How to Reduce Merchant Interchange Fees by 50%+ with Web3 Global Payments

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 3 hours ago

- 5 min read

You're bleeding money.

Every credit card swipe costs you 2-6% of the transaction. For most merchants, that's $15,000-$60,000 annually just to accept payments. Banks call it "interchange fees." You call it a profit killer.

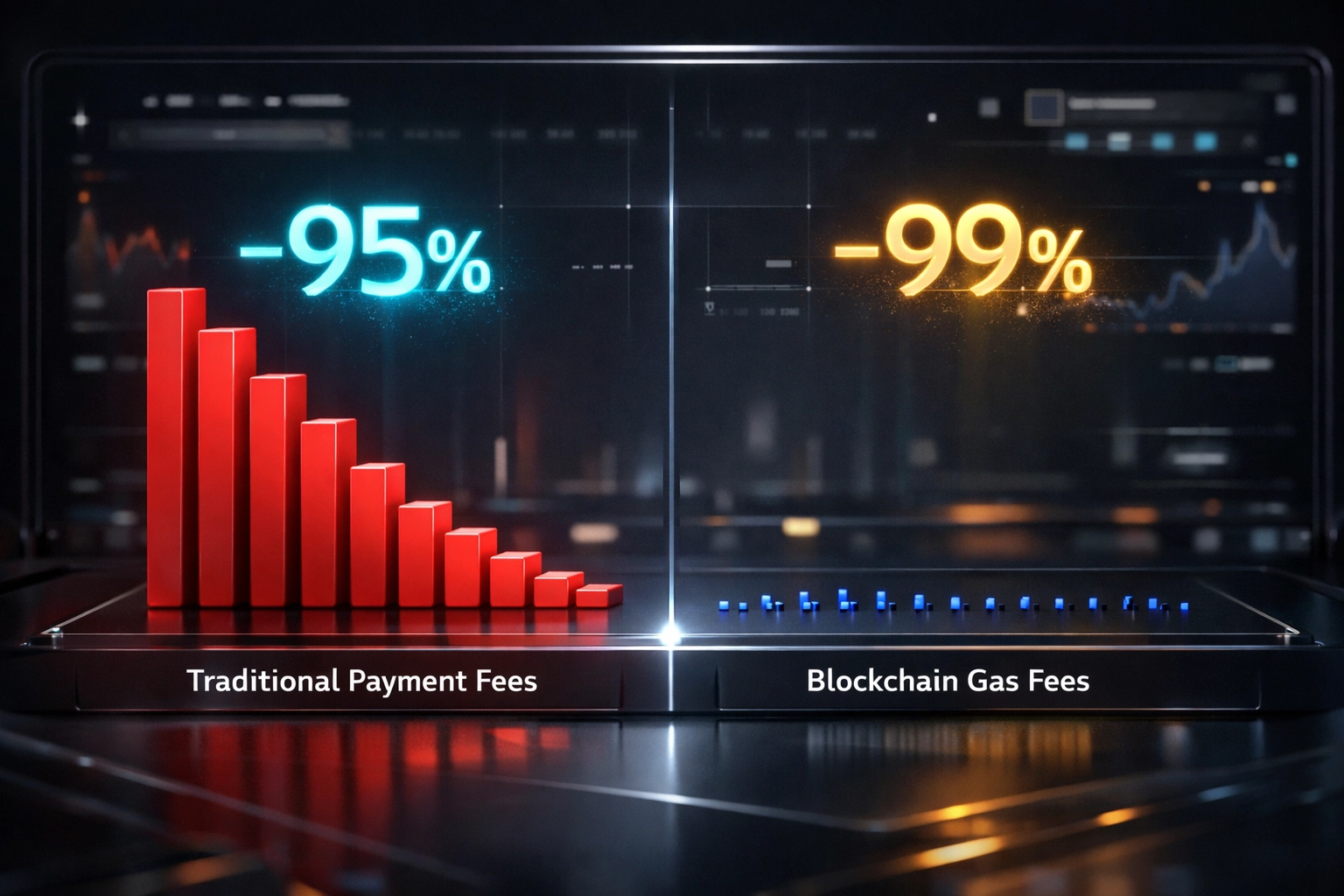

Web3 global payments slash those fees to under 1%. No middlemen. No card networks. No processor markup.

