How to Slash Merchant Interchange Fees by 50%+ Using a Receivables Token (Easy Guide for Small Businesses)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Interchange fees are killing your margins.

Every swipe. Every tap. Every online checkout. You're bleeding 2-4% to card networks and payment processors. For small businesses, that's thousands: sometimes tens of thousands: gone every year.

But there's a smarter way. Receivables tokens are changing the game. And you can slash those fees by 50% or more.

Let's break it down.

The Interchange Fee Problem (It's Worse Than You Think)

Traditional payment processing is a middleman bonanza.

When a customer pays with a credit card, here's who takes a cut:

Card networks (Visa, Mastercard)

Issuing banks

Payment processors

Your merchant services provider

Average interchange? 1.5% to 3.5% per transaction. Add processor fees, and you're looking at 2.5% to 4% total.

For a business doing $500K annually? That's $12,500 to $20,000 in fees. Every. Single. Year.

Small businesses get hit hardest. Less volume means less negotiating power. Higher rates. Lower margins.

Enter Receivables Tokens: The Web3 Solution

Receivables tokens flip the script.

Instead of routing payments through legacy financial rails, transactions happen on-chain. Direct. Peer-to-peer. No intermediaries taking their cut.

Here's the concept:

A receivables token represents a future payment obligation. Think of it as a digital IOU backed by blockchain technology. When a customer pays, the token is minted, verified, and settled: all without traditional payment processors.

The result? Fees drop from 2.5-4% down to near-zero. Some platforms report cross-border costs falling from 6% to below 1%.

That's not a typo. That's financial freedom.

Why LUSD Stablecoin Changes Everything

Volatility scares merchants away from crypto. Understandable.

Nobody wants to accept payment in a token that loses 15% value overnight. That's where stablecoins come in: and LUSD specifically.

LUSD advantages for merchants:

Pegged to USD value (no wild swings)

Instant settlement (no 3-day holds)

Self-custodied (you control your funds)

Near-zero transaction fees

24/7/365 availability

Traditional card payments? Settlement takes 2-3 business days. LUSD? Minutes. Sometimes seconds.

Cash flow matters. Faster settlement means better cash flow. Better cash flow means growth.

NFT Receipts: More Than a Gimmick

NFT receipts sound fancy. But they're actually practical.

Every transaction generates an NFT receipt. Immutable. Verifiable. Permanent record on the blockchain.

Why this matters:

Audit-proof records – No lost receipts. No disputes about transaction details.

Customer loyalty – Receipts can double as loyalty rewards, unlocking future discounts.

Fraud prevention – Impossible to forge. Every receipt has cryptographic proof.

Tax simplicity – Automated, accurate transaction history for accountants.

Traditional receipts get lost. Paper fades. Emails get deleted. NFT receipts live forever on-chain.

For small businesses, this isn't just tech novelty. It's operational efficiency.

Self-Custody: Why It's Non-Negotiable

Third-party custody is risky.

Remember FTX? Celsius? BlockFi? Billions in customer funds: gone. When someone else holds your money, you're trusting them with everything.

Self-custody means you control your private keys. You control your funds. No intermediary can freeze, seize, or "accidentally lose" your money.

Larecoin's approach:

Your wallet. Your keys.

Push-to-card functionality for instant fiat conversion

Gas-only transfers (minimal on-chain costs)

No custodial risk

Web3 payments without self-custody isn't really Web3. It's just traditional finance with extra steps.

Larecoin vs. The Competition

Let's talk alternatives.

NOWPayments and CoinPayments offer crypto payment processing. But they come with limitations.

Feature | Larecoin | NOWPayments | CoinPayments |

Receivables Token | ✅ Yes | ❌ No | |

LUSD Stablecoin | ✅ Native | ❌ Limited | ❌ Limited |

NFT Receipts | ✅ Built-in | ❌ No | ❌ No |

Self-Custody | ✅ Full | ⚠️ Partial | ⚠️ Partial |

Fee Reduction | 50%+ | ~30% | ~25% |

Push-to-Card | ✅ Yes | ❌ No | ⚠️ Limited |

NOWPayments requires third-party integrations for stablecoin support. CoinPayments holds funds before settlement: custody risk.

