NOWPayments Alternative: 7 Reasons Larecoin Cuts Merchant Fees by 50%+ (Comparison Guide)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

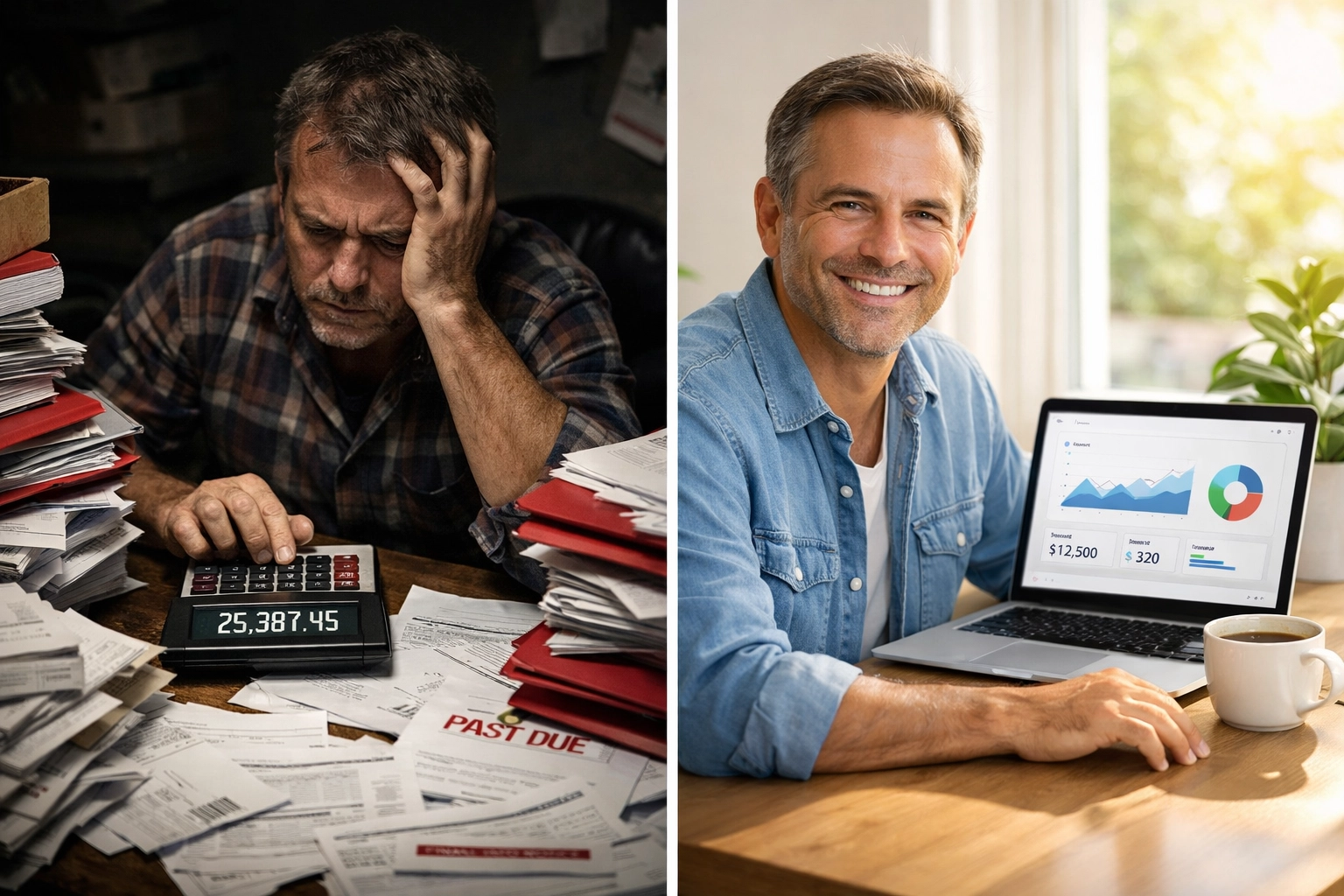

Merchant fees eat profits.

NOWPayments charges 0.5-1% per transaction. Add withdrawal fees. Stack currency conversion markups. Watch costs spiral.

Larecoin flips the script. Zero platform fees. Gas-only costs. Self-custody settlements.

The math isn't subtle. At $1.2M annual volume, NOWPayments costs you $9,000. Larecoin? Around $2,000.

That's 67-83% savings. Let's break down exactly how.

Reason #1: Zero Platform Fees vs. 0.5-1% Transaction Charges

NOWPayments bills you 0.5% for single-currency transactions. Multi-currency? That jumps to 1%.

Larecoin charges 0%. Not a promotional rate. Not a temporary discount. Zero.

The only cost? Solana blockchain gas fees. Fractions of a penny per transaction.

Real Numbers:

$100,000 monthly volume on NOWPayments = $500-$1,000 in platform fees

Same volume on Larecoin = ~$150 in gas fees

Monthly savings = $350-$850

Scale that annually. Multiply by growth projections. The gap becomes a canyon.

Reason #2: Gas-Only Cost Model Eliminates Hidden Charges

Traditional processors layer fees like sediment.

Transaction fee. Withdrawal fee. Currency conversion spread. Monthly minimums. Setup charges.

Each layer compounds the last.

Larecoin operates on Solana. One cost structure. Blockchain gas fees. That's it.

No surprise charges on your monthly statement. No fine print penalties. No escalating percentages as you grow.

Gas fees on Solana average $0.00025 per transaction. At 10,000 transactions monthly, you're looking at $2.50 in total network costs.

Compare that to percentage-based models that scale with your success.

Reason #3: No Withdrawal Penalties or Cash-Out Fees

NOWPayments hits you twice.

