How to Slash Interchange Fees by 50%+ Without Sacrificing Control (A Merchant's Guide)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Interchange fees kill margins.

$50,000 in monthly revenue? You're paying $17,400 annually to payment processors.

$100,000 monthly? That's $34,800 vanishing into processor pockets.

The game is rigged. Visa and Mastercard set the rates. Traditional processors add their cuts. You're stuck paying 2.9% + $0.30 per transaction while losing control over your money.

Three paths exist to cut these fees by 50% or more. The third one reduces costs by 96-97%.

Let's break down each approach.

Method 1: Surcharging (50% Recovery, Traditional Infrastructure)

Surcharging passes credit card fees directly to customers who choose card payments.

The Numbers:

Maximum surcharge cap in USA: 4%

Most merchants set rates at 2.5-3.5% to stay competitive

Recover up to 50% of interchange costs immediately

Implementation Rules:

Display surcharge notices clearly at point of sale

Show surcharges on receipts and invoices

Offer alternative payment methods (cash, debit, crypto)

Stay compliant with state regulations

Dual pricing works best. Offer discounts for cash or debit. Apply surcharges only to credit cards. Customers choose their preferred payment method based on cost.

The downside? You're still locked into traditional processors. Still dealing with their terms. Still facing potential account freezes.

Method 2: Interchange Optimization (20-30 Basis Point Reduction)

Interchange optimization submits enhanced transaction data to qualify for lower rates.

The Strategy:

Use Level 2 and Level 3 data fields

Optimize B2B transactions specifically

Implement local acquiring strategies

Save approximately $1.00 per $100 spent

B2B merchants see the biggest wins. Manufacturers, distributors, and wholesale operations cut monthly fees by 10-30%.

Around 25% of merchants achieve 30-50% savings through optimization.

The problem? You're still paying percentage-based fees. Still dependent on processor infrastructure. Still vulnerable to chargeback fraud.

Method 3: Self-Custody Crypto Payments (96-97% Fee Reduction)

Self-custody eliminates traditional payment processors entirely.

The Cost Comparison:

$50,000 monthly revenue:

Traditional processors: $17,400/year

Self-custody crypto: $60-$600/year

Savings: 96-97%

$100,000 monthly revenue:

Traditional processors: $34,800/year

Self-custody crypto: $120-$1,200/year

Savings: 96-97%

You pay flat blockchain gas fees. $0.001-$2.00 per transaction. No percentage cuts. No monthly minimums. No processor middlemen.

The Freedom Factor:

Instant settlement (5-30 seconds to your wallet)

Zero chargebacks (crypto transactions are final)

No account freezes (you control your funds)