Larecoin? Built from the ground up for merchant sovereignty. Your payments. Your terms.

Step-by-Step: Start Slashing Fees Today

Ready to cut those interchange fees? Here's how:

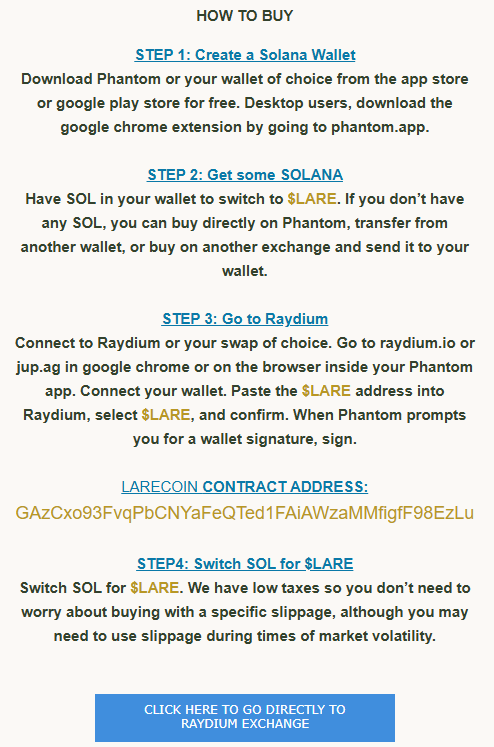

Step 1: Set Up Your Wallet

Download a Solana-compatible wallet. Phantom, Solflare, or similar.

Write down your seed phrase. Store it securely. This is your access key.

Step 2: Acquire SOL for Gas

You'll need a small amount of SOL for transaction fees. Purchase on any major exchange. Transfer to your wallet.

Step 3: Get LARE Tokens

Head to Raydium. Connect your wallet. Swap SOL for $LARE using the official contract address.

Pro tip: Set slippage to 1-2% for smooth transactions.

Step 4: Integrate with Your Business

Visit Larecoin.com to access merchant tools. Configure payment acceptance. Add checkout widgets to your site.

Step 5: Accept Payments, Slash Fees

Every crypto payment bypasses traditional interchange. Watch your processing costs plummet.

Real Numbers: What 50% Savings Looks Like

Let's run the math.

Traditional Processing:

Monthly sales: $50,000

Average interchange: 3%

Monthly fees: $1,500

Annual fees: $18,000

With Larecoin Receivables Token:

Monthly sales: $50,000

Average cost: 1% or less

Monthly fees: $500

Annual fees: $6,000

Annual savings: $12,000

That's $12K back in your pocket. Reinvest in inventory. Marketing. Staff. Growth.

Small businesses running $100K+ monthly? Savings hit $24,000+ annually. Real money. Real impact.

The Future of Merchant Payments

Traditional payment rails were built for the 1970s.

Interchange fees exist because legacy systems require layers of verification, settlement, and trust. Blockchain eliminates those layers.

Web3 payments are:

Faster – Seconds, not days

Cheaper – Near-zero fees

Transparent – Every transaction verified on-chain

Sovereign – You control your funds

The shift is happening. Major brands are experimenting. Savvy merchants are adopting early.

Early adopters win.

Get Started with Larecoin

Interchange fees don't have to eat your margins.

Receivables tokens, LUSD stablecoin, NFT receipts, and self-custody: Larecoin brings it all together in one ecosystem designed for merchants.

Your next steps:

Visit Larecoin.com

Set up your wallet

Start accepting Web3 payments

Slash fees. Keep more revenue. Grow your business.

The future of payments is here. Time to claim it.

Comments