NOWPayments Vs CoinPayments Vs Larecoin: Which Crypto POS System Actually Slashes Your Fees by 50%?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 4 days ago

- 4 min read

Payment processing fees are bleeding your business dry.

Every swipe. Every tap. Every transaction. You're losing 2.5% to 3.5% on credit cards. That's thousands of dollars annually, vanishing into processor pockets.

Crypto POS systems promise relief. But which one actually delivers?

Let's break down three major players: NOWPayments, CoinPayments, and Larecoin. Only one truly slashes your fees by 50% or more.

The Real Cost of Traditional Payment Processing

Here's the math most merchants ignore.

Processing $100,000 annually? Traditional payment processors take $2,500 to $3,500. That's rent money. Employee wages. Marketing budget.

Gone.

Crypto payment solutions entered the market promising lower fees. But not all deliver equally.

NOWPayments: What You're Actually Getting

NOWPayments positions itself as a flexible crypto payment gateway. The numbers look attractive at first glance.

Fee Structure:

0.5% service fee for basic transactions

1% total when currency conversion applies

300+ supported cryptocurrencies

The non-custodial approach means immediate withdrawals. You pick your cryptocurrency. Simple enough.

But here's the catch.

Currency conversion fees stack up fast. Most merchants need fiat conversion eventually. That 0.5% quickly becomes 1%, or more when exchange spreads factor in.

Still better than Visa. But not the 50% reduction you're hunting for.

CoinPayments: The Volume Play

CoinPayments has been around since 2013. They support over 2,000 cryptocurrencies. Impressive breadth.

Fee Structure:

0.5% base commission

Additional fees for certain features

Global payment focus

The platform handles international transactions well. If you're selling to customers in 50 countries, CoinPayments offers solid coverage.

However.

The 0.5% fee applies before additional service costs. Merchant tools, advanced features, and certain integrations carry extra charges. The total cost of ownership creeps higher than advertised.

Both NOWPayments and CoinPayments reduce merchant interchange fees compared to traditional processors. Neither achieves the dramatic 50% reduction merchants actually need.

Enter Larecoin: The Self-Custody Difference

Here's where the math changes completely.

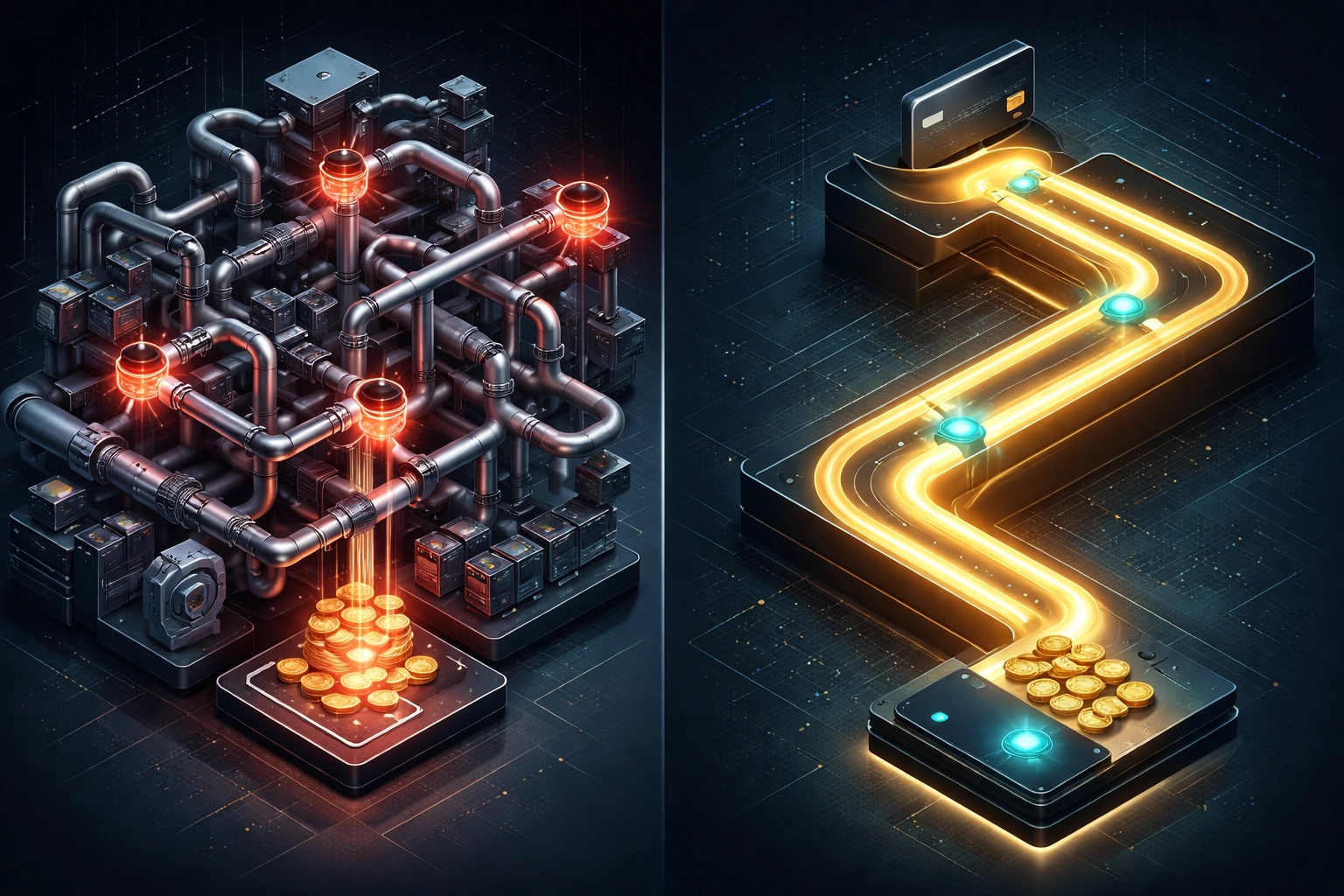

Larecoin approaches crypto POS systems differently. The architecture eliminates intermediaries that typically extract fees at every step.