No processor approval needed

No compliance holdups

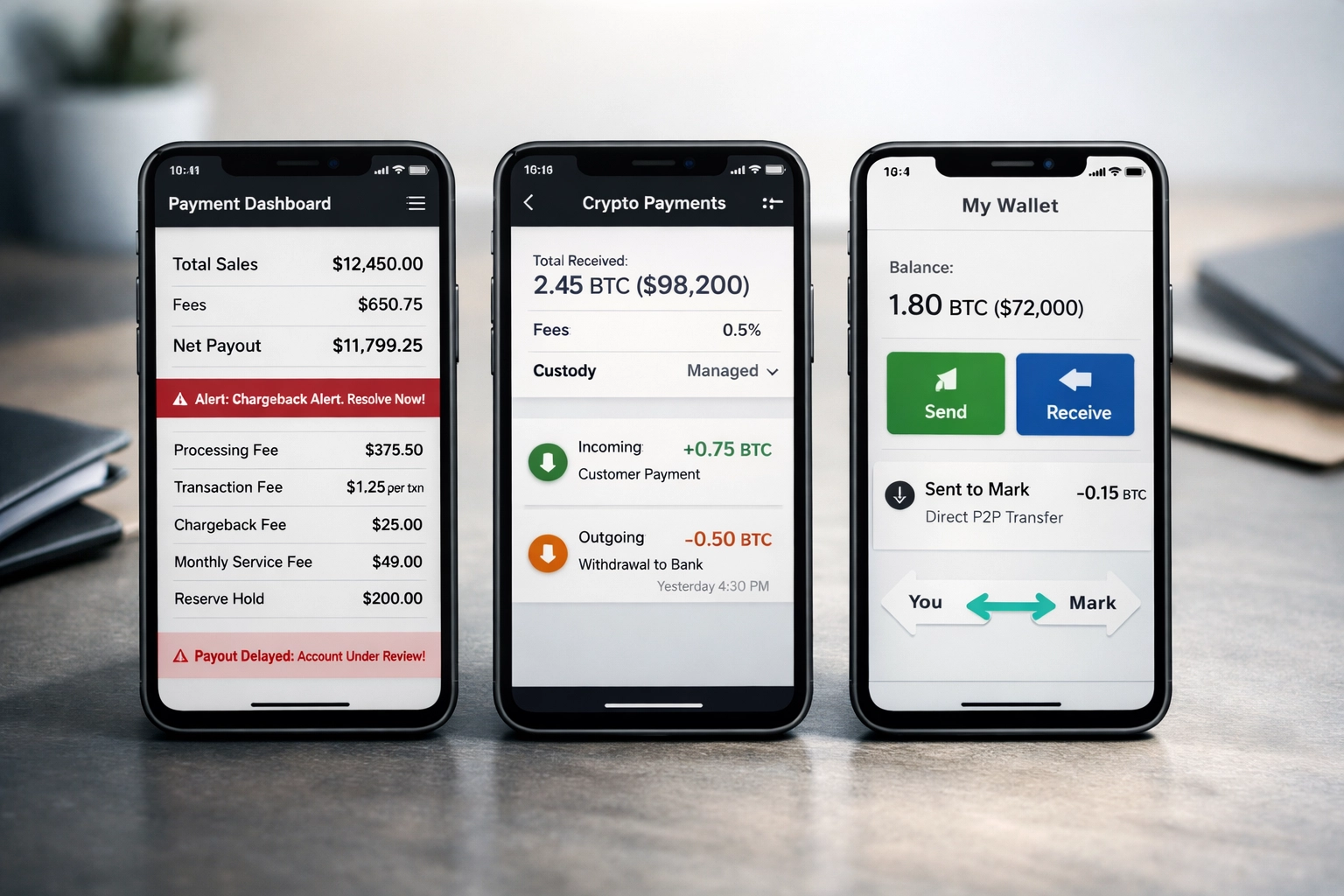

How Larecoin Stacks Against NOWPayments and CoinPayments

Let's get specific about crypto payment platforms.

NOWPayments Fee Structure:

0.5-1% per transaction

Still percentage-based pricing

Custody model (they hold your funds temporarily)

Settlement delays possible

Over 70 cryptocurrencies supported

CoinPayments Fee Structure:

0.5% per transaction

Custody-based system

Withdrawal fees apply

Settlement in batches

Multi-currency support

Larecoin Ecosystem Advantage:

Gas-only fees (flat rate, not percentage)

Self-custody (funds go directly to YOUR wallet)

Instant settlement (no withdrawal waiting)

LUSD stablecoin option for zero volatility

NFT receipts for enhanced loyalty programs

No custodial risk

The difference is fundamental. NOWPayments and CoinPayments still operate as intermediaries. They hold your crypto temporarily. They charge percentage fees. They control settlement timing.

Larecoin enables direct peer-to-peer settlement. Customer wallet to merchant wallet. No middleman custody. No percentage extraction.

The LUSD Stablecoin Advantage

Volatility scares merchants away from crypto payments.

Fair concern. Bitcoin fluctuates. Ethereum moves fast. Traditional crypto acceptance creates accounting headaches.

LUSD solves this problem.

What is LUSD?

Decentralized stablecoin pegged to USD

Maintains 1:1 dollar value

No algorithmic instability

Overcollateralized with ETH

Self-custody compatible

Accept LUSD through Larecoin's ecosystem. Get dollar-stable payments with crypto's fee advantages. No conversion needed. No volatility risk. Just stable value directly to your wallet.

