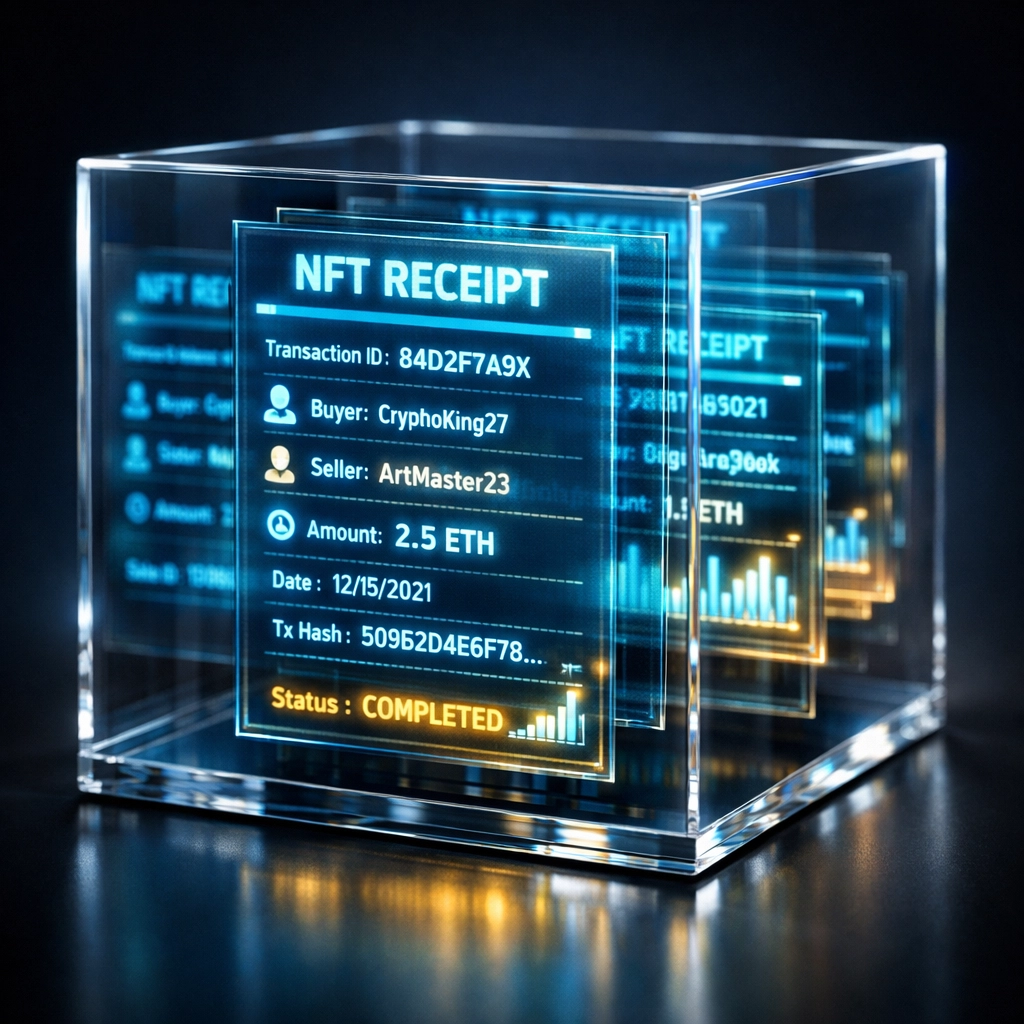

NFT Receipts: Permanent Transaction Records

Every Larecoin payment generates an NFT receipt.

Permanent. Immutable. Stored on-chain.

Contains:

Transaction timestamp

Amount paid

Wallet addresses

Product details

Tax-relevant metadata

Benefits for merchants:

Audit Trail: Every transaction verifiable on blockchain. No missing records. No altered receipts.

Tax Compliance: Automatic documentation for reporting. Export data directly to accounting software.

Dispute Resolution: Immutable proof of payment. Customer can't claim they didn't receive goods after blockchain confirms delivery.

Customer Loyalty: NFT receipts double as collectibles. Add exclusive perks, discounts, or membership benefits to receipt NFTs.

Traditional processors give you CSV exports and hope nothing corrupts. Larecoin gives you cryptographic proof.

US Compliance: Actually Legal and Above Board

Most crypto payment solutions operate in regulatory gray zones.