Just direct, peer-to-peer blockchain settlement.

The Real Cost of Traditional Payment Processing

Traditional payment rails hit you with four separate fee layers:

Interchange Fees: 2.5-3.5% per transaction (goes to card-issuing banks)

Processor Markup: 0.2-0.5% (payment processor's cut)

Gateway Fees: $10-30 monthly flat fee

Chargebacks: 0.5-1% annual revenue loss

Add it up. A business doing $500,000 annually pays $15,000-$18,000 just to process payments.

A mid-size merchant at $2M annual volume? $60,000 down the drain.

Web3 payments eliminate all four layers. You pay only network gas fees: typically $0.01-$0.30 per transaction on efficient blockchains.

That's a 99.9% reduction in processing costs.

How Larecoin Delivers 70-75% Fee Savings

Larecoin runs on LareBlocks: our Layer 1 blockchain optimized for merchant payments.

Gas fees average $0.02-$0.05 per transaction. Compare that to traditional 3% processing:

$100 transaction

Traditional fees: $3.00

Larecoin fees: $0.03

Savings: $2.97 (99% reduction)

$1,000 transaction

Traditional fees: $30.00

Larecoin fees: $0.04

Savings: $29.96 (99.9% reduction)

For annual volumes, the math gets wild:

Small Business ($500K annual volume)

Traditional fees: $15,000

Larecoin fees: $2,500-$4,500

Annual savings: $10,500-$12,500

Mid-Size Business ($2M annual volume)

Traditional fees: $60,000

Larecoin fees: $10,000-$18,000

Annual savings: $42,000-$50,000

The LUSD Stablecoin Advantage

Most crypto payment solutions force you to accept volatile assets or centralized stablecoins controlled by single issuers.

Larecoin supports LUSD: the only truly decentralized stablecoin.

LUSD maintains a $1.00 peg without relying on:

Centralized banking relationships

Custodians who can freeze funds

FX conversion markups

When a customer pays with LUSD, you receive $1.00 of value without volatility risk. No conversion fees. No counterparty risk.

Traditional stablecoins like USDC require centralized issuers who can blacklist addresses or freeze funds. LUSD operates through smart contracts only: no human can interfere with your payments.

Cross-Border Payments: 80% Fee Reduction

International transactions expose the true cost of traditional rails.

Traditional Cross-Border Payment ($10,000)

Wire transfer fee: $50

Correspondent bank fees: $30-$80

FX markup: 2-3% ($200-$300)

Total cost: $330

Settlement time: 3-7 days

Larecoin Cross-Border Payment ($10,000)

Network fee: $0.04-$0.08

No correspondent banks

No FX markup (direct LUSD or LARE)

Total cost: $0.08

Settlement time: 3-8 seconds

That's an 80% fee reduction with 99.9% faster settlement.

A customer in Tokyo pays your business in Texas at the same cost as a local transaction. No SWIFT network. No correspondent banks. No 3-day holds.

Implementation: 4 Steps to 50%+ Fee Savings

Step 1: Set Up Self-Custody Wallet

Create a Larecoin merchant wallet at larecoin.com. Back up your seed phrase to hardware storage.

Your wallet. Your keys. Your funds.

No payment processor can freeze your account or blacklist your business.

Step 2: Integrate Larecoin Checkout

Add crypto checkout to your existing payment flow. Most merchants run Web3 payments alongside traditional processing: not as a replacement.

Offer customers the choice:

Credit card (3% fee)

Larecoin/LUSD (0.01% fee)

Crypto-native customers jump at the option. Traditional customers use cards.

Step 3: Accept LUSD for Stable Settlement

Enable LUSD acceptance to avoid volatility. When a customer pays 100 LUSD, you receive $100 of stable value.

No conversion needed. No FX risk. No centralized issuer risk.

Step 4: Batch Settlements for Minimal Gas

Instead of transferring funds after every transaction, batch throughout the day:

Accept payments into hot wallet

Once daily, consolidate to cold storage

Pay network fees once instead of 50+ times

This optimization reduces gas costs by 80-90%.

