NOWPayments vs. CoinPayments vs. Larecoin: Which Crypto POS System Slashes Your Fees by 50%+?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

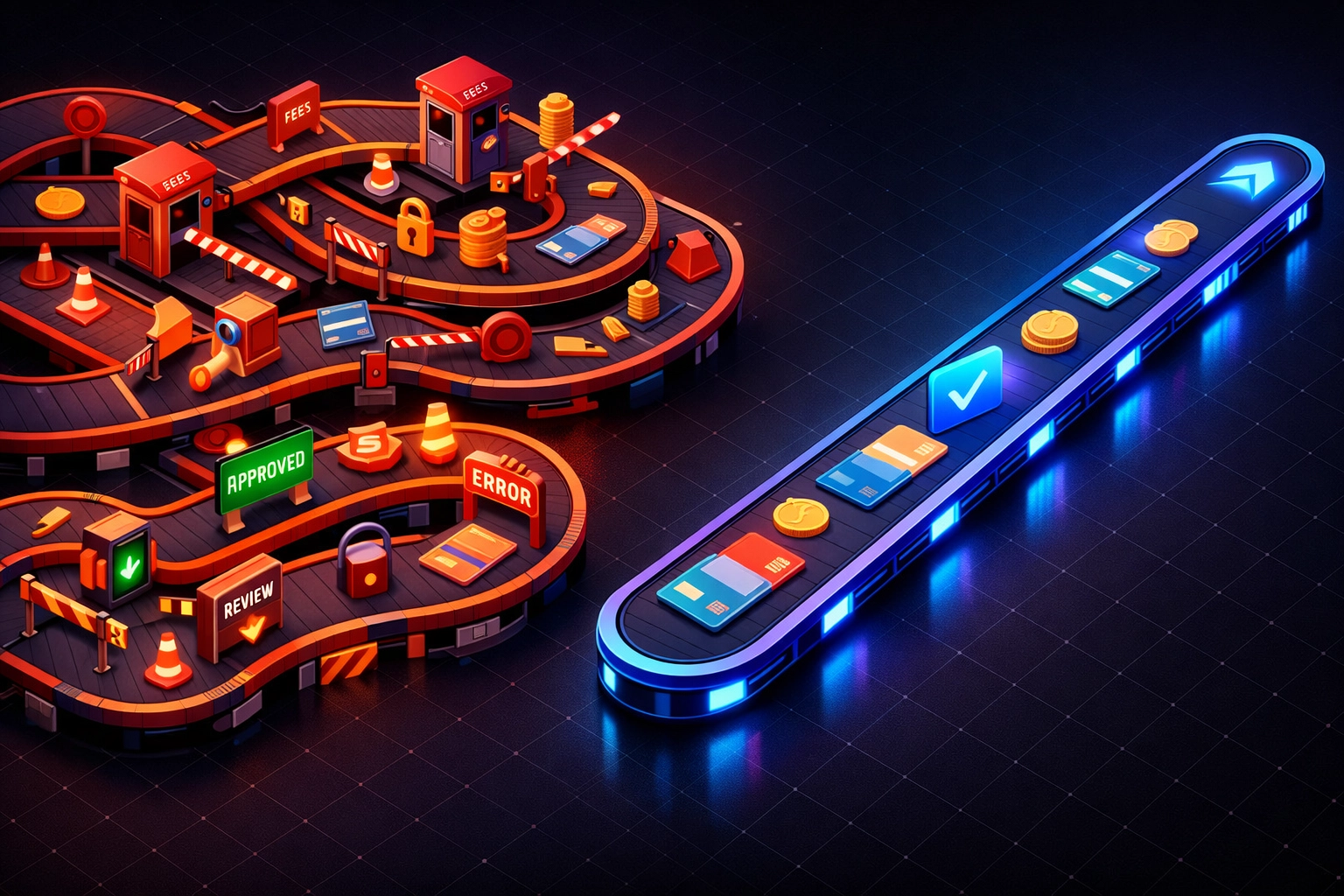

The Fee Problem Nobody Talks About

Every payment processor says they're "affordable."

But affordable for who?

When you're processing $500K annually, those 0.5% fees don't sound scary. Until you realize you're handing over $2,500-$5,000 every single year. For what? Permission to access your own money.

That's the hidden tax of custodial crypto payment systems.

NOWPayments and CoinPayments built empires on percentage-based fees. They sound small. They add up fast. And they scale brutally as your business grows.

Larecoin flipped the script.

How Traditional Crypto Processors Drain Your Revenue

Here's the dirty secret about NOWPayments and CoinPayments:

NOWPayments Fee Structure:

0.5% for single-currency transactions

1% when you touch multiple currencies

Network fees on top

Withdrawal fees when you want YOUR money

Currency conversion spreads (hidden markup)

Custodial control (they hold your keys)

CoinPayments Fee Structure:

0.5-1% per transaction

Separate blockchain network fees

Withdrawal charges every time

Conversion costs when switching coins

Platform controls private keys

Your funds, their vault

Both platforms claim "low fees." Both platforms use the same playbook: percentage-based extraction that grows with your success.

The Gas-Only Revolution

Larecoin eliminated platform fees entirely.

Zero.

You pay Solana network fees: fractions of a cent per transaction. That's it.