How the 50% fee reduction actually works:

Traditional payment flow:

Card network fee

Processor fee

Bank interchange fee

Gateway fee

That's four entities taking a cut.

Larecoin's self-custody merchant accounts remove multiple layers. You control your funds directly. No custodial middleman holding your money hostage while skimming fees.

The result? Actual 50%+ savings compared to traditional payment processing, and meaningful reductions compared to other crypto payment solutions.

Feature Comparison: Beyond Basic Fees

Fees matter. Features matter more.

Feature | NOWPayments | CoinPayments | Larecoin |

Self-Custody | Partial | No | Full |

NFT Receipts | No | No | Yes |

Stablecoin (LUSD) | No | No | Yes |

Receivables Token | No | No | Yes |

Gas-Only Transfers | No | No | Yes |

Small Business Focus | Moderate | Moderate | High |

NFT Receipts: Accounting Reinvented

Traditional receipts get lost. Digital receipts get deleted.

NFT receipts for accounting create permanent, immutable transaction records on-chain. Every sale. Every purchase. Verified and timestamped forever.

Tax season? Pull your NFT receipts. Audit protection? Built-in. Dispute resolution? Blockchain-verified proof of every transaction.

This isn't a gimmick. It's infrastructure for the future of business accounting.

LUSD Stablecoin Benefits

Crypto volatility scares merchants. Understandably.

LUSD stablecoin benefits solve this problem directly. Accept any crypto. Settle in stable value. No exposure to Bitcoin's mood swings or Ethereum's price fluctuations.

You maintain crypto's speed and fee advantages without the volatility risk.

The Receivables Token Innovation

Here's something neither NOWPayments nor CoinPayments offers.

Larecoin's receivables token converts outstanding invoices into tradeable assets. Cash flow problems disappear. Waiting 30, 60, or 90 days for payment becomes optional.

Tokenize the receivable. Access liquidity immediately. Your business never stalls waiting for slow-paying customers.

Why Self-Custody Matters for Merchants

Most crypto payment processors operate like traditional banks: they hold your money.

Self-custody merchant accounts flip this model.

Your keys. Your crypto. Your funds.

No waiting for settlement. No processor deciding when you access your earnings. No counterparty risk if the payment company fails.

For small businesses running tight margins, this control matters enormously.

Bank-free business operations become reality. You're not asking permission to use your own revenue.

The Global Reach Advantage

Web3 global payments eliminate borders instantly.

A customer in Tokyo pays you in crypto. A customer in Berlin does the same. No currency conversion fees. No international wire delays. No correspondent bank complications.

Larecoin's crypto POS system for small business handles this natively. Your corner coffee shop suddenly has the same global payment infrastructure as multinational corporations.

The playing field levels.

Real Numbers: What 50% Actually Means

Let's make this concrete.

Annual Revenue: $200,000

Traditional processing (3% average): $6,000 in fees NOWPayments (1% with conversion): $2,000 in fees CoinPayments (0.5% base + extras): ~$1,500 in fees Larecoin (self-custody model): Under $1,000 in fees

That's $5,000+ back in your pocket annually.

Hire a part-time employee. Upgrade equipment. Invest in marketing. That money works for your business instead of disappearing into processor profits.

Making the Switch: What It Takes

Adopting any crypto POS system requires adjustment. Here's what each demands:

NOWPayments:

API integration required

Moderate technical knowledge

Self-managed crypto conversion

CoinPayments:

Plugin options for common platforms

Account setup process

Custody trade-offs

Larecoin:

Self-custody wallet setup

Contactless POS integration

Full control from day one

The learning curve exists for all three. The long-term benefits differ dramatically.

Who Should Choose What?

NOWPayments works best for:

Businesses wanting 300+ crypto options

Merchants comfortable with 1% fees

Those prioritizing immediate crypto access

CoinPayments fits:

High-volume international sellers

Businesses needing 2,000+ coin support

Established operations with existing crypto infrastructure

Larecoin dominates for:

Fee-sensitive small businesses

Merchants wanting true self-custody

Forward-thinking operators ready for NFT receipts and receivables tokens

Anyone seeking bank-free business operations

The Verdict

NOWPayments and CoinPayments reduced crypto payment fees compared to traditional processing. Credit where due.

But neither achieves 50% fee reduction. Neither offers NFT receipts for accounting. Neither provides LUSD stablecoin benefits or receivables tokens.

Larecoin delivers what others promise.

The architecture eliminates fee layers. Self-custody puts you in control. Innovative features like NFT receipts and receivables tokens solve real business problems.

If you're serious about slashing fees by 50% or more: not just shaving a percentage point: the choice becomes clear.

Ready to stop bleeding money on payment processing? Explore Larecoin and see what actual fee reduction looks like.

Your margins will thank you.

Comments