Stop Wasting 3%+ on Payment Processing: Try These 5 Self-Custody Crypto Payment Hacks (LUSD Stablecoin Included)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Payment processors are bleeding your business dry.

3% here. Gateway fees there. Monthly subscriptions. Chargeback penalties. Cross-border markups. It adds up fast.

You're not running a charity for Visa, Mastercard, and their payment processor friends.

Self-custody crypto payments flip the script. No middlemen. No percentage cuts. Just network gas fees: often under $0.10 per transaction regardless of amount.

Here's how smart merchants are cutting payment costs by 50-97% while maintaining complete control of their funds.

Hack #1: Eliminate Intermediaries with Direct Wallet Payments

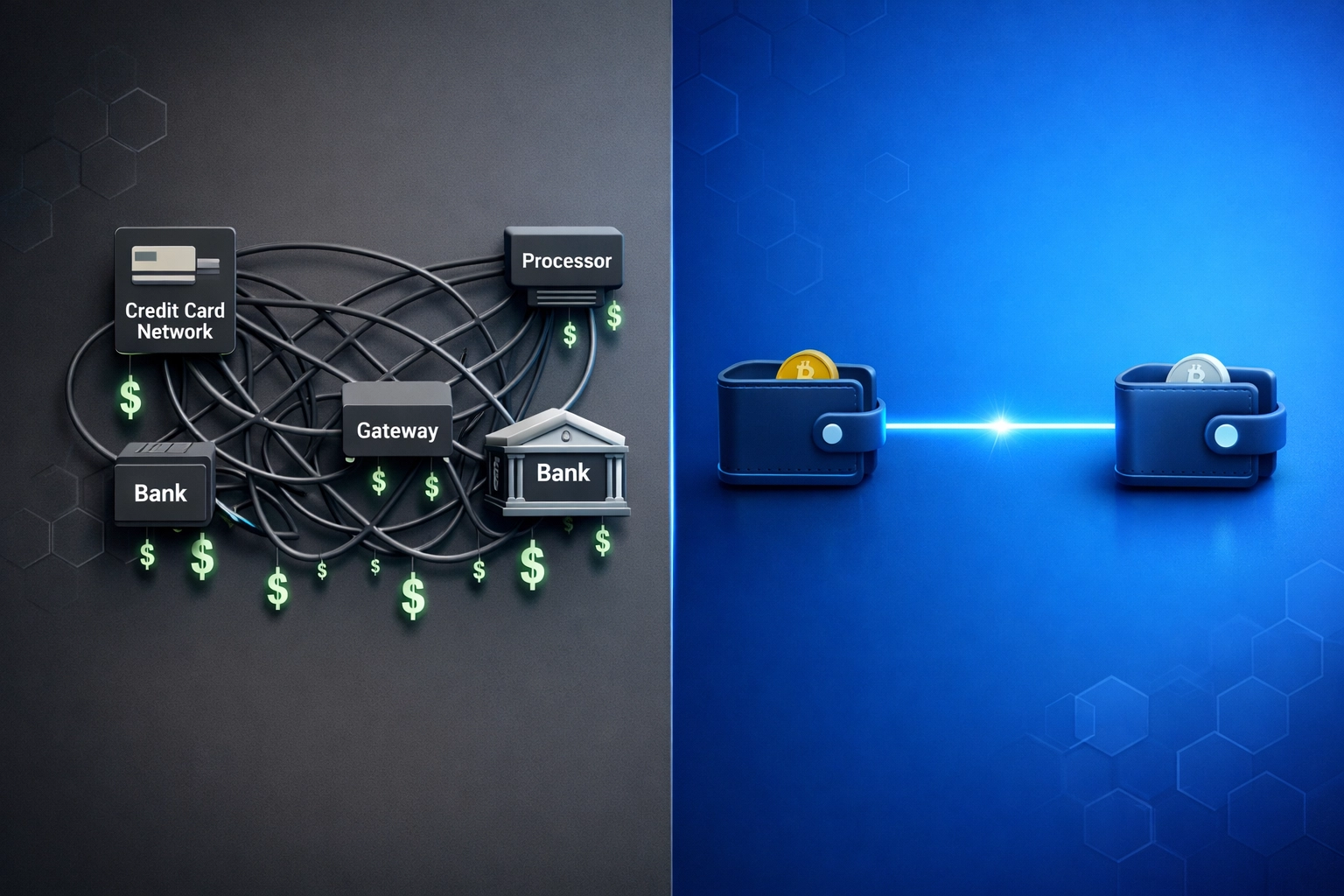

Traditional payment flow looks like this: Customer → Credit Card Network → Payment Processor → Gateway → Your Bank Account.

Every step takes a cut.

Self-custody crypto flow: Customer Wallet → Your Wallet.

Two steps. Zero intermediaries. Zero percentage fees.

The math is brutal for traditional processors. A $10,000 transaction costs you $300-350 in fees. That same transaction on blockchain? Maybe $0.05 in gas fees.

You control your wallet. You control your funds. No frozen accounts. No arbitrary limits. No processor suddenly changing terms.

Larecoin's self-custody architecture puts you in the driver's seat. Funds hit your wallet within minutes: not the 3-5 business day hold traditional processors impose.

Hack #2: LUSD Stablecoin for Predictable Revenue

Crypto volatility scares merchants. Valid concern.

LUSD stablecoins solve it.

Pegged 1:1 to the US dollar, LUSD gives you crypto's efficiency without price swings. Your $500 sale stays $500: not $487 or $523 depending on market mood.

Here's why LUSD outperforms regular crypto for payments:

Price Stability – No conversion headaches. Revenue predictability restored.

Low Gas Fees – Stablecoin transactions cost fractions of a cent on efficient networks.

Instant Liquidity – Convert to fiat when needed or hold for future use.

Cross-Border Simplicity – Same low fee whether customer is local or international.