Larecoin's Fee Structure:

0% platform fees

Gas-only costs (Solana network: $0.00025 per transaction)

No withdrawal fees

No conversion markups

Self-custody from day one

Your keys, your crypto, your control

The math isn't complicated. It's revolutionary.

Real-World Cost Comparison

Let's run actual numbers:

Annual Volume | NOWPayments Cost | CoinPayments Cost | Larecoin Cost | Your Savings |

$100K | $500-$1,000 | $500-$1,000 | ~$500 | 50% |

$500K | $2,500-$5,000 | $2,500-$5,000 | ~$1,500 | 60-70% |

$1M | $5,000-$10,000 | $5,000-$10,000 | ~$2,000 | 70-80% |

$5M | $25,000-$37,500 | $25,000+ | ~$5,000 | 80%+ |

At $100K monthly processing over 36 months:

NOWPayments: ~$28,000 in cumulative fees

CoinPayments: ~$31,320 in fees

Larecoin: ~$7,128 in gas costs

That's a $20,000+ difference over three years.

For the same service. The same transactions. The same crypto payments.

The only difference? Who controls the rails.

Why Percentage Fees Are a Scam at Scale

Here's what NOWPayments and CoinPayments don't tell you:

Percentage fees scale linearly with your success. Process $1M? Pay $10K. Process $10M? Pay $100K.

Gas fees don't scale that way.

A $100 transaction costs the same network fee as a $100,000 transaction on Solana. Same blockchain. Same security. Same speed.

The fee model determines your profit ceiling.

With percentage-based systems, every dollar you earn costs more to process. With gas-only systems, your costs stay flat while revenue grows.

That's not a feature. That's the whole game.

Beyond Fees: The Self-Custody Advantage

Lower costs mean nothing if you can't access your funds.

NOWPayments and CoinPayments operate as custodians. They hold your private keys. They control withdrawal timing. They decide when you get paid.

Larecoin flips custody:

You control private keys from transaction one

No withdrawal approval process

No "processing time" to access your money

No platform holding funds hostage

Instant liquidity on your terms

Self-custody isn't a buzzword. It's financial sovereignty.

When a platform controls your keys, they control your business. When YOU control your keys, you control your future.

NFT Receipts: Accounting That Actually Works

Here's where Larecoin gets weird (in the best way):

Every transaction generates an NFT receipt.

Not a PDF. Not an email. An immutable, blockchain-verified proof of payment that lives forever.

Why this matters:

Tax audits? Pull up the NFT receipt: cryptographically verified

Accounting reconciliation? Every transaction has a permanent digital twin

Dispute resolution? The blockchain doesn't lie

Compliance reporting? Automated and verifiable

NOWPayments gives you a CSV export. CoinPayments sends email confirmations.

Larecoin gives you permanent, portable, blockchain-native proof.

LUSD: Stablecoin Stability Without Tether Risk

Most crypto payment systems force you into USDT or USDC.

Larecoin supports LUSD: a decentralized, over-collateralized stablecoin pegged to USD.

LUSD advantages:

No centralized issuer risk (looking at you, Tether)

Over-collateralized with ETH (150%+ backing)

Algorithmically maintained peg

DeFi-native integration

Zero counterparty risk

Accept payments in LUSD. Hold in LUSD. Spend in LUSD. All without trusting a centralized stablecoin issuer.

Compliance Without Compromise

"But is Larecoin legal?"

Larecoin holds full US compliance credentials:

Money Services Business (MSB) registration

State-level Money Transmitter Licenses (MTL)

FinCEN compliant

AML/KYC frameworks in place

You get decentralization AND regulatory compliance.

NOWPayments and CoinPayments operate under similar frameworks, but they charge percentage fees for the privilege. Larecoin delivers compliance without the extraction model.

The Hidden Costs Nobody Calculates

Percentage fees are just the visible expense.

What NOWPayments and CoinPayments don't advertise:

Currency conversion spreads: They mark up exchange rates 0.5-2%

Withdrawal batching delays: Your money sits in their wallet earning THEM interest

Network fee markups: They charge more than actual blockchain costs

Account minimums: Some tiers require minimum balances

Integration complexity: APIs designed to lock you into their ecosystem

What Larecoin eliminates:

All of it

Gas fees are transparent. Solana network fees are public. No hidden markups. No withdrawal games. No minimum balances.

The Verdict: Math Doesn't Lie

If you're processing under $50K annually, the difference between platforms might not matter.

Above $100K? The math becomes undeniable.

At $500K annual volume, you save $2,000-$3,500 per year with Larecoin.

At $1M annual volume, you save $3,000-$8,000 per year.

At $5M annual volume, you save $20,000-$32,500 per year.

Those aren't projections. That's arithmetic.

Choose Your Future

NOWPayments and CoinPayments built profitable businesses by taking a cut of yours.

Larecoin built infrastructure that makes taking a cut obsolete.

Same crypto payments. Same blockchain rails. Same global reach.

Different fee model. Different custody model. Different future.

Ready to slash your payment processing costs by 50-80%?

Explore the Larecoin merchant ecosystem and see how gas-only payments change the economics of crypto commerce.

Your money. Your keys. Your terms.

Welcome to Web3 payments that actually make sense.

Comments