NOWPayments vs CoinPayments vs Larecoin: Which Crypto POS System Slashes Your Merchant Fees by 50%+?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

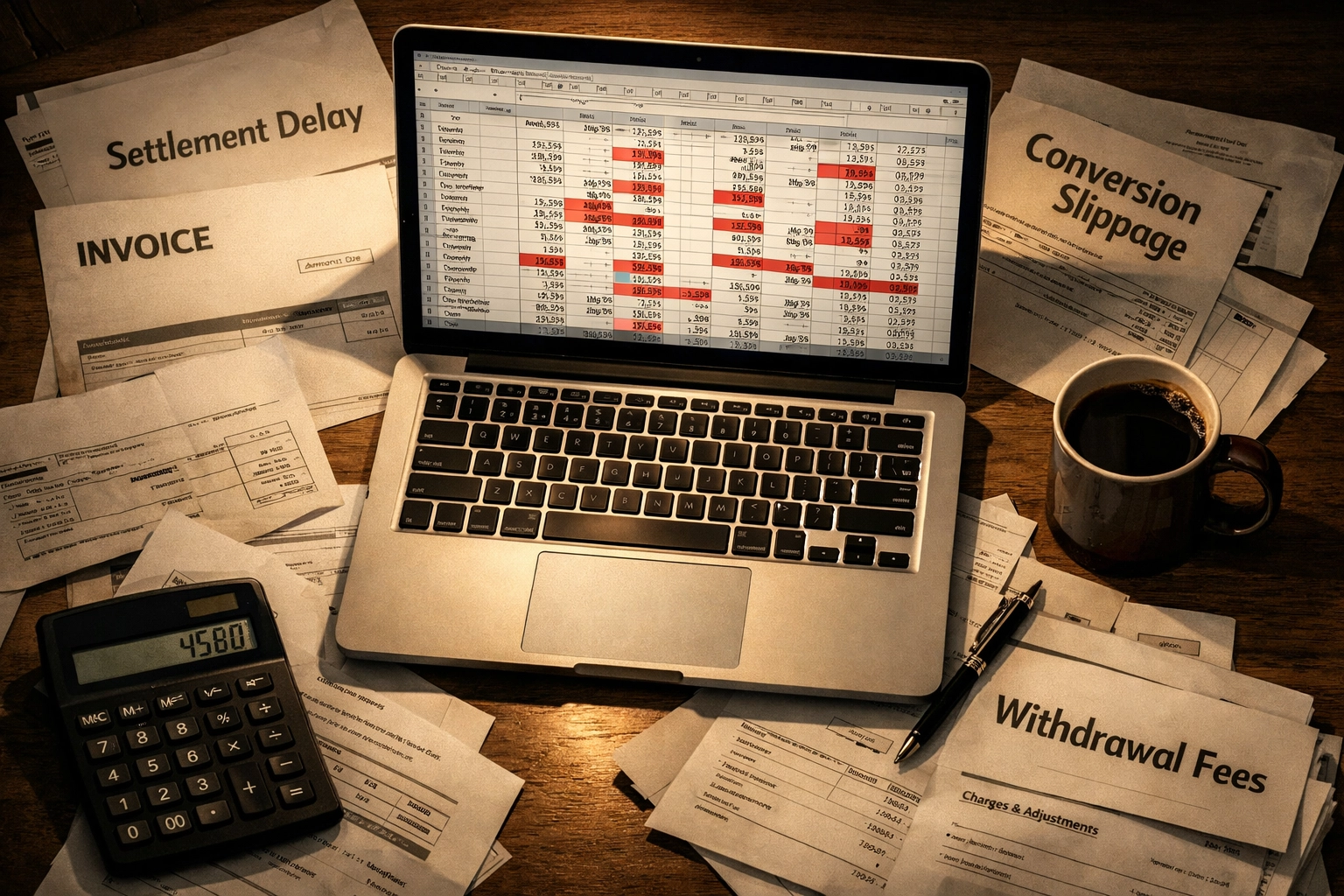

Merchant Fees Are Bleeding Your Business Dry

Every transaction costs money. Credit cards take 2-3%. PayPal grabs another chunk. Add currency conversion, withdrawal penalties, and settlement delays.

You're losing thousands monthly.

Traditional crypto payment processors promise relief. They don't deliver.

NOWPayments and CoinPayments still charge percentage-based fees that scale with your success. More revenue = more fees. The model is broken.

Larecoin flips this entirely. Zero platform fees. Just Solana gas.

Let's break down the math.

The Fee Structure Face-Off

NOWPayments Fee Model:

0.5-1% per transaction

Network fees on top

Withdrawal penalties

Conversion charges

Auto-conversion costs extra

Custody fees for holding

CoinPayments Fee Model:

0.5-1% platform cut

Blockchain fees separate

Withdrawal fees compound

Multi-coin acceptance adds complexity

Settlement delays cost money

Conversion slippage

Larecoin Fee Model:

Zero platform fees

Solana gas only ($0.001-$0.02 per transaction)

Self-custody = no withdrawal penalties

LUSD stablecoin eliminates conversion losses

Instant settlement

NFT receipts included

The difference isn't subtle. It's transformative.

Real Numbers: Your Actual Savings

Let's calculate what you'd pay processing $500,000 annually.

