NOWPayments vs CoinPayments vs Larecoin: Which Crypto POS System Really Slashes Your Merchant Fees?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Merchant fees are killing your margins.

Processing $500,000 annually? You're probably bleeding $2,500 to $5,000 in transaction fees alone. Scale that to $5 million and you're looking at $25,000+ vanishing into payment processor pockets.

Traditional crypto payment gateways like NOWPayments and CoinPayments charge percentage-based fees that compound with every transaction. The more you grow, the more you pay.

Let's break down which crypto POS system actually delivers on the promise of slashing merchant interchange fees.

The Fee Structure Showdown

NOWPayments and CoinPayments operate on similar models. Both platforms charge 0.5% to 1% per transaction, plus network fees, withdrawal charges, and conversion costs.

Larecoin? Zero platform fees. You pay only Solana gas costs.

Here's the math:

NOWPayments:

0.5-1% transaction fee

Network fees (variable)

Withdrawal fees when moving funds

Conversion charges if switching between cryptos

CoinPayments:

0.5-1% transaction fee

Network fees on top

Withdrawal fees

Custody-related overhead

Larecoin:

Zero transaction fees

Solana gas costs only ($0.00025 per transaction average)

No withdrawal fees (self-custody model)

No conversion charges within ecosystem

Real-World Cost Scenarios

Numbers don't lie. Let's run actual processing volumes through each system.

$100,000 Annual Processing:

NOWPayments/CoinPayments: $750–$1,000

Larecoin: $300–$400

Savings: 50%+

$500,000 Annual Processing:

NOWPayments/CoinPayments: $2,500–$5,000

Larecoin: Under $2,000

Savings: 60%+

$1.2 Million Annual Processing:

NOWPayments/CoinPayments: $6,000–$12,000

Larecoin: ~$2,000

Savings: 67–83%

$5 Million Annual Processing:

NOWPayments/CoinPayments: $25,000+

Larecoin: ~$5,000

Savings: 80%+

The pattern is clear. As your business scales, percentage-based fees compound exponentially. Gas costs remain flat.

For small businesses doing $100K annually, you save hundreds. For enterprises processing millions, you save tens of thousands.

Beyond Fees: The Self-Custody Advantage

Here's what NOWPayments and CoinPayments don't tell you.

Both platforms use custodial models. They hold your crypto. You need permission to move your own funds. Withdrawal windows. Processing delays. Third-party risk.

Larecoin operates on self-custody merchant accounts. Your keys. Your crypto. Your control.

Transfer funds instantly. No withdrawal fees. No waiting periods. Bank-free business operations become reality.

Self-custody means:

Instant access to your revenue

Zero counterparty risk

No frozen accounts

Direct control over treasury management

Reduced regulatory exposure

Traditional payment processors can freeze accounts without warning. With self-custody, that's impossible. You own the infrastructure.

