NOWPayments vs CoinPayments vs Larecoin: Which Crypto POS System Actually Cuts Your Merchant Fees by 50%?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The Merchant Fee Problem Is Worse Than You Think

Traditional crypto payment processors are bleeding merchants dry.

NOWPayments charges 0.5-1% per transaction. CoinPayments hits you with the same. Add network fees. Withdrawal penalties. Currency conversion costs. Suddenly your "low fee" crypto solution costs more than you bargained for.

Here's the math merchants ignore:

Processing $500,000 annually? You're paying $2,500-$5,000 in fees to NOWPayments or CoinPayments. Process $1 million? That's $5,000-$10,000 gone. Hit $5 million in volume? You just handed over $25,000 to a payment processor.

That's before gas fees. Before withdrawal costs. Before conversion spreads.

Why Percentage-Based Fees Are a Merchant Trap

Every crypto POS system uses one of two models:

Percentage Model (NOWPayments, CoinPayments)

Fees scale with your success

More sales = higher costs

Zero incentive for processor efficiency

Hidden costs stack silently

Gas-Only Model (Larecoin)

Fixed blockchain costs

Fees stay constant regardless of volume

Complete fee transparency

Savings compound as you grow

The difference becomes exponential at scale.

Real Numbers: Where Your Money Actually Goes

Let's break down a $1 million annual processing scenario:

NOWPayments/CoinPayments:

Base fees: $5,000-$10,000

Network fees: Variable (Ethereum gas can spike)

Withdrawal fees: $50-$200 per withdrawal

Conversion spreads: 0.5-2% additional

Total annual cost: $10,000-$15,000

Larecoin:

Platform fees: $0

Solana gas costs: $0.00025 per transaction

Withdrawal fees: $0 (self-custody)

Conversion spreads: Market rate only

Total annual cost: Under $2,000

That's 67-83% savings.

Your processor shouldn't profit more when you succeed. You should.

Self-Custody: The Feature Traditional Processors Won't Offer

NOWPayments and CoinPayments hold your funds. Always.

They control:

When you withdraw

How much you withdraw

Which currencies you can hold

Your transaction limits

Larecoin flips this model.

You control your funds from the moment payment hits. No custodial accounts. No withdrawal windows. No permission required to access your own money.

Self-custody means:

Instant access to funds 24/7

Zero counterparty risk

No frozen accounts

Complete financial sovereignty

Traditional processors call this "risky." We call it ownership.

