NOWPayments vs CoinPayments vs Larecoin: Which Slashes Your Merchant Interchange Fees Fastest in 2026?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Merchant fees are killing your margins.

Traditional crypto payment processors charge 0.5-1% per transaction. Plus network fees. Plus withdrawal charges. Plus currency conversion costs.

It adds up fast.

Let's cut through the noise and compare three major players: NOWPayments, CoinPayments, and Larecoin. We'll show you exactly which one delivers the fastest fee reduction for merchants in 2026.

The Fee Structure Breakdown: Where Your Money Actually Goes

NOWPayments and CoinPayments operate on similar models. Both charge 0.5-1% platform fees on every transaction.

Here's what that looks like annually:

Processing Volume | NOWPayments Cost | CoinPayments Cost | Larecoin Cost | Your Savings |

$500K annually | $2,500-$5,000 | $2,500-$5,000 | Under $2,000 | 50-60% |

$1M annually | $5,000-$10,000 | $5,000-$10,000 | Under $2,000 | 67-83% |

$5M annually | ~$25,000 | ~$25,000 | ~$5,000 | 50-80% |

Larecoin operates differently. Zero platform fees. You pay only Solana network gas costs: typically fractions of a cent per transaction.

That's the difference between percentage-based gouging and true cost transparency.

Settlement Speed: Cash Flow Is King

Speed matters. A lot.

Larecoin: Sub-second finality. Transactions settle almost instantly on Solana.

NOWPayments: ~5 minutes. Better than traditional banking, but still slower than necessary.

CoinPayments: Minutes to hours. Depends on blockchain congestion and internal processing.

When you're running a business, faster settlement means better cash flow. You can reinvest profits immediately instead of waiting for some processor to release your funds.

Self-Custody vs Custodial Control: Who Owns Your Money?

This is the big one most merchants miss.

NOWPayments and CoinPayments hold your funds in custodial wallets. They control the private keys. You request withdrawals. They decide when to process them.

Larecoin offers self-custody from day one. You control your private keys. Your wallet. Your funds. Always.

No withdrawal requests. No waiting periods. No permission needed.

Real-World Savings Scenarios for 2026 Merchants

Let's get specific.

Scenario 1: Mid-Size Online Store

Monthly volume: $100K

NOWPayments/CoinPayments annual cost: $6,000-$12,000

Larecoin annual cost: ~$1,500

Savings: $4,500-$10,500 per year

Scenario 2: High-Volume Merchant

Monthly volume: $500K

NOWPayments/CoinPayments annual cost: $30,000-$60,000

Larecoin annual cost: ~$6,000

Savings: $24,000-$54,000 per year

Those savings compound. Year over year. That's capital you can reinvest into inventory, marketing, or expansion.

The LUSD Advantage: Stablecoin Simplicity

Volatility is crypto's biggest merchant objection.

Larecoin supports LUSD (Larecoin USD), a stablecoin designed specifically for merchant payments. Pegged 1:1 to the dollar.

Accept crypto payments. Settle in stable value. Avoid the volatility rollercoaster.

NOWPayments and CoinPayments offer stablecoin support too: but remember those percentage fees? They apply to stablecoin transactions just like everything else.

With Larecoin, you pay gas-only costs whether you're processing LARE, LUSD, or other Solana-based tokens.

