How to Reduce Merchant Interchange Fees by 50%+ Without Sacrificing Security

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

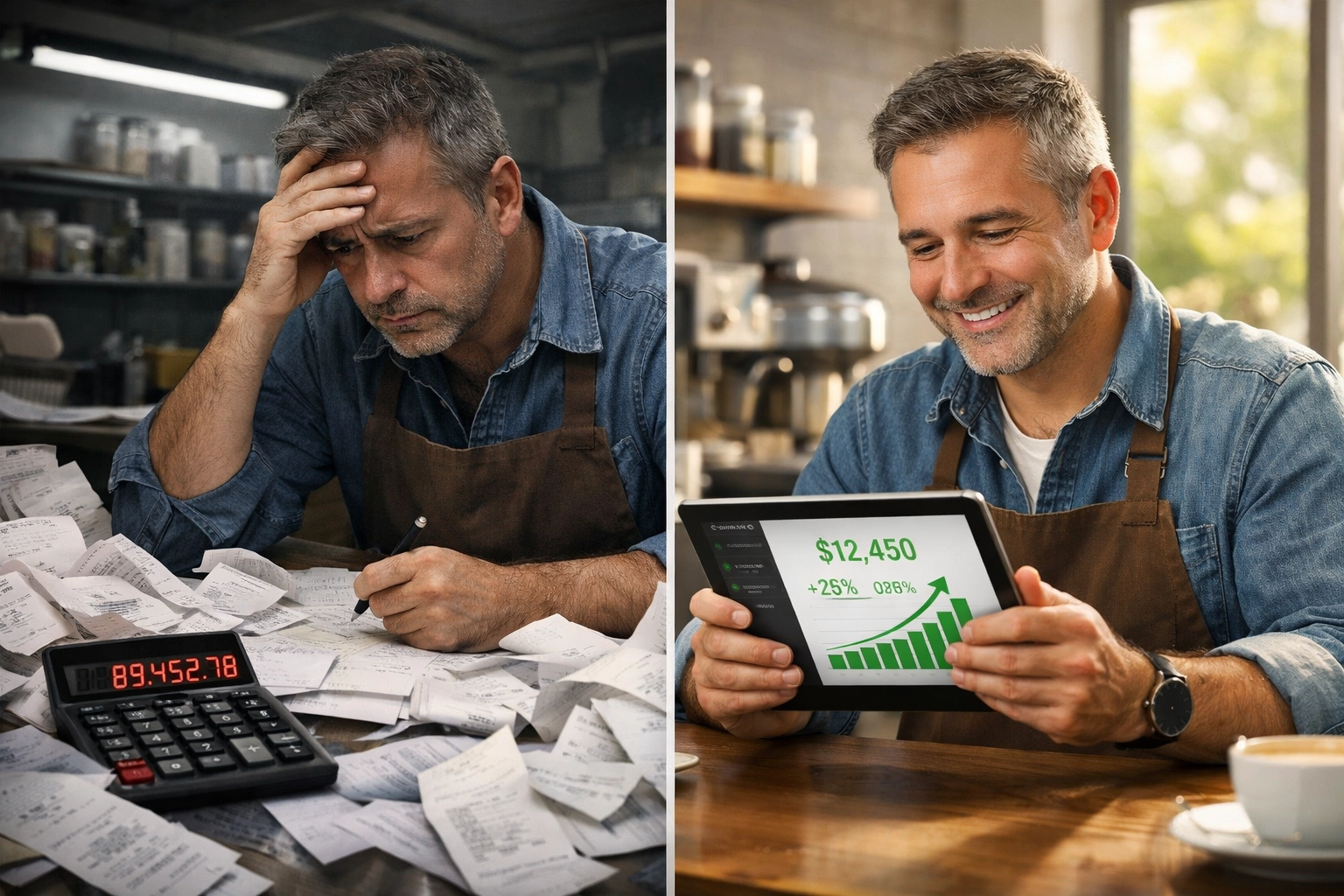

The 3% Tax Killing Your Margins

Every swipe. Every tap. Every online checkout.

Card processors take their cut. 2.9% to 3.5% plus transaction fees. For what? Moving digits between accounts.

That $50,000 monthly revenue? You're handing $1,500 to Visa and Mastercard. Every single month.

$18,000 annually. Gone.

Traditional payment processors built their empires on these fees. They convinced merchants this was "the cost of doing business."

It's not.

The Blockchain Loophole

Web3 payments slash interchange fees to under 0.5%. Sometimes under 0.1%.

No intermediaries. No card networks. No permission required.

Direct wallet-to-wallet transfers. Peer-to-peer. Merchant-to-customer.

The infrastructure exists. The technology works. The savings are real.

How Larecoin Eliminates 95% of Processing Fees

Traditional route: Customer → Bank → Card Network → Payment Processor → Your Account

Blockchain route: Customer Wallet → Your Wallet

Five steps become two. Five fee layers become one network fee.

Settlement time? Milliseconds instead of 2-3 business days.

Your funds. Your custody. Your control.

NFT Receipts: The Security Upgrade Nobody Talks About

Card processors charge 3% for "security." What security?

Chargebacks happen. Fraud happens. Disputes happen.

NFT receipts change everything.

Each transaction mints an immutable, on-chain proof of purchase. Timestamped. Verified. Permanent.

No he-said-she-said disputes. The blockchain doesn't lie.