Compare that to NOWPayments' auto-conversion fees. Or CoinPayments' settlement delays. LUSD gives you stability AND control.

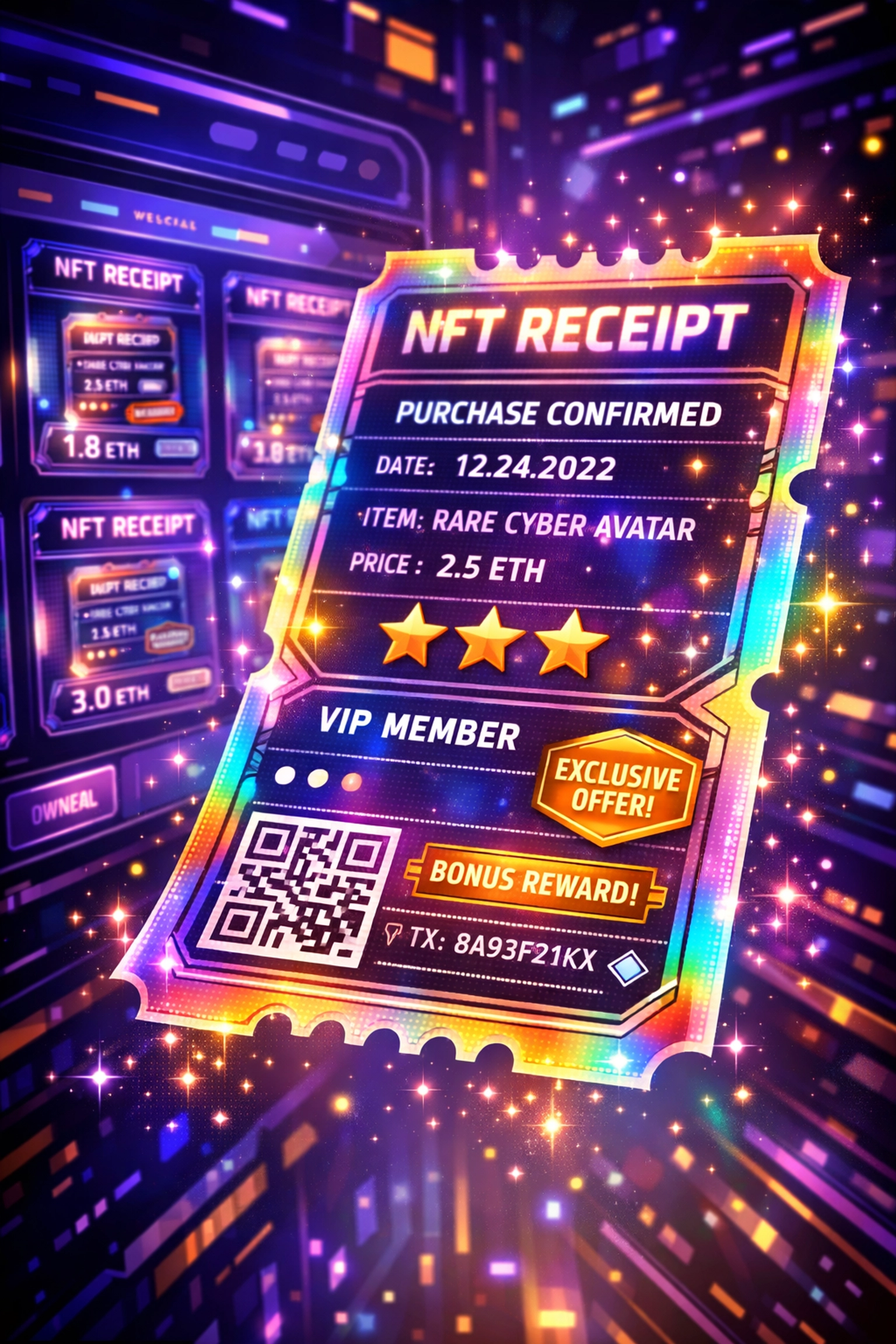

NFT Receipts: The Loyalty Program Game-Changer

Traditional receipt systems cost money. Email receipts get ignored. Paper receipts waste resources. Digital receipts offer zero customer engagement.