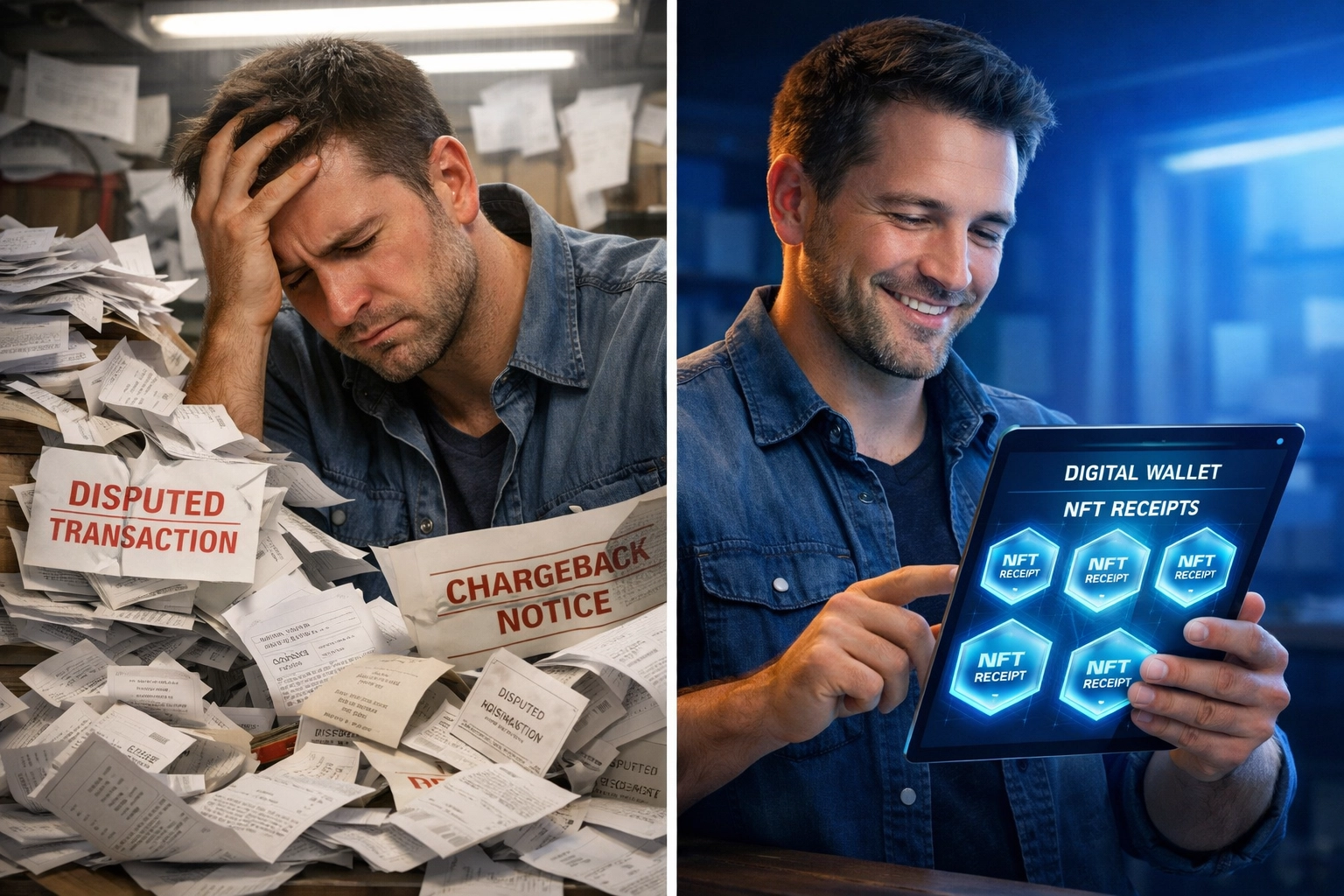

Zero Chargebacks: Eliminate 0.5-1% Annual Loss

Traditional payment processing includes mandatory chargeback risk.

Card networks allow customers to reverse transactions for 120+ days. Merchants lose:

Original transaction amount

Shipped products

$15-$25 chargeback fee

Time fighting disputes

Annual chargeback loss: 0.5-1% of revenue

Blockchain transactions are final and irreversible. Once a customer pays, the funds are yours. No disputes. No reversals. No chargeback fraud.