Customer claims they didn't receive the product? Check the NFT. Delivery confirmed. Case closed.

Chargebacks become mathematically impossible. Every transaction carries cryptographic proof.

This isn't theoretical. This is live. This is happening now.

Self-Custody: Why Giving Up Control Costs You Money

Payment processors hold your funds. They control settlement timing. They freeze accounts on a whim.

Self-custody flips the script.

Your wallet. Your private keys. Your assets.

No holds. No freezes. No "we'll review your account in 3-5 business days."

Instant access. Complete control. True ownership.

Larecoin's merchant wallets give you full custody while maintaining enterprise-grade security. The best of both worlds.

LUSD: The Stablecoin Merchants Actually Want

"But crypto is volatile!"

Not anymore.

LUSD maintains dollar parity without the centralized risk of USDT or USDC.

Fully decentralized. Fully collateralized. Fully transparent.

Accept LUSD payments. Hold value. Convert when you want. Not when a processor decides.

Price today equals price tomorrow. Stability without sacrifice.

Merchants using LUSD report zero volatility concerns. The stablecoin just works.

Larecoin vs NOWPayments vs CoinPayments

Let's get specific.

NOWPayments:

Transaction fees: 0.5%

Custody: They hold your crypto initially

NFT receipts: Not available

Settlement control: Limited

CoinPayments:

Transaction fees: 0.5%

Monthly minimums: Required for some features

Self-custody: Optional, not default

Accounting integration: Basic

Larecoin:

Network fees: Under 0.1%

Custody: Self-custody by default

NFT receipts: Built-in for every transaction

Settlement: Instant, always

LUSD integration: Native support

The difference? Philosophy.

NOWPayments and CoinPayments replicate traditional payment processors using crypto rails. Same centralized model. Different technology.

Larecoin embraces true decentralization. No middleman. No markup. No permission.

Real Numbers: What You Actually Save

$50,000 monthly revenue example:

Traditional card processing (3%):

Monthly fees: $1,500

Annual fees: $18,000

Your actual revenue: $582,000

Larecoin blockchain payments (0.1%):

Monthly fees: $50

Annual fees: $600

Your actual revenue: $599,400

Difference: $17,400 saved annually.

That's not a typo. That's your money staying in your business.

Scale those numbers. $100,000 monthly? Save $34,800 yearly. $500,000 monthly? Save $174,000.

The math doesn't lie.

Security Without the Security Theater

"Lower fees mean lower security."

False narrative pushed by legacy processors.

Blockchain security comes from cryptography. From decentralization. From transparency.

Every transaction verified by thousands of nodes. Every record immutable. Every transfer traceable.

Traditional processors use security as a marketing term. Blockchain makes security a mathematical guarantee.

Smart contracts execute exactly as programmed. No human error. No fraud. No exceptions.

The code is the security.

The Migration Path for Existing Merchants

Switching payment processors feels risky. Change is hard.

Here's the reality:

Week 1: Set up your Larecoin merchant wallet (10 minutes) Week 2: Add crypto payment option alongside cards Week 3: Monitor adoption and savings Week 4: Evaluate results

You don't flip a switch. You test. You validate. You expand.

Many merchants run dual systems initially. Cards for resistant customers. Crypto for everyone else.

Over time, the savings speak. Customers adapt faster than expected.

Some merchants report 40% crypto adoption within 90 days. The momentum builds naturally.

What About Customer Adoption?

"My customers don't use crypto."

Yet.

2026 crypto wallet penetration exceeds 15% in North America. Higher in younger demographics.

But here's the secret: You don't need 100% adoption to save money.

Even 20% crypto payment volume cuts your overall processing fees by 15%+.

Every crypto transaction that replaces a card transaction is pure margin recovery.

Customers with wallets actively seek merchants accepting crypto. You become discoverable to a growing market segment.

Early adopters spend more. Tech-savvy customers bring higher lifetime value.

The ROI compounds.

The Independence Factor

Beyond fees. Beyond security. Beyond savings.

This is about independence.

Your business. Your rules. Your infrastructure.

No payment processor suspending your account because of "high risk" industry classification.

No sudden policy changes forcing compliance.

No account reviews holding your revenue hostage.

Blockchain payments can't be deplatformed. Can't be censored. Can't be controlled by any central authority.

True merchant freedom. True financial sovereignty.

That's worth more than percentage points.

Implementation Reality Check

Most merchants go live in under 30 minutes.

Create wallet. Share payment address. Accept crypto. That's it.

Advanced features: NFT receipts, LUSD auto-conversion, accounting integration: layer on gradually.

The barrier to entry is gone. The technology works. The savings are immediate.

What Happens Next

Traditional payment processors see the writing on the wall. They're building crypto divisions. Adding blockchain features.

Too late.

The infrastructure shifted. The merchant community awakened. The alternatives exist.

You can keep paying 3%. Keep waiting 3 days for settlement. Keep accepting the status quo.

Or you can join Larecoin and keep your money.

The choice scales. The savings compound. The freedom matters.

Every transaction you process through traditional rails is revenue you're donating to card networks.

Stop donating. Start keeping.

Your business deserves better margins. Your customers deserve better options. Your future deserves better infrastructure.

The 50% fee reduction isn't the ceiling. It's the floor.

Some merchants reduce fees by 90%. Some effectively eliminate processing costs entirely.

The tools exist. The technology works. The community grows.

Your move.

Comments