NFT receipts flip the script.

How NFT Receipts Work:

Customer completes purchase via crypto

Receives unique NFT receipt to their wallet

NFT contains purchase data, warranty info, rewards points

Merchant can airdrop exclusive offers to NFT holders

Customers build verifiable purchase history

The Merchant Benefits:

Direct customer wallet connection for remarketing

No email list management costs

Permanent purchase records on blockchain

Loyalty program built into payment infrastructure

Enhanced customer engagement

Neither NOWPayments nor CoinPayments offer native NFT receipt functionality. They process payments. That's it.

Larecoin builds the entire customer relationship infrastructure into the payment layer.

Real Cost Breakdown: Traditional vs. Larecoin Ecosystem

Let's run actual numbers for a mid-sized merchant.

Scenario: $75,000 monthly revenue

Traditional Payment Processors:

Transaction fees (2.9% + $0.30): $26,100/year

Monthly gateway fees: $300/year

Chargeback fees (assume 0.5% dispute rate): $1,350/year

PCI compliance costs: $500/year

Total Annual Cost: $28,250

NOWPayments/CoinPayments:

Transaction fees (0.5-1%): $4,500-$9,000/year

Withdrawal fees: $200-$500/year

Settlement delays (opportunity cost): Variable

Total Annual Cost: $4,700-$9,500

Larecoin Self-Custody:

Gas fees (average $0.50 per transaction): $900/year

Wallet management: $0 (self-custody)

Settlement delays: $0 (instant)

Chargeback costs: $0 (irreversible transactions)

Total Annual Cost: $900

The math is brutal for traditional processors.

Crypto custody platforms improve things. But self-custody through Larecoin's ecosystem delivers maximum savings while maintaining complete control.

Merchant Freedom: The Non-Negotiable Factor

Payment processors hold power over your business.

They freeze accounts. They hold reserves. They demand documentation. They change terms unilaterally.

Traditional Processor Risks:

Account freezes for "high-risk" industries

Rolling reserves (holding 5-10% of revenue)

Sudden fee increases with minimal notice

Compliance audits that halt operations

Chargeback ratio monitoring and penalties

Crypto Custody Platform Risks:

Temporary custody of your funds

Withdrawal limits and delays

KYC requirements that can block access

Platform dependency for settlement

Larecoin Self-Custody Model:

Zero account freeze risk (you control private keys)

Instant access to 100% of funds

No compliance gatekeepers

No withdrawal limits

No platform dependency

This is the independence traditional commerce promised but never delivered.

Implementation Strategy: Hybrid Approach

Not every customer uses crypto yet. Smart merchants run dual systems during transition.

Phase 1: Add Crypto Option

Set up Larecoin payment acceptance

Offer 2-5% discount for crypto payments

Display crypto option prominently at checkout

Keep traditional processor for non-crypto customers

Phase 2: Build Crypto Volume

Launch NFT receipt loyalty program

Market crypto payment benefits to customer base

Use LUSD for customers concerned about volatility

Track percentage of revenue shifting to crypto

Phase 3: Reduce Traditional Dependence

Negotiate lower rates with traditional processor (you have alternatives now)

Shift majority of volume to self-custody crypto

Maintain minimal traditional processing for holdout customers

The goal isn't 100% crypto overnight. The goal is control. Options. Freedom from processor monopolies.

The Bottom Line

Slashing interchange fees by 50% is possible through surcharging or optimization.

Cutting fees by 96-97% requires self-custody crypto payments.

NOWPayments and CoinPayments improve on traditional processors. But they're still intermediaries. Still charging percentage fees. Still controlling your funds temporarily.

Larecoin's ecosystem delivers true merchant independence. Self-custody wallets. Gas-only fees. LUSD stablecoin stability. NFT receipt innovation.

Your business. Your funds. Your control.

Start accepting crypto payments through Larecoin's merchant solutions today. Cut fees. Gain freedom. Keep control.

The payment revolution doesn't need permission. It just needs you to opt in.

Comments