Larecoin supports LUSD natively, making it dead simple to accept stable crypto payments without volatility risk.

Hack #3: Master/Sub-Wallet Configuration for Multi-Location Businesses

Running multiple locations or departments?

Traditional payment processors charge per location. More terminals. More monthly fees. More complexity.

Self-custody master/sub-wallet setup changes everything.

One master wallet oversees multiple sub-wallets. Each location gets its own address. You manage everything centrally.

Setup time? About 5 minutes per location.

Benefits stack up fast:

Separate revenue streams for accounting clarity

Individual location tracking without extra fees

Centralized oversight and control

Simplified tax reporting

Zero additional monthly costs per location

Compare this to NOWPayments or CoinPayments: both charge per-transaction fees and often require separate accounts for multi-location setups. More complexity. More costs.

Larecoin's wallet infrastructure handles unlimited sub-wallets with zero added fees. Scale without bleeding profit.

Hack #4: QR Code Payment Systems at Point-of-Sale

Credit card terminals cost money. Monthly rentals. Transaction fees. PCI compliance headaches.

QR code crypto payments cost nothing.

Generate a QR code in 2 minutes. Customer scans with their wallet. Payment confirmed on blockchain. Done.

Fixed QR codes work for set amounts. Dynamic codes adjust per transaction. Both eliminate:

Terminal rental fees ($50-150/month)

PCI compliance costs ($1,000+ annually)

Terminal maintenance issues

Card present vs. card-not-present rate differences

Your smartphone becomes your payment terminal.

Larecoin's merchant tools generate both fixed and dynamic QR codes instantly. Check out payment options here.

Plus, Larecoin issues NFT receipts for every transaction. Permanent, verifiable proof of purchase on blockchain. Customers get digital collectibles. You get fraud protection. Win-win.

Hack #5: Instant Settlement with Zero Withdrawal Fees

Traditional processors hold your money hostage.

Payment clears → Processor holds funds 3-5 days → Withdrawal to bank (often with fees) → Finally access your money.

Self-custody crypto: Payment sent → Blockchain confirms → Funds in your wallet.

Total time: Minutes. Not days.

