NOWPayments vs CoinPayments vs Larecoin: Which Crypto POS System Gives Small Businesses True Financial Freedom?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 6 days ago

- 4 min read

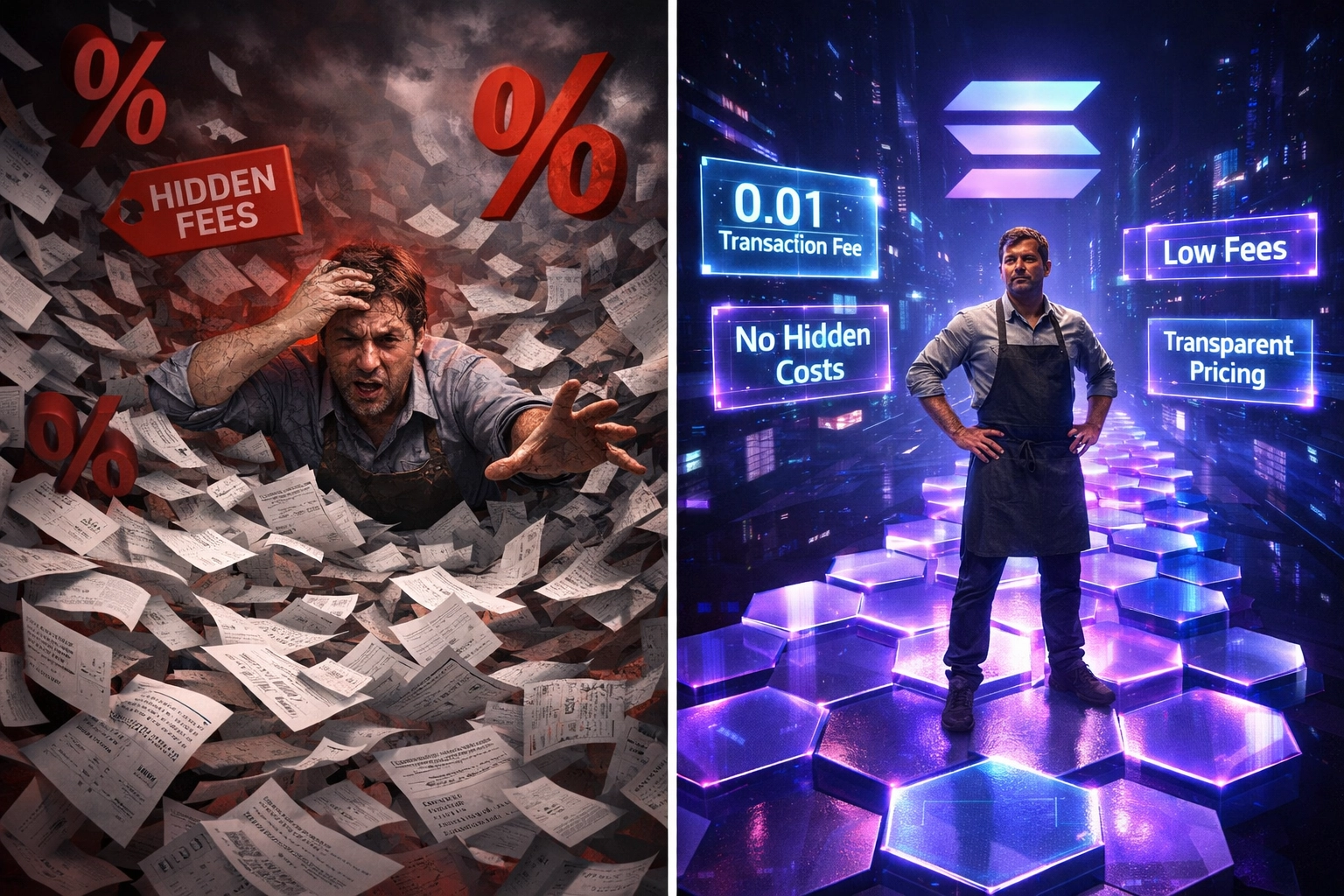

The Hidden Costs Eating Your Crypto Revenue

Most crypto payment processors promise low fees. They're lying to you.

NOWPayments and CoinPayments both advertise "competitive rates." Look closer. Those rates are competitive with Visa and Mastercard: the exact gatekeepers Web3 was built to disrupt.

0.5% to 1% per transaction. Plus network fees. Plus withdrawal fees. Plus conversion charges.

At $500K annual volume, you're bleeding $2,500-$5,000 in platform fees alone. That's before blockchain costs hit.

Small businesses need better.

Gas-Only Processing: The Math That Changes Everything

Larecoin runs on a gas-only model. Zero platform fees. Zero middleman cuts.

You pay Solana network costs. That's it.

A typical Solana transaction? Under $0.01. Even during peak congestion, rarely above $0.05.

Real numbers:

$500K annual volume on NOWPayments: $2,500-$5,000 in fees

Same volume on CoinPayments: $2,500-$5,000 in fees

Same volume on Larecoin: Under $2,000

That's $1,500-$3,000 back in your pocket. Every year.

Scale to $1M annual processing? You're saving $3,000-$8,000 compared to custodial platforms.

This isn't marginal improvement. It's 50-80% fee reduction.

Self-Custody: Who Actually Owns Your Money?

Here's the question nobody asks: Where do your funds go after a customer pays?

With NOWPayments and CoinPayments: Into their wallets. They hold your crypto. You request withdrawals. They process them on their timeline. You trust they're solvent. You hope they don't get hacked.