NOWPayments/CoinPayments:

Base fees: $2,500-$5,000

Network fees: $500-$1,000

Withdrawal penalties: $200-$500

Conversion costs: $300-$800

Total: $3,500-$7,300

Larecoin:

Platform fees: $0

Solana gas (average $0.005 per transaction): $1,500

Withdrawal fees: $0 (self-custody)

Conversion costs: $0 (LUSD stable)

Total: $1,500

You save: 58-79%

Scale this to $1 million in annual processing.

Traditional processors: $7,000-$14,600

Larecoin: Under $3,000

Savings: 67-83%

The percentage-based model punishes growth. Larecoin rewards it.

Hidden Costs Nobody Talks About

Settlement Delays = Cash Flow Nightmares

NOWPayments holds funds 24-72 hours. CoinPayments can delay 3-5 days for verification.

You're running a business, not a charity. Every day funds sit locked is inventory you can't buy, payroll you can't meet, opportunities you miss.

Larecoin settles instantly. Self-custody means your money hits your wallet in seconds.

Conversion Slippage Murders Margins

Accept Bitcoin, receive dollars. Sounds simple.

Reality: conversion happens at their rate, their timing, their spread. You lose 0.5-2% on every conversion.

Processing $500K annually? That's $2,500-$10,000 vanishing into spreads.

LUSD stablecoin eliminates this entirely. Stable value. Predictable accounting. Zero conversion bleed.

Multi-Coin Support Isn't Free

CoinPayments brags about 2,000+ coins. Cool marketing.

Terrible business model.

Each coin adds complexity. Different withdrawal fees. Different network delays. Different reconciliation headaches.

Your accountant charges extra. Your time gets wasted. Your reports look like alphabet soup.

Larecoin focuses on what works. Solana-based efficiency. LUSD stability. Web3 global payments without the chaos.

What Makes Larecoin Different (Besides Fees)

NFT Receipts for Accounting

Every transaction generates an NFT receipt. Immutable. Verifiable. Audit-ready.

Tax season? Export everything instantly. No manual reconciliation. No missing records. No disputes with auditors.

Traditional processors give CSV files. You get blockchain-verified proof.

True Self-Custody Merchant Accounts

NOWPayments holds your crypto. CoinPayments controls your funds. You're trusting third parties with your money.

Larecoin gives you the keys. Your wallet. Your coins. Your control.

Bank-free business operations aren't a slogan. They're the architecture.

Receivables Token Innovation

Turn invoices into tradable tokens. Sell receivables for instant cash. Finance inventory without loans.

This isn't available anywhere else.

Your $50K invoice due in 30 days? Tokenize it. Sell it at a discount for $48K today. Liquidity problem solved.

No credit checks. No loan applications. No bank approval needed.

LUSD Stablecoin Benefits

Price volatility kills crypto adoption. Bitcoin swings 10% daily. Ethereum isn't much better.

LUSD maintains dollar parity without centralized backing. Decentralized stability. No Tether risks. No Circle dependencies.

Accept payments without conversion stress. Hold value without volatility fear.

Which System Wins for Your Business Size?

Small Business (Under $250K Annual Processing)

Winner: Larecoin

You can't afford percentage fees. Every dollar matters. Gas-only costs keep you profitable.

Setup is simple. Self-custody is secure. NFT receipts save accounting hours.

Medium Business ($250K-$2M Annual Processing)

Winner: Larecoin by landslide

Fee savings hit 60-75% at this scale. That's hiring another employee. Opening another location. Investing in marketing.

Receivables tokens unlock working capital. Traditional processors just take more money.

Large Business ($2M+ Annual Processing)

Winner: Still Larecoin

Percentage fees become obscene at scale. $2M processed = $10K-$20K in traditional fees.

Larecoin keeps that in your business. Plus enterprise-grade features without enterprise pricing.

The Migration Math

Switching payment processors feels risky. Let's quantify it.

Migration costs:

Technical integration: 2-4 hours (straightforward API)

Staff training: 1-2 hours

Testing period: 1 week

Total disruption: Minimal

Monthly savings on $100K processing:

Traditional processors: $500-$1,000 monthly fees

Larecoin: ~$125 gas costs

Net savings: $375-$875 monthly

Break-even happens in week one. Everything after is pure profit recapture.

What About Support and Reliability?

NOWPayments has tickets. CoinPayments has email queues. Both have 24-48 hour response times.

Larecoin operates on Solana. 99.9% uptime. Sub-second confirmations. Built-in redundancy.

Community support is active. Developer resources are extensive. The tech just works.

The Bottom Line

You're paying too much for crypto payment processing. Percentage-based fees made sense in 2015. They're outdated in 2026.

Web3 global payments run on efficiency, not extraction.

Choose NOWPayments/CoinPayments if:

You enjoy paying thousands in unnecessary fees

You like waiting days for settlements

Third-party custody feels comfortable

Conversion slippage seems reasonable

Choose Larecoin if:

Saving 50-80% matters

Instant settlement helps cash flow

Self-custody merchant accounts make sense

NFT receipts for accounting sound useful

Financial sovereignty beats bank dependency

The crypto POS system for small business isn't a race anymore. Larecoin already won.

Your only decision: how much longer you'll overpay before switching.

Ready to reduce merchant interchange fees by 50%+? Start here.

Comments