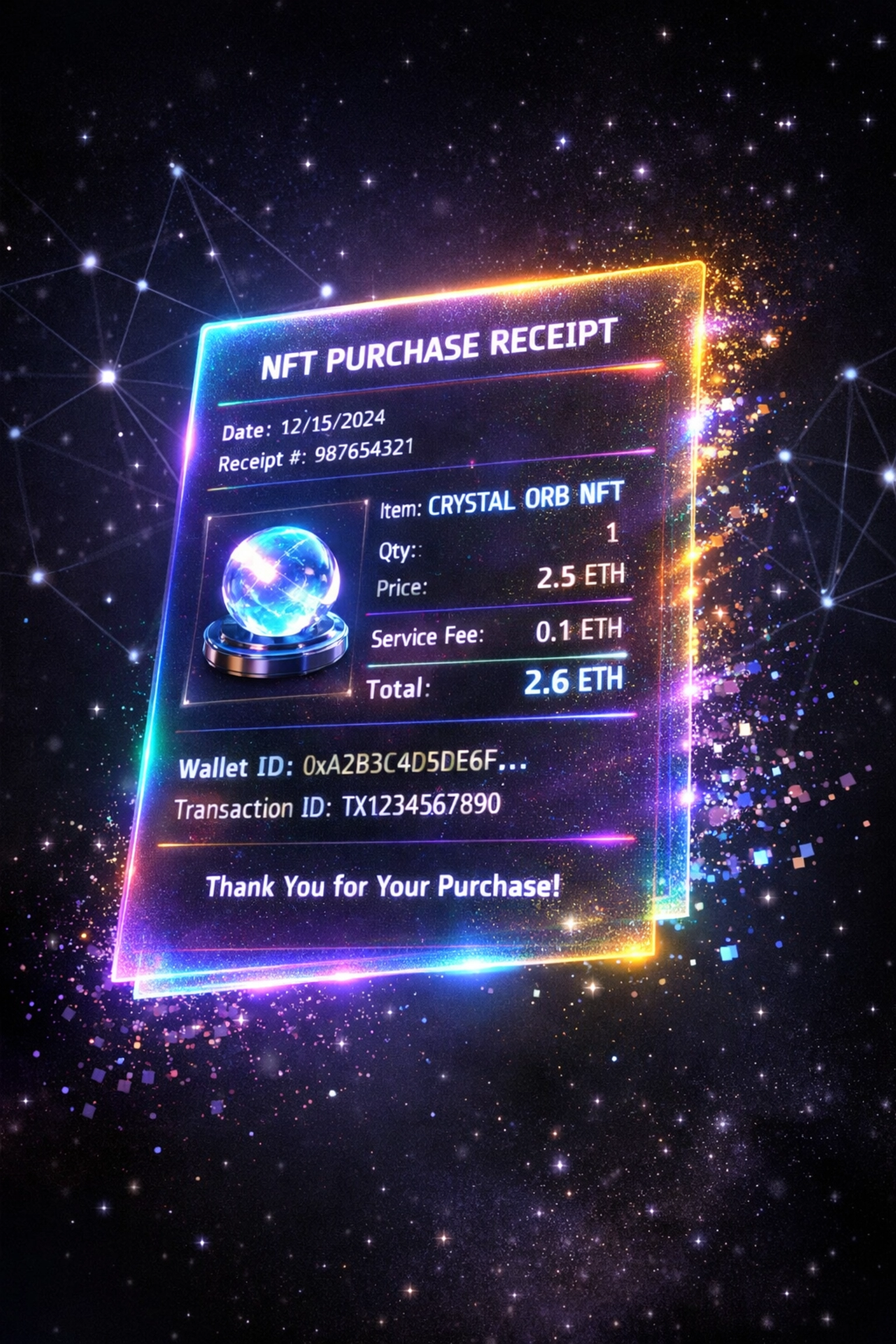

NFT Receipts: The Innovation Nobody Else Offers

Here's where Larecoin pulls ahead technologically.

Every transaction can generate an NFT receipt. On-chain proof of purchase. Immutable. Permanent.

Use cases:

Warranty verification

Loyalty program integration

Collectible receipts for limited editions

Transparent accounting for tax purposes

Customer engagement and gamification

NOWPayments? Standard transaction records. CoinPayments? Same old email confirmations. Larecoin? Blockchain-native innovation that creates new value for merchants and customers.

Merchant Independence: Why Decentralization Matters

Traditional processors create dependency.

They can freeze accounts. Change terms. Increase fees. Add restrictions.

Larecoin's decentralized architecture means no single point of failure. No corporate overlord deciding your fate.

Built on Solana. Open-source protocols. Permissionless access.

You're not a customer at the mercy of a service provider. You're a participant in a decentralized payment network.

That's merchant freedom in 2026.

The Gas-Only Model Explained

Let's demystify this.

"Gas" refers to the computational cost of processing transactions on a blockchain. On Solana, gas costs are incredibly low: often $0.00025 per transaction.

Compare that to percentage-based fees:

0.5% of $1,000 = $5

Gas cost = $0.00025

The difference is staggering at scale.

Larecoin doesn't add layers of fees on top of network costs. You pay what the blockchain charges. Nothing more.

Cross-Chain Flexibility Without the Premium

NOWPayments supports 200+ cryptocurrencies. CoinPayments offers similar multi-coin support.

Impressive numbers: but you're paying that 0.5-1% fee across every chain and every token.

Larecoin focuses on Solana's ecosystem but delivers interoperability through bridges and swaps. The key difference? No premium for flexibility.

Processing a Solana-based token costs the same minimal gas fee whether it's LARE, LUSD, or any SPL token.

Direct Comparisons: Feature Matrix

NOWPayments:

0.5% platform fee

Custodial wallet system

~5 minute settlements

Standard transaction records

CoinPayments:

0.5-1% platform fee

Custodial wallet system

Variable settlement times

Traditional payment confirmations

Larecoin:

Zero platform fees (gas-only)

Self-custody wallets

Sub-second finality

NFT receipt generation

LUSD stablecoin integration

Decentralized architecture

The choice becomes obvious when you prioritize merchant profitability and independence.

Why This Matters for Your Bottom Line in 2026

Margins are tightening everywhere. Competition is global. Customers expect crypto payment options.

Traditional processors treat crypto like just another payment method: with fees structured to maximize their revenue.

Larecoin treats crypto as what it actually is: a fundamentally different technology that enables lower costs through decentralization.

Every percentage point you save on fees flows directly to your bottom line. Every second faster in settlement improves your cash position. Every element of self-custody reduces counterparty risk.

Getting Started: The Implementation Reality

NOWPayments and CoinPayments offer familiar onboarding. Create an account. Submit documentation. Integrate their API. Wait for approval.

Larecoin offers something different. Set up your self-custody wallet. Start accepting payments immediately. No approval process. No account restrictions. No geographic limitations.

The decentralized model means you're live as fast as you can integrate. For merchants who value speed and independence, that matters.

The Verdict: Fastest Fee Reduction in 2026

The numbers don't lie.

Larecoin delivers 50-80% lower costs compared to NOWPayments and CoinPayments. Settlement happens in fractions of a second instead of minutes or hours. Self-custody means you control your funds from day one.

If you're processing significant volume, the savings compound quickly. If you value merchant independence, the decentralized architecture offers security traditional processors can't match. If you want innovation, NFT receipts and LUSD integration create new possibilities.

The question isn't whether crypto payments make sense in 2026. They do.

The question is whether you want to pay percentage fees to middlemen: or embrace gas-only costs through genuine decentralization.

Learn more about reducing merchant interchange fees or explore Larecoin's metaverse commerce features.

Your margins will thank you.

Comments