First, the transaction fee. Then, withdrawal fees ranging from 1.5-2.3% when converting crypto to fiat or moving funds.

CoinPayments follows the same playbook. Every withdrawal carries a fee.

Larecoin? Move your funds anytime. No penalties. No withdrawal charges.

Self-custody means your money stays yours. Settlements happen in seconds. Transfer to your wallet. Push to card. Bridge to other chains.

Zero friction. Zero extra costs.

Example Scenario:

Weekly withdrawals on NOWPayments (4x monthly)

Each withdrawal: 1.5% fee

Monthly volume: $250,000

Withdrawal costs: $15,000 annually

Larecoin eliminates that entire line item.

Reason #4: Transparent Cost Structure vs. Buried Markups

Traditional payment processors profit from opacity.

Currency conversion happens at "competitive rates" that hide 0.5-2% markups above market. Monthly statements show transaction counts but obscure the real cost per transaction.

Setup fees appear after onboarding. Monthly minimums kick in during slow months.

Larecoin publishes transparent costs.

Solana gas fees are public. Blockchain explorers show exact costs. No conversion spreads. No hidden percentages.

You know your cost structure before processing your first transaction. You can forecast expenses with precision.

That certainty matters when building financial models. When pitching investors. When planning growth.

Reason #5: Scalability Advantage as Volume Grows

Percentage-based fees punish success.

Your first $10,000 in transactions costs 0.5-1%. Your millionth dollar? Same percentage. Different impact.

At $5M annual volume:

NOWPayments charges ~$25,000-$50,000

CoinPayments similar range

Larecoin gas fees ~$5,000

The gap widens exponentially with scale.

High-volume merchants hit the hardest. Every percentage point costs tens of thousands. Every transaction bleeds margin.

Larecoin's fixed gas costs create a cost advantage that compounds as you grow. Your 10,000th transaction costs the same as your first.

Build a million-dollar business. Pay startup-level processing fees.

Reason #6: No Currency Conversion Markups

NOWPayments converts crypto to fiat at rates above market value.

That spread: the difference between market rate and your settlement rate: is invisible revenue for the processor.

Typically 0.5-2% depending on currency pairs and volume.

Real Impact:

$500,000 in annual conversions

1.5% average spread

Hidden cost: $7,500

Larecoin settles in native crypto or stablecoin. LUSD. USDC. Direct to your wallet.

Want fiat? Use your preferred exchange at market rates. Or leverage Larecoin's push-to-card feature for instant settlement.

You control the conversion timing. You capture market rates. You keep the spread.

Reason #7: Self-Custody and Direct Settlement

NOWPayments holds your funds. Settlement times vary. Your crypto sits in their custody until withdrawal.

That creates counterparty risk. Delays working capital. Limits financial flexibility.

Larecoin enables self-custody from transaction one.

Payments settle directly to your wallet. No intermediary holdings. No custody risk. Instant liquidity.

Settlement in fractions of a second. Not days. Not hours. Seconds.

That matters for cash flow management. For taking advantage of market opportunities. For true financial sovereignty.

Your business. Your funds. Your control.

Real-World Savings Breakdown

Let's compare head-to-head at three volume levels:

Small Business ($100K Annual Volume):

NOWPayments: $750-$1,000

CoinPayments: $500-$1,000

Larecoin: ~$300

Savings: 50-70%

Growing Merchant ($1.2M Annual Volume):

NOWPayments: ~$9,000

CoinPayments: $6,000-$12,000

Larecoin: ~$2,000

Savings: 67-83%

Enterprise ($5M Annual Volume):

NOWPayments: $25,000-$50,000

CoinPayments: Similar range

Larecoin: ~$5,000

Savings: 80-90%

These numbers exclude withdrawal fees, conversion spreads, and monthly minimums. Include those? The gap grows wider.

Why This Matters Now

2026 crypto payments are exploding.

Merchant adoption accelerates. Consumer demand intensifies. Payment volume skyrockets.

Traditional processors scale their revenue with your volume. Larecoin's cost structure remains flat.

That fundamental difference transforms economics at scale. What starts as 50% savings at $100K becomes 80-90% savings at $5M.

The businesses that lock in Web3-native payment infrastructure today will dominate margin conversations tomorrow.

The Technical Edge

Larecoin runs on Solana. Built for speed. Optimized for cost. Designed for global payments.

65,000+ transactions per second capacity. Sub-second finality. Negligible gas fees.

Compare that to older blockchain architectures where gas fees fluctuate with network congestion. Where settlement times slow during peak periods.

Solana's architecture means predictable costs. Consistent performance. Reliable settlement.

Plus NFT receipts for accounting. LUSD stablecoin integration. Receivables tokenization. Push-to-card settlements.

NOWPayments offers cryptocurrency processing. Larecoin delivers a complete Web3 financial infrastructure.

Making the Switch

Migration takes hours, not weeks.

API integration mirrors traditional processors. Documentation covers every use case. Support responds in minutes.

Test in sandbox. Go live same day. Start saving immediately.

No contract lock-ins. No setup fees. No monthly minimums.

Just transparent, predictable, drastically lower costs.

Bottom Line

NOWPayments works. It processes crypto payments. It converts to fiat. It does the job.

But it costs 50-90% more than necessary.

Larecoin strips away intermediary fees. Eliminates withdrawal penalties. Removes conversion markups. Delivers self-custody. Provides transparent costs.

The result? Merchant fees cut by more than half. Sometimes by 80-90%.

That's not marketing spin. That's blockchain math.

Your business processes payments. Make sure those payments don't process your profits.

Ready to slash merchant fees and keep more of what you earn? Explore Larecoin's merchant solutions and see the difference transparent, Web3-native payments can make.

Comments