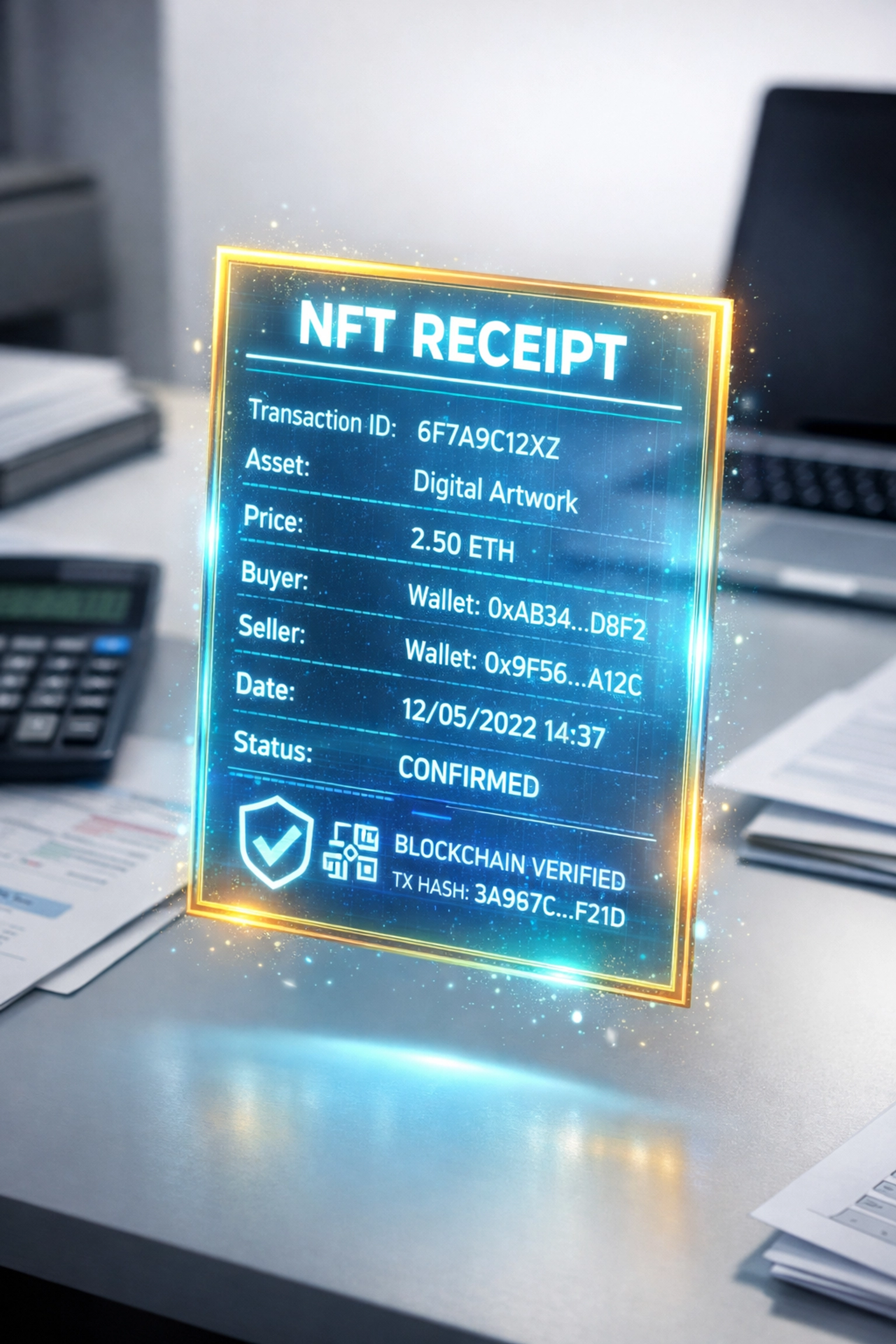

NFT Receipts for Accounting

Every Larecoin transaction generates an NFT receipt.

Not just a digital record. An immutable, blockchain-verified proof of transaction that simplifies accounting, tax reporting, and audits.

NOWPayments provides standard transaction logs. CoinPayments offers CSV exports. Both require manual reconciliation with accounting software.

Larecoin NFT receipts integrate directly with Web3 accounting tools. Automated tax reporting. Real-time reconciliation. Verifiable transaction history that satisfies regulators and accountants.

Each receipt contains:

Transaction amount

Timestamp

Wallet addresses

Gas fees paid

LUSD stablecoin conversion rates

Merchant metadata

For businesses handling hundreds of transactions monthly, NFT receipts eliminate reconciliation headaches.

LUSD Stablecoin Benefits

Crypto volatility scares merchants. Bitcoin surges 10% overnight, then crashes 15% by lunch.

Larecoin integrates LUSD (Liquity USD), a decentralized stablecoin pegged to the US dollar. Zero centralized control. No bank dependencies.

Accept payments in any supported crypto. Instantly convert to LUSD. Lock in dollar value without touching traditional banking rails.