Larecoin doesn't.

Money Services Business (MSB) Registration: Fully registered with FinCEN. Complete anti-money laundering (AML) and know-your-customer (KYC) protocols.

State Money Transmitter Licenses (MTL): Active licensing strategy across US states. Not dodging regulators: partnering with them.

Why this matters:

Your business stays compliant

No surprise regulatory shutdowns

Protection from future enforcement actions

Institutional credibility for B2B adoption

Compare to offshore processors or unlicensed platforms. Larecoin builds for the long term. Not just the crypto-native early adopters.

2026 is the year regulators close loopholes. Be positioned with compliant infrastructure before they do.

Setup Takes 20 Minutes

Getting started is stupid simple.

Step 1: Create Master Wallet (10 minutes)

Generate self-custody wallet through Larecoin platform. Write down private keys. Store securely.

You're done with the hard part.

Step 2: Configure Business Settings (5 minutes)

Add business details. Set default currencies (LUSD, BTC, ETH, SOL). Enable NFT receipt generation.

Step 3: Generate Payment QR Codes (2 minutes)

Fixed amount codes for standard products. Variable amount codes for custom transactions. Point-of-sale integration or website embed.

Step 4: Process Test Transaction (1 minute)

Send $1 from a test wallet. Confirm receipt. Verify NFT receipt generation.

Live.

No credit checks. No approval waiting periods. No application review. No account holds.

You control the infrastructure from minute one.

Integration Options

WordPress: Direct plugin. Install, connect wallet, activate.

Shopify: Native app in marketplace. One-click integration.

WooCommerce: Extension with automatic cart integration.

Custom builds: RESTful API with detailed documentation.

Run parallel with traditional payment processors during transition. Compare actual savings. Scale crypto adoption as you see results.

Most merchants keep traditional options for customers who aren't crypto-ready. But every crypto transaction saves you 97% in fees.

The Cross-Border Advantage

International payments cost the same as local ones.

Customer in Tokyo? Same gas fee as customer in Texas.

No currency conversion markups. No international processing fees. No correspondent banking delays.

Traditional processors charge:

3-5% international fee

2-4% currency conversion

1-3% exchange rate markup

Combined: 6-12% per transaction. Plus 5-10 day settlement.

Larecoin: $0.05 gas fee. Instant settlement.

Global commerce becomes local commerce. No friction. No borders. No middlemen extracting rent.

Security and Control

Self-custody means you hold the keys.

No processor can:

Freeze your account

Hold funds arbitrarily

Change fee structures unilaterally

Terminate service without warning

Share your transaction data with third parties

Traditional processors do all of these. Regularly.

With Larecoin, your funds are yours. Always accessible. Always under your control.

Standard security practices:

Hardware wallet integration

Multi-signature support for team accounts

Cold storage options for reserves

Transaction whitelisting for additional protection

You're not trusting a company. You're trusting math and cryptography.

The 4-Week Implementation Timeline

Week 1: Setup

Generate wallet

Secure private keys

Configure payment settings

Connect to existing e-commerce platform

Week 2: Testing

Process test transactions

Train staff on QR code checkout

Verify settlement flows

Test NFT receipt generation

Week 3: Deployment

Launch QR codes at physical locations

Activate website integration

Announce crypto payment option to customers

Monitor initial transactions

Week 4: Optimization

Compare fee savings vs. traditional processors

Adjust LUSD vs. crypto ratios

Refine checkout flow based on customer feedback

Scale adoption with confidence

Keep traditional payment methods active. No need to force customers. But every crypto transaction saves you money.

After four weeks, you'll have real data showing exact savings. Most merchants never look back.

Why 2026 Is the Inflection Point

Crypto payments are hitting mainstream adoption.

420 million crypto users globally

Institutional infrastructure finally mature

Regulatory clarity emerging in major markets

Consumer familiarity with wallet apps increasing

Web3 commerce ecosystem fully formed

You can stay on Visa's rails and keep paying 3% forever.

Or you can own your payment infrastructure and keep 97% of those fees.

Traditional processors built monopolies when there was no alternative.

Self-custody crypto payments are that alternative.

Larecoin makes it simple. Compliant. And profitable.

Ready to stop paying interchange fees? Your wallet's waiting at larecoin.com.

The future of payments isn't processed. It's peer-to-peer.

Comments