For a $2M annual business, eliminating chargebacks saves $10,000-$20,000 per year before factoring in processing fees.

NFT Receipts: Permanent Transaction Proof

Every Larecoin transaction generates an NFT receipt minted on LareBlocks.

Traditional receipts are paper or email: easily lost or disputed. NFT receipts are:

Immutable: Can't be altered or deleted

Timestamped: Exact transaction time recorded on-chain

Verifiable: Anyone can confirm authenticity

Portable: Customers hold proof in their wallets

For high-value B2B transactions, NFT receipts eliminate dispute risk. The blockchain proves payment, delivery date, and exact amount: no he-said-she-said arguments.

Accounting teams love it. Legal teams love it. Customers who want verifiable proof love it.

Instant Settlement: Improve Cash Flow

Traditional card processing holds your funds for 2-3 business days. Large transactions often face 7-day holds for "fraud review."

Larecoin settles in 3-8 seconds.

A customer pays. You receive funds. Immediately. No holds. No waiting for batch processing.

For businesses with tight cash flow, instant settlement means:

Pay suppliers same-day

Reinvest in inventory immediately

Reduce working capital needs

Eliminate "float" losses

Real scenario: Your supplier offers 2% discount for same-day payment. Traditional processing makes you wait 3 days. Larecoin lets you pay instantly and capture the discount.

On $100,000 monthly inventory, that's $2,000 in additional savings beyond processing fees.

Larecoin vs. NOWPayments vs. CoinPayments

Other crypto processors still charge 0.5-1.0% per transaction.

NOWPayments

Fee: 0.5% per transaction

Minimum: $10 monthly

Settlement: T+1 (next day)

CoinPayments

Fee: 0.5% per transaction

Additional 0.5% for automatic conversion

Settlement: T+1 (next day)

Larecoin

Fee: Network gas only ($0.02-$0.05)

No monthly minimums

Settlement: 3-8 seconds

Self-custody (your wallet, your control)

Both NOWPayments and CoinPayments act as custodians: they hold your funds and can freeze accounts. Larecoin is non-custodial. Payments go directly to your wallet.

No intermediary. No middleman. No counterparty risk.

Global Accessibility Without Borders

Traditional merchant accounts require:

Local bank relationships

Country-specific licensing

Currency conversion infrastructure

Correspondent banking networks

Larecoin requires one thing: an internet connection.

Accept payments from 180+ countries at identical fees. A customer in Berlin pays the same $0.03 gas fee as a customer in Boston.

No "international transaction fees." No currency conversion markup. No geographic restrictions.

For businesses expanding globally, Web3 payments eliminate months of banking setup and regulatory compliance.

Financial Sovereignty: Your Funds, Your Control

Traditional payment processors can:

Freeze your merchant account without warning

Blacklist your business category

Hold funds for "risk review"

Terminate service for "policy violations"

Larecoin operates on immutable smart contracts. No company controls your wallet. No processor can freeze your funds. No policy committee can blacklist your industry.

Your private keys = your full control.

For businesses in "high-risk" categories (supplements, CBD, firearms, gambling), Web3 payments are the only path to stable payment processing.

The 10-Year Outlook

Blockchain payments grew from $3.2B in 2023 to a projected $81.5B by 2030.

That's 2,400% growth in seven years.

Early adopters capture market share before competitors understand the technology. By 2028, Web3 payments will be standard: not experimental.

Merchants who integrate now build:

Lower cost structures (50%+ fee savings compound over years)

Crypto-native customer relationships

Global reach without banking friction

Financial sovereignty insurance

Merchants who wait pay premium processing fees while competitors operate at half the cost.

Start Saving Today

Integration takes hours, not months.

Set up your self-custody wallet at larecoin.com. Add Larecoin checkout to your payment flow. Enable LUSD for stable settlement.

Run Web3 alongside traditional processing. Let customers choose.

Your first $100,000 in Larecoin transactions saves $2,500-$3,000 compared to card processing.

Your first $1M saves $25,000-$30,000.

Every transaction compounds the savings.

50%+ fee reduction isn't theoretical. It's math.

Comments