With Larecoin: Directly to your wallet. Instantly. No intermediary custody. No withdrawal requests. No counterparty risk.

You control your private keys from transaction one.

This is the Web3 promise. Actual financial sovereignty.

Settlement Speed That Actually Matters

Traditional processors talk about "fast" settlements. Let's define fast.

NOWPayments: Approximately 5 minutes for most transactions. Longer during network congestion.

CoinPayments: Minutes to hours depending on blockchain selection and network status.

Larecoin: 2-3 minutes with sub-second finality on Solana.

But speed alone misses the point. The real advantage? Your funds never stop at a custodial waystation.

Payment hits Solana. Solana finalizes. Funds appear in your wallet. Done.

No approval queues. No batch processing. No "business days."

NFT Receipts: Beyond Transaction Confirmation

Every Larecoin payment generates an NFT receipt.

Not a gimmick. A utility asset.

For customers: Proof of purchase. Loyalty rewards. Exclusive access. Resale rights for high-value purchases.

For merchants: Direct customer wallet connection. Retargeting capability. Community building. Programmable rewards without third-party CRM tools.

Neither NOWPayments nor CoinPayments offer anything comparable.

Traditional receipt? Paper trash or email spam.

NFT receipt? Blockchain-verified, wallet-stored, infinitely programmable digital asset.

LUSD: Stablecoin Settlement Without Volatility Risk

Crypto volatility terrifies merchants. Understandable.

Accept payment in ETH. Ten minutes later, ETH drops 3%. You just lost margin.

LUSD solves this.

Larecoin's native stablecoin provides dollar-pegged settlement. Price stability without exiting crypto rails.

Customer pays in any supported asset. Larecoin instantly converts to LUSD. You receive stable value.

No volatility exposure. No forced conversion to fiat. No bank integration required.

CoinPayments offers stablecoin support but charges conversion fees. NOWPayments similar.

Larecoin? Gas-only conversion. Pennies per swap.

The Cryptocurrency Support Question

Full transparency: CoinPayments supports 2,000+ cryptocurrencies. NOWPayments supports 200+.

Larecoin focuses on Solana ecosystem assets with bridge capabilities.

Does this matter?

For most small businesses? No.

98% of crypto payments happen in Bitcoin, Ethereum, stablecoins, or top-20 altcoins. All supported via Larecoin's bridge infrastructure.

The remaining 1,998 cryptocurrencies on CoinPayments? Combined they represent less than 2% of actual payment volume.

You don't need 2,000 options. You need low fees, fast settlement, and self-custody for the coins customers actually use.

DAO Governance: Merchants Control the Protocol

Larecoin operates as a decentralized autonomous organization.

Token holders vote on protocol upgrades. Fee structures. Feature development. Strategic direction.

You're not a customer. You're a stakeholder.

Use the network, earn LARE tokens, participate in governance.

This model doesn't exist with NOWPayments or CoinPayments. They're traditional corporate entities. They make decisions. You accept them.

Larecoin governance is participatory. Your transaction volume gives you voting power. Your business growth influences protocol evolution.

True decentralization means merchants shape the platform serving them.

What $1M in Annual Processing Actually Costs

Let's run complete numbers.

Scenario: $1,000,000 annual crypto payment volume.

NOWPayments (0.5% + network fees):

Platform fees: $5,000

Network fees: ~$1,500

Withdrawal fees: ~$500

Total: $7,000

CoinPayments (0.75% + network fees):

Platform fees: $7,500

Network fees: ~$1,500

Conversion fees: ~$500

Total: $9,500

Larecoin (gas-only):

Platform fees: $0

Solana network costs: ~$1,800

Total: $1,800

Annual savings: $5,200-$7,700 compared to competitors.

That's not accounting software subscription money. That's hiring budget. Marketing spend. Inventory expansion.

Integration Complexity: The Hidden Cost

Complex integrations delay revenue. Training staff on new systems costs time. Technical support tickets drain resources.

All three platforms offer:

API integration

E-commerce plugins

POS terminal support

Mobile payment options

Where Larecoin differs: Non-custodial architecture simplifies compliance.

You're not holding customer funds. You're not a money transmitter. Regulatory overhead drops.

No KYC/AML requirements on your merchant account. Customers connect wallets directly. Peer-to-peer transaction model.

Less regulatory friction means faster deployment and lower legal costs.

The Financial Freedom Math

Financial freedom isn't abstract philosophy. It's mathematical reality.

Lower fees = higher margins. Self-custody = zero counterparty risk. Fast settlement = better cash flow. NFT receipts = customer lifetime value growth. Stablecoin settlement = predictable accounting.

Traditional payment processors extract value. Larecoin preserves it.

The question isn't whether crypto payments make sense. The question is whether you're choosing a payment processor that honors Web3 principles or replicates Web2 extraction.

NOWPayments and CoinPayments brought crypto payment processing to market. Credit where due.

But they copied traditional payment processor business models. Custodial control. Percentage-based fees. Gatekeeper mentality.

Larecoin represents what happens when you build payment infrastructure from Web3-native principles.

Decentralized. Self-custodial. Community-governed. Cost-minimized.

Your Move

Compare the platforms yourself. Run your numbers at https://larecoin.com.

Read the technical documentation at https://www.larecoin.com/whitepaper.

Integrate Coin Checkout and start accepting payments: https://www.larecoin.com/coincheckout.

The choice isn't complicated. It's mathematical.

Pay 0.5-1% forever or pay pennies in gas. Give up custody or control your keys. Accept generic receipts or issue programmable NFTs.

True financial freedom isn't found. It's chosen.

Choose accordingly.

Comments