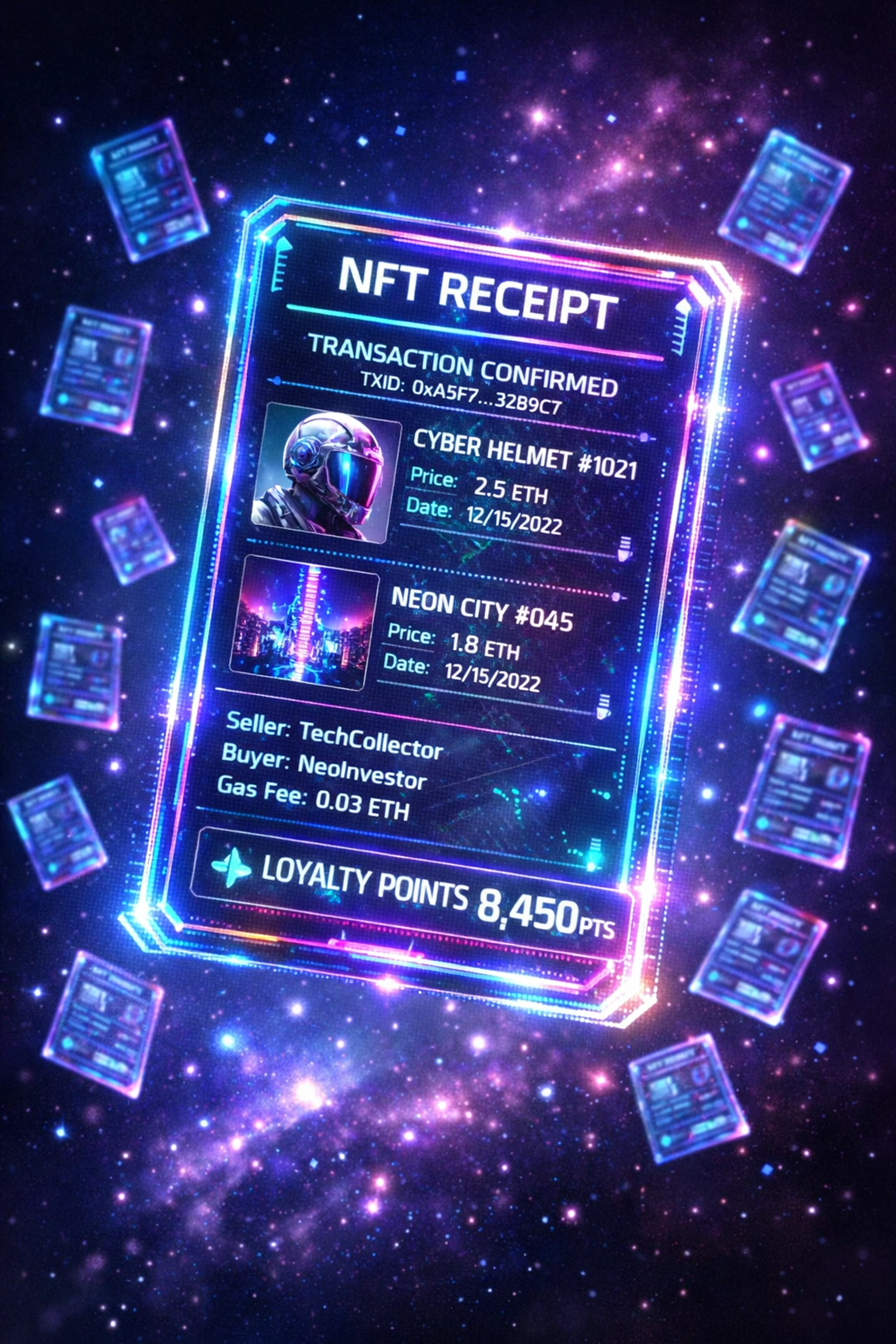

NFT Receipts: The Revenue Stream Your Competitors Ignore

Every transaction generates data. Most processors throw it away.

Larecoin turns receipts into NFTs.

Why this matters:

Each NFT receipt contains:

Transaction timestamp

Product details

Loyalty points

Warranty information

Authenticity proof

Customers can trade them. Resell them. Use them for returns. Prove authenticity.

You get:

Built-in loyalty program

Automated warranty tracking

Secondary market royalties

Customer engagement data

Anti-counterfeiting tool

NOWPayments gives you a PDF. CoinPayments sends an email. Larecoin creates a tradeable digital asset.

The merchant who understands this wins Web3 commerce.

LUSD: The Stablecoin That Actually Stays Stable

Most crypto processors force you into USDT or USDC. Centralized stablecoins. Blacklist functions. Frozen wallets.

Larecoin integrates LUSD (Liquity USD).

Why LUSD destroys USDT/USDC:

Fully decentralized protocol

No admin keys

No blacklist function

Backed by ETH only

Immutable smart contracts

Zero counterparty risk

Your stablecoin holdings can't be frozen. Can't be seized. Can't be manipulated by a centralized entity.

When regulators come for centralized stablecoins (and they will), your treasury stays liquid.

Fee Comparison: The 50% Savings Breakdown

Here's where the rubber meets the road.

Annual Volume: $500,000

NOWPayments/CoinPayments: $2,500-$5,000

Larecoin: Under $2,000

Savings: 50-60%

Annual Volume: $1,000,000

NOWPayments/CoinPayments: $5,000-$10,000

Larecoin: Under $2,000

Savings: 67-83%

Annual Volume: $5,000,000

NOWPayments/CoinPayments: $25,000+

Larecoin: ~$5,000

Savings: 50-80%

The more you process, the more you save. That's how fee structures should work.

What Traditional Processors Won't Tell You

Hidden costs NOWPayments and CoinPayments bury in fine print:

Currency conversion markups (0.5-2% above market)

Withdrawal fees every time you move funds

Monthly minimums for enterprise accounts

Setup fees for custom integrations

KYC verification delays (weeks sometimes)

Account holds during "security reviews"

Limited cryptocurrency options

Forced conversion to fiat in some jurisdictions

Larecoin eliminates all of it.

Gas fees are transparent. No conversion markups. No withdrawal penalties. No account holds.

The Web3 Payments Philosophy

Traditional crypto processors built Web2 solutions with crypto bolted on.

Wrong approach.

Web3 payments require Web3 architecture:

Self-custody by default - Not as an "advanced" feature NFT-native infrastructure - Receipts, loyalty, warranties all on-chain Decentralized stablecoins - No centralized failure points Gas-only pricing - Fees reflect actual costs Open protocol - No platform lock-in

This isn't about accepting crypto. It's about building on crypto.

When Legacy Systems Make Sense (They Don't)

Some merchants ask: "When should I use NOWPayments or CoinPayments instead?"

Honest answer: Never.

The only reason to use percentage-based processors:

You don't understand Web3

You're scared of self-custody

You trust centralized entities with your funds

You enjoy paying more for worse service

If any of those describe you, crypto payments aren't for you yet. Stick with Stripe.

But if you want to actually leverage blockchain technology? There's only one choice.

Implementation: Easier Than You Think

Larecoin POS integration takes 15 minutes:

Create self-custody wallet

Install POS terminal app

Connect to Solana network

Start accepting payments

No approval process. No credit check. No business verification. No waiting.

Compare that to NOWPayments or CoinPayments:

Multi-day application review

Business documentation required

Bank account verification

API integration complexity

Custodial account setup

By the time they approve your account, you could've processed thousands in Larecoin payments.

The Bottom Line: Do the Math

$1 million in annual payments through traditional crypto processors costs you $10,000-$15,000.

Same volume through Larecoin costs under $2,000.

That's $8,000-$13,000 back in your pocket. Every year.

Multiply that across a decade. You're looking at $80,000-$130,000 in saved fees.

Want to keep funding legacy payment processor margins? Or want to invest that capital back into your business?

Stop Paying Percentage-Based Fees

The merchant who switches to gas-only payments wins.

Lower costs. Full custody. NFT receipts. Decentralized stablecoins. No middleman taking a cut.

NOWPayments and CoinPayments built profitable businesses by charging you more than necessary.

Larecoin built a better system by charging you only what blockchain operations actually cost.

Learn how to reduce merchant interchange fees and start keeping more of your revenue.

Your competitors are already switching. The question is whether you'll lead or follow.

Comments