NOWPayments and CoinPayments offer fiat conversions: through third-party processors, with additional fees and KYC requirements.

LUSD maintains stability through algorithmic mechanisms. No Circle. No Tether. No centralized issuer who can freeze your funds.

Benefits for merchants:

Price stability without fiat conversion fees

Maintain crypto-native operations

Eliminate traditional banking relationships

Preserve privacy and sovereignty

Instant settlements in stable value

The Receivables Token Revolution

Larecoin introduces receivables tokens: a Web3-native solution for business cash flow.

Invoice a client $50,000. Generate a receivables token representing that future payment. Use it as collateral for immediate liquidity without traditional factoring fees.

This changes how businesses manage working capital.

NOWPayments and CoinPayments function as payment processors. Nothing more. They move crypto from customer to merchant. End of story.

Larecoin transforms payments into programmable financial instruments.

Receivables tokens enable:

Instant liquidity against outstanding invoices

Tradeable payment obligations

Collateral for DeFi lending

Cash flow management without banks

Reduced dependency on traditional factoring

For businesses with long payment cycles, this matters. Convert 60-day payment terms into immediate working capital.

Integration and Setup

NOWPayments and CoinPayments offer plugins for major e-commerce platforms. WooCommerce. Shopify. Magento. Standard integration paths.

Larecoin provides the same integrations: plus Web3-native tools.

Smart contract templates for custom payment flows. API access for developers building on Solana. Integration with decentralized marketplaces and metaverse platforms.

Setup comparison:

NOWPayments: Create account. Verify identity. Configure API keys. 2-3 days approval.

CoinPayments: Register. Submit KYC. Wait for verification. Similar timeline.

Larecoin: Connect wallet. Deploy merchant smart contract. Start accepting payments. Under 10 minutes.

No KYC requirements for basic merchant accounts. No waiting for approval. Connect your self-custody wallet and go.

Global Reach Without Traditional Banking

NOWPayments operates in 150+ countries. CoinPayments supports similar coverage. Both require banking relationships and comply with local financial regulations.

Larecoin bypasses traditional banking infrastructure entirely.

Accept payments from any Solana-compatible wallet worldwide. No correspondent banks. No SWIFT codes. No currency conversion through intermediaries.

For merchants in emerging markets or underbanked regions, this access matters. No local bank account required. No minimum balance requirements. No monthly maintenance fees.

Financial sovereignty becomes operational reality.

The Scaling Question

Small businesses see immediate savings with Larecoin. Large enterprises see exponential benefits.

At scale, percentage-based fees become unsustainable. Processing $10 million annually through NOWPayments or CoinPayments costs $50,000+ in fees alone.

Larecoin handles the same volume for under $10,000. All costs from gas fees.

The efficiency gap widens as you grow. Early adoption means compounding savings over time.

Businesses scaling 50% year-over-year face proportionally increasing costs with traditional processors. With Larecoin, marginal costs per transaction remain flat.

Which Platform Wins?

For merchants prioritizing:

Lowest fees at scale: Larecoin by 60-80%

Self-custody control: Larecoin exclusively

Advanced accounting tools: Larecoin NFT receipts

Stablecoin settlements: Larecoin LUSD integration

Working capital solutions: Larecoin receivables tokens

Fastest setup: Larecoin (minutes vs days)

NOWPayments and CoinPayments serve merchants comfortable with custodial models and traditional fee structures. They work. They're established. They charge accordingly.

Larecoin targets merchants ready for Web3-native infrastructure. Self-custody. Programmable payments. Bank-free operations. Gas-only fees.

The savings speak for themselves. At $500K annual processing, you save $3,000+. At $5M, you save $20,000+.

Calculate your own numbers. Run your processing volume through each platform's fee structure.

The choice becomes obvious.

Ready to slash your merchant fees by 50% or more? Connect your wallet at larecoin.com and start accepting crypto payments with zero platform fees.

Your margins will thank you.

Comments