Zero withdrawal fees. No holding periods. No "pending" status. Your money. Your wallet. Your control.

For cash flow, this is game-changing. No more waiting on processor transfers during tight weeks. Immediate access to revenue means immediate reinvestment capability.

NOWPayments and CoinPayments both impose settlement delays and withdrawal fees. CoinPayments charges 0.5% withdrawal fees on top of transaction fees. NOWPayments has minimum withdrawal thresholds and processing times.

Larecoin? Instant settlement. Zero withdrawal fees. Complete control.

The Real Numbers: What You're Actually Saving

Let's run a $500,000 annual revenue business through both systems.

Traditional Payment Processing:

Transaction fees (2.5% average): $12,500

Monthly gateway fees: $600/year

Chargeback fees (1% of transactions): $2,000

Cross-border fees (assuming 20% international): $6,000

Terminal rentals (3 locations): $4,500

Total annual cost: $25,600

Self-Custody Crypto Payments:

Gas fees (average $0.02 per transaction, 10,000 transactions): $200

Wallet setup: $0

Monthly fees: $0

Chargebacks: $0 (blockchain transactions are final)

Cross-border fees: $0 (same rate worldwide)

Total annual cost: $200

Annual savings: $25,400

That's not a typo. Over $25K back in your pocket annually.

For smaller businesses, the percentage impact is even more dramatic. A $100K revenue business saves $5,000-7,000 yearly: significant capital for growth.

Why Larecoin Crushes NOWPayments and CoinPayments

Let's be direct about the competition.

NOWPayments charges 0.5-1% transaction fees plus payout fees. They hold your funds. Settlement takes 1-3 days. You're still dealing with intermediaries: just crypto-flavored ones.

CoinPayments charges 0.5% transaction fees plus 0.5% withdrawal fees. Minimum withdrawals. Currency conversion fees. Still playing the middleman game.

Larecoin charges zero transaction fees beyond network gas. Instant settlement. NFT receipt innovation. Complete self-custody. True Web3 payments.

Plus, Larecoin is building for the long haul with serious compliance infrastructure. MSB registration. State-by-state MTL strategy. This isn't some fly-by-night operation: it's legitimate, regulated Web3 payments.

That compliance matters. When regulators inevitably tighten crypto rules, Larecoin merchants stay protected. NOWPayments and CoinPayments? They'll scramble to catch up while you're already ahead.

The NFT Receipt Advantage Nobody's Talking About

Here's a bonus hack embedded in Larecoin's system: NFT receipts.

Every payment generates a unique NFT receipt. Permanent proof of transaction. Immutable record. Customer gets a collectible. You get ironclad documentation.

For high-value transactions, this is massive. Luxury goods. Electronics. Jewelry. B2B services. Customers can't claim "I never received it" when blockchain has timestamped proof.

Traditional receipts get lost. Email receipts get buried. NFT receipts live forever on blockchain.

This feature alone reduces dispute resolution time by 80%+. No more he-said-she-said. Just blockchain truth.

Getting Started Takes Minutes, Not Months

Traditional merchant account setup: Weeks of applications. Credit checks. Equipment installation. Training. Compliance paperwork.

Self-custody crypto setup: Download wallet. Generate address. Start accepting payments.

Seriously. That's it.

Larecoin makes it even simpler with merchant-focused tools and US-based support. Explore merchant solutions here.

The barrier to entry has never been lower. The savings have never been higher.

Your Next Move

Stop subsidizing payment processor profits.

Self-custody crypto payments with LUSD stablecoins give you control, slash fees to nearly zero, and provide instant access to your money.

The five hacks above aren't theoretical. Merchants are implementing them right now and watching transaction costs drop 90%+.

Larecoin's platform makes implementation seamless. Rigorous US compliance. NFT receipt innovation. True self-custody. Zero percentage fees.

Your competitors are already making the switch. The question isn't whether crypto payments will dominate: it's whether you'll be early or late to the party.

Join the Larecoin ecosystem and keep more of what you earn.

Comments